Bim/E+ via Getty Images

In January 2022, I published 2 articles on Enterprise Products Partners L.P. (NYSE:EPD) (“What We See In Enterprise Products Besides 8% Yield” and “Something You Won’t Find in Enterprise Products’ Presentations“). While I was rather skeptical and did not expect any miracles from the company, I thought it was a decent investment because the price was low enough – below $24 at the time.

My skepticism was caused by the high required capex, with the growing ESG movement in the background. No matter how one feels about this group of people, they exist in the objective reality, they are loud and growing, and they vote. I expected it to affect the oil and gas industry eventually. Mathematically I treated this effect by truncating the “tail” of the dividend discounting model. Normally, this model assumes that dividends are being paid in perpetuity. I used 20-25 years of the dividend-paying period instead, which slashed 20% off the EPD value for the final estimate of $22-25 in round numbers (without accounting for ESG, distribution discounting provides a $27-31 value).

This was before the start of the Russian-Ukrainian military conflict which has changed the attitude toward the oil and gas industry. The stock, meanwhile, is at pretty much the same mark. It is time to revisit.

Business and Stock

EPD is a very complicated business to operate, but its stock evaluation is rather straightforward. Since tax-deferred income generation is the company’s main objective (guarded by the descendants of the founder through the Duncan’s Trust, which controls close to one-third of the company), there are only two main inputs to play with: the current distribution yield and its expected rate of growth (I am using a standard 10% discounting for stocks). The current yield is known to everybody, and implicitly or explicitly most efforts are focused on estimating the distributions’ future growth rate.

Before going into valuations, it is vital to consider the stock’s quality. And in this regard, EPD is arguably peerless in the oil and gas industry. Let me list some of its main attractions:

- Its margins are not sensitive to commodities’ prices. I analyzed it in detail in the previous publications.

- Most of the revenues are guaranteed by long-term contracts with creditworthy customers.

- Its leverage is fixed-rate and investment-grade and it has the best credit rating in the midstream sector.

- It is diversified across several segments. Importantly, besides gas, NGL, and oil infrastructure, it is heavily invested in petrochemicals. This may be the most future-proof segment within the oil and gas industry.

- I like that most of its pipelines are for natural gas and related NGL rather than for oil. From several standpoints, natural gas is less risky than oil.

- The company is notoriously conservative which, in my opinion, is a plus in a volatile industry.

- EPD is bigger than its peers in the midstream sector. It goes back to the original Benjamin Graham’s principle to invest in big companies that are out of favor. Smaller actors may not survive harsh periods.

Changes in the industry

The Russian-Ukrainian conflict has changed the paradigm. I will limit myself solely to its economic consequences. The main upshot is suppressed demand for Russian oil and gas that will persist even if the war in Ukraine stops shortly one way or another.

The effect is more pronounced for natural gas with European demand to be partially replaced by U.S. LNG. More LNG plants will be needed with all their massive infrastructure, including pipelines, gathering plants, processing facilities, storage, etc. This is extremely beneficial for EPD.

The same might be true about oil, but not to the same degree. While most of the Russian gas is shipped through pipelines that are impossible to reroute, Russian shipments of oil are more balanced between pipelines and tankers. Still, part of the Russian share of world oil is expected to be replaced by the U.S.

EPD (and the industry) will benefit not only from the increase in demand but also from the decreased opposition from the ESG movement. Currently, Germany, where Greens are a part of the governing coalition, is reverting to coal to secure sufficient energy for the coming winter. The same is true for several other countries in Europe.

I do not expect ESG folks to melt away, but their pressure will be less palpable, at least temporarily. What does it mean for EPD’s estimated value?

Back in January, I slashed 20% off the EPD value due to the ESG factor (just as a reminder: it was not arbitrary but based on crude math). One still has to account for the ESG factor, but it might be more reasonable to limit this reduction to 10%. Then EPD’s value today stands at roughly $24-28 at a 3-4% distribution growth rate.

Distributions growth rate

In my simple model from the previous posts, I assumed the growth rate to be 3-4% as the most plausible scenario based on what we know today (the latest dividend bump was 3.3%). EPD fans were not in love with this figure. There is always hope that EPD’s coming projects, be it a new petrochemical complex or still unapproved oil export terminal, will increase the growth rate. Let us see if it is possible.

