Laurence Dutton

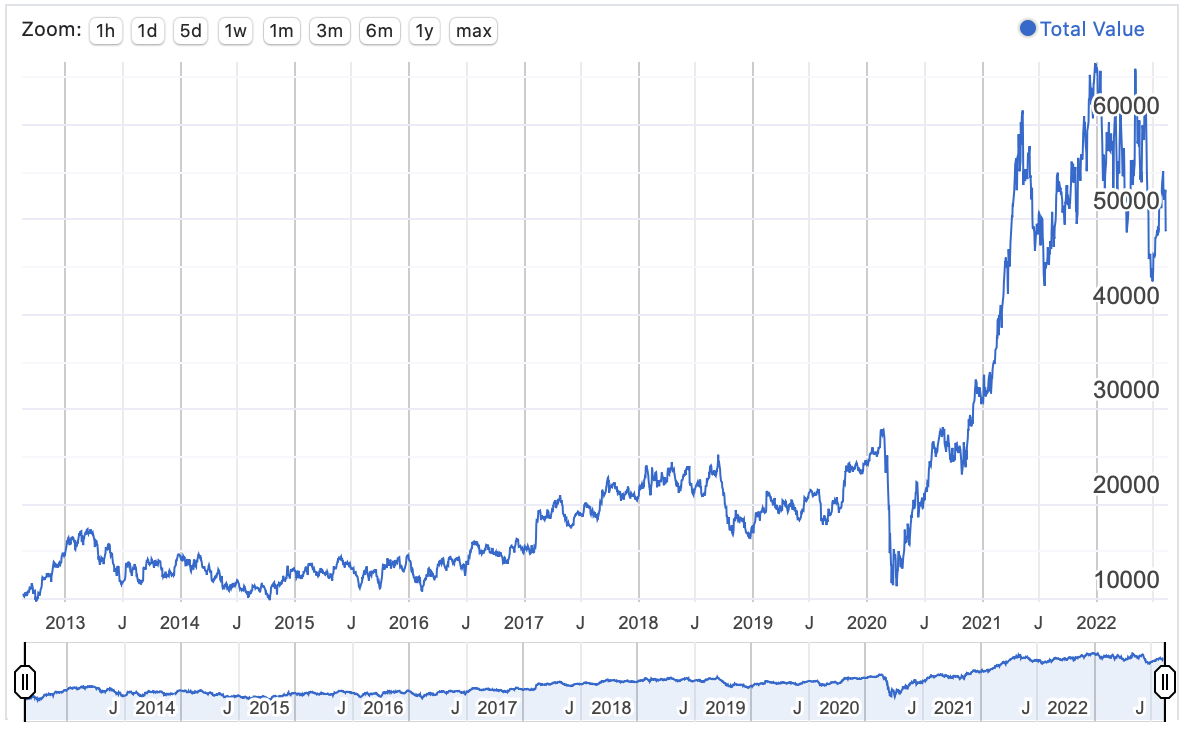

In the last decade, the Louisiana-Pacific Corporation (NYSE:LPX) has generated total shareholder returns (TSR) of 17.19%, compared to nearly 11.43% for the S&P 500. Nevertheless, the company continues to trade at a very attractive valuation. Investors seem to believe that the housing market is declining and that the company will not be able to sustain its profitability.

Source: DQYDJ

Louisiana-Pacific’s Commitment to Profitability

Chief executive officer, Brad Southern, has been an exceptional addition to Louisiana-Pacific. His leadership has overseen a turnaround in the fortunes of the company, with operating costs slashed, unprofitable mills closed down, profitability increased, and exposure to growth markets increased. Its strategy for the 2019 to 2022 period has been a success. By 2020, Louisiana-Pacific had shot past its target of generating $165 million in cumulative EBITDA efficiency and economic gains, and achieving a cumulative impact of $178 million.

The 2019-2022 strategy was created at a time when the oriented strand board (OSB) industry was in a downturn, with pricing down 50%, and Louisiana-Pacific’s revenue down 27%. In many ways, that proved beneficial. The OSB industry is notoriously cyclical, with actors suffering from very poor capital discipline. Southern was aware of the cyclicality of the market, and the economic losses that the industry had generated in the decade prior to his ascension. Southern aimed at transforming his business by aiming at something that most industry participants had not: earning economic profits.

