Bet_Noire/iStock via Getty Images

The Fed minutes are due on July 6 at 2 PM, and it is anyone’s guess how these minutes will read. The Fed has believed that the economy is strong and not heading towards a recession.

Slower economic growth is what the Fed wants. While a recession isn’t the desirable outcome, it would seem the Fed is more than willing to let one happen in real terms if it means getting inflation to slow down.

It creates a significant challenge for the Fed and the markets. On the one hand, the economic data suggests the U.S. economy is slowing. At the same time, there are very few signs of inflation easing.

Market Beliefs Are Dated

The market has believed that slowing growth will be all it takes for the Fed to pivot and ease off its rate hiking cycle. We have seen this happen multiple times in the past, and more recently in 2015 and late 2018/2019. Economic growth slowed, the equity market had a tantrum, and the Fed eased off and, in the case of 2019, began to cut rates.

This time may be different because inflation was never an issue during prior episodes. The more significant risk was that an economic slowdown could create a deflationary spiral. Now, high inflation rates are a problem, and an economic slowdown is what the Fed is trying to induce. So it seems unlikely that a minor technical recession will derail the Fed from its rate-hiking mission.

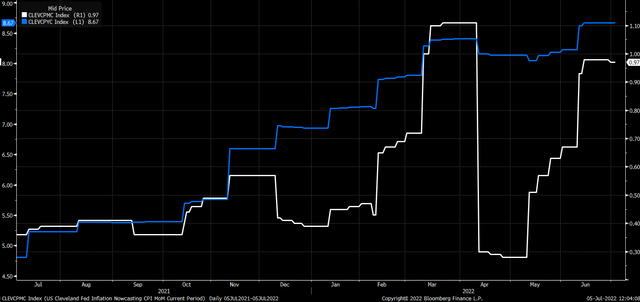

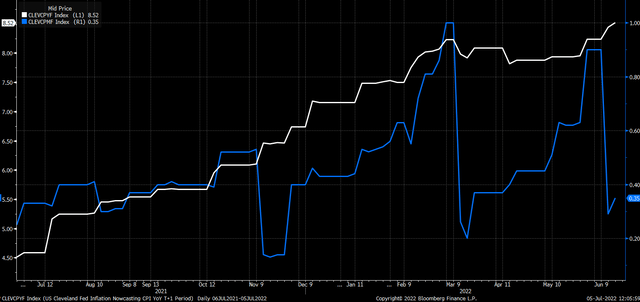

The other problem is that inflation rates are not showing any signs of coming down. The latest data from the Cleveland Fed shows that Y/Y CPI is expected to be 8.67%, which would be a fresh cycle high. Meanwhile, the M/M reading is tracking at close to 1%. So any hope of the Fed pulling back at the July FOMC meeting seems highly unlikely.

Meanwhile, the Year-over-Year reading for next month’s CPI doesn’t come down much and is currently tracking around 8.5% year-over-year and dropping to approximately 35 bps on a month-over-month basis. So any hope of headline inflation coming down anytime soon seems highly unlikely.

Fed Needs Tighter Conditions

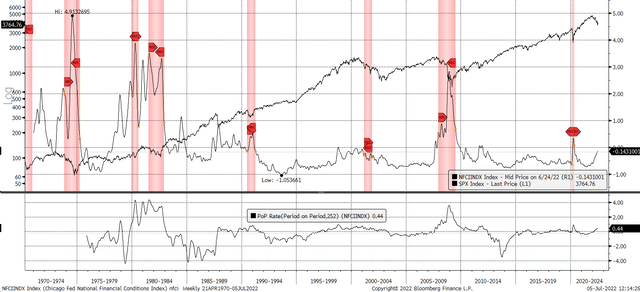

These forecasts would indicate that the Fed will continue to tighten rates until it gets its monetary policy to a restrictive stance and financial conditions to tighten further, hoping to bring demand down to matching that of supply. The Fed ideally needs financial conditions to continue tightening and get to a point where they negatively impact the economy. To this point, those financial conditions have not gotten there.

The Chicago Fed National Financial conditions index is currently at -0.14, which is still accommodative. Typically, when the reading is above 0, it represents restrictive conditions, and when below 0 describes accommodative conditions. So while conditions have tightened a lot, they need to tighten much more.

What is interesting is that financial conditions may need to rise significantly above 0 for the Fed to achieve its objective of slowing growth and reining in inflation. In the 1970s and 1980s, those conditions were substantially higher than 0.

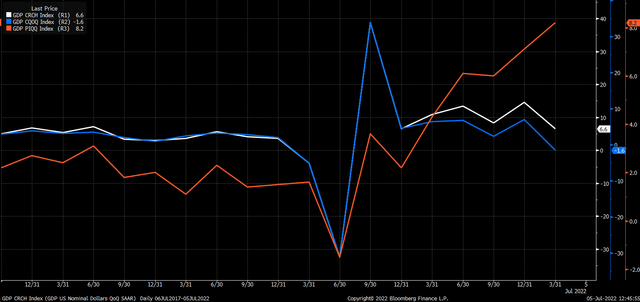

Nominal Vs. Real Growth

The minutes will probably show that the Fed is on a path to tightening significantly more and will not deviate from this path due to slowing growth. This will likely scare the markets when the minutes are released on Wednesday.

