gesrey

Note: This article was written with Darren McCammon.

Article Thesis

In investing, boredom can be good. Reliable companies that pay recession-resilient and growing dividends can be great investments, even though their business models may not be as spectacular or grandiose as that of some flashy tech firms. Some of our favorite income names remain solid picks today, despite having generated hefty returns for us already.

Overview

In Cash Flow Club, we sometimes discuss investments that are inherently trades. EGY, VET, ZIM, and INSW are recent examples. This is because these firms do not enjoy steady eddy cash flows, but rather volatile cash flows that are tied to the price of a commodity or service.

Firms with steadier cash flows can be better buy-and-holds (e.g., natural gas midstream), even though their short-term upside potential usually is less pronounced. In fact, one of the beauties of cash flow investments—Archrock, Inc. (AROC), Enterprise Products Partners (EPD), MPLX (MPLX), etc.—is that, after coming to know the firms thoroughly, we no longer need to spend as much time on them. They were analysed deeply in the past, so all we really need to keep abreast of is the changes. Moreover, most of the time with these firms, not much changes over time, other than them pretty much continuing to produce and grow their cash flow per share as planned.

Sometimes it feels like one can get bored reading yet another article that effectively says, “Another solid quarter from…”? But admittedly, in investing, boredom is one of the nicer problems to have.

Boring Dividend Stocks Rock

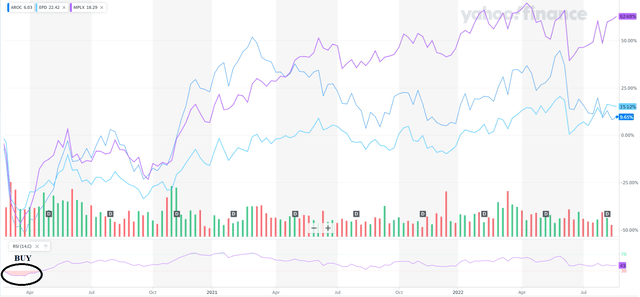

If your goal is a 7-9% growing dividend stream — something very much in demand by retirees, near-retirees, and many others — these types of investments are key. If you can buy at even more opportune times, such as when these names are beaten down for a temporary reason (e.g. Covid-induced fear), or just when they hit an RSI near 30, that’s even better.

We were fortunate enough to be able to buy during Covid-induced lows. We used a February 2022 start date in the chart so you could see the effect of buying the dip when the RSI (relative strength index) was below 30. However, at Cash Flow Club, we mostly bought at the end of March and the beginning of April. So, our actual returns are higher than what is shown on the right side of this chart.

Even so, today it’s relatively easy to forget about these names. They just aren’t as imperative in our minds because they don’t have to be. Also, price graphs like those shown at Yahoo seriously underestimate the power of dividends — neither the dividends themselves nor the effect of dividend reinvesting are included in the return calculation from above.

A useful way to look at the importance of dividends is by using an online dividend reinvestment calculator. Here we see what occurs if dividends were immediately reinvested.

Archrock

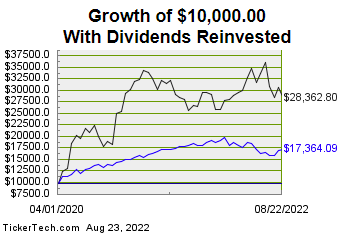

AROC (black line) for instance has produced a 54.6% average annual return since the Covid crash (vs. 26% for SPY, blue line) if dividends were reinvested:

Dividend Reinvestment Calculator

Despite these hefty gains, Archrock remains a solid investment today, we believe. The company, which rents out natural gas compressors to companies in the oil & gas industry. These compressors are used to move natural gas from the regions it is produced to the markets where it is used/burned. This makes Archrock an important energy infrastructure company that has an important role in moving energy to the markets where it is used.