His stance has paid off. Revenue has grown from over $2.3 billion in 2019 to nearly $4.6 billion in 2021. In the trailing twelve months (TTM), the company has earned nearly $4.7 billion. Net income in that time has grown from -$5 million to nearly $1.43 billion. Free cash flow (FCF) has grown from -$4 million in 2019, to $1.235 billion in the TTM period.

The company’s profitability is evident from its return on invested capital (ROIC), which has grown from 0.1% in 2019, to 102.1% in the TTM period.

The market has responded favorably to the company’s changes, with its market capitalization rising from nearly $3.5 million in 2019, to nearly $4.5 billion in the current period. The enterprise value has obviously followed a similar path, from nearly $3.7 billion in 2019, to $4.336 billion in the current period.

Construction Prices Will Push Prices Up

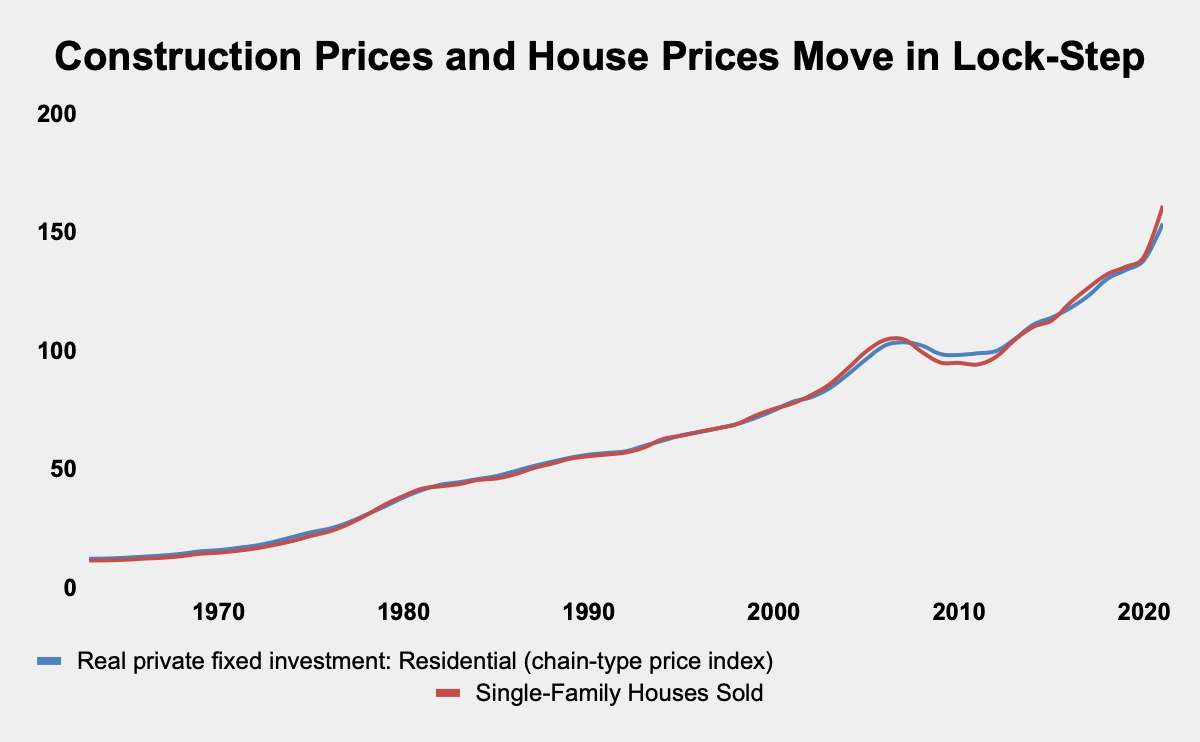

The housing boom is over, as interest rates rise, and with affordability at its worst level since 1989. Yet, the S&P/Case-Shiller U.S. National Home Price Index still rose 7% in the first five months of the year. Since the Great Recession, investors have assumed that mortgage rates drive housing prices, but it is more accurate to say that construction costs drive them.

Data shows that construction prices and the price of single-family homes, have moved in lockstep since 1963.

Source: FRED and the U.S. Census Bureau

Looking at Louisiana-Pacific’s Q2 results, it’s clear that the company has been a winner, with net sales up 3% (despite OSB prices down 24%), thanks to siding revenues up 24%, setting a quarterly record, and structural solutions sales volume up 28% year-over-year.

