hapabapa

Palantir Technologies (NYSE:PLTR) reported its Q3 earnings results last week and they were close to expectations. The company also provided encouraging signs regarding future operating momentum. Its shares remain undervalued and long-term investors should continue to buy.

As I’ve covered in previous articles, I’m bullish on Palantir over the long term as I see the upside potential as quite attractive, even though in recent quarters the company’s financial performance has been soft due to macroeconomic issues that led to slower growth.

However, if the company executes well on its growth strategy, it will become a much larger company over the next few years, and is likely to reach operational break even by 2025, as I’ve analyzed in a recent article. While as an early growth company Palantir’s investment case is still somewhat speculative, it is in the right direction to become a profitable company over the medium term.

Palantir’s Earnings Analysis

Last week, Palantir has reported its most recent quarterly earnings results and they were largely in line with expectations. Its quarterly revenue amounted to $477.9 million, while the street was expecting $474.5 million and its guidance was $475 million, and its adjusted EPS was $0.01 (vs. $0.02 expected).

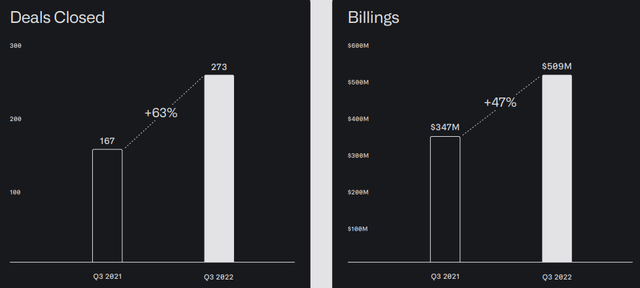

In Q3 2022, Palantir’s revenue grew by 22% YoY, a smaller growth rate than achieved in the previous quarter (+26% YoY), and also lower than its annual target of about +30%. Despite slower growth in the past few quarters, the company has reached some significant milestones, namely its government business reached $1 billion in revenue on a trailing 12-month basis and this was the very first time it had reached this figure. In addition, new deals and billings continued to increase at strong growth rates.

Deals and billings (Palantir)

Additionally, while revenue growth has slowed down, on the other hand its customer count continues to increase at a steady pace, reaching 337 at the end of September, representing an increase of 66% YoY. In the quarter, the company added 33 net new customers (vs. 27 during Q2 2022), being a positive sign that Palantir’s growth strategy is progressing well, especially regarding its commercial push, which is the segment that has been leading revenue growth more recently.

Indeed, in the last quarter, Palantir’s U.S. commercial revenue increased by 53% YoY to $88 million, while total commercial revenue represented some 43% of total revenue. This is supported by a rising number of customers, which increased to 132 just in the U.S. at the end of Q3 2022, up 124% YoY. On the other hand, U.S. government revenue increased by 23% YoY, a much lower growth rate than compared to the commercial segment.

Regarding its net dollar retention, it was 119% in the last quarter and unchanged from the previous one, which is positive as recurring customers continue to increase engagement with the company, boding well for future revenue growth as the total number of customers increases.

Additionally, in Q3 its total remaining deal value increased by 14% YoY to $4.1 billion, an increase of $600 million compared to Q2 2022, which is another positive signal of stronger revenue growth in the near future. Investors should note that Palantir reported some softness in this metric during Q2 (up by only 4% YoY to $3.5 billion), thus the increase reported in Q3 shows that Palantir’s offering continues to add value for its customers and they are willing to enter into medium to long term service commitments even during the current uncertain macroeconomic environment.

Regarding Palantir’s profitability, the company continues to invest in business growth and maintains its hiring plans, which hurts its short-term operating margins, but support its long-term business growth. Palantir continues to add salespeople and software engineers despite the softer macroeconomic backdrop, while other technology companies are freezing hiring or reducing staff to cut costs, like Meta Platforms (META) and Microsoft (MSFT) have done recently.

