simpson33

Investment Thesis

The Trade Desk (NASDAQ:TTD) is leading the charge in a world of advertising that is demanding more transparency. This has been severely lacking due to the dominance of walled gardens such as Alphabet (GOOGL) and Meta Platforms (META). The Trade Desk has grown into a true Ad-Tech leader, and as digital advertising (particularly connected TV) continues to take up a higher share of global advertising dollars, I think this company is positioned to benefit immensely.

Its main offering is a demand-side programmatic advertising platform that ad buyers can use to get the most out of their advertising dollars. Using this cloud-based, self-service platform, ad buyers can create, manage, and optimize their digital campaigns across a spectrum of channels and devices, including mobile phones, computers, and connected TVs. The Trade Desk generates revenues through charging platform fees based on a percentage of a customer’s total ad spend, as well as through providing additional data and other services.

In truth, The Trade Desk’s business model can take a while to get your head around – specifically, the way the industry works. In my previous article, I outlined the digital advertising industry and The Trade Desk’s role within it, and also gave a detailed breakdown of my investment thesis.

In short, my investment thesis is the following: The Trade Desk has established itself as a true leader in the programmatic advertising space, an industry with multiple tailwinds that should enable the business to keep growing for years to come. It has embraced openness and transparency in an industry famed for walled gardens full of opacity, and this has enabled it to win customers whilst leaving its competitors to get scrutinized by antitrust regulators. I also believe that Jeff Green is the best CEO of any company in my portfolio, as The Trade Desk consistently beats guidance & appears to be 3 steps ahead of the rest of the industry, with a lot of credit going to Green himself.

Co-Founder & CEO Jeff Green (The Trade Desk)

With that big build up, let’s take a look at The Trade Desk’s Q2 results in an earnings season where advertising companies have been plagued by recession-driven pullbacks in spending.

Earnings Overview

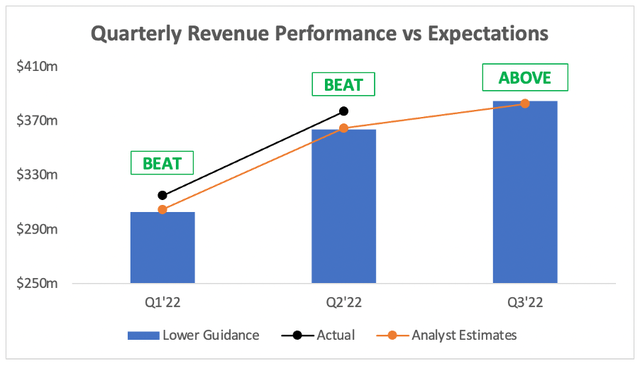

Starting from the top, and The Trade Desk grew its revenue by 35% YoY to achieve $377m, beating analysts’ estimates of $365m & coming in ahead of management’s revenue guidance for ‘at least $364m’.

Investing.com / The Trade Desk / Excel

Management’s guidance for Q3 revenues of ‘at least $385m’ also came in above analysts’ expectations of $383m. Considering the broader macroeconomic conditions, and the fact that other advertising businesses such as Roku (ROKU) or Snap (SNAP) have missed and lowered guidance, this was an absolutely pristine quarter from The Trade Desk. It shows once again why this company’s shares always appears to be ‘expensive’ – because you are paying for quality, and it shows. As Co-Founder & CEO Jeff Green said in the Q2’22 earnings press release:

We delivered outstanding performance in the second quarter, growing 35% versus a year ago, significantly outpacing worldwide programmatic advertising growth. More of the world’s leading brands are signing major new or expanded long-term agreements with The Trade Desk, which speaks to the innovation and value that our platform provides compared to the limitations of walled gardens

Despite the tough times, The Trade Desk keeps delivering while other companies continue to struggle.

