Seiya Tabuchi/iStock via Getty Images

Basic Thesis:

All year, I have heard a relatively steady drumbeat from many market pundits that the bottom is near for stocks and other risk assets such as Bitcoin (BTC-USD) that led markets before the recent downturn. Obviously, “stocks” is not a terribly descriptive word given the wide variety of companies, valuations, industries, market caps, factors, etc. These market pundits, especially frequent CNBC guests such as Stratcap’s Tom Lee, ARK Investment’s Cathie Wood, and Wharton School Professor Jeremy Siegel generally espouse buying “growth” and “technology” stocks which were the market leaders of the past few years. Being kind, investors who have followed their advice (or invested with them in the case of ARK) have not seen gains this year.

There is a term that I find useful with investing: “Don’t Fight the Last War”. Since the start of the GFC in 2008, investors have faced a nearly continuous backdrop of low economic growth and low inflation (or threat of deflation in some countries) and central banks battling factors with near-zero interest rates (or below zero in some countries) and quantitative easing. Fixed income offered tiny yields, commodities from energy to metals suffered mostly poor supply/demand dynamics, and many alternative strategies foundered.

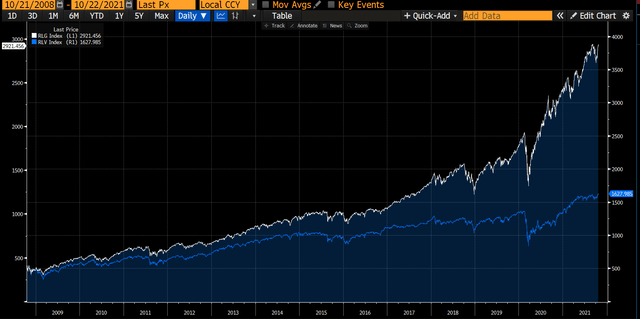

That environment gave rise to the term TINA (There Is No Alternative) to stocks. From my perspective, TINA usually meant “growth” and/or technology stocks instead of those considered “value”. The numbers bear that out. During the thirteen-year period from October 2008 to this time last year, the Russell 1000 Growth Index absolutely trounced the Russell 1000 Value Index.

Russell 1000 Growth vs Value Indices 2008 to 2021 (Bloomberg)

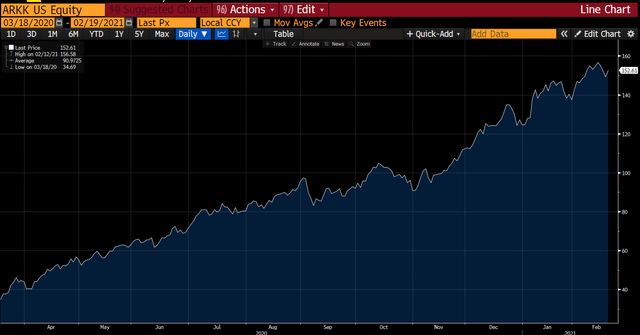

As you can see in the chart above, the return differential picked up some real steam at the beginning of 2019 and went exponential with the onset of Covid. A poster child for this outperformance is Wood’s ARK Innovation ETF (ARKK), which increased almost fivefold from its Covid low to its high last February.

ARKK Innovation ETF Covid Low to 2021 High (Bloomberg)

With returns like that and fixed income offering paltry yields, it was certainly hard to argue that growth and technology equities were not the place to be. The changed environment of the past year has turned that argument on its head.

TOATS: Tons of Alternatives to Stocks

Yeah, I came up with that one myself. And when I speak of stocks, I mean the growth and technology stocks on which many of the bullish pundits lay claim.

This year has been painful for anyone who has tried to pick a bottom. As of this writing (10/23) Nasdaq (QQQ) is down ~30% this year, the S&P (SPY) is down ~20% and the Russell 2000 (IWM) is down about 21%. Cathie Wood’s (ARKK) is down a whopping 62% and has given up nearly ALL of the gains from the Covid low.