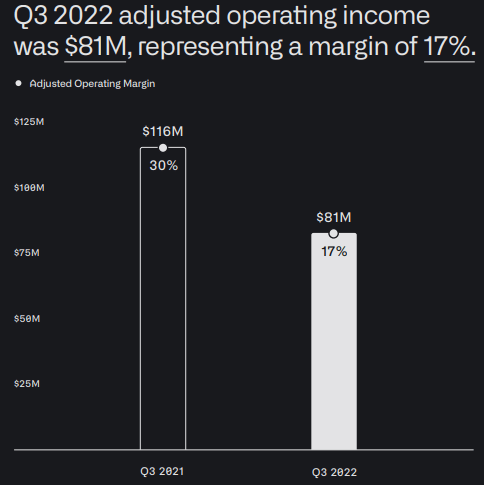

During the quarter, Palantir increased its headcount by 450 people, its largest quarterly hiring during the year, which was the major driver of higher operating expenses, which increased by 9% quarter-on-quarter to $397 million excluding stock-based compensation. Due to this strategy, its adjusted operating profit was $81 million in Q3, a decline compared to the same quarter of last year, and its operating margin declined to 17% (vs. 30% in Q3 2021).

Operating profit (Palantir)

Its adjusted free cash flow amounted to $37 million in Q3, marking the eighth consecutive quarter of positive free cash flow generation, while in the first nine months of 2022, its adjusted free cash flow was $231 million. At the end of September, Palantir’s cash position was about $2.4 billion and the company remains debt free, having therefore a very strong balance sheet.

Regarding its guidance, the company expects Q3 revenue to be about $504 million, while the market was expecting $503 million, and sees operating income of $78-$80 million. For the full year, its annual revenues should be about $1.9 billion, representing annual growth of 23.3%.

This means that Palantir will miss its annual revenue growth target of about 30%, as the challenging economic environment and strong dollar are impacting international revenue, and U.S. government revenue has increased at a slower rate in recent quarters than expected.

Despite that, Palantir’s medium-term growth strategy is not being scaled down, which clearly shows that management has a long-term mentality and is maintaining its business plan to create value for shareholders over the long haul, despite in the short term this having a negative impact on its operating margins and share price.

Valuation

Regarding its valuation, like most growth companies, Palantir’s valuation has de-rated considerably over recent months, even though its long-term fundamentals haven’t changed that much. While revenue growth and profitability have been softer in recent quarters, this is justified by external pressures rather than fundamental issues, thus a rebound in these metrics is likely when economic conditions improve over the next few quarters.

Taking into account this background, like many growth companies that aren’t profitable right now and are showing some slowdown in their top-lines, Palantir’s stock has been punished in recent months and is down by some 55% year-to-date.

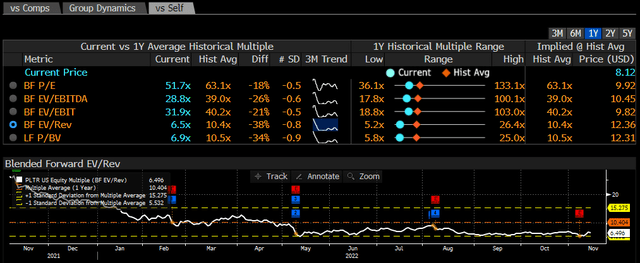

As shown in the next graph, Palantir was valued at more than 30x forward revenues at the end of 2021, but its valuation has dropped considerably in the past few months, and is trading at some 6.5x forward revenues nowadays.

Valuation (Bloomberg)

Therefore, Palantir’s de-rating has been quite fast and is trading at a discount to its historical valuation over the past year (about 10.4x forward revenues), and also much lower than its historical valuation since its direct listing in 2020 (historical valuation of about 18.6x revenues). This means that looking at its recent historical valuation, Palantir’s risk-reward proposition seems good, as the downside looks limited and upside potential is quite good.

This view is also confirmed from an absolute valuation approach, given that current consensus estimates of 2025 revenue of around $4 billion, and a valuation multiple of 10.4x (in-line with its recent historical average), my price target for end-2024 is $14 per share, or 76% higher than its current share price. However, this valuation may be much too conservative, and a higher multiple is likely if growth improves in the next couple of years, which would lead to even higher upside.

Conclusion

Palantir reported a decent Q3 and its guidance was more or less in line with market expectations, which was not enough to boost its share price, which reacted negatively on earnings day. However, more importantly for long-term investors, in my opinion, the company reported good metrics regarding customer growth, number of deals and billings, and increased the total remaining deal value, all positive signs for revenue growth in the next few quarters.

Additionally, Palantir continues to invest in business growth, showing that it’s maintaining its long-term approach, which should create value for shareholders over the long haul. Its shares remain undervalued and Palantir is a buy following its Q3 earnings report.

Be the first to comment