metamorworks

Investment Thesis

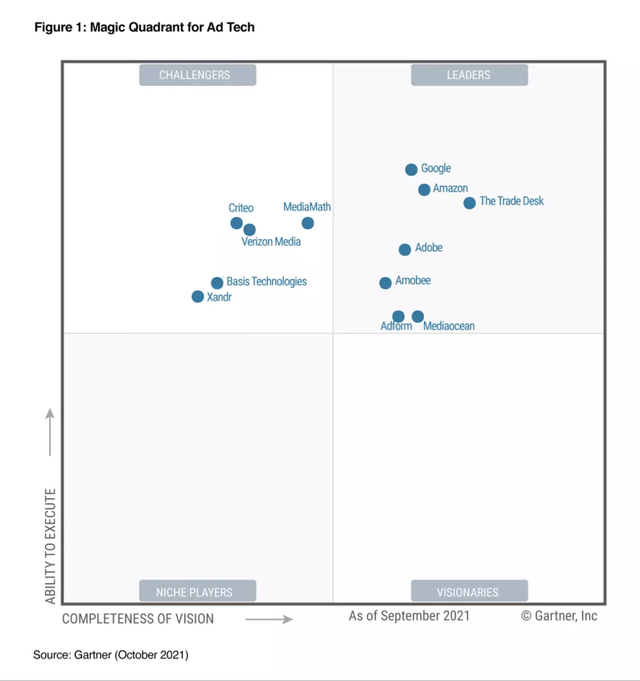

The Trade Desk (NASDAQ:TTD) is leading the charge in a world of advertising that is demanding more transparency. This has been severely lacking due to the dominance of walled gardens such as Alphabet (GOOG) (GOOGL) and Meta Platforms (META). The Trade Desk has grown into a true Ad-Tech leader, and as digital advertising (particularly connected TV) continues to take up a higher share of global advertising dollars, I think this company is positioned to benefit immensely.

I outlined my full rationale for investing in The Trade Desk, along with an explanation of its somewhat complex business model in a previous article. In short, my investment thesis is the following: The Trade Desk has established itself as a true leader in the programmatic advertising space, an industry with multiple tailwinds that should enable the business to keep growing for years to come. It has embraced openness and transparency in an industry famed for walled gardens full of opacity, and this has enabled it to win customers whilst leaving its competitors to get scrutinized by antitrust regulators. I also believe that Jeff Green is the best CEO of any company in my portfolio, as The Trade Desk consistently beats guidance and appears to be 3 steps ahead of the rest of the industry, with a lot of credit going to Green himself.

The Trade Desk Q3’22 Investor Presentation

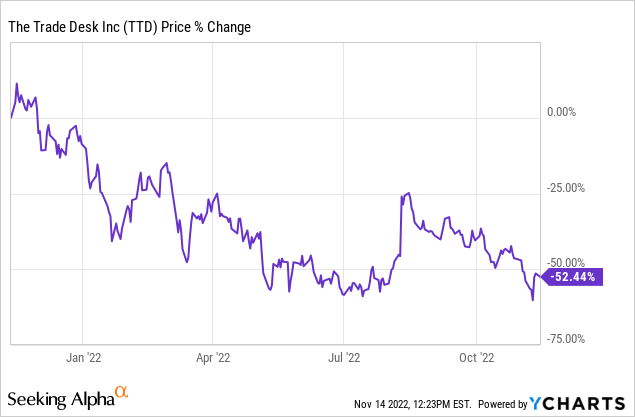

Yet many investors know that the past twelve months have not been too pretty for advertising companies, particularly as the global economy is facing the threat of a severe slowdown.

One of the quickest and easiest cost-cutting measures that businesses can take is to reduce advertising spend, which makes sense when the consumer is spending less due to interest rate hikes and macroeconomic difficulties. This, at least in part, explains why The Trade Desk shares have tumbled more than 50% over the past twelve months.

With this backdrop, investors were braced for the worst when Q3 results were released on Wednesday, November 9. Companies across the spectrum of advertising, from Snap (SNAP) and Alphabet to Roku (ROKU) and PubMatic (PUBM), have been unable to avoid the wave of macroeconomic pressures felt by the global economy.

But The Trade Desk is a leader that delivers time and time again – so, did it manage to do so in this most difficult of environments? Let’s take a look.

The Trade Desk’s Q3 Earnings Overview

Starting from the top, The Trade Desk’s Q3 revenue grew 31% YoY to $395, coming in ahead of analysts’ estimates of $387. The strength of that result in the current macroeconomic environment should not be underestimated, as Co-Founder and CEO Jeff Green said on the Q3 earnings call:

While I don’t often comment on competitor performance, I do think it’s worth noting again that in an environment where many of our competitors have contracted or grew in the single-digit range, we grew 31%. That shows that we are outperforming the market and that we are gaining share, even in what many are calling a challenging macro environment.