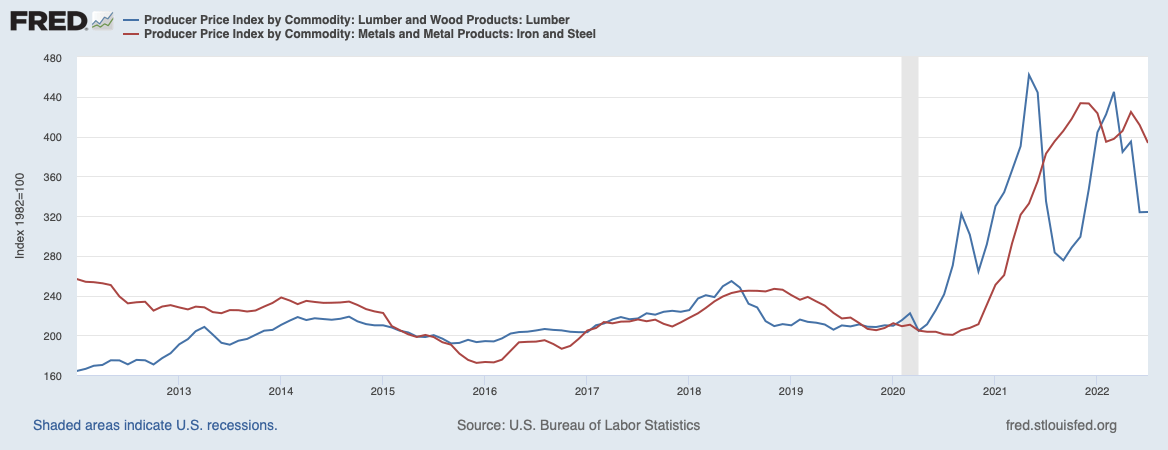

Of course, the background to this is the start of a period of stagflation, and the continuation of the global supply chain disruption. The result of this will be that construction prices will go up, driven by timber and timber prices, and that Louisiana-Pacific will be able to pass those costs on, and continue to grow revenue and profitability. As the chart below shows, although lumber prices have softened this year, their long run trend has been upward.

Source: FRED

Rather than mortgage prices driving house prices, what has happened is that supply of inputs has trailed demand. In addition, the United States is undergoing a secular shift with migration to the South and West of the United States, as people seek out larger homes, lower costs of living and better living conditions. This secular process started before this period of low mortgage rates and is not going to be stopped because of rising mortgage rates. It can be argued that even with mortgage rates rising, they still significantly trail rates in the past. Furthermore, counties in the South and West not only have supply deficiencies in housing, they have the fastest growing counties in the country.

A Shareholder-Friendly Dividend Policy

According to the company’s 2021 annual report, Louisiana-Pacific’s capital allocation strategy is geared toward delivering “exceptional returns” for its shareholders. The company is committed to giving back at least half of its free cash to its shareholders, in the form of dividends and share repurchases. In 2021, it spent $1.3 billion to buy over 21 million shares. The company also issued $66 million in dividends. Dividends for the year are $0.84 per share, for a dividend yield that is currently at 1.39%

The company’s Q2 2022 results revealed that it paid $471 million to buy 7.3 million of its own shares. As of August 8, the company had paid an additional $197 million to repurchase 3.4 million of its own shares. The company has just $329 million left of its $600 million share repurchase authorization, and 73.9 million common shares outstanding.

Valuation

With a FCF of $1.235 billion and an enterprise value of $4.336 billion, the company has a FCF yield of over 28%, compared to 1.7% for the 2000 largest firms in the United States. Investors have an opportunity to buy growing FCF at a very attractive price.

Louisiana-Pacific has a price-earnings (P/E) ratio of 3.83, compared to a 5-year average of 48.1, 17.59 for the homebuilding industry, and 21.59 for the S&P500.

Conclusion

Louisiana-Pacific has transformed itself over the last few years, into a capital disciplined company, with a focus on keeping costs down and earning its cost of capital. The company’s profitability occurs at a time when construction prices have risen, driving home prices up. Although investors tend to think there is a connection between mortgage rates and home prices, the reality is that construction prices drive house prices. That suggests that in the long run, the company will be able to pass costs on, raise revenue, and widen profitability, in an environment of rising home prices. The company is trading at very attractive rates, and should be part of your portfolio.

Be the first to comment