Douglas Rissing

TINA, the acronym for There Is No Alternative, was used to describe the phenomenon in which capital poured into equity markets because there was nowhere else one could generate a return. With Treasury rates formerly just a hair above zero and corporate bonds only slightly higher than that, anyone who needed to generate a return above 4% was largely forced into equities, even if their risk tolerance normally wouldn’t allow it. This caused market prices to swell and earnings multiples to expand.

In 2022, however, the Fed has killed TINA.

Fed Funds rate as of the announcement on 9/21/22 is now 3.0%-3.25% which has forced the 2-year treasury up to 4.067% shortly after the Fed minutes. That is a very real alternative. Its impacts on the market have been profound.

Risk premium expanding

When Treasuries were yielding 1%, the equity market had an expected return of about 5%. If we keep that same 400 basis point risk premium, with Treasuries now at roughly 4% depending on duration, equities would need to be priced such that their forward expected return is 8%.

That would assume a parallel shift, and I don’t think that is realistic.

There is a big difference between the comparison between 1% and 5% and the comparison between 4% and 8%. In the eyes of investors who need to generate a return, 1% just wasn’t a real option. That caused the risk premium associated with equities to contract. Yeah, 5% is a weak return for taking on equity risk, but it was the only option for generating a meaningful return.

The 8% risky return versus the 4% “risk free” treasury return is a much harder decision. 4% is enough of a return that many market participants might be happy to just take that and sleep soundly. As such, I think the risk premium must expand. I posit that a 500 basis point risk premium is more appropriate for this environment. This means that stocks would need to be priced such that the forward expected return is 9%.

As you know, forward expected return is not a metric one can look up. It is not an observable statistic. So what does it mean?

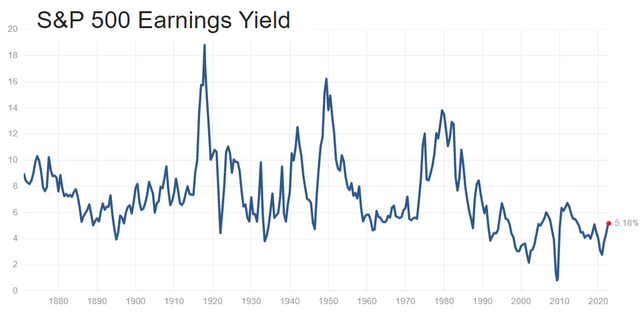

The best estimate for forward expected return is based on the earnings yield of the market, which is of course the inverse of the Price to Earnings multiple. A 5% earnings yield does not necessarily translate to a 5% forward expected return, as growth causes returns beyond the earnings. It is not an exact science, but the higher the earnings yield, the higher the forward expected returns.

Multiple contraction – is there more ahead?

The S&P 500 got very expensive toward the end of 2021 with the earnings yield dropping to well below 4%.

The crash in 2022 has taken the earnings yield to 5.18% trailing or 5.9% forward as of September 21st, which is closer to historic norms between 4% and 9%. Notably, the last 30 years have largely been at 6% or below.

It is also worth looking at the earnings yield of other major areas of the market.

- Nasdaq has an earnings yield of 4.43%

- REITs have an earnings yield of 6.7% (based on FFO)

Multiples have already contracted substantially in the market’s fall. The question is whether they have contracted enough to get to a 9% forward expected return.

I think of this as a sliding scale for what fair value of the stock market is. In order to know the fair value of a stock, one must know the risk-free rate and have a good estimate of the risk premium associated with that sort of equity.

Well, the risk-free rate is known, now sitting at just over 4% on the 2-year Treasury and I opine a 500 basis point risk premium. Thus, fair value is where stocks have a forward expected return of 9%. Does this imply more downside ahead, or is the bottom in?

Fair value of S&P 500

Forward price to earnings for the S&P is 16.95X or a yield of 5.9%. Whether or not that translates to a forward expected return of 9% depends on the level of organic growth.

One of the challenges to organic growth is that the S&P 500 consists of massive companies that are highly international. Europe and Asia are potentially already in recession, which could stifle overseas growth. International revenues are also being hurt materially by the incredible strength in the U.S. dollar.

My hunch is that at current pricing, the S&P 500 is fairly close to a 9% forward expected return, but I would like to see the multiple get down to 15X to feel more comfortable that 9% is covered.

Fair value of Nasdaq

The Nasdaq still looks quite overvalued to me, with an earnings yield of 4.43%. That would require substantial growth to equate to a 9% forward expected return, and this is at a time when growth seems to be rolling over in some of the names that dominate the index.

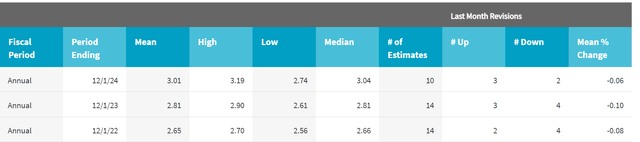

The forward consensus earnings estimates through 2024 are shown below.

There have been multiple downward revisions in the last month, resulting in estimates for 2023 and 2024 declining. The growth rate embedded in these numbers is about 6% which is quite low compared to history.

It is always possible the analysts are wrong, but if they are in the right ballpark, the Nasdaq remains significantly overvalued for the current environment.

Fair value of real estate (private and public)

Publicly traded REITs have an FFO yield of 6.7% based on the 14.9X FFO multiple of the average REIT. This relatively higher earnings yield means REITs don’t need as much growth to achieve a 9% forward expected return.

However, REITs actually appear to be growing faster, with expected FFO/share growth north of 7% based on consensus estimates through 2024. A likely reason for the faster growth is the positive impact that inflation has on rental rates.

Given the growth and the low earnings multiple, I think REITs are trading a bit below fair value as they have a forward expected return north of 9% which is appropriate for the high-interest rate environment.

Private real estate is a different story. Boulder Group tracks property transactions to establish cap rate trends in real-time or as close to real-time as possible. As an example, 7-Eleven retail stores are still being transacted at 5% cap rates with a 10-year lease term. Sure, it is good tenant credit, but that is aggressive pricing in this environment.

Some real estate sectors are overvalued and some are undervalued. Overall, I think private real estate is slightly overvalued and that property values will moderate.

The takeaway

As interest rates change, it is helpful to take a step back and revalue the markets in light of the new information. Fair value is inversely correlated with prevailing interest rates. The more the fed hikes, the lower multiples need to be to have equity fairly priced relative to alternatives. As of Treasury yields post impact from the 9/21/22 rate hike, here is how I see fair values for major sectors:

|

Sector or Index |

Valuation |

Forward Expected Return |

|

S&P 500 |

Close to fair value |

~9% |

|

Nasdaq |

Overvalued |

~6.5% |

|

REITs |

Undervalued |

~10% |

|

Private Real Estate |

Overvalued |

~7% |

Be the first to comment