While we will never be immune from those macro challenges, we are confident that we will continue to outperform. I could not be more confident and excited about how we are positioned for 2023 and beyond.

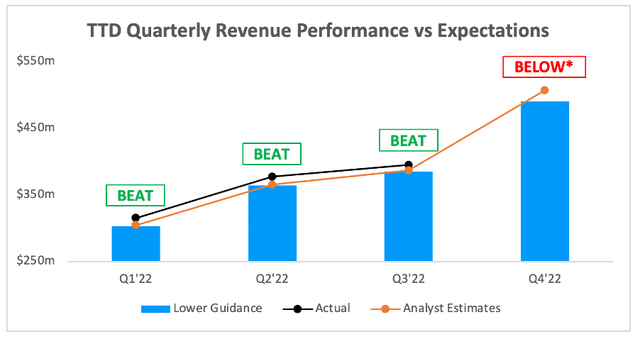

As Green said, The Trade Desk will never be immune from macroeconomic challenges, and I think this is apparent in the Q4 revenue guidance. Management guided for fourth quarter revenue of at least $490m, which would represent 24% YoY growth.

Whilst this came in comfortably below analysts’ estimates of $507m, it is worth stressing that The Trade Desk only provides a minimum guidance – they may well exceed this $490m, but it makes sense to be prudent given the uncertainty within the advertising market.

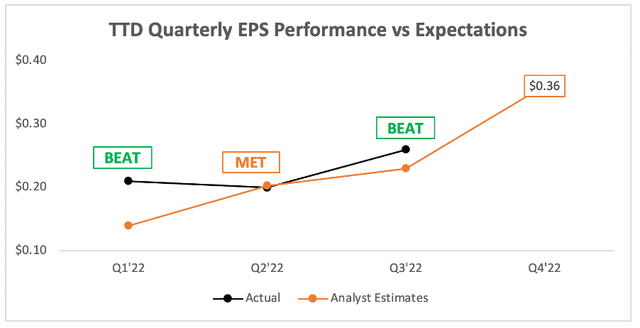

Moving onto the bottom line, and The Trade Desk delivered adjusted EPS of $0.26, coming in ahead of analysts’ estimates of $0.23. This translated into a solid adjusted earnings of $129m for the quarter, although the real earnings were just $16m – but, more on that later.

The Trade Desk doesn’t give guidance on EPS, but analysts are currently expecting the company to deliver EPS of $0.36 when Q4 comes around.

All in all, another strong performance by The Trade Desk in an industry that has fallen victim to the slowdown in advertising. Despite this, I remain confident as ever in The Trade Desk’s long-term prospects; in fact, I almost feel more confident, because whilst its competitors will be scrambling around to cut costs, The Trade Desk will continue to reinvest in itself and grab more and more market share – providing a coiled spring for when the economy eventually recovers.

TTD Remains In A League Of Its Own

I always enjoy listening to The Trade Desk’s earnings call; it’s like music to my ears as an investor, because this is a company that just delivers time and time and time again. Thankfully, despite the macro challenges, Q3 was no different, and the business is continuing to perform exceptionally.

Let’s start with the revenue growth rate of 31% YoY, which may be a minor slowdown, but in the broader context of advertising it was a stellar result. As CEO Green said on the earnings call:

Just one more data point on the market overall and how we are performing. WPP’s GroupM predictive worldwide advertising will increase 8.4% in 2022 and we are growing at more than 3x that rate. CTV continues to be a key growth driver and our shopper marketing initiatives are yielding very encouraging results.

It’s only fair to judge a business on the things they can control. The Trade Desk cannot control the macroeconomic environment, but its ability to grow at triple the pace of the overall advertising market speaks of its incredible execution and innovation.

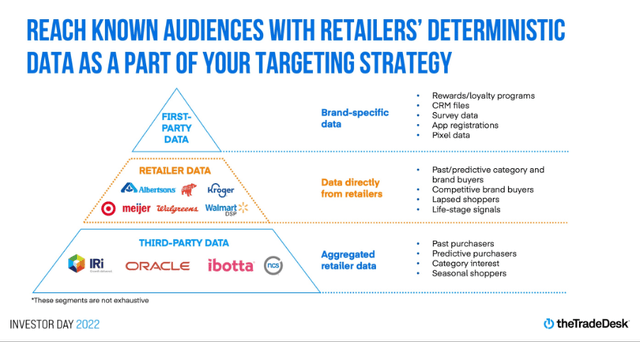

The company’s investments into connected TV are already paying off, and should continue to do so throughout the decade, whilst its shopper marketing spend increased nearly 3x from Q2 to Q3.

