sefa ozel/iStock via Getty Images

The Goodyear Tire & Rubber (NASDAQ:GT) is one of the leading companies that manufactures and sells tires globally. It has been in business for more than a century and has 57 manufacturing plants in 23 countries worldwide. In recent quarters, the company has faced numerous operational challenges. This pushed its stock price lower, and it has lost more than half of its market capitalization since last year’s highs. As of this writing, GT has reached an all-time revenue of $20.1 billion, thanks to its recent acquisition and continued growth in demand.

However, the overall bearish sentiment from the global economy remains a key risk for the company, especially considering its riskier capital structure than its peers. While this may cause further downward momentum over the next few trading weeks, the resulting panic should provide a good buy-the-dip opportunity.

Company Overview

Goodyear is one of the most successful tire producers in the market. In fact, the company has been in business for over a century. Despite the company’s declining market cap over time, one of its exciting catalysts is its continued market share gains. In fact, its recent acquisition of Cooper Tires changed its competitive environment, as they now control more than 25% of the replacement tire market.

Some may argue that the company’s most recent purchase dilutes its shareholders’ value; however, looking at its long-term prospects, GT is well positioned to grow internationally and solidify its leadership in the US market. Additionally, this set them to increase their capacity to produce innovative tire solutions, which is in line with today’s digitalization.

As one of the pioneers in the field of intelligent tires, I believe there is much growth ahead, especially in times of the most awaited global economic recovery. In fact, there is news in China that they are already reducing their restrictions, which may encourage demand recovery in GT’s Asia business.

With the company’s enhanced operation in China, thanks to its Cooper acquisition, I believe the market currently ignores GT’s long-term prospects. As mentioned before, the company lost so much market cap and dropped below its $17.95 5-year book value per share average; this makes GT undervalued and attractive at today’s price. Lastly, I believe fear of further value dilution and slowing automotive production is already priced in, especially considering the fact that the Biden administration is encouraging investments in electric cars and that China is relaxing its restrictions on Covid-19.

Enjoys A Stable Demand Outlook

Contrary to today’s bearish global economy, automobile companies such as Ford (NYSE:F) are very optimistic about ramping up their EV production. In fact, despite the current shortage issues, EV sales are expected to hit an all-time record in 2022. Furthermore, as stated below, management sees a stable demand environment in retail and commercial areas.

…we are seeing a pretty stable demand environment. And we are watching and doing a lot of analytics, trying to figure out if we are – if we were to start to see any lead indicators. But so far, the demand – end-user demand is remaining pretty good, good in consumer, good in commercial. And that is notwithstanding the macroeconomic situation, notwithstanding price increases from us and other members of the industry. So, I think overall, that’s feeling pretty good. Source: Q2 Earnings Call Transcript

GT enjoys an enhanced portfolio in the mobility industry with its leading commercial fleet services, making the company well positioned for ongoing digitalization, as quoted below.

…More to come on this technology, but note that our focus and investment will not be deterred as we navigate tumultuous economy. The future remains brighter than ever and Goodyear will be leading it. Source: Q2 Earnings Call Transcript

Lastly, with the ongoing aging car problem in the US, I believe GT’s growing top line will be sustainable despite the proposed growth recession by the US government.

Q2 Performance

GT ended its Q2 with outstanding top-line growth of $5,212 million, up from $3,979 million recorded in the same period last year. According to management, this is due to its compelling price/mix and increasing tire volume while increasing revenue per tire, as stated below.

Our consumer tire volume globally grew 6% and commercial grew nearly 2%, excluding Cooper and we achieved this volume growth while increasing revenue per tire by 14% compared to last year. Source: Q2 Earnings Call Transcript

Despite this, GT was unable to translate this into growing operating margins. The company’s gross margin declined this quarter to 20%, down from 22.6% year over year. While its merger-adjusted total segment operating margin declined to $7.1% from 8.8% year over year, this is due to a mixture of inflationary pressures and ongoing cost restructuring. The management sees another $100 million in restructuring costs in FY2022, which aims to improve operational efficiency in the long run. In addition, management anticipates a $250 million run-rate synergetic savings in FY2023. This strategy includes reducing repetitive tasks to improve sales and general administrative expenditure.

