Hulton Archive/Hulton Archive via Getty Images

“All Soccer, Minute by Minute”

Frederick Stibbert was a very wealthy English art collector, born and living in Florence during the 19th century. He is mainly linked to the work to which he devoted his entire life, namely the Stibbert Museum located on the hill of Montughi in Florence. The museum holds one of the world’s most conspicuous and important collections of antique arms and armor, which are beautifully displayed in the majestic “Sala della Cavalcata” (The Cavalcade Room).

The Stibbert Museum is, in fact, a collection of the most diverse genres of art and applied arts. It contains more than 36,000 artifacts from Eastern and Western civilizations, the result of a lifetime devoted to collecting not only arms and armor but also furniture, paintings, tapestries, porcelain and objects of antiquity from all over the world. To house this collection, he turned his villa into a museum, which he then left to the city of Florence upon his death.

At the foot of the villa is a park, covering an area of about ten acres, where I spent my adolescence. My family lived on one of the streets at the foot of the hill, and my desk mate was the son of the museum custodian. For us, the garden had no timetable; when it was closed to the public, he and I, together with other friends, would go through his house (or climb over the fence, but keep it between us…) and scamper the length and breadth of the park’s lawns kicking a ball around, which was of course forbidden during opening hours.

On Sundays, we would even bring a radio and listen at full volume to “All Soccer, Minute by Minute,” a live radio broadcast of the Series A championship matches (it was the 1970s) as we tried to imitate our heroes on the pristine lawns of the garden.

At that time, we didn’t know the difference between price and value, something that belongs to the grown-ups, but we still had very clear ideas about how much a leather soccer ball, a pair of soccer cleats or a dirt bike might cost. On our value scale, however, the leather soccer ball was definitely at the top.

The Eternal Dilemma

Price and value: Warren Buffett built an empire on their difference. We CEF investors, more modestly, try to buy the funds we are interested in by paying less than their value, without having to study the account books of each company within them. And, in order to pay less for them, the best way is to buy them at a discount to NAV, that is, to look for those funds whose price is some percentage less than the net value of their component assets.

As for me, when I decide to study a CEF, the first thing I analyze is the NAV performance over time since its launch. In the case of a positive trend, I decide whether to investigate further end eventually invest by following my simple “rule of thumb,” which suggests that I invest in “CEFs with a positive NAV trend, the highest discount and lowest leverage, and whose Total Return is more than its yield on NAV.”

This method leads me to predominantly select CEFs that are priced affordably relative to value, i.e., they quote at a discount to NAV. From this perspective, the world of CEFs is truly strange and what dynamics determine the price of a CEF remains a mystery to me. Rivers of ink have been spilled trying to explain why they price at a discount or premium to NAV. I personally have come to believe that the explanation is mainly related to two factors, regardless of market conditions: distribution yield and management reputation. I don’t want to venture on slippery paths, but in my opinion, the existence of Dr. Premium and Mr. Discount is a proof that the market does not have a rational approach in pricing CEFs.

Let’s take a look at some examples, taken from my Cupolone Income Portfolio, which is entirely devoted to this kind of instrument.

Cupolone Income Portfolio

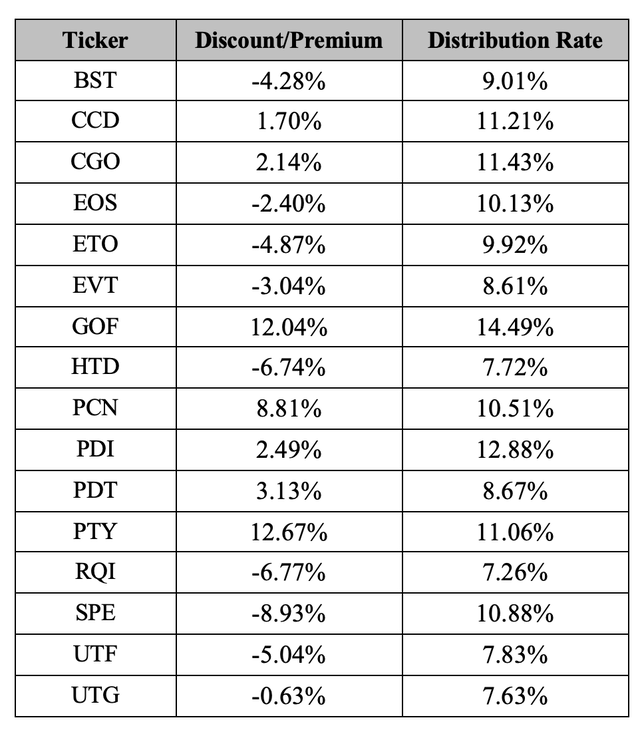

Cupolone Income Portfolio (named after Brunelleschi’s Florentine dome) is my strategic, primary investment portfolio. It now contains these sixteen funds and is a mixture of securities representing various investment sectors:

- BlackRock Science and Technology Trust (BST)

- Calamos Dynamic Convertible and Income (CCD)

- Calamos Global Total Return (CGO)

- Eaton Vance Enhanced Equity Income II (EOS)