The past few years, many investors have been conditioned to BTD (Buy the Dip). It has worked for them in the past and they are still doing it. For example, despite horrendous performance, ARKK’s shares outstanding are UP this year, meaning that ETF has had inflows. QQQ shares outstanding are about flat year to date, but up over 10% since the beginning of 2021.

In the case of ARKK, perhaps investors are buying at a low (I don’t think so, but I can see the argument after such devastating declines). In the case of other indices, while they are down this year, it’s hard to argue they are down a lot over just a slightly longer time frame. The Nasdaq is down 11% from the beginning of 2021, but up almost 32% from the beginning of 2020. That’s a >10% annualized return. Meanwhile, the S&P is up 2% from the beginning of 2021 and up 21.5% since the beginning of 2020, a 5.5% annualized return. This 5.5% for the S&P compares to a 5% average annual total return for that index this century.

However, in the intervening years since the start of this decade, the macro picture has changed dramatically. First off is inflation, which I have written about extensively. The CPI (Consumer Price Index) finished last year up 6.5% and is currently running at 8.2%. Even without compounding, that basket is up almost 15%. In response, the Federal Reserve has raised interest rates from 0.25% to 3.08%. They appear likely to raise another 75 basis points next month. The 10-year US Treasury has responded from under 2% at the end of 2019 and under 1% in 2019 to 4.22%.

This change in the inflation and interest rate environment has reverberated throughout the economy and asset classes. Generic High Yield Bond spreads as measured by the CDX High Yield Index have widened from below 300 (over LIBOR) to 540 currently. That translates to a total yield of about 10%. Even the (HYG) ETF, with all of its flaws, is yielding ~5.8% after yielding less than 4% recently. It’s important to remember that many pension funds target high-single-digit returns. They can now be close to that with many fixed-income instruments.

As for commodities, they have been on a tear. While many commodity-sensitive and other cyclical stocks have rallied, many if not most have not kept up with the growth of their earnings and cash flows. I have written about several of my favorites in this arena Crestwood (CEQP), Enterprise Products (EPD), Vermilion (VET), California Resources (CRC), Equinor (EQNR) and Ferroglobe (GSM). There are others and one can invest in ETFs such as the Alerian (AMLP) that is up this year but still down since pre-Covid.

I am not saying that equities cannot rally from here. At a P/E of about 18.5, the S&P 500 is close (although on the higher side) of its long-term average. If you believe earnings will grow next year (which is questionable), then perhaps equity indices such as the S&P and QQQ are ok. Of course, there is also the possibility of a bear market rally. We have seen several violent ones this year. Moreover, in addition to the companies I mentioned above, I think there are a number of other equities that are cheap and offer compelling risk/reward, but they are generally considered “value” stocks.

The point I’m trying to make is that we have moved from an environment where many argued there was NO ALTERNATIVE to stocks (particularly growth stocks) to one where I believe there are many places to invest. Frankly, some money market funds are yielding over 3% right now, so cash is an option. In a world of major geopolitical and economic uncertainty, 3% and liquidity is indeed a viable alternative.

Conclusion:

The switch from central bank largesse to restrictive policy is a sea change that many investors have not seen in their careers. Think about it, anyone who entered the markets in 2008-2009, including professionals, has not had to contend with a true bear market, anything approaching normalized interest rates, or a hawkish central bank. I also contend that the events in Europe and China represent geopolitical risks the world has not seen for decades. That backdrop represents a major departure from that where BTD worked for so long.

Valuation, cash flows and true asset protection used to be the paramount factors in investing. In a world of zero cost of money, investing in growth without regard to valuation mattered more. Maybe the Fed will pause and inflation and interest rates will stop rising. That does not mean they will revert to the regime leading up to Covid and the year following.

TOATS, (there are tons of alternatives to stocks), particularly growth stocks. Do your work and consider your alternatives.

Be the first to comment