PhonlamaiPhoto

The semi-cap space is the bread and butter of the entire semiconductor industry. We recommend investors buy the stock pullback of the most critical semi-cap stock, ASML (NASDAQ:ASML). ASML is at the center of our bullish thesis on the semi-cap space, as we believe the company’s EUV technology has made it indispensable to the entire semiconductor peer group. We expect ASML to enjoy demand tailwinds as chip-making expands to U.S. soil and consumer demand picks up in 2023.

We believe the semiconductor group was the first to bottom as macroeconomic headwinds materialized. Hence, we expect it will be the first to pick up, starting with the semi-cap group. Understanding the semiconductor capital equipment industry, or semi-cap industry, can be daunting for investors. In simplified terms, the semi-cap is the collection of semiconductor companies that manufacture the equipment that enables other semis to make chips. In more ways than one, the semi-cap companies enable the end-market product we use on a daily basis, whether that’s our cars, phones, or 5G. We recommend investors buy into the growth of ASML alongside Lam Research (LRCX), and Applied Materials (AMAT), as we believe each of the companies covers an essential aspect of the semi-cap industry and is well positioned to grow as supply-demand dynamics fall back into balance.

Capturing Alpha through the semi-cap

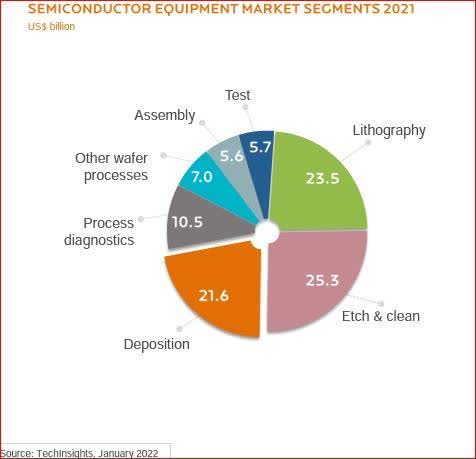

Together ASML, LRCX, and AMAT cover over 70% of the semiconductor equipment market segments. While ASML dominates lithography largely uncontested, AMAT and LRCX lead the fields of etching and deposition.

The following graph breaks down the semi-cap industry by segment.

TechInsights

Our bullish sentiment on ASML, LRCX, and AMAT is based on our belief that each company successfully dominates its respective segment in the semi-cap space.

ASML:

It’s uncontested that ASML has a monopoly over the lithography space as it remains the only semi-using extreme ultraviolet technology, or EUV, lithography systems. EUV technology replaced DUV as a faster, more precise mechanism to design and manufacture equipment for chip-making. Hence, we expect ASML to grow as it monopolizes the lithography systems needed by any major chip-making company to manufacture the most advanced high-end tech. ASML has around 90% market share of the lithography market, followed by Canon and Nikon. Taiwanese Semiconductor Manufacturing Company (TSM), Samsung (OTCPK:SSNLF), or Intel (INTC) must go to ASML to produce chips and keep the supply-demand chain going. We recommend investors take advantage of the 24% YTD drop and buy ASML as we expect the stock to rally once macroeconomic headwinds ease.

LRCX & AMAT:

Together LRCX and AMAT dominate the etching and deposition space. We believe most of the consumer weakness and macroeconomic headwinds have been priced into both stocks. We believe the weaker-than-expected demand has been recognized, and guidance is now de-risked for the most part. LRCX is primarily exposed to memory market weakness, accounting for around 52% of total revenue, while AMAT is more exposed to logic/foundry markets, making up 71% of semiconductor sales. We believe the weakness of each company’s vulnerability has been factored into the stock for the most part.

