Justin Sullivan

When an American icon company falls, the market is tempted to acquire the stock for an eventual turnaround. Investors have made this mistake on Intel (NASDAQ:INTC) going on a decade now. My investment thesis remains ultra Bearish on the chip giant as indications exist chip design issues are only mounting.

More Troubling Signs

While the market is focused on the CHIPS Act approval in the U.S. and signs Intel might get more government assistance in Europe, the market continues to miss the major problems facing the chip giant. In my opinion, the company has never lacked the capital needed to invest in modern manufacturing fabs, Intel has lacked the technology and design processes to develop and build modern chips on time and at scale.

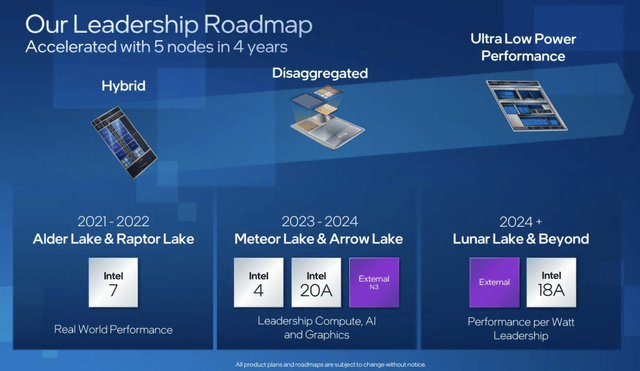

The latest news has TSMC (TSM) slowing down capacity expansion due to further chip design troubles at Intel. According to TrendForce research, TSMC has slowed the production expansion for 3nm due to Intel delaying the once expected manufacture of the tGPU chipset in Meteor Lake from an initially planned 2H22 all the way until 2024. TSMC will reduce capex growth in 2023 due to this shift by Intel until a future period.

As usual, TSMC is highly reliant on a shift to 3nm for Apple (AAPL) to produce M series chips to replace Intel CPUs in Macs. While the chip giant falters over and over to produce chips, a company focused on making consumer gadgets continues to out design Intel over and over.

Interestingly, Intel denied the rumors from TrendForce, but investors are used to these rumors being true. As highlighted by The Verge, Meteor Lake is an important development of the chip giant being the first client processor on the new Intel 4 architecture and possibly using extreme ultraviolet lithography (EUV) manufacturing.

Source: Intel Investor Day 2022

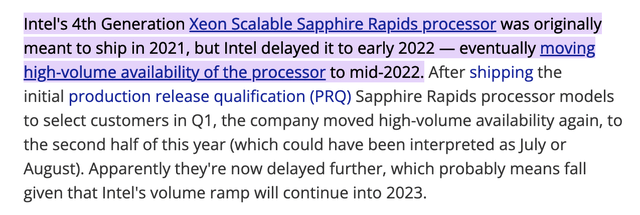

After all, Intel just announced more execution issues with the Sapphire Rapids chip placing the company further behind AMD (AMD) in data center chips. Per CEO Pat Gelsinger on the Q2’22 earnings call:

…we had some of our own unique execution issues and we kept the quality bar high on Sapphire Rapids and thus we did another stepping, which was a forecast, which put some inventory and reserve issues in front of us as opposed to high ASP new product revenue.

As Tom’s Hardware detailed, Sapphire Rapids has had a lengthy list of delays since original plans were to ship the server chip in 2021.

By now, investors should be used to delays in shipping new chips to customers.

Another Step Down

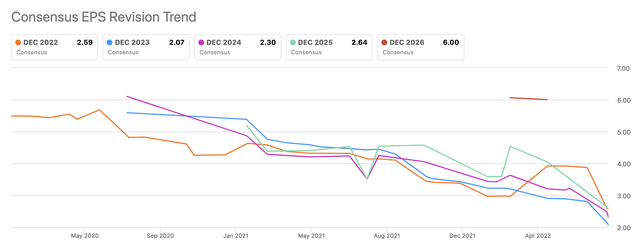

Intel dropped the Q2’22 earnings bomb on shareholders back on July 28. After a little over a week, investors can see how analyst expectations have shaken out in the ensuing period.

Analysts now forecast Intel earning $2.59 per share this year followed by another dip to $2.07 next year. While the numbers appear ok, analyst estimates continue to take major steps down on a regular basis as the company falters.

At the start of 2021, analysts originally forecast Intel to earn nearly $5 per share in 2024. The average analyst estimate is now down over 50% to just $2.30.

The big question for investors now is whether these numbers can even be trusted. Another delay for Meteor Lake would surely crush these lowered EPS targets.

The reason the stock is likely to have more pain ahead is the stock already trades in the 15x to 17x range of forward earnings. Intel isn’t technically cheap despite the stock falling down to multi-year lows at $35.

The company forecast being free cash flow negative bringing in a whole different risk to the business on any further chip delays. Intel can’t afford to keep paying the large dividend on a scenario where cash flows don’t rebound anytime soon.

The chip giant is now paying out $6 billion annually in dividends. The payouts are quickly becoming unsustainable and a dividend cut would surely cause another leg down for the stock.

Takeaway

The key investor takeaway is that Intel doesn’t appear to have solved any of the chip design issues leading to the major problems of the last few years. The company no longer has any margin of safety to maintain the dividend while paying excessive amounts of capex to build new fabs, even with government assistance. Intel might appear cheap at multi-year lows, but the stock hasn’t hit bottom yet.

Be the first to comment