AndresGarciaM

Dear readers,

In this article, I will provide you with an update on the Spanish company Telefonica (NYSE:TEF). Compared to other telco holdings in my portfolio, this is a relatively small stake, but it still offers a significant potential upside – which is why recent investments have favored Telefonica as a business when I’ve been putting capital to work.

TEF is a fairly volatile telco – and opinions on the company are at times split. My stance remains very clear – a major telco that offers millions of people access to networks and communications remains a staple in today’s world. This can translate to investability.

Let’s update on TEF.

Updating on Telefonica

So, Telefonica is a Telco with an 80% focus on the geographies of Spain, Germany, UK, and Brazil. There is some risk inherent to some of these, but most of them are fairly stable areas, all things considered. What’s more, Telefonica is a market leader in most of these nations.

The company’s relatively recent asset monetization/spin-off of all Non-Brazil Hispanoamerica assets was a very well-timed overall sale, and a merger between O2 and Virgin, which brought together TV and Mobile UK, was another excellent example of the company’s superior capital allocation and M&A skills.

Telefonica still offers investors a 7%+ yield, which stands out as one of the highest in the industry compared to the actual safety of the business. The company is investment-grade rated, and even at its current valuation has a market cap of close to $25B. Telefonica remains one of the best examples of strong assets being discounted to an unfair degree by the market. There are different degrees of unfair undervaluation when it comes to this.

You can see this in other telcos that I follow – take Orange (ORAN) and Deutsche Telekom (OTCQX:DTEGY). Both of these are currently in far better positions valuation-wise than TEF – but I did not buy them at this price. I bought each of them when the market’s opinion on them was at close to all-time lows, meaning I’m significantly up on both of them. For DTEGY I’m up nearly 30% inclusive of dividends, and despite ORAN’s volatility, I’m up 10% here. This all goes to show you the importance of investing at the right price.

The market is telling us a story that TEF is a risky play and should be ignored in favor of safer and better-yielding businesses.

Let me tell you a different – but also true – story.

H1 22 results are out. And growth is good.

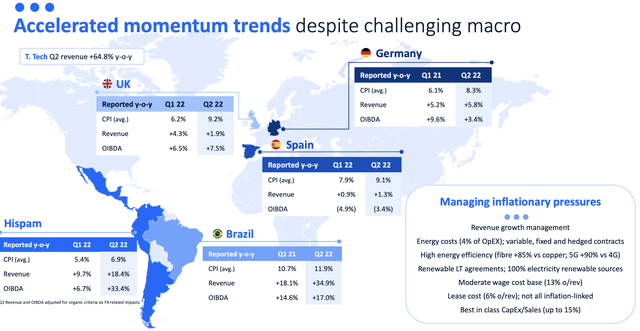

The company over-delivered on growth and is officially moving to the mid/high-end range of its yearly guidance despite all of the issues the world is currently facing. The company saw both revenue and earnings growth, and Telefonica is successfully managing the host of challenges we’re currently seeing in the market.

As I mentioned in my previous pieces, the company is moving to an entirely new operating model, and this model is showing clear results. Each of the company’s aforementioned key markets is delivering positive results.

Spain is improving earnings, and its streaming services and connections are improving, with the company’s portfolio gaining traction. Brazil is strengthening its leadership, improving both fundamentals and earnings, and Germany saw good progress on 5G with sustained financial performance.

The company also has a whole host of levers it can pull for further growth and operational improvements, many of which are either planned or ongoing.

In pure numbers, the company saw a 5.2% revenue, 3.4% OIBDA growth (all for 2Q22), and a CapEx/sales of below 14% which for a telco is among the lower in the peer group. The company saw a resilient mix development with B2B growth, and the digital ecosystem the company is offering is starting to deliver results as well. FCF improved by over 48%, and the ongoing FX trends are actually positive for Telefonica.

The company’s balance sheet, which is one of the only real worries to me about the business, is now stronger. The maturity profile has been evened out with fewer hills and valleys, and the liquidity the company currently has is enough for over 2 years of debt coverage – debt that has an average life of 12.8 years with over 75% of it at fixed rates.

As I mentioned, the company is actually accelerating – and inflation is being managed.

Things are going so well that TEF has confirmed its 2022E dividend as well as the upper range of its guidance. The remuneration will be €0.3/share, paid out in Dec-22 and Jun-22, meaning the company’s native yield at this time is now above 7%. The dividend alone is enough to take a big chunk out of the ongoing inflation for you.

You’re investing capital at one of the largest telco players around – a player that has not seen any sort of massive downturn in any of its major markets here. Nothing that would cause you to need to worry about the company’s safety or stability as an investment, disregarding the volatility in the company’s share price.

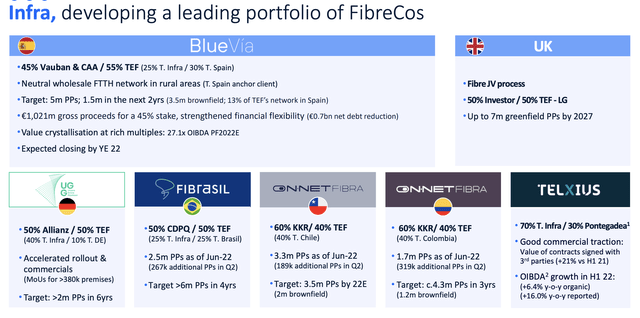

Remember, the company is developing a portfolio of fiber companies, and this work is very much ahead, with strong partners like Allianz (OTCPK:ALIZY) and others.

