Feverpitched

The debate between bulls and bears is likely to shift to the topic of recession in 2023. Bears believe that persistently elevated levels of inflation will force the Fed to raise short-term interest rates above 5%, suffocating the modest growth the economy is exhibiting today and resulting in a significant decline in corporate earnings that drives the market averages to new bear-market lows. Bulls like myself see the rate of inflation falling more rapidly than the consensus expects, easing the burden on the Fed to continue tightening past year end and resulting in a lower terminal rate than the market is accounting for today. As a result, consumers should benefit from a return to real wage growth next year, which should prolong the expansion and lead to a modest increase in corporate profits, as the economy navigates a soft landing.

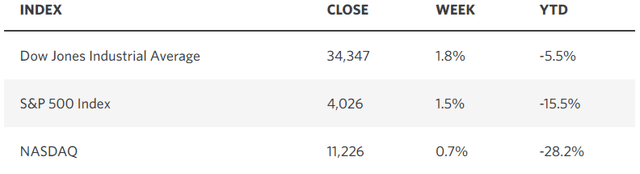

Edward Jones

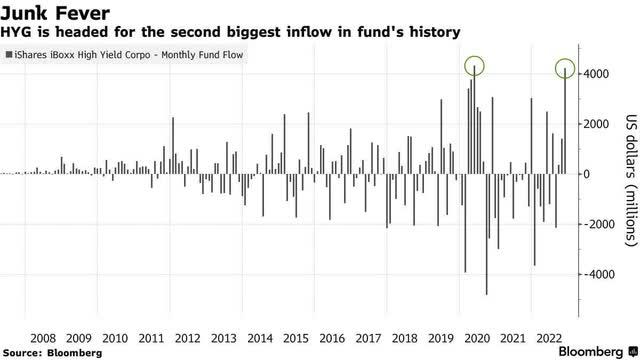

Last week’s weaker economic data in combination with the less aggressive tone carried in the minutes from the Fed’s November meeting gave the advantage to the bulls. This week we will see if Chairman Powell continues to carry that tone when he speaks on Wednesday at the Brookings Institute. I have reservations, as he and other Fed officials have been quick to suppress any meaningful exuberance for risk assets out of fear that it will loosen financial conditions and fuel more inflation. Regardless, investors’ appetite for risk continues to grow, as high-yield corporate bonds have had record inflows over the past two months, which is not what we typically see in advance of a recession.

Bloomberg

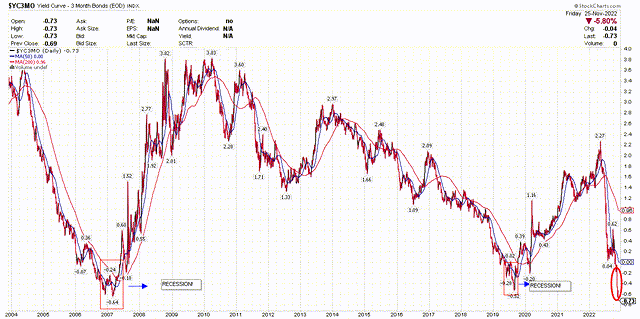

Still, recession fears are bound to linger, which will limit the upside in the broad market until there is more clarity on inflation and monetary policy next year. A recession is at the top of my list of concerns for 2023, but I still see it as a low probability, despite some very foreboding signposts that I cannot ignore. The most obvious one is the inversion of the yield curve when we compare both 3-month and 2-year Treasury yields with the 10-year yield. They indicate that the Fed is already overly restrictive with the fund funds rate at 3.75-4% and on track to increase to 4.25-4.5% in mid December. The more reliable 3-month/10-year curve is inverted by more than we saw in advance of the past two recessions.

