real444/E+ via Getty Images

On Wednesday, March 16, 2022, the Federal Reserve announced that it was raising its target range for the Federal Funds rate by 25 basis points.

The night before this announcement, the Standard & Poor’s 500 stock index had closed at 4,262.

The stock market rose for the next three days, ending the week at 4,463.

In this current week, the S&P also rose, it closed the week at 4,543, recording the second weekly gain in the index.

Both the Dow Jones Industrial Average and the NASDAQ index also closed up this past week, the second week in a row these measures also rose.

But, the Federal Reserve is tightening up on monetary policy…or, is it?

It seems as if market participants do not fully believe that the Federal Reserve is really doing what it needs to do to combat inflation.

I have raised this question a number of times over the past several weeks, but I now have one more piece of information that causes one to question whether or not the Fed is really tightening up on its monetary policy.

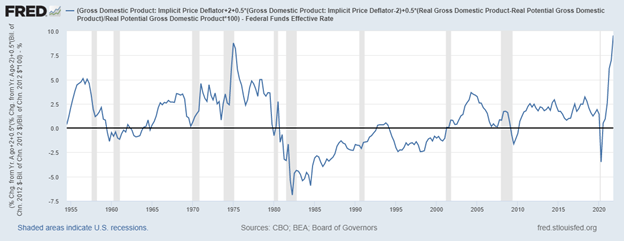

The “Taylor Rule”

Amber Hestla reminds us in Money & Markets of something called the “Taylor Rule.”

The Taylor Rule was devised by the economist John Taylor. It is a “rule” that applies a formula to the current economic situation to determine if the Fed is in a “restrictive” stance or in an “accommodative” stance.

The model incorporates data on the current rate of inflation, actual GDP, and the potential GDP in an optimized economy.

If the formula is negative, the Federal Reserve policy is restrictive. However, if the formula is positive, then monetary policy is accommodative.

Note the current results.

The Taylor Rule (Federal Reserve)

“The Taylor rule finds the current Federal Funds rate should be 9.6 percent!”

The past week, the Federal Reserve has been holding the effective Federal Funds rate at 0.33 percent.”

If the Federal Reserve moves the range for the policy rate by 25 basis points five more times this year, the top of the Fed’s range will only get to 1.75 percent.

If the Federal Reserve raises the range by 50 basis points five times this year, the top of the Fed’s range will only be 3.00 percent.

In other words, the “Talyor Rule” review of the current environment indicates that the Federal Reserve is excessively accommodative and that it would take quite some time for the Fed to move into a restrictive position.

In other words, the current position of the Federal Reserve will do little or nothing to combat the inflation that is challenging the U.S. economy right now.

Investors in the stock market, it would seem, are positioning themselves correctly. The Federal Reserve continues to support the stock market and investors should continue to be willing to place their money in the market.

Even if the current results are excessive, the fact is that they are still, well within the range of accommodative monetary policy.

The Federal Reserve has been so accommodative over the past two years that it has created this situation that it now must deal with.

Has the “Taylor Rule” ever been this high before?

The answer is no. The measure reached an 8.8 percent number in 1975, in the years just before Paul Volcker and the Fed drove the Federal Funds rate up above 20.0 percent to combat the inflation at the time.

But, now, it seems, the situation that has been created by the Fed is one that may require some pretty “hard” policy positions.

We have not reached that point yet, but investors may be waking up to the realization that what the Federal Reserve is now doing and what the Federal Reserve is now signaling is not really consistent with what the Federal Reserve is going to need to do.

And, this may mean that there are some pretty hard times ahead for investors in the stock market.

But, For Now

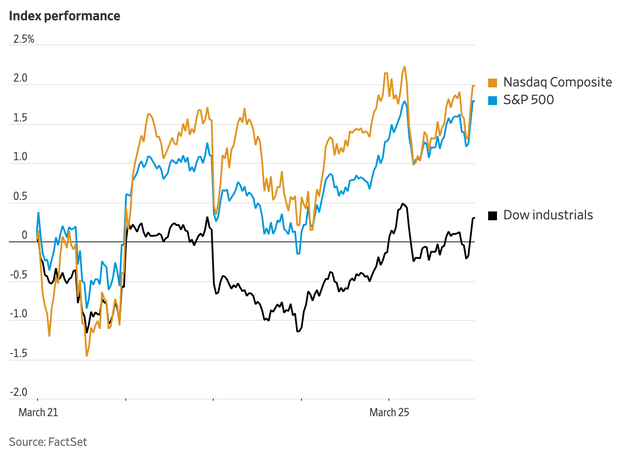

So, the U.S. stock market rose for the second week in a row.

Weekly stock market performance (Wall Street Journal)

Volatility continues to remain relatively high.

Radical uncertainty continues to dominate the scene.

The situation in Ukraine seems to have achieved some stability, but people still have no idea what is going on in the mind of Russian leader Vladimir Putin. What may happen in Ukraine is anyone’s guess.

But, one still must not forget the rest of the world.

The Wall Street Journal, in a major editorial, warns:

“A spate of bad news outside Europe this week is a reminder that the U.S. and its allies face challenges from authoritarian regimes on multiple fronts.”

Just one event in the week is enough to be disconcerting.

“North Korea on Thursday fired an intercontinental ballistic missile, its 12th missile this year.”

Bottom line: a lot of other nations may be just waiting to test the current American leadership.

“Markets are trying to price something that is basically impossible to price, as part of what’s going on in the world depends on Putin’s thinking, which nobody knows.”

“The longer (these uncertainties) last, the higher the upside to inflation, the lower the downside to growth, It’s massive, radically uncertain.”

And, just how is the Federal Reserve going to manage through these disruptions?

Can the Fed fight inflation when there are other, physical, battles going on in the world?

In other words, can the Fed really tighten up on monetary policy at this time?

Your answer to this, I believe, determines where you should be as an investor.

Be the first to comment