- Eaton Vance Tax-Adv. Global Dividend Opps (ETO)

- Eaton Vance Tax-Adv. Dividend Income (EVT)

- Guggenheim Strategic Opp (GOF)

- John Hancock Tax-Adv. Dividend Income (HTD)

- PIMCO Corporate & Income Strategy (PCN)

- PIMCO Dynamic Income (PDI)

- John Hancock Premium Dividend (PDT)

- PIMCO Corporate & Income Opportunities (PTY)

- Cohen & Steers Quality Income Realty (RQI)

- Special Opportunities Fund (SPE)

- Cohen & Steers Infrastructure (UTF)

- Reaves Utility Income Trust (UTG)

These are their premium/discount ratio values, as of June 24, 2022

Despite the fact that the recent blizzard in the markets has changed the game a bit, this table tells us that the majority of these funds are at a discount to NAV (BST, EOS, ETO, EVT, HTD, RQI, SPE, UTF and UTG). All others are quoting at a premium, starting from minimum values (CCD, CGO, PDI and PDT) up to PCN and then well above 10% with GOF and PTY (whose premiums were even above 20% just a few days ago).

Are the last three justifiable premiums? Probably yes, but a simple graph of the NAV performance of these funds suggests a different reading, however. As an example, let’s compare BST and ETO, which invest in equities, with PCN and PTY, which invest in fixed income.

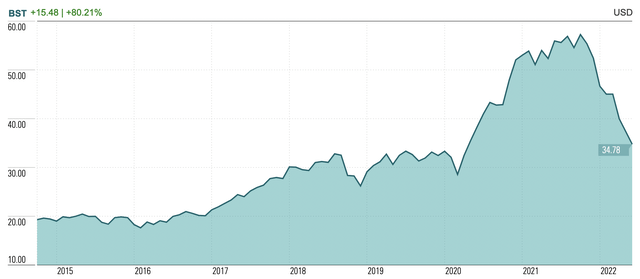

BST

The NAV of BST, a fund that invests in the technology sector, has grown by more than 80 percent since its launch, despite the recent collapse of the NASDAQ. We can definitely say that it has created value over the years for its investors, and has always paid regular dividends. In addition, it can be bought at a slight discount.

ETO

Since its launch in 2004, ETO’s NAV has grown almost 20%, despite recent declines. So we can say that this fund has also created value for its investors, as well as paying regular dividends all these years. In addition, it too can be purchased at a slight discount.

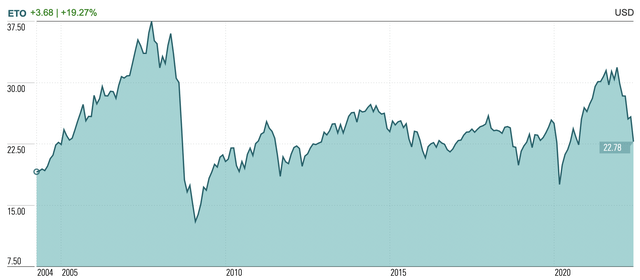

PCN

PCN is one of PIMCO’s flagship CEFs. PIMCO is considered among the world’s top fixed-income investment firm. A fact also reflected in the premium of more than 8 percent (but it was almost double until a few days ago) demanded by the market to buy the fund, whose NAV, however, has lost more than 17% since launch. I believe that in this case Mr. Market has confidence that management is living up to its reputation.

Mr. Market’s confidence is even more evident in the following fund, PTY, also managed by PIMCO.

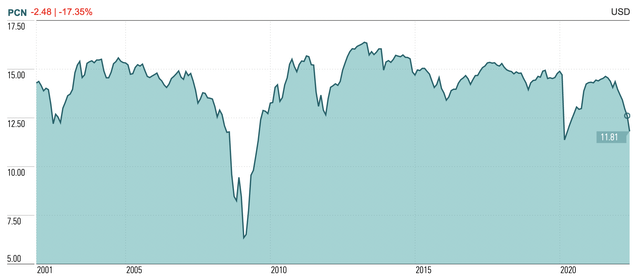

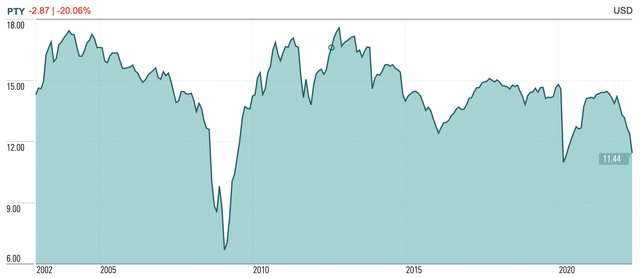

PTY

PTY trades at a premium of 12.67 percent to NAV (but was over 20% just a few days ago), even if its NAV has lost more than 20% since launch.

The graphs tell us that investors in the latter two funds have seen the capital value of their investment decline over time. This decline is offset by a high and steady distribution, which evidently justifies the actual premium. (As far as I’m concerned, I have no intention of selling these two CEFs, which form the basis of the bond component of my portfolio.)

