Editor’s note: Seeking Alpha is proud to welcome Ricardo Fernandez as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

John Kevin/iStock via Getty Images

NDX Consensus Base Case

The NDX (NDX) or “Nasdaq 100” is tech and mega cap heavy with 47% of the index in Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOG), Tesla (TSLA), Meta (META) and NVIDIA (NVDA). The top 21 stocks make up 65% of the NDX.

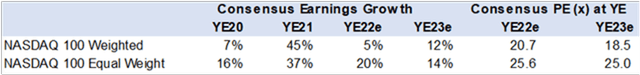

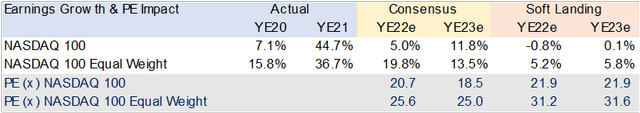

Using current consensus estimates from the Capital IQ database, the NDX is trading at 18.5x P/E with a 12% earnings growth for YE23. On an equal weight basis (each of the 100 stocks is 1%), it’s more expensive at 25x P/E YE23.

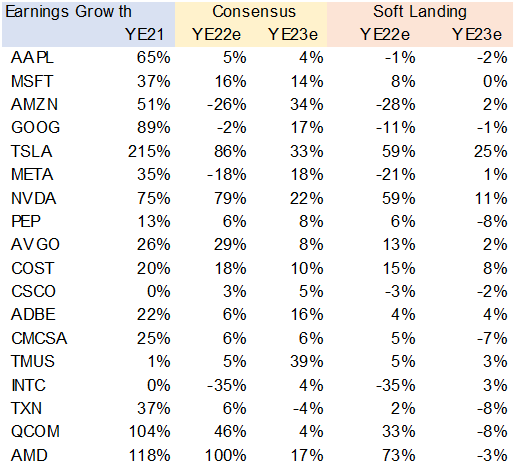

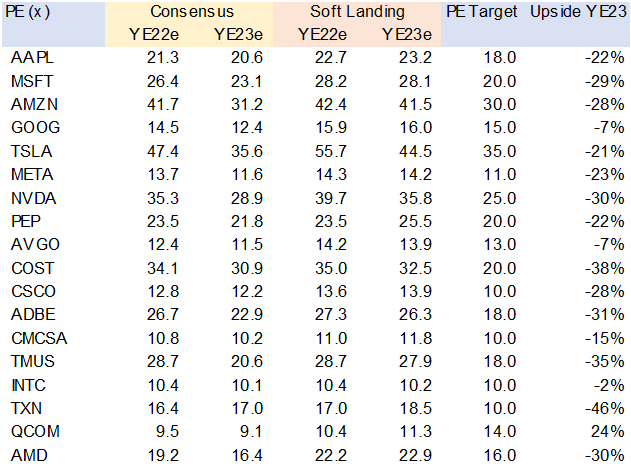

NDX Consensus Estimates and P/E (Capital IQ and Maxinvest)

NDX Sensitivity Analysis

However, in my view there are two problems with this base case consensus. First, it does not seem to take into account the very real probability of a soft landing or, worse, a recession as the Fed increases rates to tame inflation. While higher rates for longer could lead to multiple compression. Does 20x P/E reflect fair value?

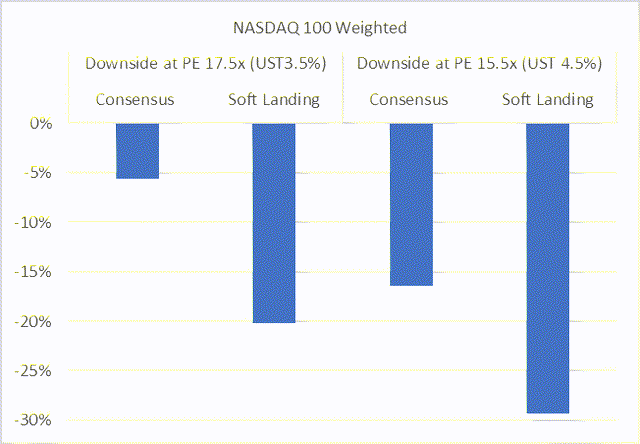

Under a soft landing scenario with of 0% ESP growth and 17.5x fair P/E, the NDX has 20% downside to 9,300.

- Under my scenario I assume US GDP growth will be zero (0%) in YE23, which is not yet consensus but the downgrades are starting as seen in US Economic Outlook SP Global. While a Fed Funds rate along with the 10yr UST of 3.5% is in reach.

- I conducted a company-by-company analysis (100 stocks) using the Capital IQ consensus data base. In aggregate, revenue growth declines to 7% and net margins to 16% which results an EPS growth of 0% in YE23.

- I adjusted every stock’s fair P/E multiple based on earnings growth, margins and own history that resulted in a 17.5x fair P/E for the NDX.

- A 4.5% 10yr UST yield could lead to a 15.5x fair market P/E.