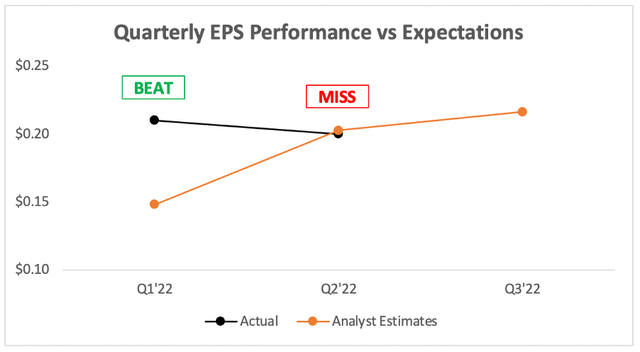

Yet on the face of it, not everything was perfect – The Trade Desk actually missed analysts’ estimates on EPS, the first time they have missed analysts’ estimates on anything since Q4’20!

Investing.com / The Trade Desk / Excel

Firstly, The Trade Desk doesn’t give guidance on EPS so I don’t pay an awful lot of attention to it – but what happened? Well it was a tiny miss; EPS of $0.20 vs expectations of $0.2027 so I’d almost call it ‘in line’, and such a small margin could be driven, for example, by the increase in income taxes YoY due to lower benefits from SBC awards. Either way, this isn’t really anything to be bothered about – particularly since adjusted EBITDA of $139m came in comfortably above management’s guidance of $121m, so clearly profitability is of no concern.

All in all, a stellar quarter from this incredible company. I never usually worry when it comes to The Trade Desk’s results, but this quarter I was a bit nervy. I have written articles this earnings season on Roku, Snap, Meta, Alphabet, Pinterest (PINS), and Shopify (SHOP), all of whom have an element of advertising to their business – and they all struggled. So I was nervous about The Trade Desk seeing the same impacts, but oh boy was I wrong; there’s a reason that this company is my second largest personal holding.

A Celebratory Earnings Call

Whilst many CEOs at the minute are quick to talk about the difficult macroeconomic environment on their earnings calls, and use that as reasoning for their company’s struggles, Jeff Green took a different approach – he just spoke about how amazing The Trade Desk is, and I’ll share some of the highlights.

Firstly, he did speak about macro factors… but, POSITIVE macro factors – who knew they still existed?

There are a few vectors and macro factors that are creating an amazing opportunity for us to grow into a much bigger company and wind share regardless of the economic environment. I’d like to take a minute to identify those macro factors that are providing wind at our back. First, there is a secular tailwind that continues to propel us forward, and that’s the worldwide shift to advertising fueled connected television.

I don’t know that we’ve ever experienced a secular tailwind like this before. CTV is evolving faster than anyone predicted. And if we continue to execute, I believe we will benefit as much as any company in the world from this tailwind, just like we did in Q2 and through most of the pandemic.

Connected TV has long been the story for The Trade Desk, and CEO Geen has often highlighted exactly how big it will be for the industry – having predicted back in 2018 that the likes of Netflix will eventually switch to an AVOD (as-supported video on demand) model that will require CTV advertisements. CTV has also been the fasting growing segment for The Trade Desk for many quarters, and this quarter was no different, with one highlight being the fact that CTV spend in Europe doubled YoY as The Trade Desk continues to grab more market share.

Green did mention the difficult macroeconomic environment, however, but in a slightly different way to other CEOs…

So, while we can’t control the macroeconomic environment, the pace at which we are signing new and expanded customer agreements indicates that we are becoming an indispensable partner in their business growth and we anticipate grabbing land regardless of the macroeconomic environment.

Basically, The Trade Desk sees its platform as being a ‘must have’ in the advertising industry & the tailwinds behind digital advertising are stronger than the short-term recessionary headwinds.

He summarized his opening remarks on the earnings call as follows:

As I said, at the outset, the transformational impact of CTV, the revolutionary approaches to identity and growing instability in some of our walled garden competition will only accelerate our ability to deliver value and to continue to gain share. I could not be more excited about the work ahead of us in the second half of this year and in the years ahead.