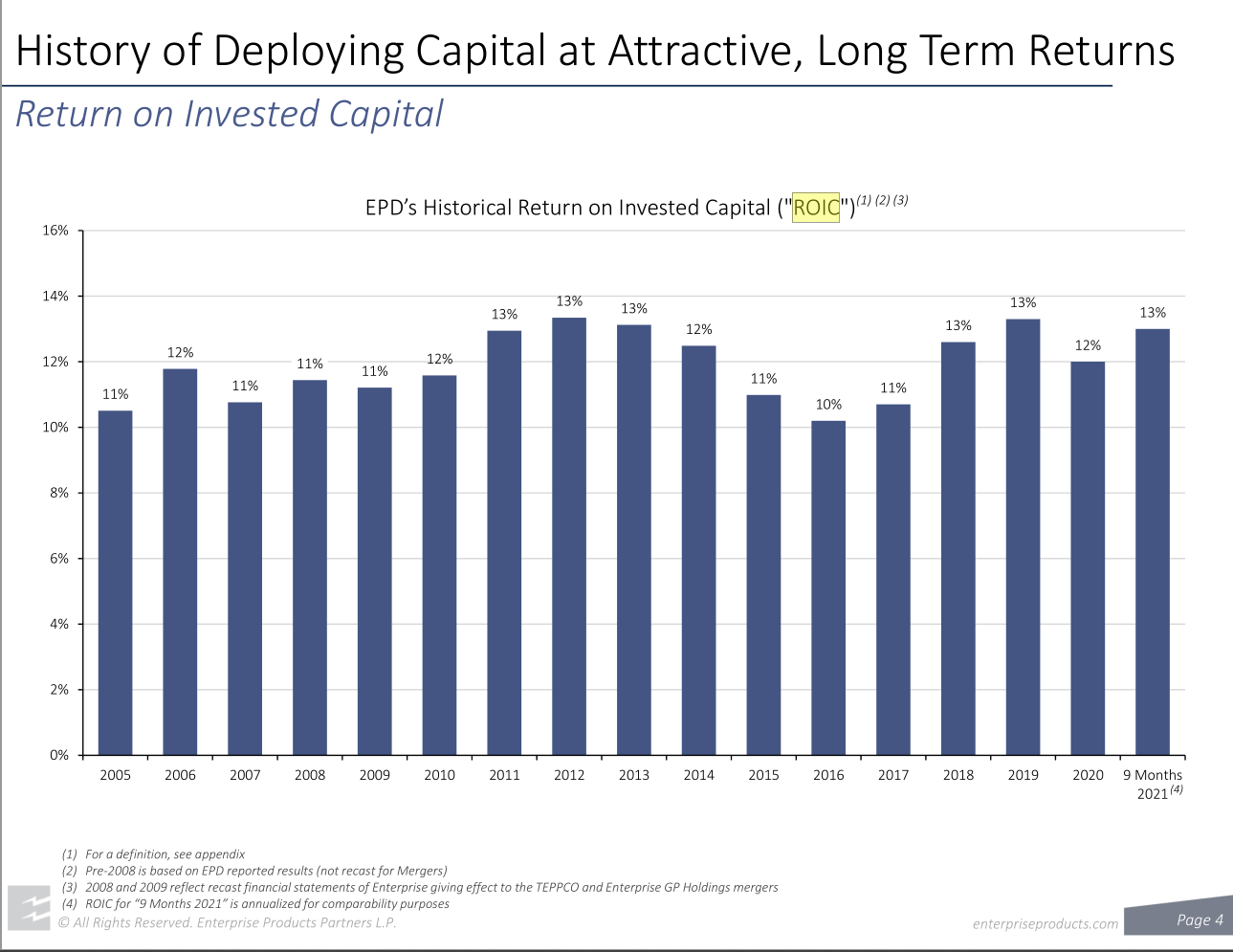

The critical figure here is EPD’s ROIC. The company measures it as the ratio of Segment GOM (gross operation margin) and historical costs of assets without adjusting for depreciation. To put it simply, Segment GOM is similar to EBITDA without deducting corporate overhead. It is a measure of cash flow generated by EPD’s assets.

EPD’s ROIC has almost always been between 11 and 13%, with 12% on average.

EPD’s ROIC (Company’s presentation)

We can state that no matter what kind of assets EPD will put into service, we expect them to produce 12% ROIC on average. If it were possible to exceed this figure, EPD would have already done it.

Each quarter, EPD reports its adjusted CFFO (cash flow from operations) which is equal to GAAP CFFO before the net effect of changes in operating accounts. This is a quote from EPD filings:

We believe that it is important to consider this non‐GAAP measure as it can often be a better way to measure the amount of cash generated from our operations that can be used to fund our capital investments or return value to our investors through cash distributions and buybacks, without regard for fluctuations caused by timing of when amounts earned or incurred were collected, received or paid from period to period.

