jetcityimage/iStock Editorial via Getty Images

The Great American Used-Car Bubble

Used car prices exploded during the pandemic as millions of locked-down consumers spent their stimulus money on a new set of wheels. COVID was the perfect storm for the auto industry. Manufacturers canceled orders for semiconductors in 2020, expecting a deep recession. But around the world, governments printed money to stave off deflation, causing demand for new and used cars to surge. Because consumers weren’t spending as much money on travel, live entertainment, or eating out, a disproportionate amount of cash ended up “chasing cars.” Normally, this would be something the manufacturing supply chain could adjust to, but work-from-home demand effectively sold out the market for computer chips, severely hampering the supply of new cars.

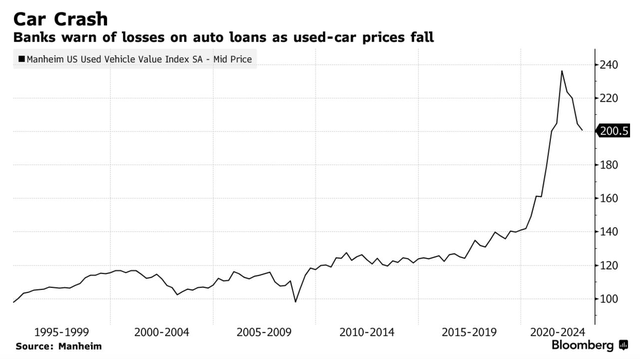

So more money flooded the market for cars, and this happened.

Used Car Insanity (Manheim via Bloomberg)

Wholesale prices for used cars (adjusted for seasonality, mileage, and age) shot up roughly 70% from January 2020 to the peak in January 2022. I’ve heard dozens of crazy stories over the past few years.

- People paying crazy prices for old pickup trucks with over 100k miles that barely run.

- Dealers generally refusing to sell cars for MSRP–and getting away with it, while hapless buyers financed the difference over six years.

- Selling flooded cars (speaking of the devil, there will be way more of this after Hurricane Ian).

- Forged titles, etc, etc.

But now wholesale used car prices are down about 20% from the peak. Going forward, there’s no compelling reason why used car prices shouldn’t trade closer to their pre-pandemic average, because if there’s demand, then manufacturers can produce to meet it and make money. There’s an old saying in economics that the cure for high prices is high prices – that’s likely true here going forward. Most people don’t want to pay crazy prices for cars now without stimulus lining their pockets, and manufacturers are going to sell as many as they can to the few who do!

The real dilemma here, however, is that people aren’t just forking over their cash in exchange for a car. In fact, 80%-90% of new car buyers and around 60% of used-car buyers take out a loan to buy their car, whether from their dealership, bank, or credit union. With interest rates surging and prices sky high for cars, the open question here is whether millions of people who took out loans to buy cars at inflated prices will default on their loans at higher rates than they historically have.

Overpaying for a used car is a personal problem, but when millions of people overpay for cars it becomes a problem for banks and lenders as well if enough of them default. For lenders who originated loans in the latter half of 2021 before the used car market began to tank, the underlying collateral is likely no longer worth enough to secure the loan.

From a recent Bloomberg report on the auto-lending space:

- Wells Fargo (WFC) reported a higher loss ratio from auto loans in its most recent earnings call.

- Ally Financial (ALLY), the company formerly known as GMAC before its 2008 bailout, saw charge-offs quadruple in the third quarter. Ally is forecasting that their level of charge-offs will only rise to 1.6% next year, but that seems a bit naive to me if the value of the collateral is in free fall.

- Fifth Third Bancorp (FITB) is reducing originations, likely seeing the writing on the wall.

Is The Used Car Market The Next Subprime Crisis?

I don’t think it’s a systemic risk, but it seems likely to punish lazy banks and lenders that underwrite loans largely based on used car values rather than consumer creditworthiness. For the economy, it’s likely that the used car market is more of a symptom than a disease – of consumers overly reliant on stimulus, long amortizations, and low interest rates rather than on their own earning power.

Of course, Cathie Wood has issued dire warnings about the used-car market, calling for big losses for auto lenders as consumers shift to EVs. Historically speaking, auto lenders aren’t dumb – they take a down payment, charge interest based on credit risk, and can repossess the car if the buyers don’t make the payments. As far as collateral goes, used cars usually aren’t bad. But what’s interesting this time around is that the collateral is really volatile in value, so loans were made at inflated prices. Now that the value of used cars is crashing, lenders may take unprecedented levels of losses. And one wonders how many of these loans are being securitized by Wall Street and sold onto investors’ balance sheets as super safe when in reality the collateral is quite poor.

