Lemon_tm

By Anu Ganti

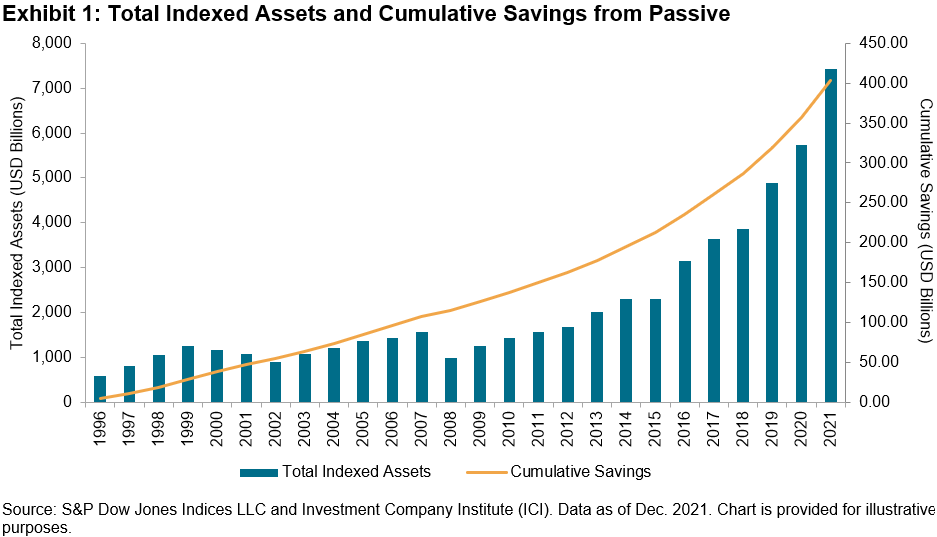

One of the benefits of indexing is its low cost relative to active management. As indexing has grown, investors have benefited substantially by saving on fees and avoiding active underperformance. We can estimate the fee savings each year by multiplying the difference between the average expense ratios of active and index equity mutual funds by the total value of indexed assets for the S&P 500, S&P 400 and S&P 600. When we aggregate the results of these annual computations, we observe that the cumulative savings in management fees over the past 26 years is USD 403 billion (see Exhibit 1).

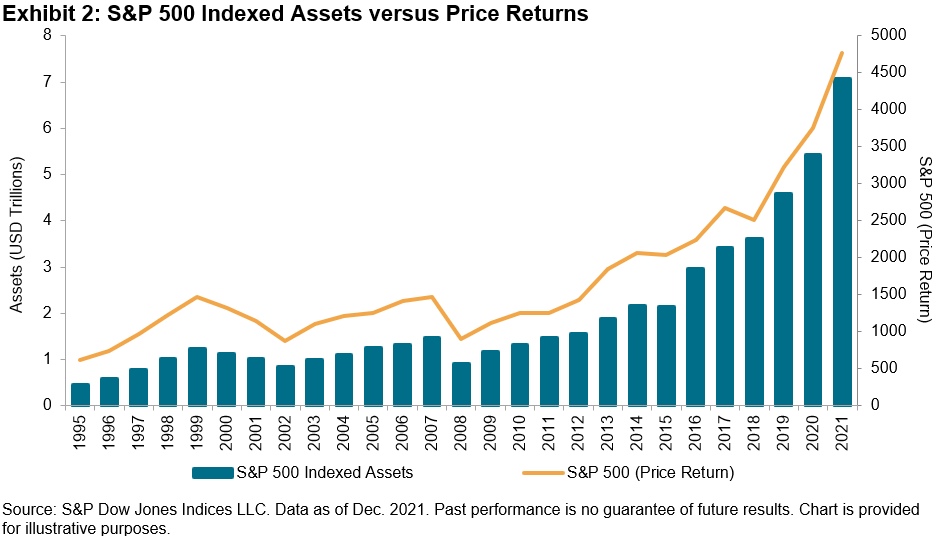

Of course, this USD 403 billion estimate understates the full cost savings of the index industry, since it encompasses indices only from S&P Dow Jones Indices (and not all of those). Our recent Annual Survey of Indexed Assets shows a 30% surge in assets tracking the S&P 500 since 2020 to USD 7.1 trillion as of December 2021. Exhibit 2 illustrates that since 1995, this growth (CAGR of 11.1%) has outpaced the growth due to market gains (CAGR of 8.2%), indicating a substantial increase in flows.

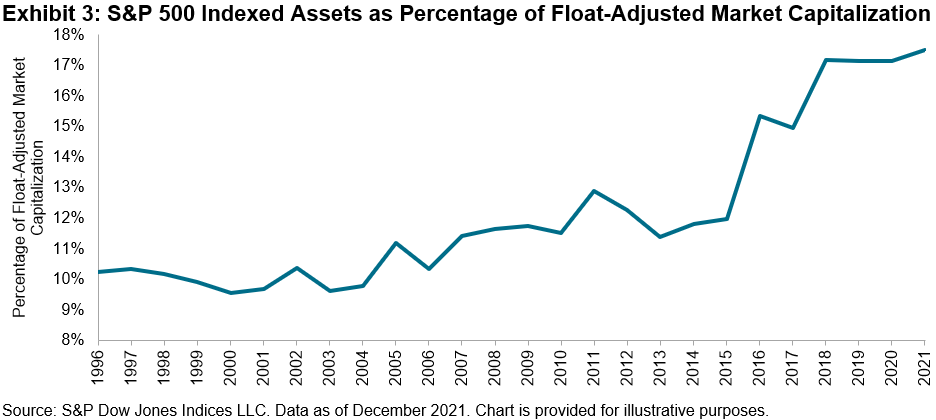

To provide context on the size of the passive market, Exhibit 3 divides S&P 500 indexed assets historically by the float-adjusted market capitalization of the S&P 500. This percentage has stabilized at approximately 17% since 2018, indicating that the potential for future passive growth is promising.

Obviously, the cost savings generated by the shift from active to passive management would be inconsequential if investors lost more in performance shortfalls than they gained in reduced fees. As readers of our SPIVA reports are well aware, of course, that’s decidedly not the case: most active managers underperform most of the time. In the 20 years ending in 2021, 94% of all large-cap U.S. managers lagged the S&P 500. Mid- and small-cap results were almost equally disappointing. The rise of passive management has been a notable consequence of active performance shortfalls.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures, please visit Terms of Use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment