blackdovfx

A Quick Take On Innodata

Innodata (NASDAQ:INOD) reported its Q3 2022 financial results on November 10, 2022, with revenue exceeding previous guidance.

The company provides data engineering, AI data training and content distribution and monitoring capabilities.

Given the company’s worsening operating and net results combined with tepid revenue growth, I’m on Hold for INOD until we see evidence of faster growth and a meaningful turn toward operating breakeven.

Innodata Overview

Ridgefield Park, New Jersey-based was founded in 1988 to provide a variety of outsourced data engineering services and software to companies worldwide.

The firm is headed by Chief Executive Officer Jack Abuhoff, who has been with the firm in various capacities since its founding and was previously Chief Operating Officer at Charles River Corporation and practiced international law prior to that.

The company’s primary offerings include:

-

Data Collection

-

Data Annotation

-

Applied AI

-

AI Data Marketplace

-

Third Party Risk Intelligence

Innodata primarily acquires new customers through its in-house sales and marketing efforts, as well as through social media and digital advertising, attending industry events and conferences, fostering relationships with partner companies, and leveraging existing customer referrals and word-of-mouth.

Innodata’s Market & Competition

According to a 2018 market research report by MarketsAndMarkets, the market for big data and data engineering services was an estimated $29.5 billion in 2017 and is forecasted to reach $77.4 billion by the end of 2023.

This represents a forecast CAGR of 176% from 2018 to 2023.

The data engineering industry has experienced rapid growth in recent years, driven by increased demand for data-driven insights and improved technology.

There is a wide range of potential customers, including businesses, government entities, educational institutions, and other non-profits. Data engineering projects can range from simple database management to complex algorithms used to build predictive models.

As the industry continues to expand, new technologies and strategies are being incorporated in order to drive more effective data engineering projects.

Major competitive or other industry participants include a variety of consulting firms and specialist companies providing a wide range of data engineering services.

