Justin Sullivan

Abiword HTML Document

We maintain our April sell rating on Advanced Micro Devices (NASDAQ:AMD). We love AMD’s business and believe it’s well-equipped on multiple fronts, but demand trends are not working in its favor and won’t likely for a while in the near term. We expect weakening consumer demand will likely impact the company’s primary PC business, eventually spreading to its data center/cloud business. Micron (MU) and Nvidia (NVDA) already announced weakness in their business, and we expect a similar thing with AMD. Micron already had lowered guidance once before when it reported its results just over a month ago, implying the business rapidly became much worse than anticipated. Micron supplies its products (Memory and SSD/Flash units) for PCs, data center, and cloud servers. If Micron sees weakness in its business, it is very likely everyone in the PC supply chain will also see the weakness.

We also believe AMD is at risk because of its exposure to GPU sales related to crypto mining. Ethereum’s recently announced transition from Proof of Work (POW) to Proof of Stake (POS) allows crypto-miners to mine without using GPUs. While we like AMD’s position in the semiconductor landscape, we believe the company is also at risk of softening in the market, as seen by industry stalwarts Nvidia and Micron.

AMD announced results only a week ago, and its guidance was weak. But we think there is a more significant shoe to drop when it reports results in October. Hence we believe AMD will likely have to lower its estimates, eventually leading to weakness in the stock.

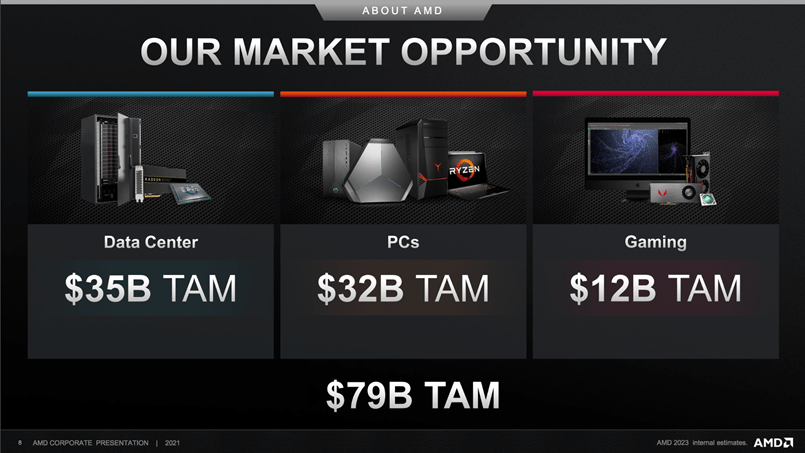

End market TAMs are on-decline with weakening consumer spending.

Our sell rating on AMD is based on our belief that AMD’s end markets will face same demand headwinds Micron and Nvidia are facing. Many bulls keep pushing the narrative that AMD is somehow magically immune to the growth slowdown. Bulls expect the share gains from Intel (INTC) will trump the slowdown in the market. We see discrepancies between AMD’s reported TAMs in earnings and the market’s reality. We believe the company’s end-market TAMs are desperately up for a correction. AMD TAM was based on the pandemic driven demand which continues to unwind. AMD operates primarily in the following: data center, PC client, gaming (GPUs), and embedded. The following image outlines AMD’s primary end markets.

AMD

Here is a breakdown of the company’s biggest end markets and our insight on each:

AMD

- PC Client (TAM of $32B): PC markets are declining worldwide, and shipments are set to drop 9.5% in 2022. AMD’s PC TAM forecasts reflect a COVID-driven boom in PC sales. But PC sales are moderating fast now in the post-pandemic world. Our sell thesis is primarily based on the fact that AMD will see its PC business shrink further than the company expects. Both HP (HPQ) and Dell (DELL) already reported slowing PC demand. Today, Micron reported weakness in its business. We expect AMD’s PC business to slow in the upcoming quarters; estimates are yet to reflect that. AMD will need to cut its estimates when it reports results in October.

- Gaming (TAM $12B): We believe AMD’s TAM for gaming is unrealistic for two reasons. The first is that gaming demand is suffering due to weakening consumer spending. According to NewZoo, consoles will decline by -2.2% in 2022. The second and more critical – is AMD’s GPU exposure to crypto-mining. We expect AMD’s GPU sales to slow down significantly as Ethereum switches to Proof-of-Work. We believe GPU sales will decline because GPUs are no longer needed for crypto-mining services. Nvidia already announced weakness for its gaming GPUs, and we believe this is the canary in the coal mine one needs to worry about.

- Data Centers ($35B TAM): No one is safe from weakening consumer demand, not even data centers. Although data centers are not directly exposed to the decline in PC or smartphone shipments, we believe data centers will likely see demand slowdowns. Despite this, data centers remain a relatively strong segment for AMD. While we believe AMD will continue to gain share against Intel in the data center market through 2023, we believe the increasing macro headwind could be a risk and possibly impact its cloud customers’ CAPEX spend in 2023.

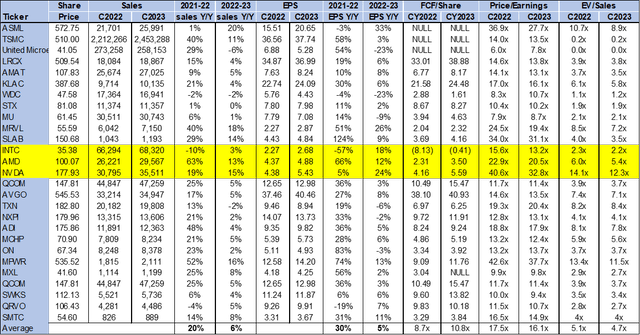

Valuation:

AMD is trading at around $100 and is not exactly cheap. The company is relatively expensive, trading at 2 1x C2023 P/E EPS of $4.88 compared to the peer group average of 16x. The stock is trading at 5.4x EV/C2023 sales versus the peer group average of 4.7x. The following chart illustrates the semiconductor peer group valuation.

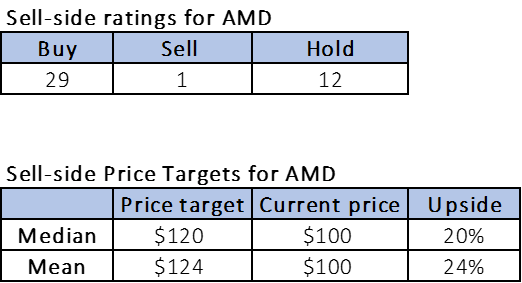

Word on wall street:

Market consensus on AMD is a buy. Out of the 43 analysts, 29 are buy-rated, 12 are hold-rated, and the remaining are sell-rated. AMD is currently trading at $100. The sell-side median price target is $120, and the mean is $124, with a possible upside of 20-24%. The upside is limited for the stock at the current levels, and we expect more downside than upside. The following chart indicates AMD sell-side ratings and price targets.

Refinitiv

What to do with the stock:

We believe AMD stock is yet to reflect its downside fully. We’ve seen the stock drop around 31% YTD and believe the stock will still pull back further. We expect demand headwinds to catch up with the company and recommend investors sell at current levels before the stock drops further.

Be the first to comment