The Trade Desk 2022 Investor Presentation

A result of The Trade Desk’s market outperformance is that it’s taking market share left right and center, especially when it comes to political advertising, according to Green:

We are proud of the work we do in political advertising, particularly our focus on helping provide a better advertising process for all political candidates. We are an objective and independent platform open to registered candidates on both sides. With all of this in mind, I believe that through the first 9 months of the year, we have gained more market share, grabbed more land than at any point in our history.

And once again, it’s The Trade Desk’s open and transparent nature that has helped it to keep pushing ahead of its Walled Garden competitors:

Throughout 2022 and in particular, in Q3, The Trade Desk has significantly outperformed seemingly all other forms of digital with a significant contrast to walled gardens in our ability to win advertising budgets.

…Our vision and business strategy continues to be validated by our advertising clients… They want an Internet where relative value can be found as we have predicted CTV is a catalyst for massive change on the Internet, when possible, the power balance is shifting to the open Internet away from opaque walled gardens and systems that aren’t comparable to others. In short, more and more, our clients embrace the value of the open internet compared to the limitations of walled gardens and they are embracing The Trade Desk as the default platform to execute on the open Internet.

As I said during Investor Day, most publishers I speak with complain that they do not believe that they are getting their fair share of spend today relative to the walled gardens.

In short, there is plenty for investors to be smiling about when it comes to The Trade Desk. Although this company has been hit by macroeconomic headwinds, its lower-quality competitors have been hit significantly harder.

This gives The Trade Desk an opportunity to thrive whilst others flounder around, meaning that The Trade Desk will be in an even stronger position when the economy recovers – this should excite any shareholder of The Trade Desk.

Let’s Talk About Stock-Based Compensation

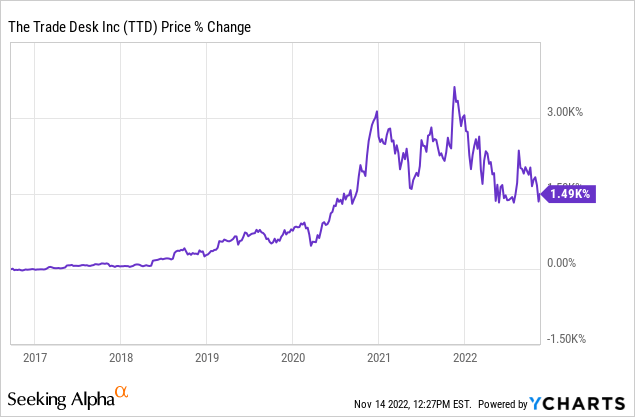

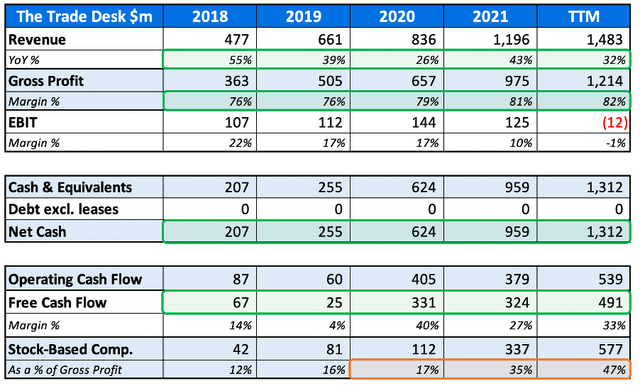

Not only has The Trade Desk been growing rapidly since its IPO in 2016, but the company has done this whilst being profitable. In fact, The Trade Desk has had one of the most impressive financial profiles of any growth company I’ve looked at: consistently strong revenue growth, gross margins above 80%, healthy free cash flow margins, and a balance sheet with $1.3 billion in cash and equivalents with zero debt.

Yet over the past year or two, investors have had a bone to pick with The Trade Desk’s financial profile; in particular, the fact that its stock-based compensation over the past twelve months accounts for a whopping 47% of gross profits, compared to 17% back in 2020.

So what happened? Has The Trade Desk seen all these other ‘growth’ stocks go crazy with SBC and decided that it wants to get in on the action? Well, no.

This large spike in stock-based compensation relates to a CEO Performance Option that was triggered in October 2021 due to the performance of The Trade Desk’s share price since the company came public. Given the astounding returns that this company has provided for long-term investors, I don’t think many complaints can be made about this bonus for CEO Jeff Green.