Innodata’s Recent Financial Performance

-

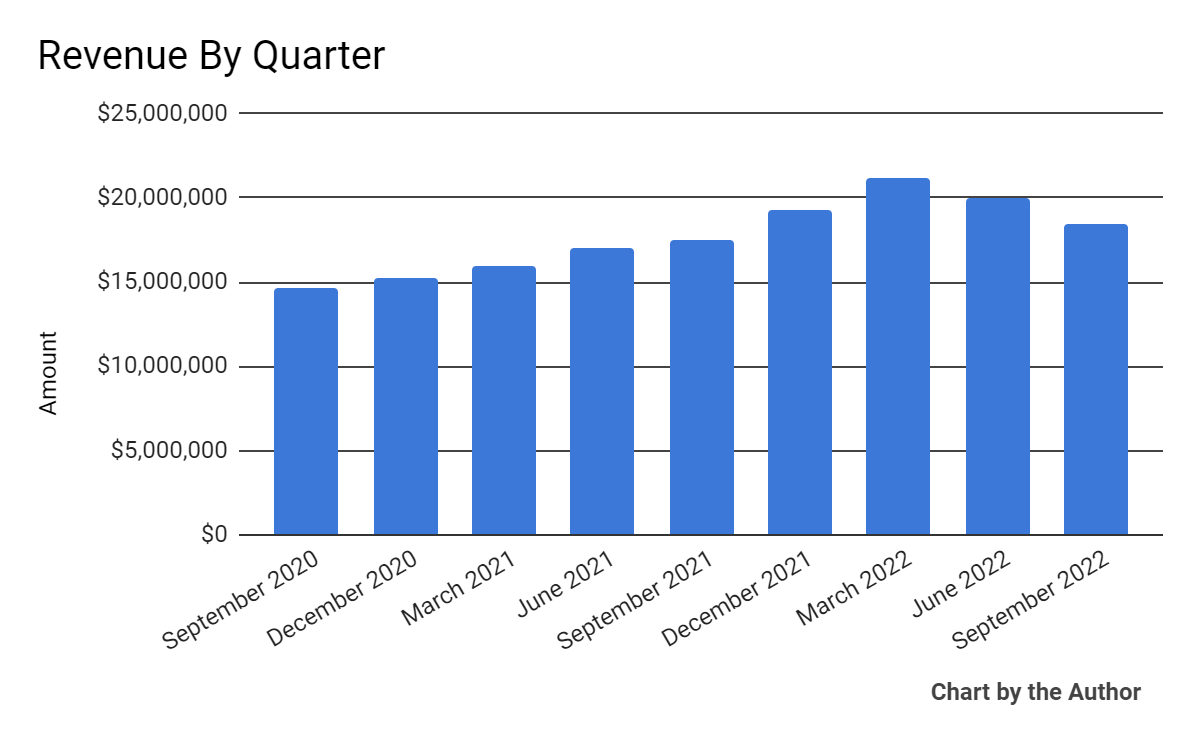

Total revenue by quarter has grown per the chart below:

9 Quarter Total Revenue (Seeking Alpha)

-

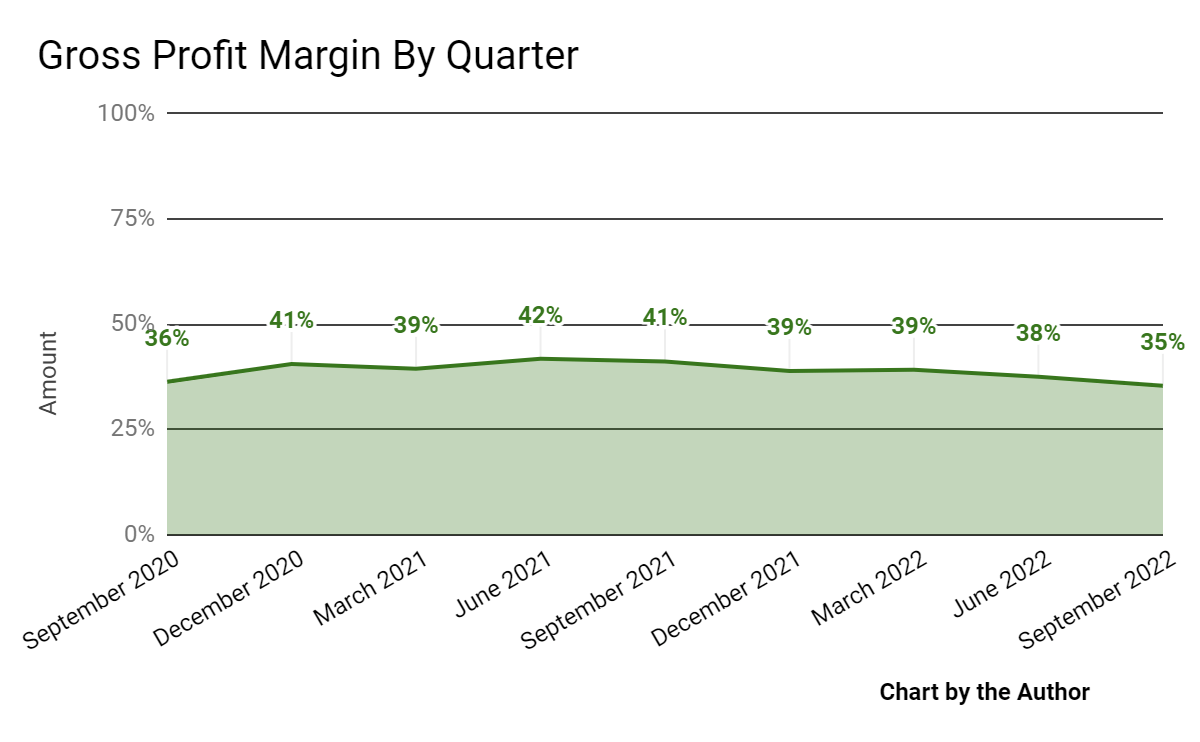

Gross profit margin by quarter has trended lower in recent quarters:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