To recap, BST and ETO have increased their value over time and yet they price at a slight discount. Meanwhile PCN and PTY have decreased their value but one has to pay a premium to buy them. Why the premium? Is it because they have a higher return? What about the announced rate hikes? Mysteries of the market…

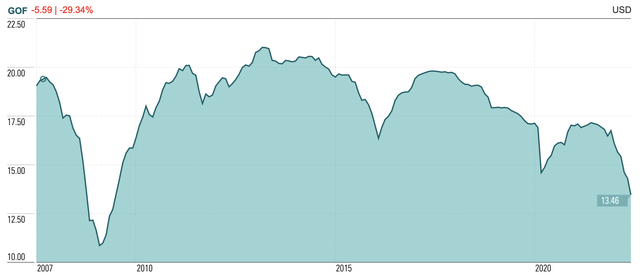

GOF, a Mystery Within a Mystery

Finally, let us look at the most striking case. GOF is in my portfolio as a result of absorption of GGM, a fund that I held long before the merger. I have since lightened my position but have not yet decided to part with it completely, despite its disappointing NAV performance.

As we can see, the NAV loss since launch is close to 30 percent, yet the fund trades at a 12 percent premium to NAV (but it was about 25% just a few days ago.) At the current price, it offers a yield in excess of 14 percent. For many SA readers this is an unsustainable yield, but the fact is that GOF continues undaunted on its way with a double-digit distribution that evidently attracts investors, who are willing to pay such a high premium in order to grab its shares.

Or are they willing to pay the premium because GOF has never cut its dividend since the day it was launched in September 2007, and indeed has raised it three times along the way? The dividends may be a reason to have confidence in its management, but tough times are ahead.

Masaccio “Tactical” Portfolio

Masaccio is a my “tactical” portfolio. It is currently biased toward financial services and consists of one MLP, three BDCs, a senior loan/CLO fund, another fund focused on small cap, and a Canadian CEF that invests in a diversified portfolio of equity securities of large-capitalization global dividend growth companies.

- AllianceBernstein Holding LP (AB)

- Ares Capital Corp (ARCC)

- Crescent Capital (CCAP)

- Royce Value Trust (RVT)

- SuRo Capital Corp (SSSS)

- XAI Octagon FR & Alt Income Term Trust (XFLT)

- Global Dividend Growth Split Corp Ordinary Shares (GDV.TO)

As I have mentioned in previous articles, in recent months I have approached the Business Development Company (BDC) universe. BDCs are comprised of 48 organizations that invest in small- and medium-sized companies as well as distressed companies, in the form of public companies whose shares trade on major stock exchanges. Like CEFs, BDCs also often offer high returns and may quote at a discount or premium to NAV.

For my Masaccio portfolio, I decided to limit the number of BDCs to only three stocks, which I tried to select by adopting the same criteria that I use for CEFs. I thought it would be easy, but it is not at all. In fact, among the BDCs with a positive NAV trend, there are many that quote at very high premiums on NAV, making them unapproachable for me. In the end, I chose three BDCs that quote at a discount, namely ARCC, CCAP, and SSSS.

- ARCC is the largest capitalization BDC on the market, has a positive NAV performance, and quotes at a discount of 8.04%.

- CCAP is a relatively young company that invests in secured and unsecured debt, as well as related equity securities of private U.S. middle-market companies: its NAV is slightly negative but the stock trades at a steep discount to NAV (-27.57%).

- SSSS is the real bet in my Masaccio portfolio, which unfortunately is declining at the moment. SSSS is a venture capital BDC that invests in the equity and debt of start-ups or developing companies.

Not all donuts come with a hole. My purchases, even with averaging down the load price, have not been enough to prevent my position in SSSS from currently being at big loss. Its NAV performance is also negative. SSSS is, however, a very dynamic entity, and the fact that it is trading at a price almost half the value of its assets (-47.55%) makes me place confidence in its future prospects. Maybe I got the timing wrong… but don’t shoot the piano player!

In Search of Rare Stones

When I think of Dr. Premium and Mr. Discount, I wonder if they make sense, and if we are really sure the markets are that rational. As I wrote in an article about a year ago, a careful screening of the 500 or so CEFs currently on the market leads to the discovery that only about 10 percent of the monthly distribution funds have a positive NAV since launch. This discovery means that although CEFs as a whole are considered to be an instrument designed to pay dividends, only a small percentage of them are able to guarantee the maintenance of that distribution. The vast majority are at best an “at par” investment: that is, they are an instrument that pays a distribution without significantly reducing or increasing the value of its assets. At worst those distributions are at the expense of NAV.

What is the point of investing in CEFs that lose value, when there are others that not only keep their distribution intact, but also grow their invested capital? If, in addition to having a positive NAV performance since launch, a fund can also be bought at a discount, the combination is perfect. Those are precisely the funds we need to go after, even if Dr. Premium and Mr. Discount seem to tell us different stories.

P.S. I would like to point out the recent release of the updated 2022 edition of an e-book that I mentioned four years ago in my first article, namely Perpetual Income with Closed-End Funds by Faithful Steward Investing. It was one of my favorite reads as I delved into the wonderful world of CEFs.

Be the first to comment