Charday Penn/E+ via Getty Images

Some companies have held up incredibly well during the extreme volatility the market has experienced so far this year. Others, meanwhile, have not fared so well. One firm that has generated a loss that is greater than the broader market, even as fundamental performance remains robust, is Fortive Corporation (NYSE:FTV). Likely because of concerns about the economy more broadly, investors have mostly ignored the strong revenue growth and cash flow expansion of the company this year relative to the same time last year. Part of the problem may have to do with how pricey shares of the company previously were and, in some respects, still are. Moving forward, it remains to be seen what the future holds. If the first quarter of the 2022 fiscal year is any indication, then shares of the company might make for an interesting and profitable investment. But given how little insight we have into the months to come, a more appropriate rating for the business would be ‘hold’ at this time.

A disparity exists

Back in December of last year, I wrote an article detailing whether or not Fortive would make for an attractive opportunity for long-oriented investors. In that article, I praised the company’s ability to slowly reinvent itself over the past few years. I acknowledged the attractive top line and bottom line performance of the enterprise and I indicated that the long-term outlook for the company would likely be positive. However, I also said that shares were rather pricey. As a result of how expensive the stock was, I ended up rating the business a ‘hold’, indicating my belief that its returns would likely match, more or less, with what the broader market achieves moving forward. Since the publication of that article, shares have plunged by 23.9%. Although this looks painful, it is worth noting that the market is down 17.4% over the same timeframe. Relatively speaking, this decline for Fortive is not horrible.

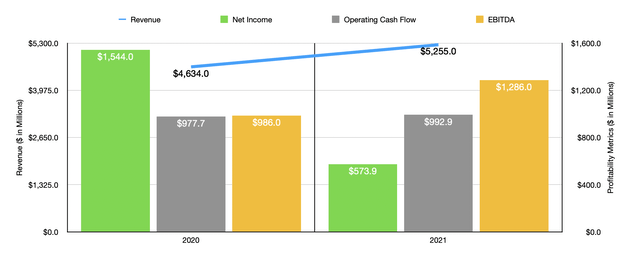

Author – SEC EDGAR Data

Surprisingly, this decline in price for Fortive has come even as fundamental performance for the company remains strong. When I last wrote about the firm, we only had data covering through the third quarter of the company’s 2021 fiscal year. Today, that dated now extends through the first quarter of this year. To begin with, however, we should cover how the company ended last year. According to management, revenue came in at $5.26 billion. That translates to a 13.4% rise over the $4.63 billion the company reported the same time one year earlier. For the final quarter alone, the year-over-year increase in revenue was 4%. Despite this apparent slowdown in sales toward the end of last year, profitability for the company has been strong. Net income of $573.9 million is down from the $1.54 billion generated in all of 2020. However, net income for the company has never really been a great measurement of its success. Instead, we should pay more attention to cash flow figures. Doing this, we would see that the company had a slightly better year last year than it did the year before, with operating cash flows inching up by 1.6%. Meanwhile, EBITDA came in stronger, climbing by 30.4% from $986 million in 2020 to 1.27 billion dollars in 2021.

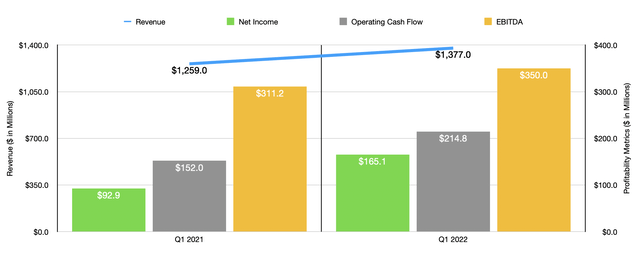

Growth for the company has continued to be strong in the early stages of the 2022 fiscal year. Revenue in the latest quarter came in at $1.38 billion. That’s 9.4% above the $1.26 billion generated in the first quarter of 2021. The real improvement, however, came from the company’s bottom line. Net income of $165.1 million in the latest quarter dwarfed the $92.9 million achieved just one year earlier. Over this same window of time, operating cash flow surged from $152 million to $214.8 million. Though not quite as strong, EBITDA also fared well, rising from $311.2 million in 2021 to $350 million this year.

Author – SEC EDGAR Data

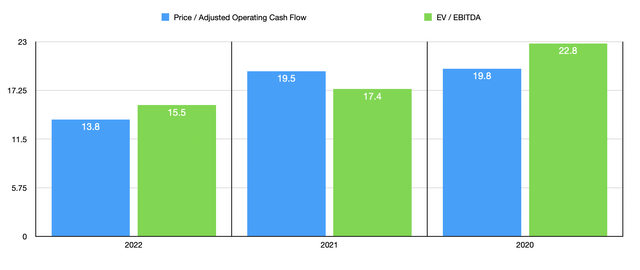

Unfortunately, management has not really provided any guidance for the current fiscal year. However, if we analyze results experienced so far in 2022, we should anticipate operating cash flow of roughly $1.40 billion and EBITDA somewhere in the range of $1.45 billion. Taking this data, we can very easily value the company. For instance, using the 2022 estimates I provided, the firm is trading at a price to operating cash flow multiple of 13.8. Meanwhile, the EV to EBITDA multiple for the company should come in at 15.5. These numbers, at first glance, look quite appealing. They’re definitely tiptoeing on value territory. However, this picture changes when we look back at 2021 results. In this case, the price to operating cash flow multiple comes in at 19.5, while the EV to EBITDA multiple should be 17.4. And if we go back even one year to 2020, these multiples would come in at 19.8 and 22.8, respectively.

Author – SEC EDGAR Data

To put the pricing of the company into perspective, I did decide to compare it to five similar firms. These are the same five companies I compared it to in my last article. On a price-to-earnings basis, these companies range from a low of 7.4 to a high of 52.2. Using our 2021 results, we can see that the enterprise is more expensive than three of the five companies. Meanwhile, using the EV to EBITDA approach, the range is from 3.5 to 14.1. In this case, Fortive was the most expensive of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Fortive Corporation | 19.5 | 17.4 |

| Mueller Industries (MLI) | 7.4 | 3.5 |

| Parker-Hannifin (PH) | 14.0 | 13.1 |

| Crane Holdings (CR) | 12.7 | 8.6 |

| Franklin Electric Co. (FELE) | 52.2 | 14.1 |

| EnPro Industries (NPO) | 10.9 | 8.1 |

Takeaway

The data available to us today suggests that Fortive continues to grow at a nice clip and is generating attractive cash flows along the way. On a forward basis, if my estimates for 2022 are accurate, the company could come to make for an attractive opportunity. However, we have no assurance that would be the case and management has not provided any detailed guidance for the current fiscal year. Using data strictly from 2021, we can see that the company is probably, at best, fairly valued. And if financial performance reverts back to what it was in prior years, it’s not hard to imagine the company becoming very pricey very quickly. Because of this, I’ve decided to rate the business a ‘hold’ pending a more appropriate understanding of how the 2022 fiscal year will look. In the event that my own estimates turn out to be accurate, shares of Fortive could offer some nice upside. But absent that, I do think that the company is more likely than not a good ‘hold’ candidate.

Be the first to comment