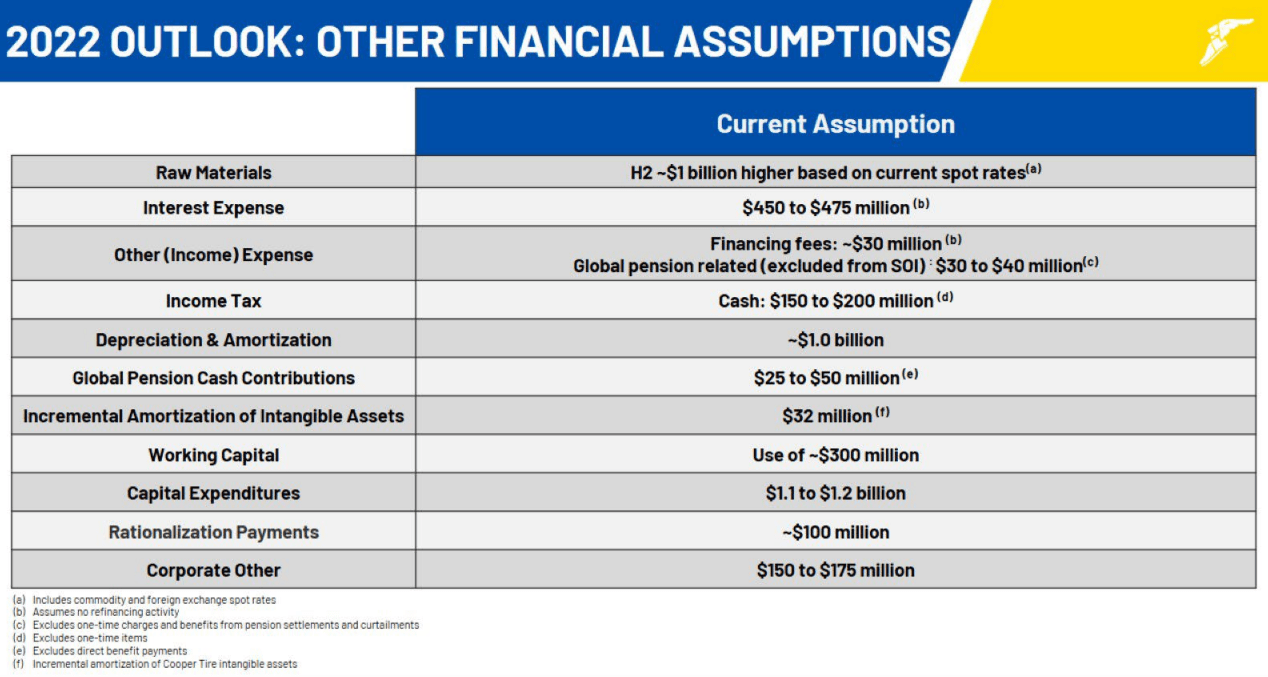

Considering its non-core operation and adjusted earnings per share, GT has an improving figure of $0.46, up from $0.32 year over year, which I believe is a good figure considering today’s inflationary environment. While management doesn’t see any sign of full recovery today, its rising input cost, as shown in the image below, and the looming global recession make GT’s profitability uncertain.

GT: 2022 Outlook (Source: Q2 2022 Earnings Call Presentation)

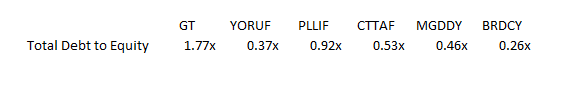

Another risk to mention is its growing fixed interest expense outlook of $450 to $475 million, up from $387 million recorded last year. This is because of its growing debt, which makes its capital structure weaker than its peers.

GT: Higher Debt-to-Equity Level Than Peers (Source: Data from SeekingAlpha and Yahoo!Finance. Prepared by InvestOhTrader)

The Yokohama Rubber (OTCPK:YORUF), Pirelli & C. (OTCPK:PLLIF), Continental Aktiengesellschaft (OTCPK:CTTAF), Michelin (OTCPK:MGDDY), Bridgestone Corporation (OTCPK:BRDCY)

