Art Wager/E+ via Getty Images

In addition to company-specific fundamentals, we like to continuously analyze submarket-specific fundamentals. Today, I will be diving into Texas with particular emphasis on Houston as two companies we respect (NexPoint Residential (NYSE:NXRT) and BSR REIT (HOM.UN) have polar opposite strategies in the area.

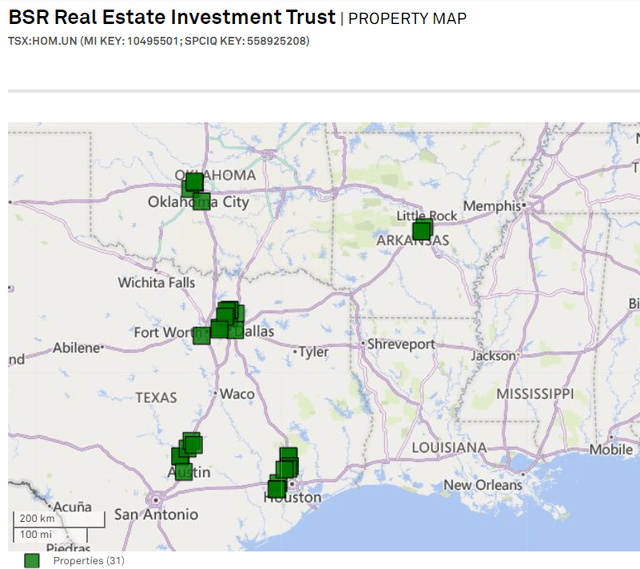

BSR REIT, also traded via the U.S. listed (OTCPK:BSRTF), is a Canadian apartment REIT that has concentrated almost all of its assets in Texas. A region spanning from San Antonio to Dallas to Houston is known as the Texas triangle and BSR has sold most of its non-Texas assets, with its portfolio now roughly 90% in the triangle.

S&P Global Market Intelligence

So far it has been working with exceptional rental rate growth. BSR is trading at about 20X forward FFO, which makes it opportunistically cheap if it can continue growing at this blazing pace.

The Houston Debate

It is not often that two publicly traded REITs go in opposite directions for the same property type in the same market.

- NXRT is attempting to fully exit Houston.

- BSRTF is rapidly growing its exposure to Houston.

While they have not directly transacted with one another, I do think it is worthwhile to explore their differing views on the market.

BSR’s Take on Houston

Beyond the fact that they have acquired many apartment assets in Houston, BSR management has some heavily bullish commentary on the market. Per the 2Q22 conference call, Dan Oberste, CEO, said:

“The fastest-growing MSAs in the country right now, #1, DFW, #3 is Houston, and #4 Austin.”

Later in the call, Blake Brazeal gave further color on why they like Houston along with the other Texas markets:

“So we’re looking at median income right now in Austin in that portfolio of 99,000 and Dallas at 91,000 and Houston at 90,000. [ ] Houston (cost of home ownership) is at $2,504 and a total of $1,200 rental rate.”

The line of reasoning makes quite a bit of sense to me. Jobs are pouring into Houston and incomes are high and rising, which facilitates rapid household formation. With mortgage prices having risen so significantly, the cost of home ownership is quite expensive relative to paying rent. The relative affordability of apartments has two implications:

- Apartments will get the majority of net absorption.

- Rents have significant room to rise, with apartments still being the more affordable option for most residents.

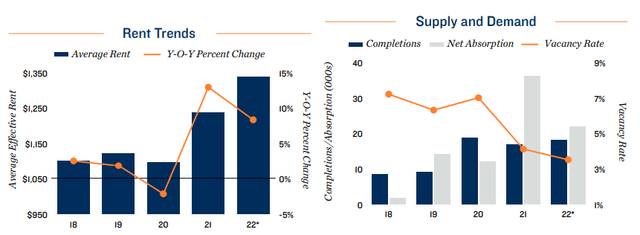

Houston level data backs up BSR’s idea with net absorption at impressively high levels which is causing vacancy rates to drop to just over 3%.