For a counterpoint: Wolf Richter, founder of Wolf Street (and former manager of a large Ford (F) dealership) has always regularly covered the car market. Wolf is far less bearish, having recently covered the current shortages of fuel-efficient cars and EVs, and the glut of pickup trucks and large SUVs. He’s made the case that pent-up demand will help dealers and automakers increase sales.

I personally don’t see a ton of systemic risk from the auto bubble, in the sense of a 2008-style collapse. But the market is clearly sending signals of distrust regarding the rosy forecasts of auto lenders that expect defaults to stay low and auto prices to simply level off.

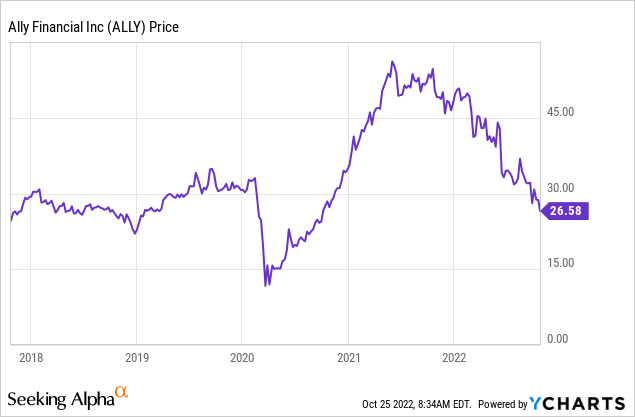

Ally Financial is the biggest car lender in America. The stock is down roughly 50% YTD.

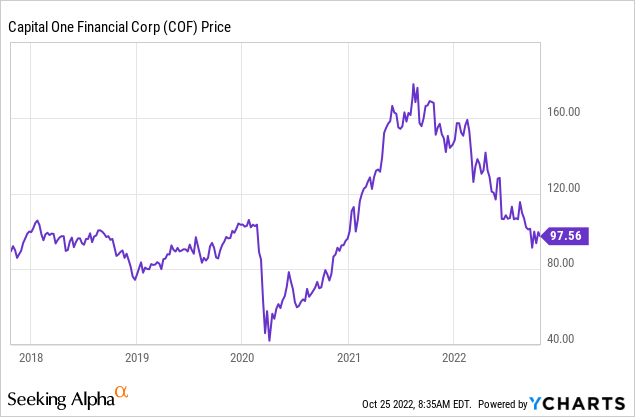

Capital One (COF) historically finances a lot of people lower on the credit spectrum. They’re taking a beating.

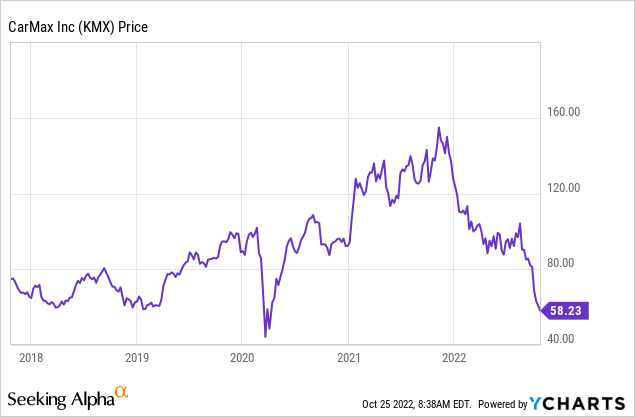

Used car kingpin CarMax (KMX) may offer a pleasant experience for car buyers, but recent shareholders aren’t as happy.

What The Used Car Bubble Means For You

Most of you reading this either own a car or have in the past. The market is sending some clear signals.

- Now is a good time to sell a car. If you have an extra car you don’t particularly need, now is a good time to sell it while prices are high and falling. This has been true for a while but I’ll reiterate it. I sold my own car in September for an inflated price.

- Now is not a good time to buy a car. With used car prices falling around 2% per month, the value of anything you buy is going to melt like an ice cube in the sun.

- Major used car lenders probably made a bunch of bad loans with used car values artificially high in 2022. Their shares are vulnerable to negative earnings and probable dilution if they take heavy enough losses.

What do you think about the madness in the used-car market? Share your thoughts below in the comments!

Be the first to comment