With demand for natural gas growing around the world and with prices being at a very high level, demand for Archrock’s compressors is healthy and could grow further, thereby allowing the company to generate attractive cash flows. Those can be used for a mix between paying down debt, investing in growth opportunities, and returning cash to the company’s owners. At current prices, Archrock offers a dividend yield of 7.5%, which makes for a pretty nice income stream.

Enterprise Products Partners

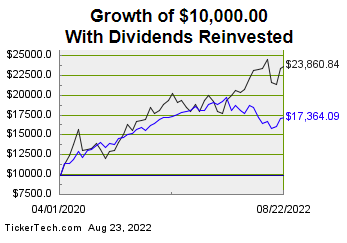

EPD has produced a 43.9% average annual return (vs. 26% for SPY) since April 2020, when dividend reinvestments are accounted for:

Dividend Reinvestment Calculator

That’s less than what Archrock has delivered, but still pretty compelling. Enterprise Products is a very diversified energy midstream company that owns pipelines, terminals, storage facilities, and so on. It has one of the best balance sheets in the industry and its management is great. Overall, this makes EPD one of the lowest-risk choices in the energy midstream space. At current prices, Enterprise Products offers a dividend yield of 7%, despite more than doubling since the COVID lows.

MPLX

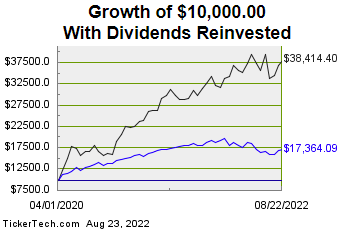

MPLX has produced a 75.5% average annual return (vs. 26% for SPY) since April 2020:

Dividend Reinvestment Calculator

MPLX has offered the strongest return among these three companies, relative to the lows seen in April 2020. And yet, despite these hefty gains, MPLX offers a compelling dividend yield of 8.5% today — the yield on cost for someone buying two and a half years ago naturally is much higher than that. When one buys at an especially high starting yield, dividend reinvestment is even more powerful, proven by MPLX’s excellent gains from the COVID lows. The energy midstream company continues to generate compelling results, lowering its leverage and growing its cash flows at the same time.

These graphs can illustrate a couple of other things that are important about dividend investing. If you recall during the Covid Crash, most people thought EPD was the most stable of these three — and many, including us, still do think the same. AROC was thought riskier, a more volatile oil services and equipment provider. MPLX was thought riskier because it had greater uncertainty about what its parent would choose to do during that crisis.

Yet both AROC and MPLX didn’t just greatly outperform the S&P 500, they also outperformed EPD.

AROC outperformed EPD because, with dividend reinvestment, volatility can be a benefit. The steady cash flows provide steady dividends. The price going up and down ensures when you reinvest those dividends you will be buying more shares when the stock is low-priced than when it is fairly or overpriced. Thus, as long as the firm is producing solid long-term cash flows and a good dividend, price volatility can be your friend. Your dividends just keep coming. Those dividends being reinvested automatically help you do the right thing: Buying low (buying more shares when prices are low). This improves one’s long-term return, and once you understand what is going on is all part of the plan, also lowers your stress level.

MPLX outperformed EPD because it was less trusted and had more unknowns when Covid occurred. There was a question about what the parent planned to do with the child. Thus, the stock saw a greater rebound when those fears were resolved. It’s important that the firm enjoyed solid and strong underlying cash flows and reasonable debt. This allowed us to be relatively assured it will still be around for the post-Covid recovery.

Conclusion

Solid underlying cash flows and reasonable debt help ensure survivability in challenging market conditions. In fact, this fundamental strength, in combination with a meaningful dividend payout, helps turn volatility, uncertainty, and fear into your friend (by buying more shares via dividend reinvesting at temporarily lower prices).

The long-term-oriented buy-and-hold income investor doesn’t have to fear volatility or temporary troubles when the investment choices were the correct ones — fundamentally healthy companies with strong cash flow generation. If one invests in these companies, the power of dividends can be a great force from which investors can benefit.

Be the first to comment