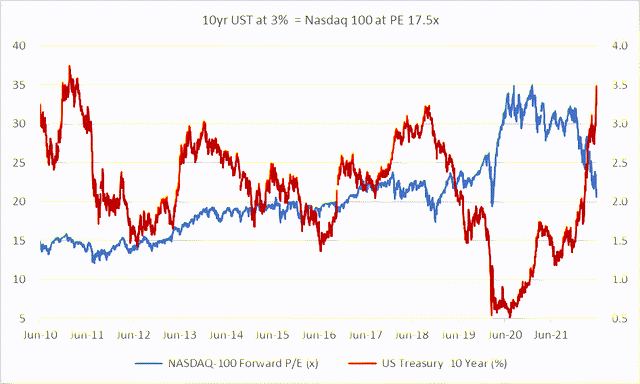

In summary higher rates will have an impact on GDP growth, corporate earnings and valuations. Under consensus estimates the NDX YE23 P/E is 18.5x, with a soft landing this moves up to 22x P/E. While, with a 10yr US Treasury rate of 3.5% the fair P/E could contract to 17.5x and at 4.5% to 15.5x.

NDX: Sensitivity to lower earnings and higher interest rates (Capital IQ and Maxinvest)

Rationale for Lower Earnings on a Soft-landing scenario in YE23

Lower GDP growth or even a recession: To bring down inflation and more importantly to not allow it to anchor in consumer and business psychology the Fed needs to destroy demand and raise unemployment via aggressive rate increases. The market went from a 2% to now a 4% terminal Fed Funds rate. This most likely means lower GDP growth of 0% vs 3% in YE23 (if not negative) which should cut into corporate revenue growth and earnings.

Database: I analyzed the consensus estimates for all the companies in the Nasdaq 100. I used Adjusted Net income that generally adds back stock-based compensation and other one-time or non-cash events. I did not factor in share buy backs that may cushion some of the EPS decline.

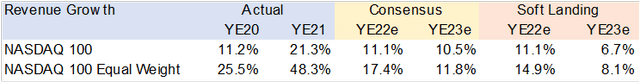

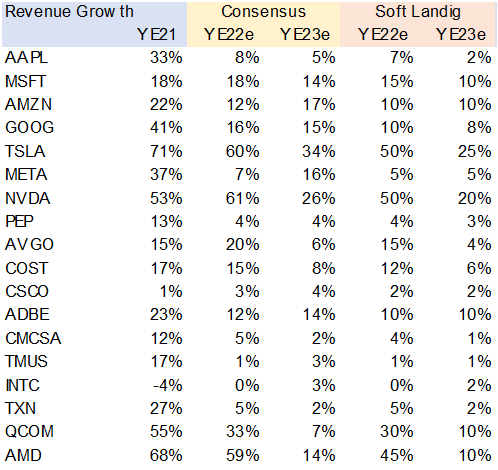

Revenue growth: I reduced revenue growth for each stock in the NDX to reflect 0% GDP in YE23. Some companies are impacted more than others; the aggregate results is a revenue growth rate of 6.7% vs 10.5% in consensus estimates.

Revenue Impact on zero GDP growth in YE23 (Capital IQ and Maxinvest)

Despite many market pundits, secular growth companies are still impacted by broader macro forces. Especially when the companies in question are massive and simply can’t grow market share because they are the market.

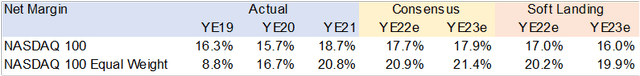

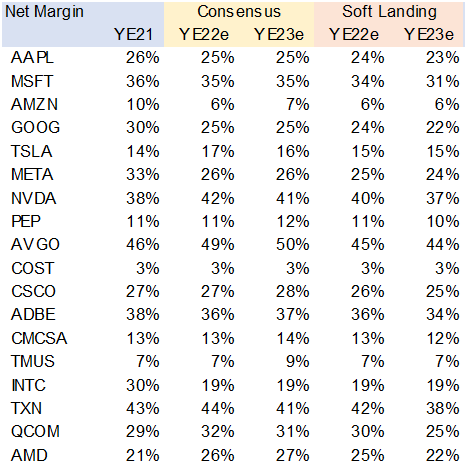

Inflation impacts margins: The ability to pass on input costs from things like wages, debt funding, raw materials and energy may become difficult as the end customer (consumer or business) balks at higher prices and reduces willingness to pay up. This can also impact earnings growth. I reduced net margins company-by-company with aggregate resulting in a decline from 17.9% (consensus) to 16%, which is in line with YE19 results.

Net Margin impact on high inflation and lower GDP growth (Capital IQ and Maxinvest)

ESP growth is zero in YE23: In a scenario where revenue slows on demand/GDP (soft landing) plus potential margin squeeze on still high inflation, EPS growth could be near flat (0%) in YE23 and negative in real terms. This would price the Index at 21.9x and 31.6x equal weighted. Not a bargain.