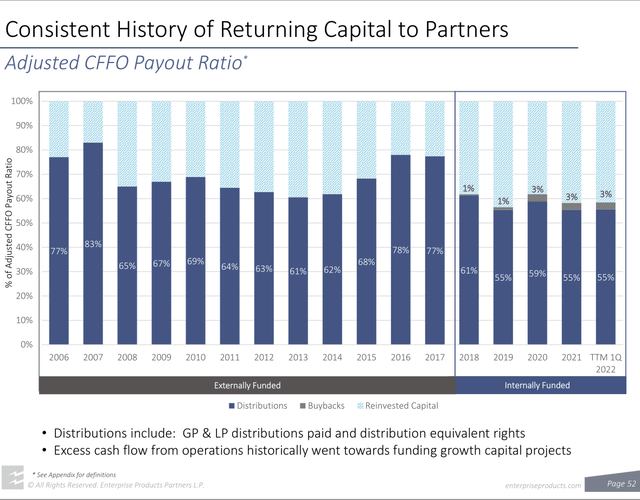

EPD’s payout ratio (Company’s presentation)

The slide above from the latest company’s presentation shows that since 2018 (the year when EPD started financing its projects solely through internally generated cash flows and stopped issuing units for this purpose), the company has been paying out in distributions and buybacks about 60% of its adjusted CFFO.

In absolute figures, adjusted CFFO grew from $6,110M in 2018 to $7,147M in 2021. Sustaining capex was growing as well from $320M in 2018 to $430M in 2021 and represented roughly 6% of adjusted CFFO. Only the remaining 34% of adjusted CFFO could be invested in growth projects.

From ROIC, we know that $1 invested in a growth project brings $0.12 in additional cash. So, 34% of adjusted CFFO can bring 34%*0.12 ~ 4% of growth in adjusted CFFO and the same 4% growth in distributions! This is the maximum rate of growth that EPD can achieve without leverage.

Leverage can allow EPD to grow distributions faster. But it is a double-edged sword. EPD can borrow at ~6% long term today and perhaps, even at a higher rate in the future. Then, leverage will eat half or more of its ROIC from new projects and increase the company’s risk at the same time. If EPD finances a new project half in equity and half in debt, ROE will be about 18%. It will allow growth of 34%*0.18 ~ 6%. This is the highest achievable growth in distributions possible under the internal financing model (this number was beaten once in the recent history – in 2013, EPD increased its dividend by 7%, but at that time EPD was financing growth by issuing new units).

We expect, however, that in the current economic environment, EPD management will use leverage more conservatively than fifty-fifty. Strategic safety is worth more than a bit of extra growth. This preference manifested itself in the recent acquisition of Navitas. The $3.2B was financed mostly with cash on hands; a far smaller part was financed with a commercial paper due in the same 2022 (please note that in early 2022, at the time of acquisition, EPD could have issued debt at a lower rate than today!).

Under these circumstances, 5% is, perhaps, an upper limit of distribution growth, and everything north of 4% is a very good result. Applying some margin of safety, we would stick with our previous estimate of 3-4% growth for valuation purposes.

Conclusions

The environment is more favorable for EPD now than in January 2022. It is reflected in our elevated estimate of the stock’s value ($24-28) and the stock appears more attractive now. While its business is not particularly dependent on commodities prices, its price fluctuates in sync with the price of oil. Most likely, this is due to trading in baskets of oil and gas stocks. This volatility creates good opportunities to add EPD at an advantageous price. In case of recession (or due to the fear of recession), the oil price can go down, bringing all oil and gas stocks lower than they are now. This would be a dream scenario to buy EPD.

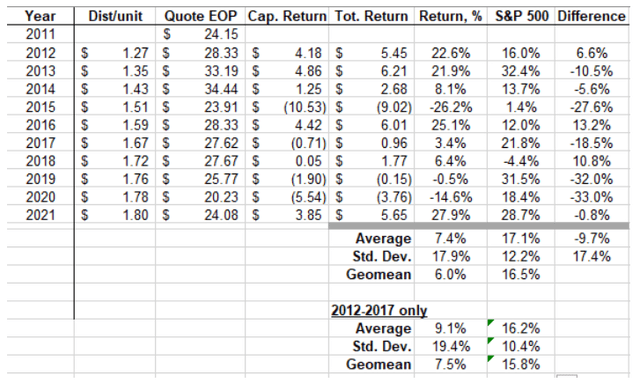

Two caveats are in order. First, I tried to avoid talking about yield, which is low-hanging fruit for an author. Quite a few long-term EPD holders, lured by its yield, ended up with a mediocre investment. To be more convincing, I am reproducing below a table from my previous post that sums up EPD returns vs S&P 500:

EPD’s total return vs S&P 500 (Company’s filings and author)

Secondly, while I considered the Russian-Ukrainian conflict as a positive for EPD and U.S. oil and gas industry in general, it is contingent on avoiding the escalation of this conflict into extreme forms. This is an additional risk for all stocks, including EPD, that was not around when I first posted in January.

Be the first to comment