Undervalued

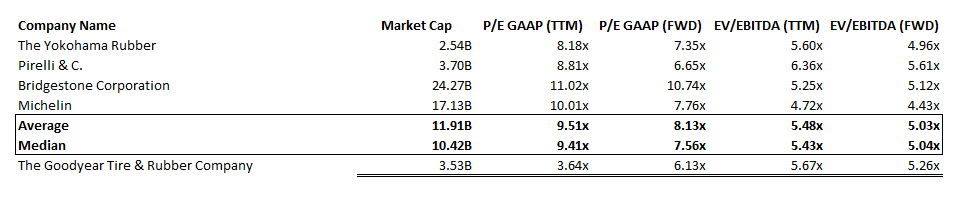

GT: Relative Valuation (Source: Data from SeekingAlpha and Yahoo!Finance. Prepared by InvestOhTrader)

Despite its stable demand outlook, GT’s margin remains under pressure, and its ongoing cost restructuring may slow down its earnings per share growth. In fact, analysts are expecting it to decline by 2.2% in the full year of 2022. However, with its improving leadership in the market, I believe today’s weakness is manageable, especially in the case of the recovery of the global economy.

Analysts estimate a growing EPS after FY 2022 and expect it to grow to $2.85 in FY 2025, applying an implied 9x P/E ratio and a conservative discount rate of 8%, we can arrive at a conservative $20 fair price. Hence, I believe GT is relatively undervalued.

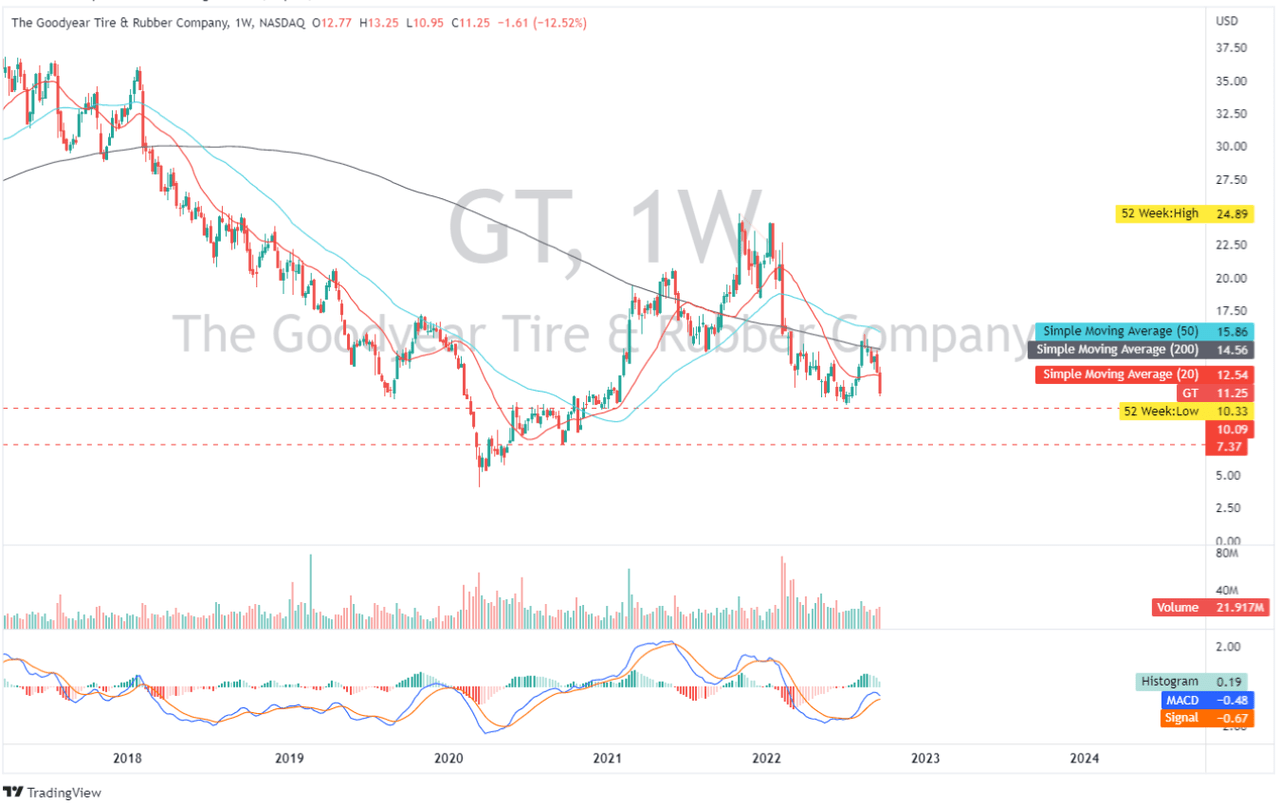

Approaching Significant Support Level

GT: Weekly Chart (Source: TradingView.com )