In turn, the low vacancy and high demand are allowing for roughly 14% rent growth in Houston.

The one downside of Houston for existing real estate is the ample amount of land. It is a big, sprawling city, so there is plenty of room for new development. Marcus and Millichap anticipates 18,200 new units being delivered in 2022. However, the new supply is expected to be more than fully absorbed, with over 20,000 units of net absorption forecast.

20,000 is an absolutely massive number for net absorption, and it is being driven by an estimated 115,000 jobs created in Houston in 2022.

Houston along with the rest of the Texas triangle does indeed look fundamentally strong. So then, why is NXRT trying to sell out of the market?

Well, we know Matt McGraner and Brian Mitts (the guys who run NXRT) to be both perspicacious and aggressive. They move decisively in their attempts to create value and are constantly looking for ways of extracting additional value.

NXRT is not the typical buy-and-hold real estate owner, but rather plays in the value-add space. They buy up apartment communities and apply cost-effective renovations to significantly increase rent, usually generating IRRs of about 25% on the renovations. They then capture the created value by selling the property at the now higher NOI and often at a lower cap rate.

For those who don’t work with real estate math every day, higher NOI and lower cap rate stack multiplicatively for a much higher sale price than where NXRT bought it.

Thus, I don’t think NXRT is looking to sell out of Houston due to not liking the market, but rather as a means of capturing the value creation from their earlier Houston acquisitions. Commentary on the second-quarter earnings conference call confirms this as Matt McGraner, CIO of NXRT, said:

“At today’s prices, our implied cap rate is north of 5%. And as we’ve routinely done in the past and to the extent we stay at these levels, we will look to sell assets, namely our Houston portfolio and buy back our stock.”

One of the analysts on the call probed for further information.

Robert Chapman Stevenson

“Matt, how has pricing been for any similar quality Houston assets to yours that you’ve seen traded recently?

Matthew Ryan McGraner

“For the quarter, I would say, we softly got unsolicited bids on Old Farm, in Stone Creek before the market, and they were just bids we couldn’t transact during the timing. But those — that was kind of [3.75], [3.8] and then those buyers have come back and they’re in the [4.25] range. So that’s the best kind of apples-to-apples comparison that I can give you. So we could transact at that level today, if we wanted to.”

So basically, the sale is planned as a means of arbitraging the delta between the private market value of NXRT’s properties at a 4.25% cap rate and NXRT’s stock, which trades at a ~5% implied cap rate. Quite simply, when you sell at 4.25% and buy at 5% it is directly accretive to FFO/share.

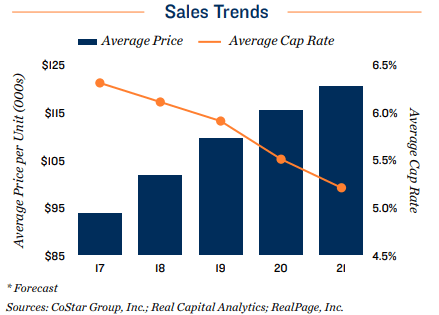

Houston-specific data confirms that cap rates have come down quite dramatically since NXRT acquired their assets, which of course translates to ample gains on sale.

Marcus and Millichap

Overall, I think Houston is a great market that is underestimated by many analysts. It is often dismissed as an oil boom town, but oil and the related industries are a diminishing portion of the overall Houston economy, with tech and healthcare responsible for much of the job growth.

How to Invest in Houston

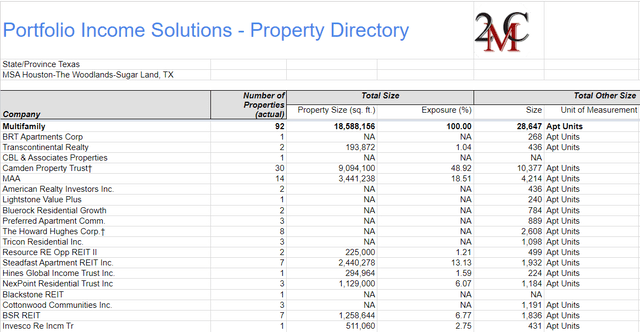

At Portfolio Income Solutions, we have compiled a directory of all the REIT-owned properties in each of the top 50 MSAs. It affords a way to quickly identify which companies provide exposure to a given market.