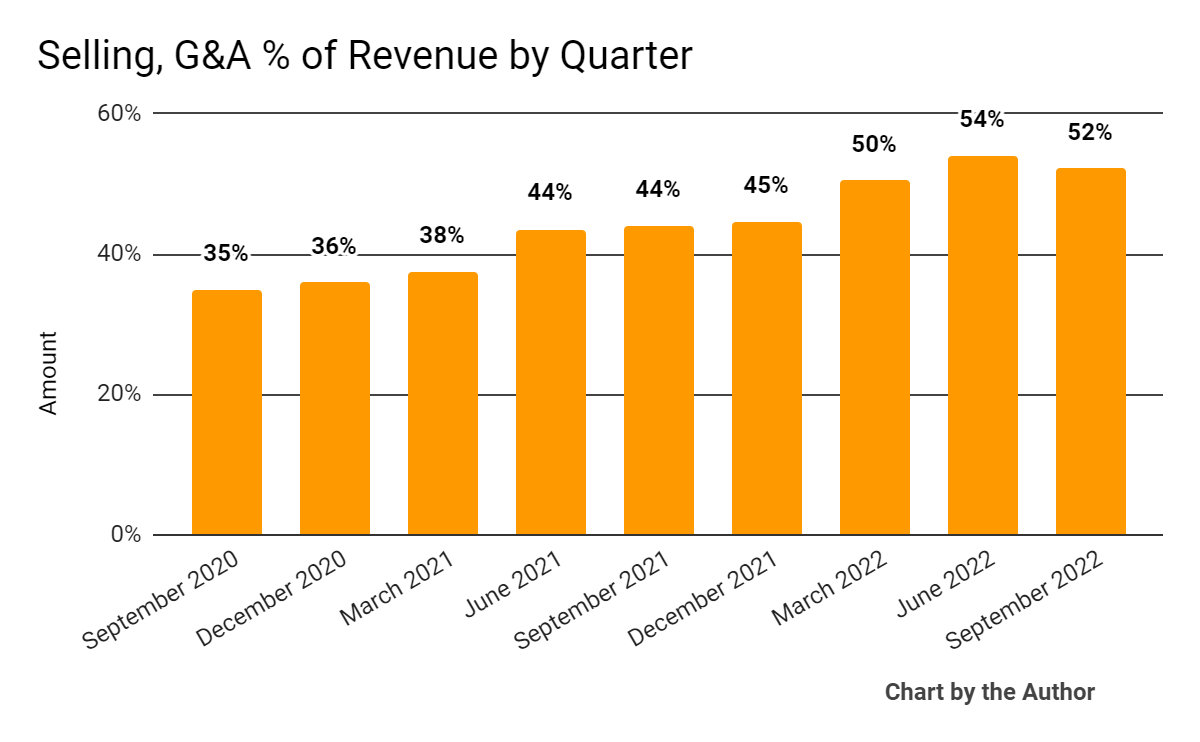

Selling, G&A expenses as a percentage of total revenue by quarter have risen markedly recently:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

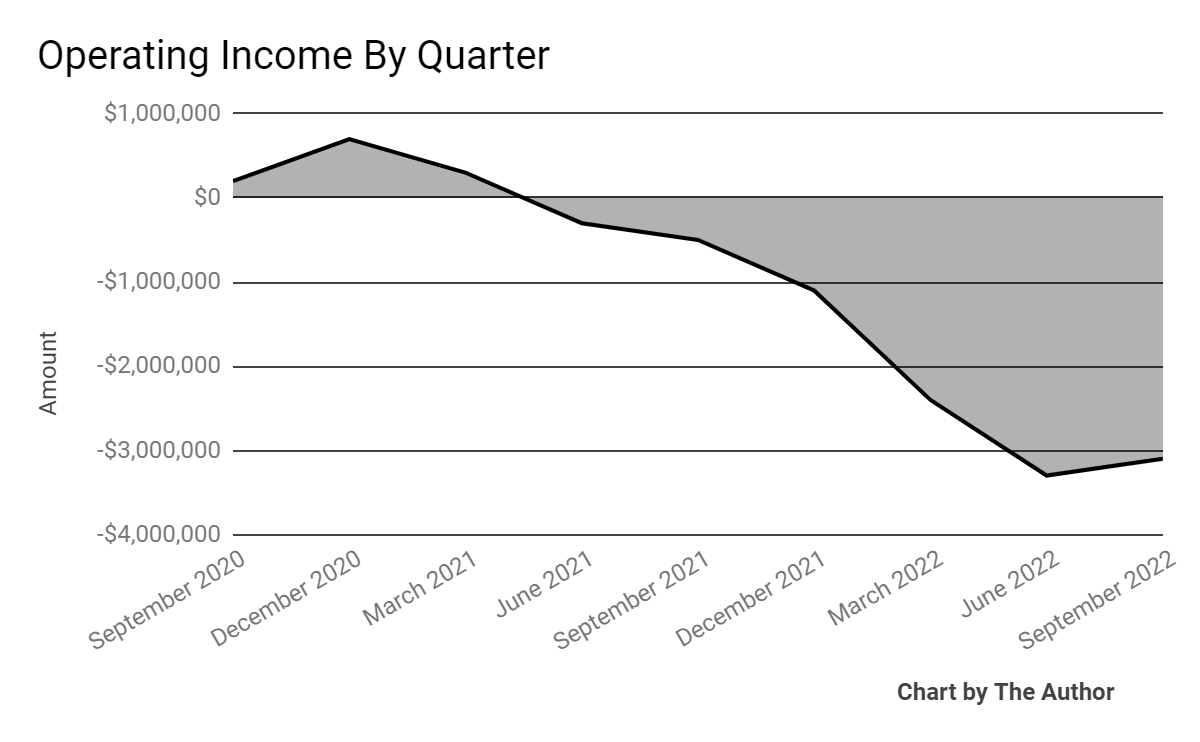

Operating losses by quarter have worsened in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

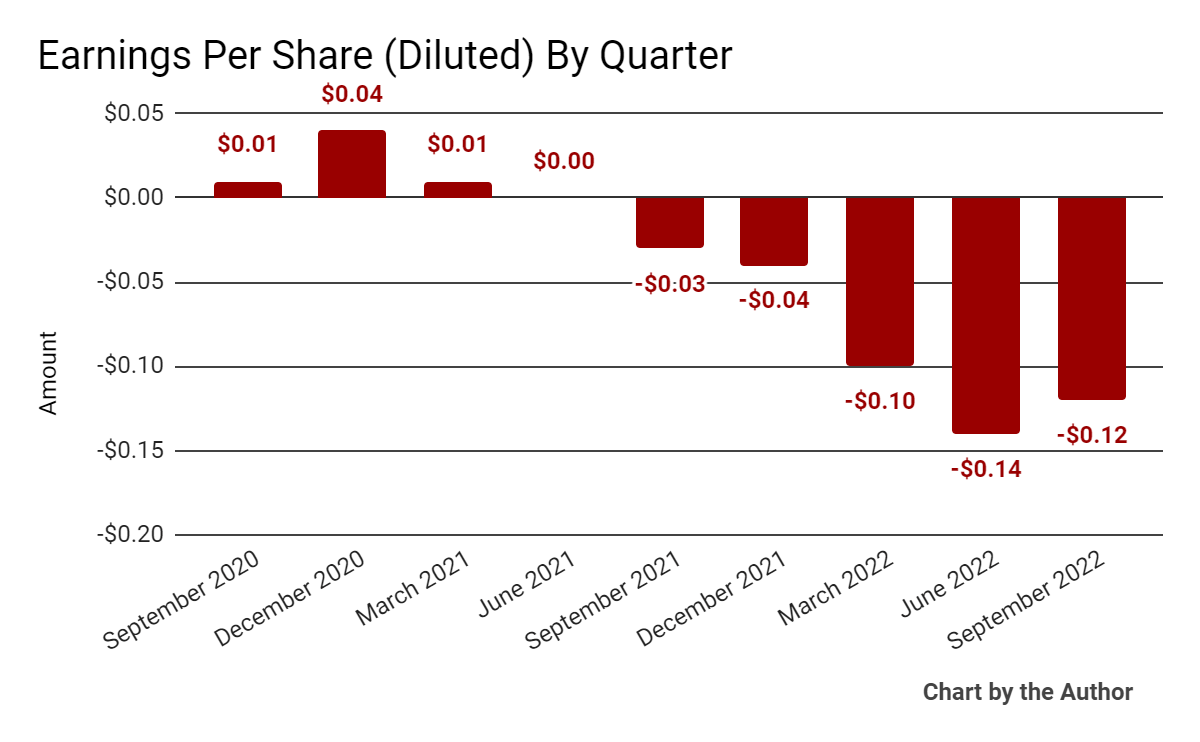

Earnings per share (Diluted) have worsened in recent reporting periods, as shown below:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

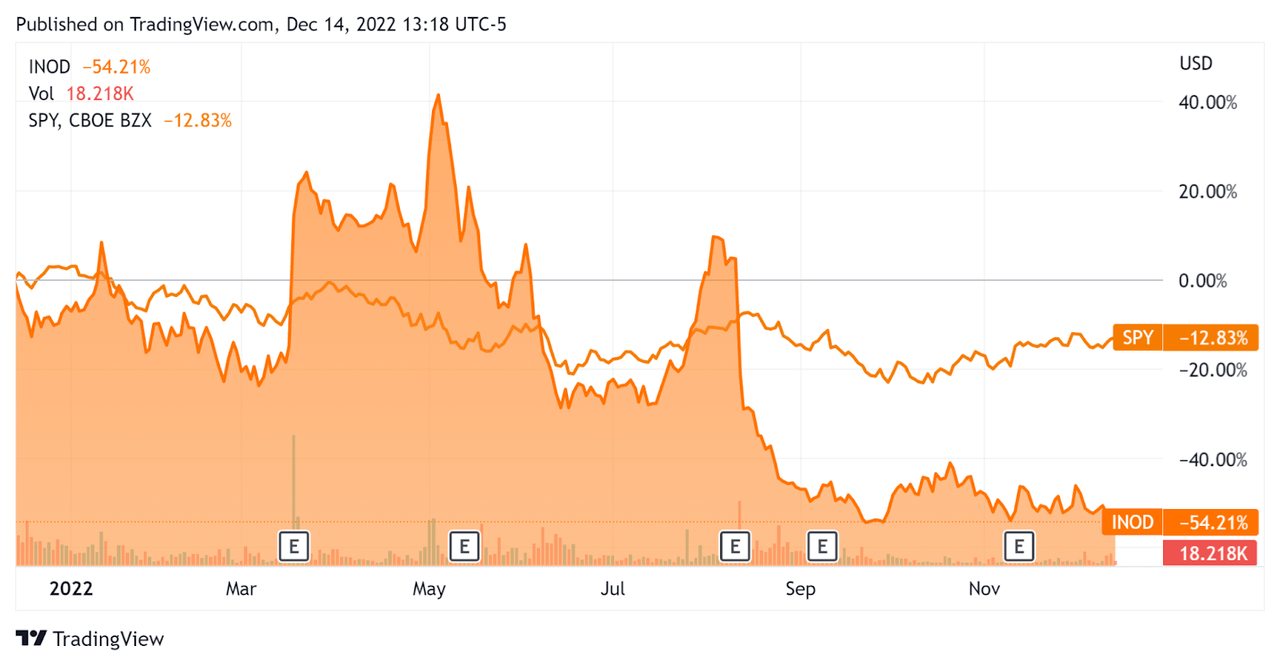

In the past 12 months, INOD’s stock price has fallen 54.2% vs. the U.S. S&P 500 index’s (SPY) drop of around 12.8%, as the comparison chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For Innodata

