Torsten Asmus

U.S. inflation expectations, based on the spread of inflation-linked bonds and regular Treasuries, continue to move lower after peaking in April this year. Despite this, bond yields continue to move higher, with 2-year yields at their highest levels since 2007, touching 4%. The Fed’s inflation fight has already been won in the eyes of investors, and once this begins to show up in headline inflation figures we are likely to see short-term yields fall sharply. Now is an excellent time to lock in yields with the iShares 1-3 Year Treasury Bond ETF (NASDAQ:SHY).

The SHY ETF

The SHY ETF holds U.S. short-term Treasury bonds with a maturity of between 1 and 3 years. The current yield to maturity of the fund is 4.0%, which is the highest it has been since the global financial crisis. The effective duration of the fund is just 1.8 years and so investors can expect very little volatility in either direction. Even the surge in yields seen over the past 12 months has only seen the ETF lose 5% in total return terms. The downside is that capital gains will be relatively mild even if we see a sharp decline in yields. However, the 4% returns that investors will receive over the next 2 years is likely to be significantly higher than the returns in most other markets, with far less volatility. Only the energy sector offers a dividend yield above 4%.

Inflation Expectations Continue To Decline

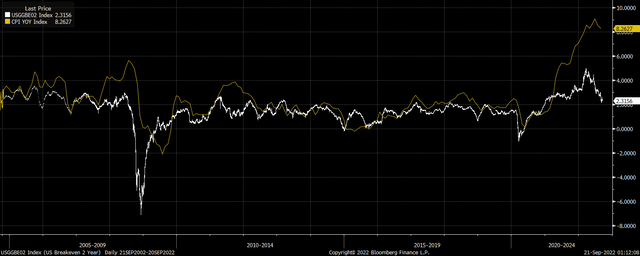

While headline inflation remains in excess of 8%, long-term inflation expectations as measured by the Treasury Inflation Protected Securities market have fallen back to long-term averages. 10-year inflation expectations sit at 2.5%, having fallen from over 3% in April. The combination of interest rate hikes and rising tax revenues has tightened global liquidity significantly and weakness in the economy has helped to bring down oil prices, which are a key driver of inflation expectations.

U.S. 10-Year Breakeven Inflation Expectation (Bloomberg)

At the 2-year level, breakeven inflation expectations have fallen even more sharply, from a peak of near 5% in March to just 2.3% today. As the chart below shows, such expectations tend to be accurate and suggest that headline CPI will fall dramatically over the next 24 months.

U.S. 2-Year Inflation Expectations Vs. Trailing CPI (Bloomberg)

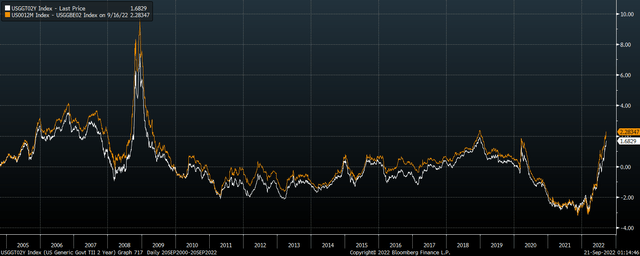

Fed Policy Is Now Very Tight

It may sound strange, with the Fed funds rate still 6% below headline inflation, to argue that Fed policy is now tight, but on a forward-looking basis 2-year yields are currently 168bps, compared to a long-term average of zero. Real yields across the banking system are even more restrictive, with 12-month LIBOR now at 4.7%, which is its highest spread above inflation expectations since the height of the global financial crisis.

US 2 Year UST And 12 Month Libor Adjusted For 2-Year Inflation Expectations (Bloomberg)

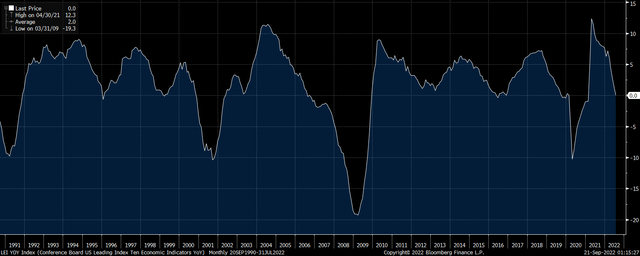

There are numerous signs that this tightening is taking its toll on liquidity and economic conditions. Equity multiples have fallen sharply, particularly in the bubbly sectors of the market, while corporate credit spreads have widened. The Conference Board’s Leading Economic Indicator has fallen to zero and has a very strong track record of predicting recessions.

US Leading Indicator Index (Conference Board)

Interest rate markets are pricing in at least a further 200bps of hikes over the next 6 months, which would likely exacerbate the above conditions, and I believe there is a significant risk of a market panic and credit crunch similar to that seen in 2008. As the risks of such an event rise, I firmly believe that the Fed will err on the side of supporting asset markets, particularly if headline CPI collapses as markets expect.

Summary

The SHY ETF offers investors relatively high yields with very limited downside risks. The 4% yield on offer is unlikely to last for long as inflation pressures continue to subside and extremely high real yields put pressure on liquidity and economic conditions.

Be the first to comment