We’re more constructive on LRCX and AMAT after Wafer Fabrication Equipment (WFE) spending cuts for 2023 took place. We expect both stocks are better positioned now to outpace expectations as the WFE spending cuts reflect market demand more accurately. LRCX and AMAT are not risk-free. We expect both stocks to be pressured in the near term due to U.S. export regulations to Chinese customers. We believe the WFE spending cuts for the 2023 outlook will help offset the revenue decline resulting from the U.S. restrictions. The stock price for both stocks remains volatile toward the end of the year. Still, we recommend investors buy the pullback as we expect both companies to outperform in 2023.

Can’t have semis without ASML

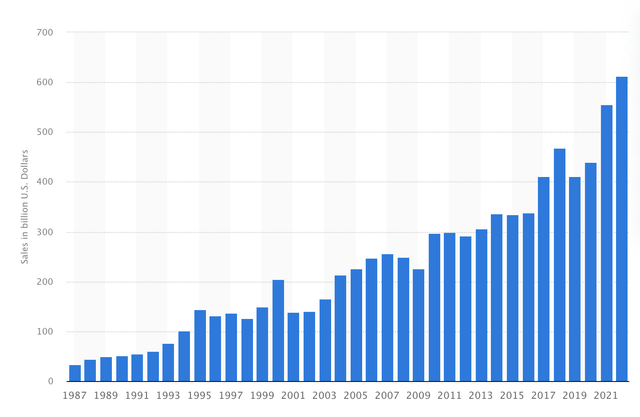

The semiconductor industry is like no other because while much competition exists within it, there’s also a lot of coordination and collaboration. Our buy rating on ASML results from the indispensable nature of the equipment the semi-cap produce. We expect ASML to grow significantly as the world becomes more digitalized and demand tailwinds in the semiconductor industry pile up. The global semiconductor industry is forecasted to grow at a CAGR of 12.2% between 2022-2029. We expect the leaders in the semi-cap space to be primary benefactors of the semiconductor industry’s expansion. The following graph outlines the growing trend within the semiconductor industry.

We expect that increased demand for semiconductors will create more demand for the chip-making equipment provided by the ASML. We’re already seeing the expansion of semiconductor manufacturing with TSMC’s recent announcement that it plans to build a second chip plant in Arizona, investing around $40B in the state. After the CHIPS Act passed, INTC has also taken steps to secure its place as the designated U.S.-based foundry player under its IDM 2.0 strategy. We expect increased chip production and fab expansion will create demand tailwinds for the holy trinity of semis: ASML, LRCX, and AMAT.

Valuation

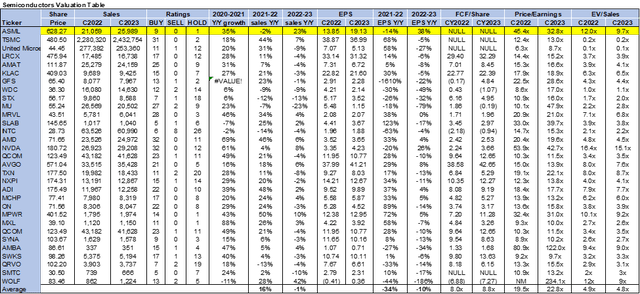

ASML is on the more expensive end of the spectrum, trading at 32.8x C2023 EPS $19.13 compared to the peer group average of 22.8x. The stock is trading at 9.7x EV/C2023 Sales versus the peer group average of 4.8x. ASML stock is not cheap, but we believe the company is reasonably priced for its crucial role in lithography.

The following table outlines the valuation and sell-side ratings of ASML.

Most Wall Street analysts share our bullish sentiment on ASML. Of the ten analysts covering ASML, nine are buy-rated, and the remaining are hold-rated.

What to do with the stocks

We recommend investors buy into the semi-cap through ASML. We believe ASML will be a safe haven as the market recovers through 2023. We also believe LRCX and AMAT provide favorable risk-reward profiles within the semi-space. We expect to see significant growth trends in lithography, etching, and deposition as the semiconductor industry grows and the need for equipment to make semiconductors increases. We recommend investors buy the stock pullback as we expect the semi-cap industry to rebound meaningfully in 2023.

Be the first to comment