For Houston, the big apartment owners are Camden (CPT), Mid-America Apartment (MAA), Howard Hughes (HHC), NexPoint and BSR REIT.

Portfolio Income Solutions Property Directory

Camden and MAA are huge companies, so while they own the most in absolute numbers, NXRT and BSR are close to the top of the list as far as how much it impacts their bottom line.

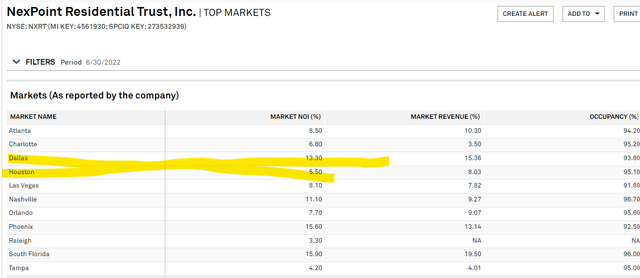

BSR gets nearly 90% of its NOI from Texas with a significant chunk of that from Houston while NXRT has 5.5% from Houston and another 13.3% from Dallas

S&P Global Market Intelligence

Apartments are of course not the only property type that benefits from rampant job and population growth.

- Simon Property (SPG) owns three Houston malls.

- EastGroup Properties (EGP) has 61 warehouses in the MSA.

- Whitestone REIT (WSR) owns 13 Houston shopping centers.

The growing affluence and population density should raise rental rates and demand for retail and industrial real estate.

Which is the Best Way to Take Advantage of the Opportunity – Camden, BSR or NXRT?

We own all three. Each has a slightly different angle

Camden is the clear winner on long-term stability. As an active manager, I never have fixed holding periods, but Camden is one of those solid durable stocks that can reasonably be a buy-and-hold. I recently wrote a full-length piece on Camden here.

BSR tends to trade at a discount due to being Canadian listed, and Canadian REITs trade at discounts to their U.S. counterparts. With BSR, however, you get strictly U.S. fundamentals with all the properties in the sunbelt and the company headquartered in Arkansas. U.S. fundamentals at the Canadian REIT discount tend to be a good deal.

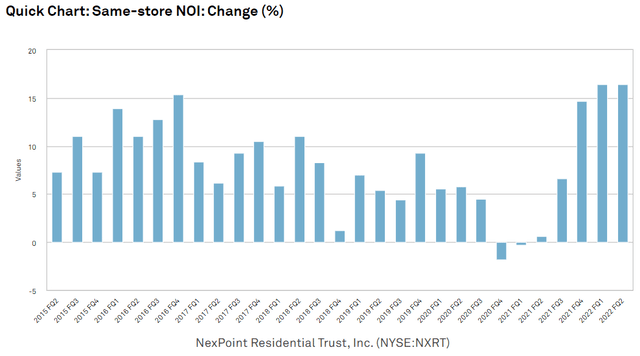

At the current price of $17.10, BSR is trading at 76% of its IFRS calculated NAV, which is $22.35. Its same community NOI growth stands near the top of the list at 16.7% year over year. Leases remain far below market and I suspect there is another 20%-25% rental rate growth over the next two years.