NDX consensus earrings and P/E vs Soft Landing (Capital IQ and Maxinvest)

Rationale for lower valuation on higher risk-free rate

Multiple Compression: When interest rates climb, the risk-free climbs and the future value of earnings declines i.e. valuations fall and we get multiple compression.

The impact of higher discount rates can lead to further valuation compression for equities:

- At a Fed Funds rate or 10yr UST yield of 3.5%, fair value P/E is about 17.5x

- At 4.5% fair value P/E is around 15.5x

The chart below tracks the 10yr UST yield vs the NDX forward P/E. As can be seen, since 2010 the 10yr UST yield has not breached 3.5% and when it did the P/E was closer to 15x. While this is not an exact science, and the market is dealing with a large set of highly varying inputs, the correlation of higher rates to lower market P/E or valuation is clear.

Nasdaq100 historic forward P/E valuation vs 10yr US Treasury Yld. (Capital IQ )

Why P/E: A price to earnings multiple reflects the net present value of those earnings at a discount rate. The higher the growth rate the and the lower the discount rate the higher the P/E. It’s not a perfect valuation tool, but then again nothing is as it calls for predicting far out into the future.

Inflation can destroy valuations further: If inflation remains higher for longer it can eat into corporate earnings and oblige the Fed and most Central Banks to keep raising rates, which is negative for equity valuations. At the same time, higher inflation may prompt the Bond market to seek far higher real yields effectively transmitting Fed policy. So far, the Bond market is pricing in a return to 2% inflation over the next three years.

Money Flow Impact: Another factor of higher rates is that once they stop climbing, bonds and other near fixed income instruments will look far more attractive to investors and should take cash away from equities. This is a real and practical impact of higher rates for equities.

NDX Constituents Analysis

The data for 65% of the NDX weight is in the tables below. Here I show revenue, net margin, earnings and P/E changes on a soft landing and multiple compression scenario vs consensus.

Rationale for mega caps

Apple: Consensus has a mere 5% and 4% earnings growth for YE22 and YE23. On a soft-landing scenario earnings could go to -2%. Not the end of the world but enough to dip P/E target to 18x in my view. As a high-end consumer products company, it’s exposed to cost pressures and lower demand.

Microsoft: Consensus earnings growth of 14% for YE23 seems high under a stagflation scenario where consumers and businesses may halt new software services. This does not include the Activision (ATVI) acquisition.

Amazon: These estimates add back stock-based compensation, which could be US$20bn in YE22/23. As the US’s largest retailer (1P and 3P) it may be difficult to escape a consumer slowdown.

Alphabet: The market estimates a decline in earnings of 2% in YE22 but a 17% increase in YE23. While its advertising reach is unparalleled, can one expect this level of growth with 0% GDP?

Tesla: The company is already cutting workforce, does that mean demand is falling. It’s had to raise sticker price substantially for its cars. While it has the first mover advantage and ramping up scale, margins and earnings power, can Tesla meet market expectations and keep 50x P/E?

Meta: The market believes the company has plateaued, gone ex growth, and hence cut P/E valuation in half. As an advertiser is it reasonable to expect 16% revenue growth in YE23?

Data base output for 65% of NDX

NDX Revenue Growth: Consensus vs Soft Landing (Capital IQ and Maxinvest)

NDX Net Margin: Consensus vs Soft Landing (Capital IQ and Maxinvest)

NDX Earnings: Consensus vs Soft-landing (Capital IQ and Maxinvest)

NDX P/E and Price Target: Consensus vs Soft Landing (Capital IQ and Maxinvest)

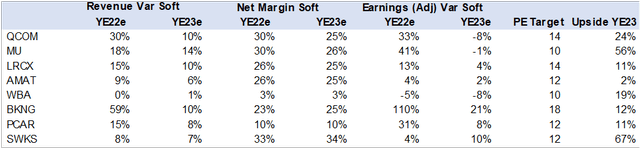

Stocks that still look attractive

I implemented this sensitivity exercise for all the stocks in the Index. Under a soft landing and multiple compression scenario only a few stocks have upside, and most are in the semi-conductor sector. This sector is not expensive relative to the broader market nor its growth rate in my view.

Nasdaq100: Stocks with upside under lower EPS and multiple scenario (Capital IQ and Maxinvest)

Conclusion

Over the last 20 years the market has become accustomed to a benign macro and monetary environment with low rates, low inflation, and positive GDP growth. This has spawned very favorable equity valuations and a sense of immortality from significant market declines. However, the situation has changed, brought on by the pandemic, inflation cannot be allowed to entrench and the Fed as well as Central Banks around the world will need to normalize interest rates. In the medium term, this will impact GDP and corporate earnings and in the long term bring down or compress equity valuations.

Thus, it’s my view that the NDX has more downside as this correction continues and one should hedge portfolios with inverse ETFs or stay defensive in consumer staples, defense industry and health care sectors.

Be the first to comment