Beautifulblossom/iStock via Getty Images

Since SPDR Dow Jones Industrial Average ETF (NYSEARCA:DIA) invests in the 31 largest companies, most of which pay dividends, it can provide investors with some protection. However, the protection isn’t strong enough to prevent negative returns if the broader market falls. With interest rates rising and economic weakness looming, DIA might not be a great option for coping with a challenging environment. It will follow broader market trends in the coming months as most of its portfolio holdings are vulnerable to inflation, slowing economic growth, and increasing interest rates.

DIA Fizzle to Protect Against Market Volatility So Far

The US stock market experienced the worst first half of the year since 1970 amid concerns over 40-year high inflation, monetary tightening, the Ukraine war, supply chain disruptions, and the risk of recession. As a result of the worst sell-off, 10 out of 11 sectors sank in the first half. Growth stocks were among the biggest laggards while value stocks also suffered hefty losses.

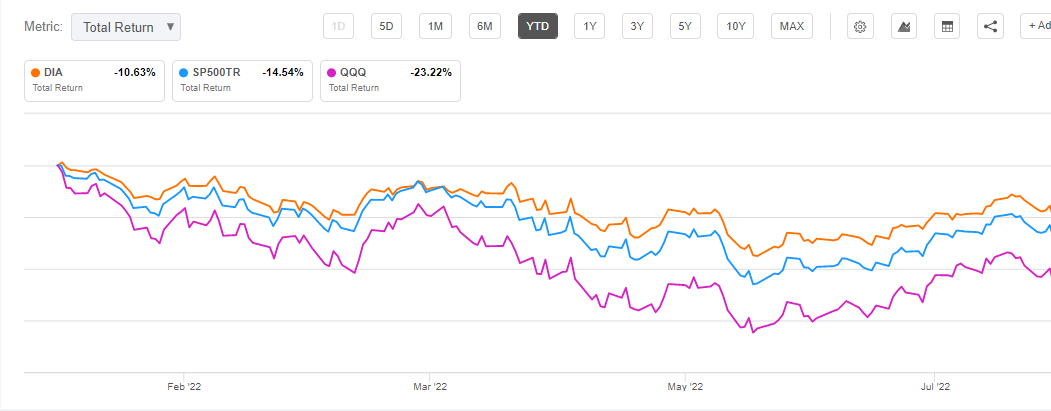

DIA Total Returns vs. S&P 500 (Seeking Alpha)

Based on the above chart, DIA has demonstrated the ability to outperform the S&P 500 and tech-heavy NASDAQ index so far in 2022. Despite that, DIA doesn’t have the characteristics to become a pure defensive ETF that investors buy with an aim to generate positive returns even in volatile periods, such as the one experienced in 2022. Since the beginning of the year, DIA has garnered a negative 10% total return compared to a negative 14% return from the S&P 500. This indicates that the ETF can help mitigate losses when compared to the broader market index, but it does not offer complete protection from market headwinds and struggles to generate positive returns. Also, the DIA underperformed against pure defensive ETFs such as the iShares Core High Dividend ETF (HDV), the First Trust Morningstar Dividend Leaders Index ETF (FDL), and the Vanguard Consumer Staples ETF (VDC). Over the past year, Vanguard Consumer Staples ETF has returned around 5%, while HDV and First Trust Morningstar Dividend Leaders Index ETF have posted double-digit returns.

What’s Next: Economic and Interest Rate Headwinds Will Intensify

In order to predict how DIA will perform in the quarters ahead, it’s essential to look at market dynamics. In the last two months, stocks bounced back amid investors’ optimism that the worst may have passed and the Federal Reserve may slow rate hikes. At the Jackson Hole conference, Fed Chairman Mr. Powell dampened bulls’ expectations by indicating that Fed will continue raising interest rates and plans to maintain a restrictive policy stance for some time. In addition, he warned that delaying the right decision could lead to steep unemployment and economic stress. This means the US economy, which has already contracted in the last two consecutive quarters, is likely to accelerate its deceleration in the coming quarters, which will negatively affect corporate profits and investors’ sentiments.