Stockcharts

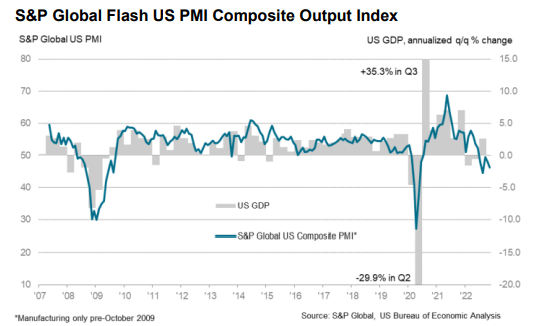

This is happening at the same time that S&P Global’s Composite PMI moved further into contractionary territory during mid-November, falling to 46.3. This survey of purchasing managers indicates that business activity, led by new orders, decelerated in both the services and manufacturing sectors to levels consistent with the economy contracting at a 1% annualized rate. I have a lot of confidence in this survey, but I have never seen it diverge so significantly from the other indicators I follow. The Atlanta Fed’s GDPNow model is estimating growth of 4.3% in the fourth quarter, and consumer spending figures so far support that estimate.

S&P Global

Therefore, while my recession antennas are on high alert, I think the post-pandemic normalization process that is still underway continues to result in wide disparities in the rates of growth for different segments of the economy, which is why we are getting mixed signals. On a positive note, the PMI showed input cost inflation slow for a sixth month in a row to its slowest rate since December 2020. In turn, companies raised their selling prices at the slowest rate in more than two years. Also notable in the survey was the expectation that output would increase over the coming 12 months, due to stronger demand and further improvement in supply chain stability. Again, that is not characteristic of an economy on the cusp of recession.

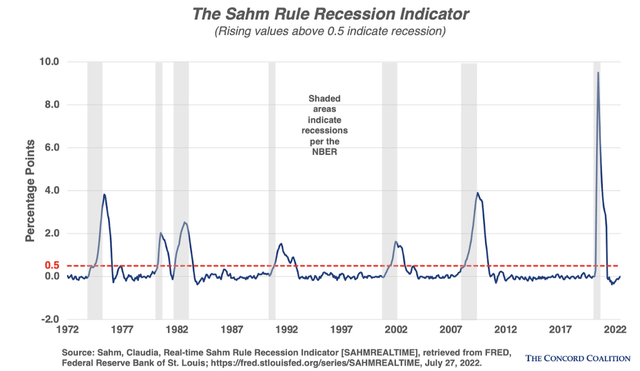

I think a more reliable indicator, especially in conjunction with the yield curves and PMIs, is the Sahm Rule Recession Indicator. It is named after Fed economist Claudia Sahm and relies on monthly unemployment data from the Bureau of Labor Statistics. The rule suggests that a recession has started once the three-month moving average of the unemployment rate rises by 0.5% or more from its low over the past 12 months. Today, that low is 3.5%, while the most recent unemployment rate is 3.7%, so 4% is the magic number.

Concordcoalition

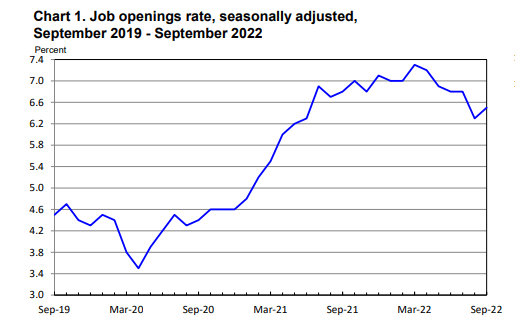

That may be hard to achieve when there are still 10.7 million job openings in the economy, but that is the good news. The Fed wants to see the rate of wage growth slow significantly, and Fed officials have stated we may need to see the unemployment rate rise by more than 0.5% to do it, but the issue is not the number of jobs but the number of job openings.

BLS

It is the openings that are putting upward pressure on wages and indirectly on the price of goods and services. Reducing the demand for additional labor should temper the wage growth we have seen over the past year, and eliminating job openings is far less damaging to the economy than losing jobs.