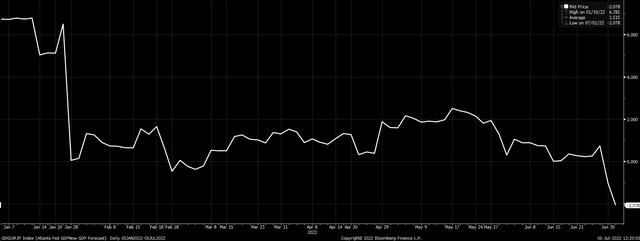

Yes, the economic data is weakening, and the economy is heading towards a technical recession. The Atlanta Fed GDPNow model forecasts a second-quarter contraction of about 2.1%, which would follow a negative first-quarter real GDP print. Two-quarters of negative GDP growth is a technical recession, by definition.

But, the Fed will need to target nominal GDP, which is likely not tracking at a negative growth rate in the second quarter. It seems more likely that if real GDP growth is tracking at a roughly negative 2.1%, and inflation is running around 8%, that nominal GDP growth is tracking at around a positive 6%. That would be roughly in line with nominal GDP growth in the first quarter.

This is where the risk is for markets because if the Fed’s focus remains on nominal growth, then there is plenty of room left for the Fed to tighten before nominal growth gets back to 0%. It means there could be a few quarters in a row of negative real GDP growth.

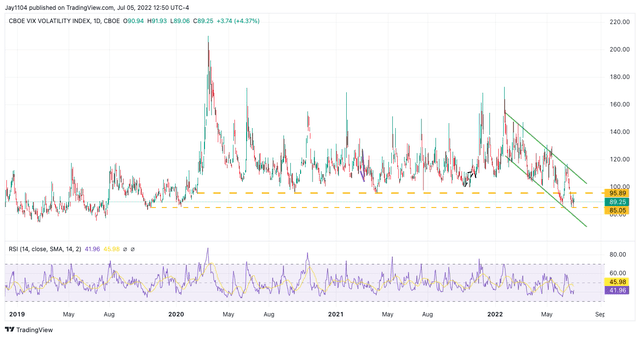

Not Enough Fear

That risk doesn’t seem to be adequately reflected in the equity markets based on where the VIX and VVIX indexes are. The VVIX index measures the implied volatility of the VIX, and the VVIX is extremely low, at 89.25. The VVIX is at a level typically seen during periods of market calm, such as in December 2019. It would even suggest that buying puts is pretty cheap right now. A level of complacency that seems to suggest fear is too low given the potential shock the markets may feel tomorrow when it realizes the Fed has no intentions of slowing down anytime soon and that slowing growth will not derail its mission.

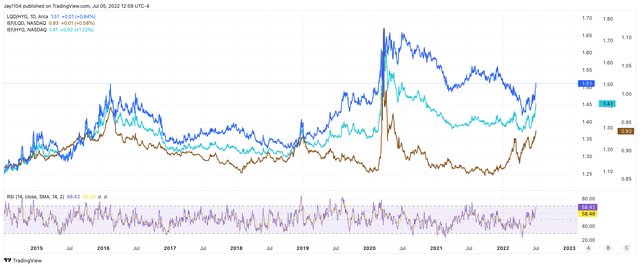

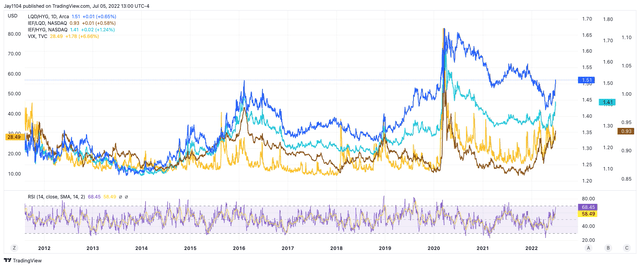

Indeed, despite Treasury rates falling, credit spreads are widening, a sign of increasing stress and concern in the credit markets and an indicator of higher levels of future equity market volatility. Ratios like the IEF to LQD ETF have risen to cycle highs, as have the IEF to HYG ETF ratio and the LQD to HYG ETF ratios. These are indications that credit spreads between Treasuries to Corporate and High Yield are widening, and Corporate to High yield bonds are widening. Signs of increased market stress.

Typically, the VIX index trades with these spreads, which would suggest the VIX is due to break out and start trending higher, which would be a big negative for the S&P 500.

Additionally, the Fed minutes have served as a risk-off event since late 2021. The release of the Fed minutes has resulted in the S&P 500 moving lower almost every time this year.

If it does turn out to be the case, and the Fed minutes reveal its intention to raise rates while indicating no path to slowing until the Fed gets to its targeted overnight rate of 3% or higher by year-end. Then it seems the equity market will be heading lower, just like it has just about every other time this year following the Fed minutes.

Be the first to comment