After Powell’s speech, all three major stock indexes plunged around 3%-4%. In my opinion, his speech has ended the bear market rally we have witnessed in the past two months. Stocks are likely to fall in the months ahead since the recent rally was based on unrealistic expectations rather than actual fundamental improvements. In recent articles that I wrote before Powell’s speech, I repeatedly warned investors that weak economic conditions, lofty valuations, and earnings revisions would lead to a downward trend in stock prices. For instance, my article on Vanguard Growth ETF (VUG) highlighted why investors might not pay a premium for growth anymore, while the other article on SPDR Portfolio S&P 500 ETF (SPLG) discussed facts about the bear market rally.

DIA’s Portfolio Doesn’t Offer Protection Against Interest Rate and Economic Headwinds

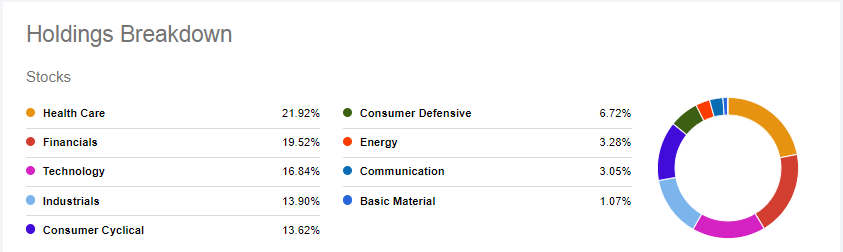

DIA’s Portfolio Holdings (Seeking Alpha)

DIA does not appear to be an appropriate ETF for defensive investors, especially when markets are likely to face economic slowdown and high-interest rates, which could result in a sharp and prolonged selloff. It appears that the fund’s majority of portfolio holdings are susceptible to economic and interest rate headwinds. DIA’s portfolio is heavily dominated by industrial, financial, technology, and communications stocks, which account for over 53% of its holdings. The financial sector, for instance, which accounts for 19.52% of the entire portfolio, fell around 13% year to date with banking and lending companies among the largest decliners. Goldman Sachs (GS), which is the second largest stock holding of DIA’s portfolio, lost around 18% of its share price value in the last twelve months as the bank has been experiencing lower revenue due to slowing debt and M&A activities. Its second-quarter revenue dropped to $11.9 billion from $12.9 billion in the previous quarter and represents a significant decline from $15.4B in the previous quarter.

SPDR Dow Jones Industrial Average ETF, on the other hand, owned stakes in several large industrial companies such as Caterpillar (CAT), 3M (MMM), The Boeing Company (BA), and Honeywell International (HON). There is a direct correlation between industrial companies and economic conditions. Share prices and financial prospects of industrial stocks have also begun to reflect worsening global market conditions. So far in 2022, the share price of 3M has fallen around 27%. Moreover, low demand and economic challenges forced analysts to cut their 2022 and 2023 forecasts for both CAT and Honeywell.

Market dynamics for the technology sector, which was among the biggest laggards in the first half of 2022, appears more challenging than those of the financial and industrial sectors. The tech sector faces multiple challenges, such as lofty valuations, earnings revisions, and higher interest rates. As of the end of June, DIA held stakes in tech stocks like Apple (AAPL), Microsoft (MSFT), Cisco (CSCO), Salesforce (CRM), and Intel Corporation (INTC). Apple’s September quarter revenue and earnings expectations were lowered majority of Wall Street analysts in the last 90 days while Microsoft and Salesforce have also slashed their 2022 outlook. On the valuation side, Apple and Visa received F grades from the Seeking Alpha Quant grading system, while Microsoft and Salesforce earned D grades. Furthermore, DIA’s stakes in Nike (NKE) and The Home Depot (HD) are likely to adversely affect its overall returns as both companies are vulnerable to economic headwinds and high-interest rates. Nike’s stock price has fallen 35% year-to-date, while Home Depot’s stock price has dropped 25%.

In Conclusion

If defensive investors want to protect their portfolio against market volatility, DIA doesn’t seem like a good addition. In the case of a prolonged bear market, it might fall at a slower pace than other indices but it cannot offer positive returns. Its portfolio is vulnerable to challenging conditions, and most of its holdings have cut their quarterly outlooks. Other ETFs like FDL and HDV, which offer better dividend yields and steady price gains in challenging times, could be better choices for defensive investors.

Be the first to comment