This is a CEO who walks the walk and talks the talk. I would strongly recommend that any investor or potential investor in The Trade Desk takes a look at Green’s opening remarks in the earnings call, as it paints an extremely positive picture that has been continually backed up by impressive business performance.

Valuation

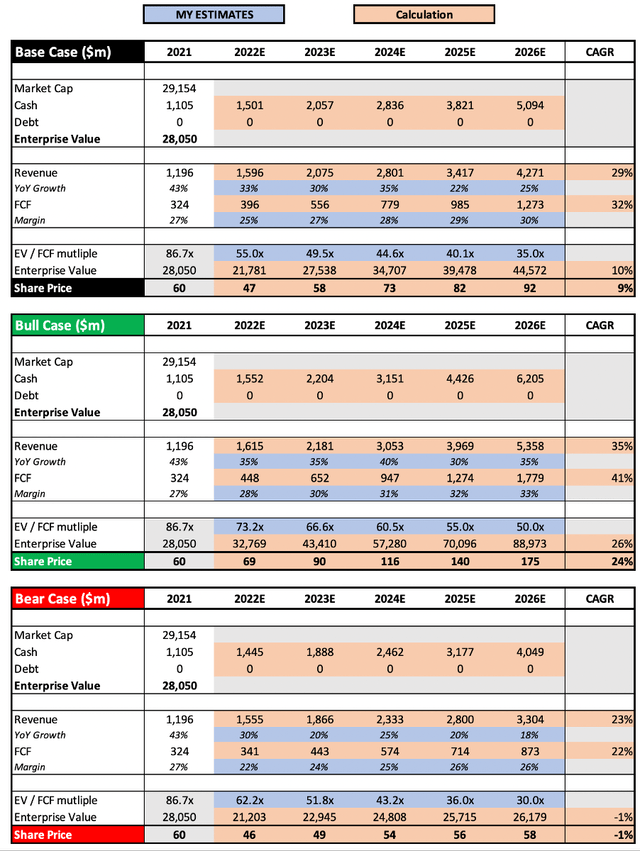

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether The Trade Desk is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

I have slightly changed the valuation approach from my previous article in order to give a better range of base, bull, and bear case scenarios. In my base case scenario, I assume that The Trade Desk achieves revenue growth of ~33% in 2022 as the company is currently on track to do so. I have assumed a 29% revenue CAGR through to 2026 as the company continues to expand and benefit from the tailwinds driving the industry forwards, with free cash flow margins also growing as The Trade Desk continues to scale. In terms of the EV / FCF multiple, I have used in each scenario what I believe to be a fair multiple given the growth outlook & margin expansion potential from 2026 onwards.

My bull case scenario assumes that The Trade Desk is able to continue growing revenue at an elevated pace, with a revenue CAGR of 35% over the period. I think this is certainly feasible, particularly given the broader tailwinds around CTV & the increased scrutiny on the walled garden competitors – everything is set up for The Trade Desk to succeed.

My bear case scenario is the opposite, assuming that a recession hits The Trade Desk from now through to 2024, and that the company struggles to regain its footing & revenue growth only reaches a 23% CAGR.

Put that all together, and I can see shares achieving a CAGR through to 2026 of (1%), 9%, and 24% in my respective bear, base, and bull case scenarios.

Investment Thesis: Strengthening

This quarter was just The Trade Desk flexing its muscles, and essentially saying ‘look how great we are’ – and you know what? The company absolutely deserves to do so, with this stellar quarter in an apparently impossible macroeconomic climate for anyone in the advertising industry.

The only reason that I am not upgrading The Trade Desk to a ‘Strong Buy’ is because there is still macroeconomic uncertainty. Clearly it coped better than most in this quarter, but if this broader difficulty persists and starts to impact The Trade Desk, then this expensive stock will likely see a pullback. But, I almost hope that it does, because I have so much faith in this company over the next decade & I would welcome another pullback to top up my holdings.

All in all, I think this is a business that should be at least on the watchlist of any investor with a 3+ year time horizon, and I will reiterate my previous ‘Buy’ rating.

Be the first to comment