peterschreiber.media/iStock via Getty Images

Some interesting labor market tidbits.

Goldman Sachs estimates that the labor market is the tightest it’s been since WWII

The latest reading of the gap shows an excess of 5.3 million in labor demand versus supply of workers – “the most overheated level of the postwar period both in absolute terms and relative to the population,” Jan Hatzius, Goldman’s chief economist, wrote in a note Monday.

Caregiving for family members is keeping a large number of people out of the labor force:

Even as the job market rapidly approaches the levels last seen before the coronavirus pandemic, a lack of affordable care for older and disabled adults is keeping many out of the workforce. At least 6.6 million people who weren’t working in early March said it was because they were caring for someone else, according to the most recent Household Pulse Survey from the Census Bureau. Whether – and when – they return to work will play a role in the continued recovery and could reshape the post-covid labor force.

Workers at an Amazon facility in New York voted to Unionize:

Workers at the facility voted by a wide margin to form a union, according to results released on Friday, in one of the biggest victories for organized labor in a generation.

Flex-work is becoming more of a norm:

Much of the banking industry, long a bellwether for corporate America, dismissed remote working as a pandemic blip, even leaning on workers to keep coming in when closings turned Midtown Manhattan into a ghost town. But with many Wall Street workers resisting a return to the office two years later and the competition for banking talent heating up, many managers are coming around on work-from-home – or at least acknowledging it’s not a fight they can win.

Let’s look at all this data:

- The labor force participation rate — the percentage of people either working or seeking work — started to decline in the early 2000s due to the aging US population. While that trend has continued (to the estimated pace of 10,000 retirements per day), others have left the labor force to care for family members. Add in the “Great Resignation” — people leaving jobs due to intense dissatisfaction with the working environment — and you have a continued recipe for additional declines in the LFPR.

- As a result, employees are feeling more empowered to unionize. According to articles on the successful New Work effort, organizers talked one on one with many employees, talking about work-life balance and working conditions.

- On the flip side, business is clearly feeling the pressure to change its attitude about quality of life issues.

It all adds up to a very different labor market environment.

Let’s take a look at some charts:

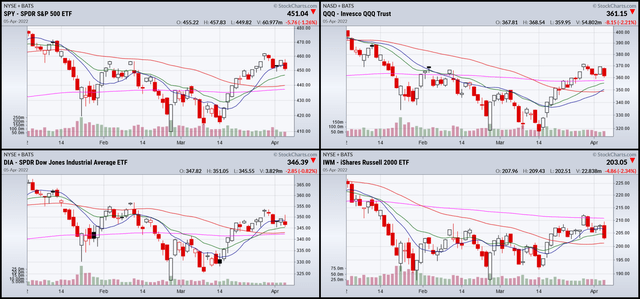

3-month SPY, QQQ, DIA, and IWM (Stockcharts)

The 3-month SPY, QQQ, and DIA charts are showing short-term consolidation of the rally that started in mid-March. However, the IWM — which never broke its 200-day EMA, is headed lower. As this index is a good proxy for risk appetite, we should pay attention. The IWM led the markets lower at the end of last year.

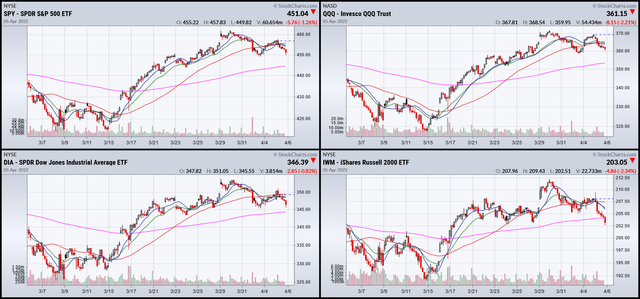

1-month SPY, QQQ, DIA, and IWM (Stockcharts)

The 1-month charts give us more detail about the consolidation. All the indexes are moving sideways. The IWM is right at support.

Consolidation is a healthy development. And there is no magic formula for how long it should last. The good news is that prices are right at support. The bad news is the IWM was headed lower for most of the day, potentially building up momentum for an additional move lower.

Be the first to comment