Net financial debt is down – and the overall picture of results here is undeniably positive. With accelerated growth and momentum, prudent management of ongoing inflation and similar challenges, and supportive FX growth throughout the current financial periods, we’ve seen the company significantly improve.

Yet it is down – why?

I ascribe most of this drop to the general trends in communication stocks at this particular time. Growth is low here – but the key point to be made with telcos is that they really don’t “need” massive growth to be at least decent performers in your portfolio. Over 3-5% growth is good, but some telcos won’t manage this in this environment. Their safety and dividends can still make them decent investments – and above all, safe ones, reflecting the underlying assets they actually represent.

Another issue the market may be having with Telefonica is nation-specific profit or OIBDA margins. Some of these are currently low despite cost-cutting – and the company expects specific Spain OIBDA margins to stay in the 30s, impacted by lower handset sale margins and IT margins (including the impact of energy costs).

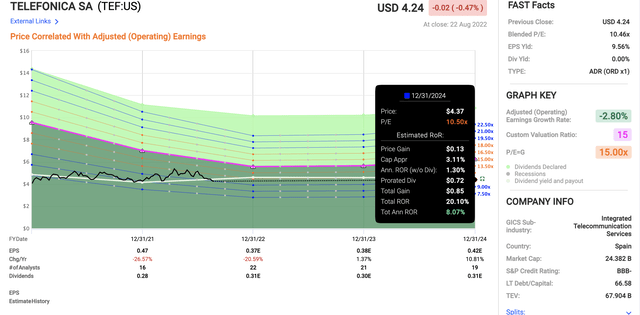

On a high level, no significant or altering impacts that would justify a valuation drop like the one we’ve seen, exists. The company has dropped from an average P/E of around 12.5x to 10x, and while this year will see lower results than last year, we’re still talking about a potential trough before the company starts moving back up.

Let’s look at company valuation.

Telefonica – The valuation

Since my last article, the company has dropped back down – a very welcome change given the opportunity this offers us. Telefonica now trades at below 10.5x P/E and offers a significant upside based on a 12-15x forward P/E range.

Even on a completely flat, 10.5x P/E forecast based on current trends, you’re far from losing money if dividends and earnings stay somewhat intact.

Oh, people can certainly argue about this or that – but it’s hard to argue with the fundamentals and the way this company is currently being valued relative to the upside and results that it offers.

Even applying a double-digit discount to the company’s ratios to account for some of the listing and debt structural issues, as well as legacy market risks, you don’t get to a point where you’re able to fairly discount the company’s assets, or earnings, as much as the market is currently doing.

The well-covered yield of over 7% as well as the upsides imply that the discount the market is applying of over 25%, despite an already 15-20%-considered discount for aforementioned risks, is unfair. We’re talking about a company that is valued lower than Telecom Italia (OTCPK:TIIAY) or even the Greek operator, Hellenic Telecom (OTCPK:HLTOY), and this borders on ridicule based on their relative risk factors.

Based on analyst targets, the company has retained a very stable €4.85-€5.95 target range on average. Many analysts are mirroring the “HOLD” the market seems to set on the company despite this average PT – margins, inflation, and upsides being put into question – but 10 analysts are still at “BUY” or “Outperform” for the company. The current upside based on the PT is 17% for the native.

I’ve applied DCF, NAV, and peer averages, and looked at forecasts. S&P Global and Equity analysts are expecting stable earnings and EBITDA on average until 2025E. 2022E is expected to bring a drop in earnings but recover to where the company can maintain its dividend payout ratio of 60-80% for the long term.

In my last article, I said the following.

The way to view this is as follows.

You either believe the company’s 5-point plan of focusing on core markets and working on Telefonica Tech and Infra in the long term, as well as the leaving of Latin America in order to create a more predictable and stable operation. Or you believe that the inherent risks of such major moves are too great to be interested in, and some of the aforementioned risk factors skew the calculation way too far in one direction.

(Source: Telefonica Article)

I obviously believe in the company’s plan, and I see the recent results as steps to start to realize them. I don’t mistake TEF for a company that will shoot up quickly or anything of the sort. This is a slow grower – like most Telco’s. The downside is protected by the generous yield, and what I am counting on for the long-term is longer-term normalization, which together with a dividend of more than 9% YoC will deliver a long-term CAGR/RoR of 15%+. All the while invested in one of the incumbent Telcos in Europe.

You’re buying TEF at below 0.4x P/B. The market can discount a Telco incumbent for a long time based on transitory headwinds. There is plenty of global evidence of this. However, eventually, things will normalize, even if the company does as major a restructuring as we’ve seen here.

I believe that eventually, that discount will end, and when it does, I firmly believe I will be on the right side of the equation to see returns of over 20% per year, with a 3-year total RoR of close to 65% for this company.

I’m not shifting my target for Telefonica – I remain at a “BUY”. Not at €6 or above, as some are doing. At that price and yield, there are far more risk-conservative potential investments with decent returns. But at around €5/share, I still see the upside as good enough to consider investing in Telefonica – especially in today’s market.

Thesis

My thesis for Telefonica is as follows:

- The currently-cheapest telco major in all of Europe, despite a double-digit growth since my last article.

- There are reasons for the valuation, but I view those reasons as unfairly discounting the fundamental advantages of the company. We can heavily discount the cash flows, assets, and multiples, and still, come out with higher targets than the market is giving us for Telefonica.

- I view this one as a “BUY” with a €5/share price target.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (bolded).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment