bgwalker/iStock Unreleased via Getty Images

Fasten your seatbelts. A wild next month lies ahead. The banks launch earnings season Friday after a major CPI report Thursday morning. Just three weeks away is the next FOMC meeting at which the Fed is expected to hike rates by a fourth consecutive 0.75 percentage point amount. Then comes the key midterm elections on Nov. 8.

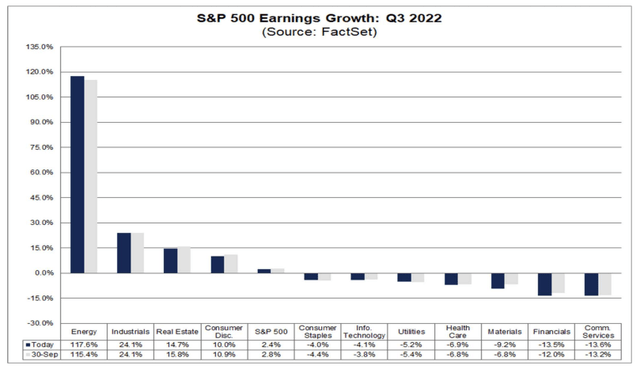

Sticking with earnings, the Bank/Brokerage area is expected to report one of the worst earnings situations among all industries, according to BofA, with an aggregate EPS drop of 14.6%. Only Media & Entertainment is worse with a forecast earnings decline of 18.1%. Moreover, senior earnings analyst John Butters at FactSet notes, “the Financials sector is expected to report the second-largest (year-over-year) earnings decline of all eleven sectors at -13.5%.” And price action is soft going into Friday – Bank of America (BAC), Citigroup (C), and JPMorgan Chase (JPM) all printed fresh 52-week lows on Tuesday.

FactSet: Financials Sector Expected To Report A Big Q3 Earnings Drop

FactSet

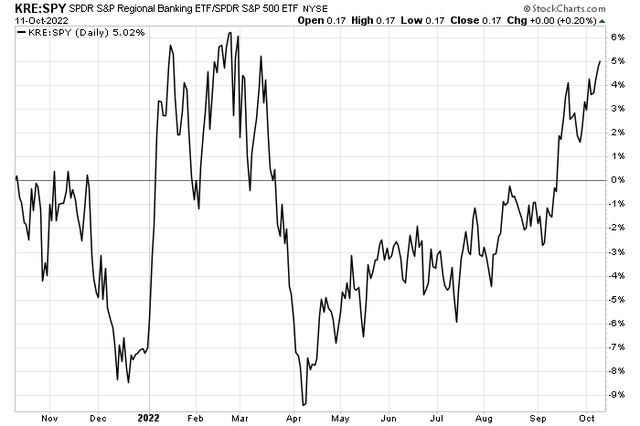

Regional banks could be a source of strength though. The SPDR S&P Regional Banking ETF (KRE) continues to rip higher vs. the S&P 500 over the past six months. One of the fund’s top holdings is PNC Financial.

Regional Banks Keep Winning (Vs. SPX)

Stockcharts.com

According to Bank of America Global Research, The PNC Financial Services Group, Inc. (NYSE:PNC) is a Pittsburgh, Pennsylvania-based financial services organization with $540 billion in assets. Founded in 1983 with the merger of Pittsburgh National and Provident National, PNC has grown to become the seventh-largest bank in the U.S. by deposits. PNC offers a wide array of financial products ranging from retail and business banking to wealth and asset management.

The $61.9 billion market cap Banks industry company within the Financials sector trades at a low 11.6 trailing 12-month GAAP price-to-earnings ratio and pays a high 4.1% dividend yield, according to The Wall Street Journal.

PNC has successfully integrated BBVA USA operations into its business, but macro risks of a recession could still pose a downside threat to the regional bank. Fortunately, with excess deposits stemming from massive stimulus programs over the last two years, consumers have plenty of excess cash sitting in checking accounts. Banks have been able to keep deposit interest rates low compared to what they can earn on short-term Treasury securities. That will begin to shift as consumers seek higher yields. Moreover, there are regulatory risks from overdraft rule changes that could pressure fee revenue for PNC.

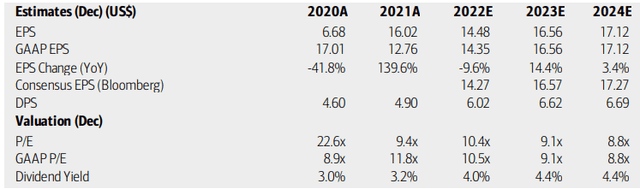

On valuation, BofA analysts see earnings falling sharply this year, but then rebounding to a new EPS high in 2023 before earnings growth stabilizes at a modest rate. Those figures are about in line with the Bloomberg consensus forecast. If shares hold here, the bank’s operating P/E will fall into the single digits next year with a yield above 4%. Those are sporty numbers for value investors for this well-positioned Financials stock. It’s a buy on long-term valuation.

PNC: Earnings, Valuation, Dividend Forecasts

BofA Global Research

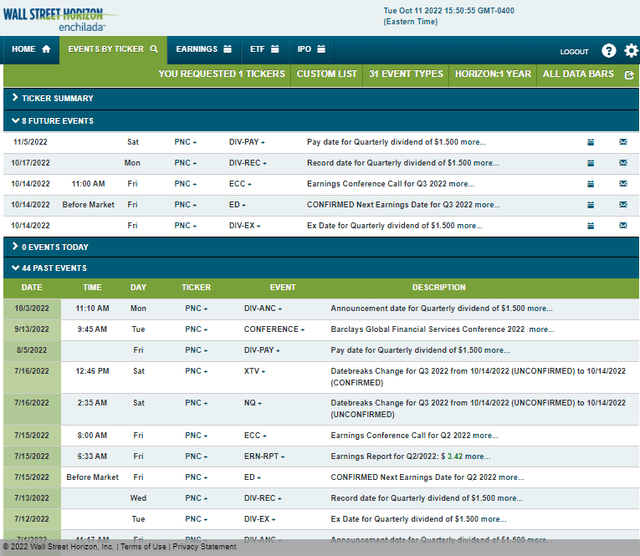

Looking ahead, all eyes will be on Friday when banks kick off the third quarter earnings season. PNC has a confirmed earnings release that morning with a conference call immediately following the results being released. You can listen live here. The next dividend ex-date also is Friday, Oct. 14.

Corporate Event Calendar

Wall Street Horizon

The Options Angle

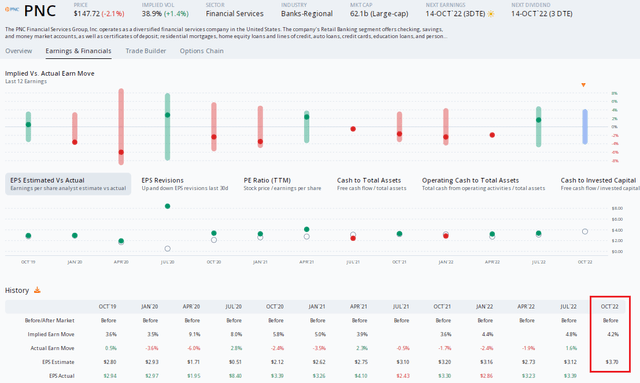

Digging into the earnings report and its expectations, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $3.70 which would be a strong 16% increase from the same quarter a year ago. The stock has a mixed earnings beat rate history with three beats and a pair of misses in the last five quarterly reports.

Traders expect a somewhat modest 4.2% earnings-related stock price move using the nearest-expiring at-the-money straddle, per ORATS. Remarkably, the stock has small post-earnings reactions dating back to July 2020. So don’t expect huge moves out of PNC. Playing the stock on its own might make sense, or perhaps selling an out-of-the-money option to collect premium could be a good play. But what should the directional bet be? Let’s look at the chart.

PNC: Options Are Rightfully Inexpensive, EPS Growth Expected

ORATS

The Technical Take

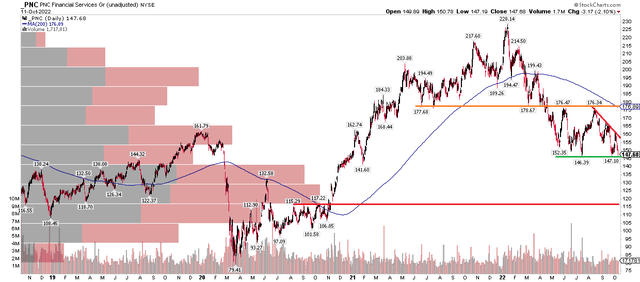

PNC is near a critical juncture. There’s support in the $146 to $148 range based on its lows from this past July and September. With volatility this month, the stock is revisiting that support. If it breaks, I see downside risks to near $117 – that’s both a measured move price objective off the current descending triangle pattern as well as the range highs from August through October 2021.

The broader trend is clearly lower on PNC. The 200-day moving average has been a critical area of trading action over the past three years. It’s now downward sloping, evidence of the downtrend. On the upside, it might prove to be resistance along with the $176 to $178 range. Overall, the onus is on the bulls to defend $146, and the stock looks vulnerable technically.

PNC: Shares In Danger Of A Bearish Breakdown

Stockcharts.com

The Bottom Line

PNC is one of those stocks that appears quite cheap with a solid yield, but the chart leans bearish. Overall, short-term traders might want to avoid the stock or buy a put spread ahead of earnings. Long-term investors, though, should incrementally add to the regional bank due to its attractive valuation, decent growth prospects, and high yield.

Be the first to comment