pixelfit

Netflix, Inc. (NASDAQ:NFLX) stock has struggled to find a bottom for the part of the year following its disastrous first-quarter earnings report, which shed light on several fundamental weaknesses with the streaming giant’s business model. As both management and investors are forced to face reality, a renewed focus on fundamentals amid a bear market and a recession-headed economy has created multiple issues for the streaming giant.

The company has been forced to deal with the consequences of having no legacy cash flows to fall back upon as demand for its streaming service seems to be slowing down. In the end, unlike most competitors, it is forced to overspend on content, seeing that it lacks any major IP it can nurture and put to its advantage. After enjoying years of first-mover advantages in a pioneer market, tides are slowly changing for the streaming giant and the future looks more uncertain by the day.

Macroeconomics bringing fundamentals back

Reflecting the complacency that a thirteen-year-long bull market induces, investors became increasingly more comfortable relying on non-fundamentally related valuation metrics when analyzing the entertainment and streaming space over the course of the past couple of years. A very strong emphasis has been placed on metrics such as subscriber growth, show popularity, and others, pushing aside any meaningful discussion about cash flows generation and earnings potential.

Perhaps more troublesome in the case of Netflix, it was obviously an entertainment company from the get-go though often mislabeled by many as a “high growth tech” company, and was as such subsequently assigned premium valuations warranted by such tech companies. As an example, the company was included in the “FAANG” acronym, which is supposed to represent five prominent American technology companies, ahead of more deserving companies such as Microsoft (MSFT).

As to what exactly remains high-tech about the decade-old business of creating movies and TV shows to distribute to the masses, albeit through a direct-to-consumer approach, has escaped us. This allowed Netflix to get away with posting weak earnings and almost no positive cash flow for years, keeping investors solely focused on the growing popularity of its streaming platform and offerings by promising a strong financial potential “down the road.”

The music slowed down on April 19th when the company released its first-quarter earnings report. It disclosed the loss of 200,000 subscribers in the first three months of 2022, while the consensus analyst expectations had been for a gain. Revenue increased nearly 10% to $7.87 billion but fell short of expectations of $7.93 billion, while Netflix earned $3.53 per share, well above the $2.89 per share analysts had expected.

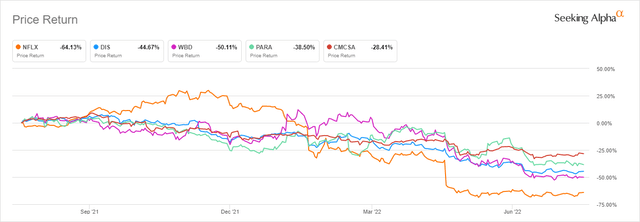

Entertainment YTD Performance (Seeking Alpha)

Netflix’s disastrous earnings release has ultimately spilled over into the entertainment space, especially those with high exposure to streaming, which subsequently caused a crash in the sector. Investor perceptions surrounding the profitability and the long-term sustainability of streaming in a rapidly more competitive sector have been shattered. As of today, since the beginning of the year, Comcast (CMCSA) is down 28.41%, Disney (DIS) is down 44.67%, Paramount (PARA) is down 38.50%, and Warner Bros. Discovery (WBD) is down 50.11%. Netflix has obviously been the greatest loser here, with shares of the company being down 68.13% since the beginning of the year.

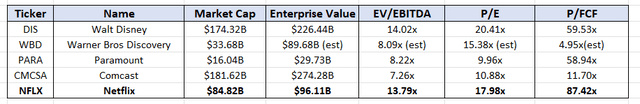

Valuation (Author Spreadsheet Using Capital IQ Data)

After the crash, we can see that Netflix is no longer the company commanding a significantly higher valuation as compared to its competitors, but is nowadays more in line with Disney’s valuation. Even after declining 68% year-to-date, the company is still selling at 13.79x NTM EV/EBITDA and an astonishing 87.42x NTM P/FCF. The streaming giant still seems to command a significant premium as compared to the other companies in the sector, which remains largely unwarranted in our view.

Lack of legacy cash flows to ensure stability

The second issue we have to raise with the streaming company is the lack of any major legacy businesses that can produce cash flows to ensure stability and fund the expensive nature of the streaming wars. In other words, Netflix, unlike its other entertainment competitors, is a full-streaming company with no exposure to other ventures that can add back structural stability by ensuring legacy cash flows.

For a long time, being solely a streaming company was considered highly desirable as the full focus of the company was set on the streaming segment, with streaming obviously generating the most growth and catching the most headlines. Today, as competition is getting fierce and the macroeconomic indications are worsening by the day, its streaming service is bound to be hit by significant challenges.

This problem is best understood when analyzing competitors in the entertainment industry, which all in one way or another have legacy cash flows to fall back upon in troublesome times. Possibly the best example of a company that is in a good place to circumnavigate the costly nature of the streaming wars is Disney. The mouse company has multiple legacy businesses it can fall back upon in difficult times such as these.