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.9 |

|

Revenue Growth Rate |

20.0% |

|

Net Income Margin |

-14.1% |

|

GAAP EBITDA % |

-11.2% |

|

Market Capitalization |

$81,313,352 |

|

Enterprise Value |

$74,527,352 |

|

Operating Cash Flow |

-$2,151,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.40 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

INOD’s most recent GAAP Rule of 40 calculation was only 8.8% as of Q3 2022, so the firm is in need of material improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

20.0% |

|

GAAP EBITDA % |

-11.2% |

|

Total |

8.8% |

(Source – Seeking Alpha)

Commentary On Innodata

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted exceeding its previous revenue guidance.

However, leadership noted a ‘rigorous focus on costs’ which it expects to lead the company to adjusted EBITDA positive status in Q4 2022.

Management has also seen longer sales cycles requiring more customer executive sign-offs, but believes these challenges are transitory in nature.

The firm now counts ‘10 large customers for [its] AI/ML lifecycle services,’ and management believes these firms will increase their spending plans in 2023.

As to its financial results, topline revenue rose 6% year-over-year while gross profit margin dropped materially.

Management said the company’s Synodex segment, which captures medical data for underwriting and claims processing purposes, produced a 150% net retention rate, indicating strong product/market fit and very good sales & marketing efficiency.

The company’s Rule of 40 results have been in need of significant improvement, with only an 8.8% result for the trailing twelve-month period.

Selling, G&A as a percentage of revenue has risen, while operating losses have worsened as has negative EPS results.

For the balance sheet, the firm ended the quarter with cash and equivalents of $10.7 million and no debt.

Over the trailing twelve months, free cash used was $8.9 million, of which capital expenditures accounted for $6.7 million in cash used.

Regarding valuation, the market is valuing INOD at an EV/Sales multiple of around 0.9x.

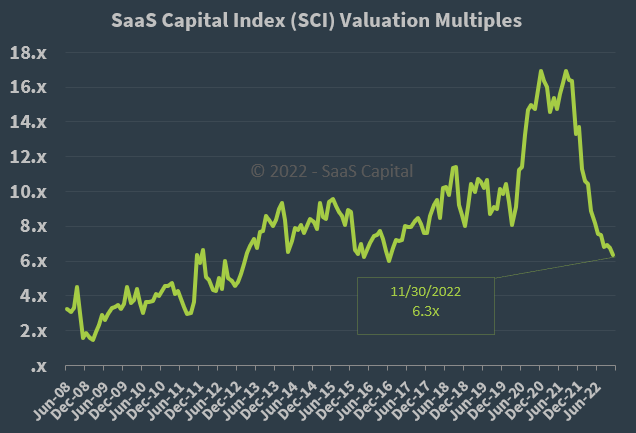

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.3x at November 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

While the firm is not a pure SaaS company, by comparison, INOD is currently valued by the market at a large discount to the broader SaaS Capital Index, at least as of November 30, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which is producing slower sales cycles and reducing its revenue growth trajectory.

A potential upside catalyst is increased interest and spending for the company’s AI/ML engineering services, as these capabilities have received growing interest from firms and their customers in recent quarters.

However, given the company’s worsening operating and net results combined with tepid revenue growth, I’m on Hold for INOD until we see evidence of faster growth and a meaningful turn toward operating breakeven.

Be the first to comment