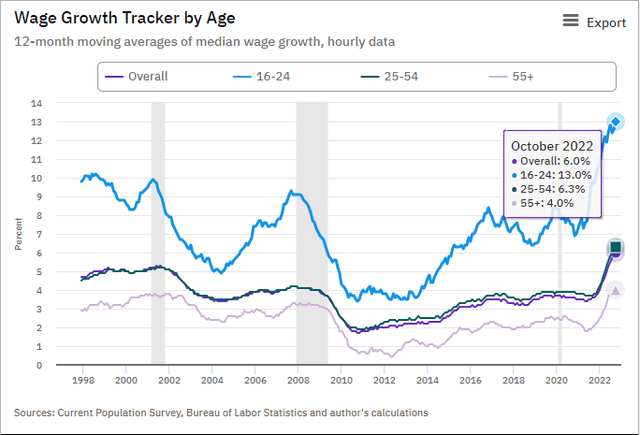

Furthermore, wage gains over the past 12 months don’t look as inflationary when we recognize that the fastest rate of growth is being awarded to the youngest and lowest paid workers in the labor force, as seen in the Atlanta Fed’s latest Wage Growth Tracker. Perhaps this is putting upward pressure on the price of a caramel macchiato, fast food, and the most popular youth fashions, but older and higher-income demographics that account for the bulk of purchases are receiving much lower pay increases.

Atlanta Fed

I still see a pathway to a soft landing for the economy, but I am not ignoring some very important warnings signs. In aggregate, the rate of inflation looks to be declining at an accelerated rate, while the economy continues to expand. The biggest question mark is whether the Fed will end its rate-hike cycle in December, which I think is a critical component of the soft landing narrative. That remains my outlook, which should support risk assets to the extent that the bear-market lows are behind us.

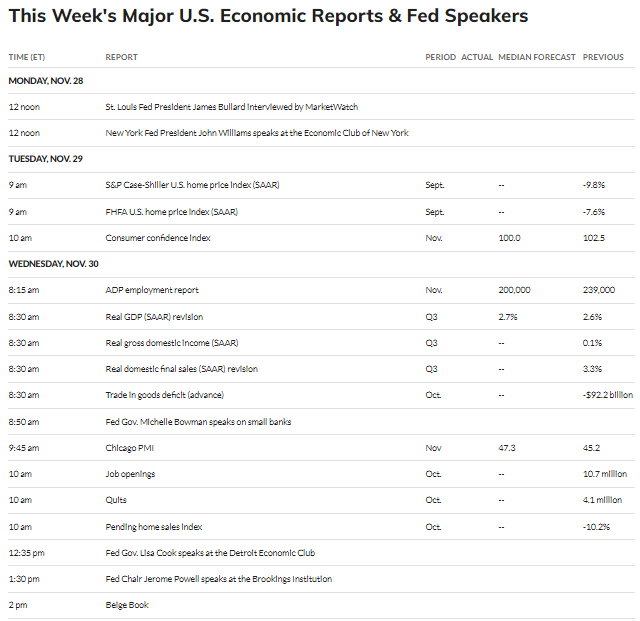

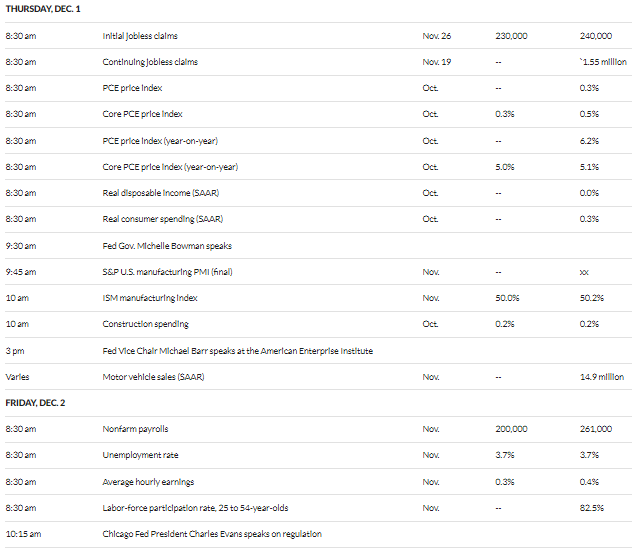

Economic Data

We have the Case-Shiller home-price index on Tuesday, which should show a continued decline in the rate of home price growth. Chairman Powell speaks on Wednesday, and we learn about job openings in October with the JOLTS report. Thursday brings personal income and spending data along with the Fed’s preferred inflation measure in the personal consumption expenditures price index. Friday is the jobs report for November.