The good news for investors is that this award will continue to impact stock-based compensation into 2023, but should ease up in 2024. The Trade Desk is not a company that dishes out excessive SBC for fun in my opinion, and this is a substantial one-off award that has to vest over three years.

As of this latest quarter, there is $465m worth of this CEO Performance Option left to be recognized over a weighted average of 2.4 years, assuming no acceleration of vesting. For context, a total of $355m (or 43% of the overall amount) has been recognized in the past four quarters.

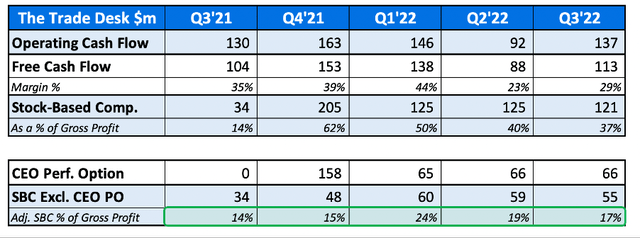

The table below sets out the impact of this CEO Performance Option on The Trade Desk’s quarterly results, and shows that the stock-based compensation levels excluding this CEO incentive are generally less than 20% of gross profit; a much more acceptable level.

I wanted to highlight this fact because it certainly can take investors by surprise to see such a big jump in stock-based compensation, but rest assured – this is a one-off bonus for a CEO’s wonderful performance, and it is not representative of a company that regularly uses excessive stock-based compensation.

TTD Stock Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether The Trade Desk is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

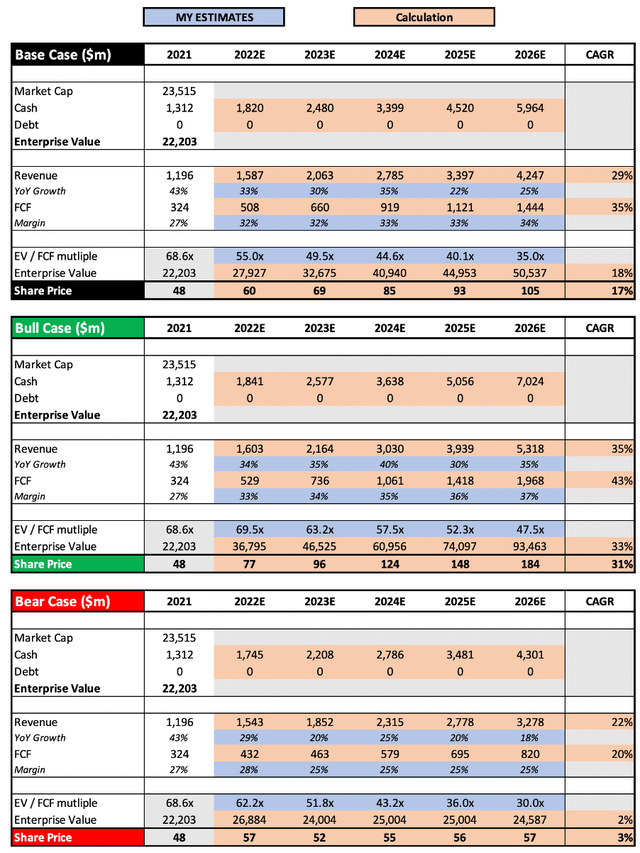

My valuation model remains similar to my previous article, with the following minor tweaks following The Trade Desk’s latest results. I have very slightly reduced the 2022 expected revenue in all scenarios, and I have increased the free cash flow margins due to The Trade Desk’s TTM FCF margin of 33%.

Put all that together, and I can see shares of The Trade Desk achieving a CAGR through to 2026 of 3%, 17%, and 31% in my respective bear, base, and bull case scenarios.

Bottom Line

The Trade Desk is a perfect example of a company that will benefit from a recession, which may sound a bit odd, but hear me out. It’s already shown fantastic business performance, substantially outperforming its peers, and has the financial fortitude and industriousness to continue investing heavily into itself and its products, which are clearly seeing traction.

This is allowing The Trade Desk to make further inroads into the advertising industry whilst its competitors focus on cost cutting and trying to figure out how to reinvigorate growth. Some competitors will go bust, some will just survive, some are behemoths that have fires to put out across multiple departments, but very few are going to come out of this in a stronger position – yet I think this is exactly what The Trade Desk will do.

Given all this, combined with what I feel is an attractive price, I will upgrade my rating on The Trade Desk to a ‘Strong Buy’. We may be in for a difficult twelve months, but I believe in 3-5 years’ time, this will have looked like a fantastic buying opportunity for this brilliant business.

Be the first to comment