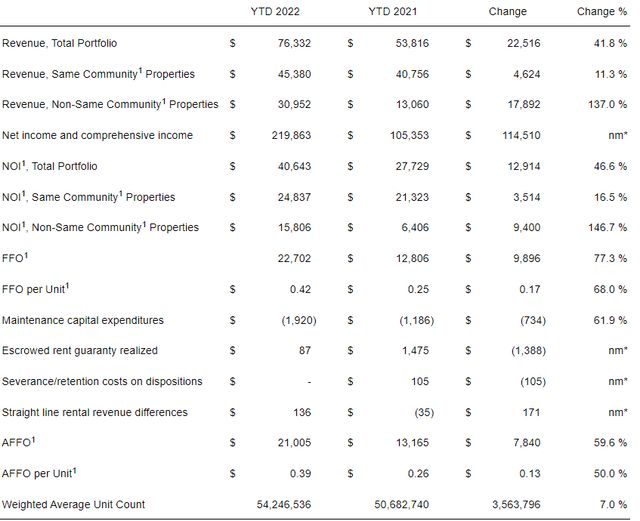

The company runs fairly lean, so the NOI growth flows nicely down to the bottom line. In 2Q22, the company grew AFFO/share by 50% and FFO/share by 68% year over year.

Growth will moderate as much of that was due to getting cash invested in properties, but the organic growth ahead provides a nice runway of double-digit AFFO/share growth. Overall, BSR presents a nice mix of value and growth.

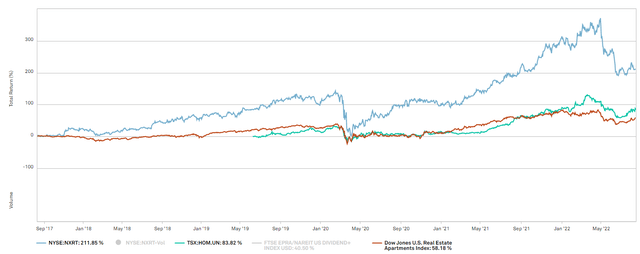

Both BSR and NXRT have substantially outperformed the apartment REIT index.

S&P Global Market Intelligence

Note that BSR’s outperformance is significantly greater than it looks as they weren’t around for the full 5-year period graphed above.

Regarding NXRT, today’s opportunity comes from the massive downdraft seen in the blue line above starting in mid-2022. All that price erosion occurred simultaneous to continued fundamental growth, which pulled NXRT from fully priced to quite cheap.

S&P Global Market Intelligence

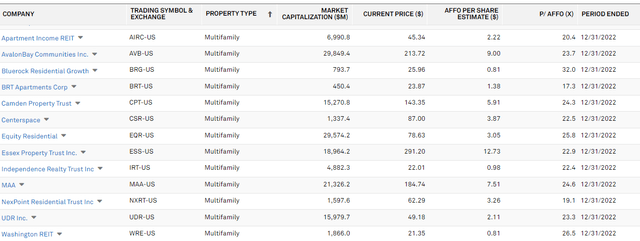

At the time of this writing, NXRT trades at 19.1X 2022 AFFO making it among the lowest multiple apartment REITs. In contrast, its growth rate is near the top.

S&P Global Market Intelligence

Its general gameplan is similar to that which is being displayed in the Houston assets. They find properties that are either opportunistically cheap or that have some low-hanging fruit such as deferred capex.

NXRT then applies capex to the properties with a submarket-specific focus on which renovations will have the biggest bang for the buck in terms of rent. Via this process, they have created outsized growth, and they do seem to have the capability to repeat the success.

Risks to Ownership

Beyond the typical risks of investing in apartment REITs, there are a few specific to these companies that I want to highlight.

BSR’s Canadian listing can make it a bit difficult to trade. It can be bought in U.S. dollars and earns its revenues in U.S. dollars, so there is no currency risk, but there can be liquidity issues. The foreign ordinary BSRTF through which we own the stock has minimal trading volume making the use of both patience and limit orders a must. Depending on one’s custodian, there can also be hassles with withholding on the dividends. I have been able to claw back the withholdings on my taxes each year, but it is a work burden.

NXRT operates at fairly high leverage compared to most publicly traded REITs. The company is operated more like private equity with a focus on maximizing returns. So far, the leverage has helped it generate substantial outperformance, but it is something to keep an eye on in the event underlying apartment fundamentals become less favorable.

Be the first to comment