MarketWatch

MarketWatch

Technical Picture

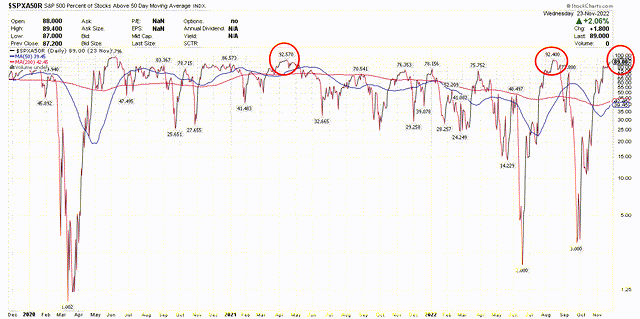

I have two charts to share, which in combination offer a tricky landscape as we approach year end. The first is short term in nature with the percentage of stocks in the S&P 500 that are trading above their 50-day moving average. The percentage has risen to 89%, which is close to the August high of 92%, and only exceeded prior to that in April 2021 at the same 92%. It suggests that the market is extended on a short-term basis.

Stockcharts

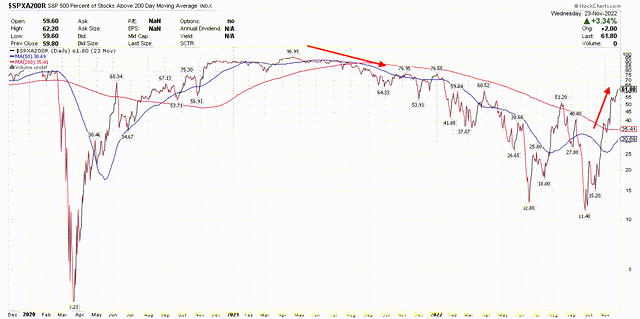

The second offers a much more optimistic picture over the longer term, as the percentage of stocks trading above their 200-day moving average is at 62% and rising, indicating an increasing number of stocks are participating in the rally. That is what we call breadth. Note that in May of last year breadth started to deteriorate from 97%, which indicated a weakening market and was an early warning sign of lower levels in the index to come.

Stockcharts

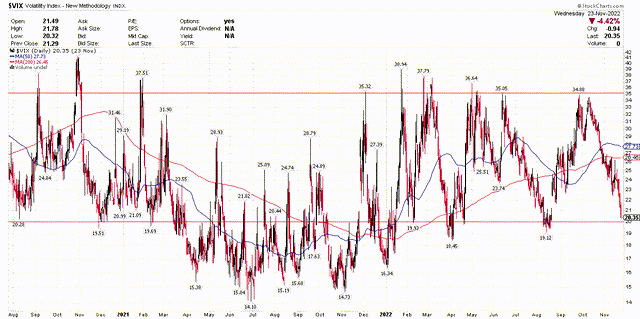

This year the S&P 500 has peaked each time the Volatility Index fell below 20. It currently stands just above 20, but volatility tends to decline as we move into year end, and it is important to note that the index fell into the mid teens through most of last year during much stronger market performance. This is not as foreboding as I had previously thought, but it does increase the near-term risk when in combination with the percentage of stocks above their 50-day is so high.

Stockcharts

A market that is extended or overbought on a short-term basis simply suggests that we need to see a period of consolidation or a pullback to resolve it, while the longer-term outlook is improving.

Be the first to comment