While its current drop seems reasonable in today’s bearish environment, I believe further bearish moves will get exhausted at the $7 and $11 support zones. A consolidation within this area will add a confluence, which may improve the probability of success in catching the stock. In my opinion, a retest of 2022 levels will provide an excellent buy-the-dip opportunity.

Final Key Takeaways

I believe the company is still liquid, especially given its $1,248 million in cash and cash equivalents on its balance sheet, despite its riskier capital structure than its peers.

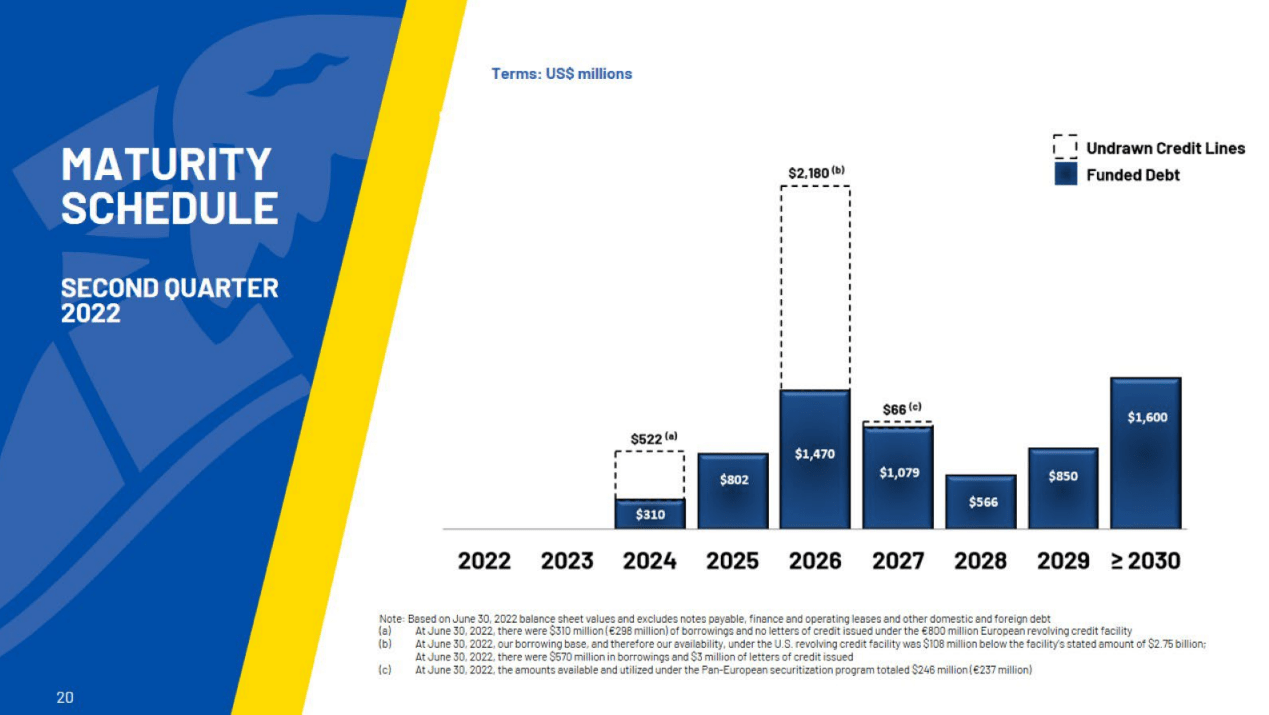

GT: Debt Schedule (Source: Q2 2022 Earnings Call Presentation)

This schedule may reassure some investors that GT will remain liquid for the foreseeable future, as no material debt will be due until 2025. In summary, while there are uncertainties in its profitability and liquidity, GT, as a market leader, possesses a tremendous long-term opportunity in today’s digitalization and the path towards a greener earth. GT is a buy at today’s weakness.

Thank you for reading and good luck!

Be the first to comment