photosvit/iStock via Getty Images

So much attention is being focused on the Federal Reserve these days that we tend to forget other performance areas of the economy.

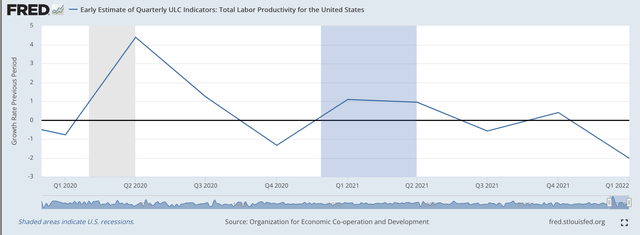

Note: U.S. labor productivity declined for the second consecutive quarter.

The decline in the second quarter was 4.6 percent from the first quarter.

In the first quarter, labor productivity declined by 7.4 percent.

This was the largest decline in 74 years.

U.S. Labor Productivity (Federal Reserve)

This chart only contains the growth rate of U.S. labor productivity through the first quarter of 2022. The second quarter data were not available at the time this post was being written.

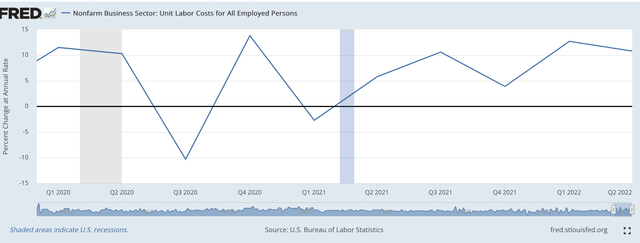

Translating this into Unit Labor Costs, a measure of worker compensation and productivity, we see the second quarter number for 2022 jumping up to 10.8 percent.

Here is the chart for this figure.

Unit Labor Costs (Percent change) (Federal Reserve)

This movement of labor productivity, connected with rising labor costs, points to the underlying inflationary pressures that the Federal Reserve is facing in its conduct of monetary policy.

Can Monetary Policy Build Up Labor Productivity?

One of the factors that characterized the period of economic expansion between the end of the Great Recession and the Covid-19 Recession was the mediocre growth that was achieved during this period.

Although this economic recovery is the longest one on record for post-World War II, it is also the slowest economic expansion in history.

The annual compound rate of growth for this time period was about 2.3 percent.

Inflation was low, but economic growth was also very low.

I have written about this factor many times over the past year or so. The slow growth of the economy can be attributed to the fact that the growth of labor productivity during this time period was very low, dropping into negative figures from time-to-time.

The economic expansion, generated by former Federal Reserve chairman Ben Bernanke, built up stimulating stock prices which resulted in a rising wealth effect that led to a healthy expansion in consumer spending in the economy.

The policy was very successful in generating the lengthy period of economic growth with very little inflation, but, it was a policy that did not generate much investment in real capital and generated little or no improvement in the growth of labor productivity.

Government policy-making was focused on demand-side efforts to stimulate spending. Little or no attention was given to supply-side programs that would increase the growth of labor productivity.

As Jeffrey Sparshott writes in the Wall Street Journal,

“Rising productivity is the key to improving living standards; it allows companies to raise wages without raising prices and fueling inflation. Instead, businesses appear to be paying workers more to produce less. The higher unit labor costs suggest companies will either endure lower profits or pass on higher costs to consumers.”

The Federal Reserve cannot do much here.

Federal Reserve stimulus impacts the demand-side of the economy, not the supply-side.

If we are going to attempt to raise the growth of labor productivity, we need to invest in government programs that stimulate supply-side expansion.

That is not what the federal government is doing at this time.

And, the tighter monetary policy is facing problems as well as the tightening up of monetary policy just constrains aggregate demand. Furthermore, lessening aggregate demand does little to help businesses to build intellectual capital and contribute to the growth of labor productivity.

Change In Approach

The last twenty years or so provide us with a picture that demand-side economic policies can only go so far in building up a wealthy, functioning economy.

The demand-side approach was successful.

But, this demand-side approach resulted in slower economic growth and an increase in the income/wealth distribution in the economy.

This demand-side approach depended upon rising asset prices.

And, if one looks at rising asset prices one must focus upon the major driving force of the last forty years, the rise in stock prices.

Furthermore, the rise in stock prices caused corporations to focus on financial engineering in order to generate and support rising stock prices, with a large part of the financial engineering going into stock buybacks and rising dividend rates.

There is no question that this was a very successful period, but financial engineering did not result in raising economic growth or raising the growth of labor productivity, but it did contribute greatly to the rise in investor wealth.

Bottom line: although successful in its way, it would seem that in moving forward we need to focus a little bit more on stimulating the supply-side of the equation and generating greater growth in labor productivity and a more even distribution of the wealth that is created.

The Coming Transformation

This is where the change needs to come.

Mr. Bernanke focused on building up an economy whose foundation was the consumer.

Now, in this transition period we are going through, we need some real leadership to guild us into an “Age” of technological change, an age where the emphasis is on the growth and spread of information.

This is where the future is going to come from, and the only way that the government is going to lead the economy into such an age is for the government to support the growth and spread of information and get away from the short-run efforts the politicians make to get themselves re-elected, the short-run effort to spend and spend to put people back into their old jobs.

This is basically what demand-side policies do…they increase demand so that employers will hire back the people that they had previously laid off. In the longer run, this really satisfies no one but the politicians that are in the game of constantly getting re-elected.

In the future, the emphasis needs to be on a longer-term horizon, a horizon that considers education, training, invention, and innovation.

Only in this way will we get faster economic growth, shared wealth creation, and a “new Age” of the American society.

The “new Age” is going to come, but the United States will give up its leadership role in this “new Age” if it continues to focus on the demand side of the equation, the side that relies on “what now is.’

The future needs policies that will create “what will be.”

Be the first to comment