LilliDay

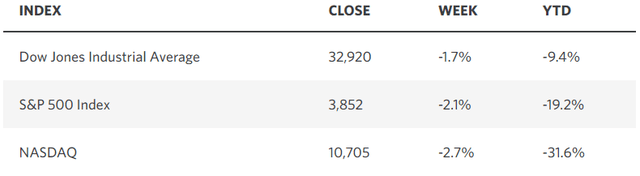

Last week, I conjectured that Chairman Powell was unlikely to acknowledge progress on the inflation front during his press conference over concern that it might light a fire under risk asset prices going into year end. On that front, he came through with flying colors. Nor was it a surprise that the Fed updated its Summary of Economic Projections from September to fall closer in line with market sentiment. The members raised their expectation for the peak Fed funds rate from approximately 4.6% to 5.1%, as well as backed away from the idea of rate cuts during the second half of 2023. The higher-for-longer rate update was not welcomed by investors whose primary concern is shifting from inflation to growth. Therefore, bad news for the economy, which implies lower prices, is no longer good news for the market, because it feeds recession fears.

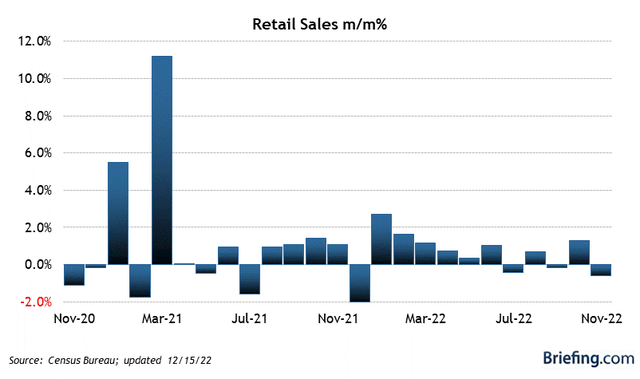

I continue to think recession fears are overblown at this juncture for the primary reason that it takes a meaningful contraction in consumer spending, which accounts for more than two-thirds of economic activity, to produce one. Still, investors recoiled last week on news that retail sales fell short of estimates during the month of November, as though this was the canary in the coal mine. Granted, sales did decline 0.6% when they were expected to decline by just 0.3%, but this had more to do with the ongoing shift in spending from goods to services than it did with a meaningful downturn in overall spending. There have been more significant monthly declines during this expansion, which typically occurred following an outsized gain the month before, as we saw in October.

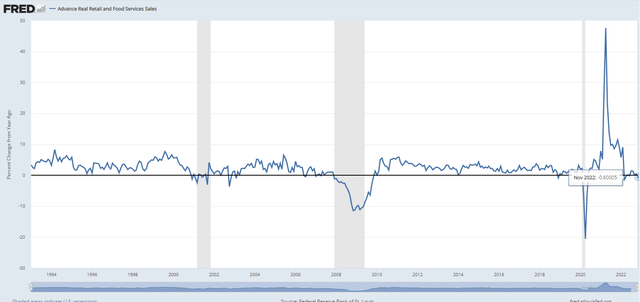

A much better metric to use is real retail sales growth on an annualized basis. Previous recessions started when inflation-adjusted (real) retail sales declined in a 1-3% range. The recession in 2001 started with a decline in real retail sales of 2.5% in March of that year, while the one in 2008 began once real retail sales dropped 1.2% in December 2007. We did see real sales decline in March of this year by 1.4%, but then sales bounced back, which was due to the anomaly of consumers shifting spending from goods to services. Last month’s sales declined 0.6% on an annualized real basis, which falls short of the range where I become concerned. Again, largely due to the shift in spending.

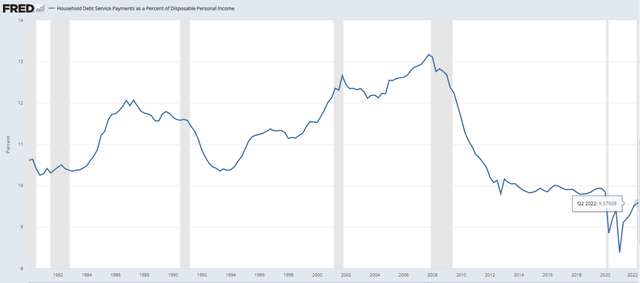

I continue to read about how indebted consumers are today, which will weigh on their ability to spend moving forward. The issue I have with this take is that debt service payments as a percentage of disposable income still stand near multi-decade lows at just 9.6%. The amount of debt is only relevant in terms of the disposable income available to service it.

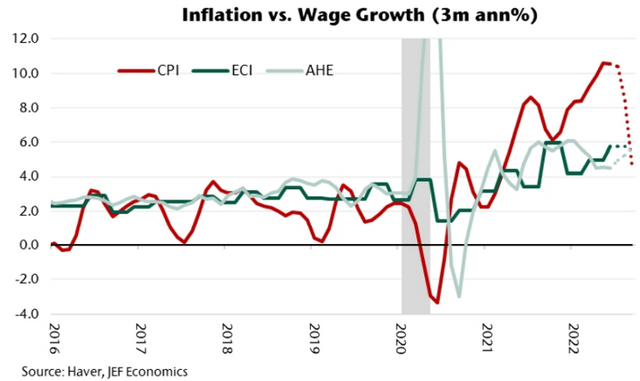

While wage growth, which determines disposable income, has clearly peaked and should start to decline as the labor market weakens, the rate of inflation is likely to fall at a faster rate in 2023. That means consumers should start to realize real wage gains again in 2023. Retirees receiving social security are already in that camp, with a cost-of-living adjustment of 8.7% to begin next month.

As for the stink being made about rising credit card delinquency rates and net charge-offs, that is also a misrepresentation, as the increases are coming from abnormally low levels to ones that are still below pre-pandemic levels. It is another example of normalization rather than deterioration.

Still, the recession mongers are relentless. I have never seen such a broad consensus forecast an ominous event with such certainty. Psychology does play an important role in recessions, because it typically involves consumers recoiling out of fear as much as necessity, which is similar to what investors do during a bear market. Yet, I do not see a lot of fear in the real world today. It is concentrated in financial markets. The recession that was supposed to occur in the second half of this year is now forecast to begin sometime next year, but it is reliant on the Fed strangling the economy with even tighter monetary-policy conditions to rein in a rate of inflation that is not expected to abate. I think real consumer spending will remain resilient, largely because the rate of inflation will fall faster than the consensus expects, allowing the Fed to end its rate hikes sooner than the consensus expects. If I am correct, the lows for this bear market should be behind us.

Be the first to comment