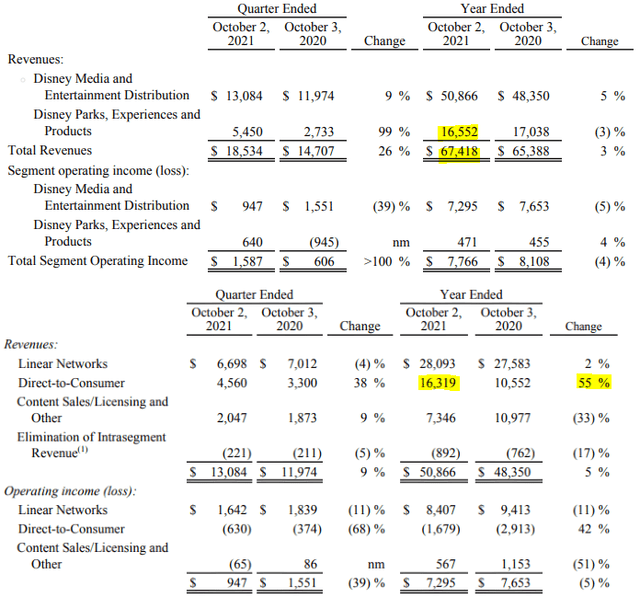

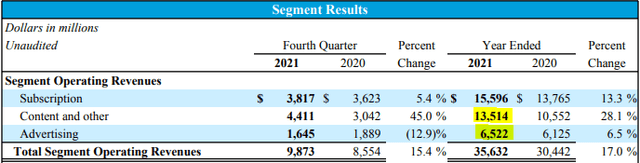

Disney Q4-FY21 Earnings (Investor Relations)

In its full-year 2021 report, even though it achieved a 55% growth rate in its direct-to-consumer offering, it only contributed roughly 24% of the $67 billion in total revenues the company generated. For example, a free-cash-flow machine like the Disney Parks generated $16 billion last year alone, which is almost half of Netflix’s total revenues. Content licensing deals themselves added back another $7.34 billion.

Another good example that comes to mind is Warner Bros. Discovery. This is especially true after the merger got completed back in April with Discovery’s legacy media empire joining up with Warner Media’s already highly respectable legacy offering. Overall, this ensures that the company has stable and relatively predictable cash flows to fall back upon while it builds up its streaming offering, which seems to catch up rapidly.

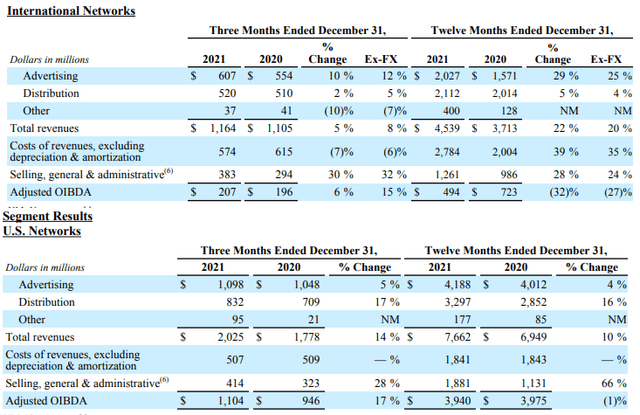

Discovery Q4 FY2021 Earnings (Investor Relations)

We will not have the privilege of knowing how the combined company will look on paper until the second-quarter results are released in August. However, on one hand we have Discovery with only a relatively new direct-to-consumer offering in the form of Discovery+, which was mostly focused on advertising and distribution, while Warner Media’s direct-to-consumer offering made up only 43% of the revenues.

Warner Media (AT&T) Q4 2021 FY Earnings (AT&T Investor Relations)

To recall, the combined two streaming platforms of HBOMax and Discovery+ currently have slightly more than 100 million subscribers, which is roughly half of the subscriber base that Netflix commands. They successfully added 5 million net subscribers in the first quarter, compared to the 200.000 subscribers lost by Netflix in the period.

Rivals such as Apple (AAPL) and Amazon (AMZN) have only partially entered the streaming space with their Apple+ and Prime Video streaming services, respectively. Both companies have well-established and vastly successful businesses outside of the entertainment industry which results in time being on their side. We cannot help but arrive at the conclusion that other competitors in the space are much better established to weather the ongoing storm and as such represent safer investments.

Lack of influential IP to nurture and develop.

In the early years of Netflix’s dominance, its rivals in the entertainment industry were willing to cooperate with Netflix on various licensing and distribution deals. Companies in the space saw it as an opportunity to generate additional sources of revenue with content they already owned. As a result, the platform was effectively considered by many a one-stop shop for almost anything streaming-related, being the streaming service that housed almost all of the content, no matter the studio or company behind it.

This has helped the company solidify its position as the undisputed market leader, which it held for years, fully utilizing the benefits of the first-mover advantage. With almost every major player in the entertainment industry either having established or being on its way to establishing a competing streaming solution, the company is finding it extremely difficult to keep quality IP on its streaming service. All streaming solutions have begun relying on original content to grow their subscribers. Slowly, as deals are running out, all the platforms are taking back their IPs one by one. This leaves the quality of Netflix’s content offering heavily deteriorating as the years go by.

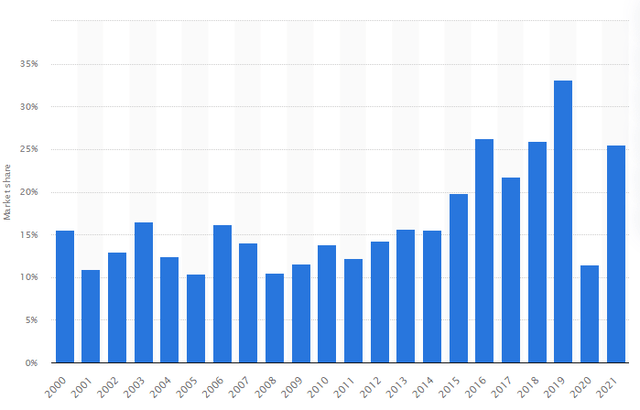

When discussing nurturing and exploring the IP an entertainment company owns, there are few success stories in history that can match what Disney has managed to accomplish with the Marvel Cinematic Universe. Disney bought Marvel Entertainment back in 2009 for what seemed to be a hefty sum of $4 billion. Today, more than a decade later, their superhero cinematic universe flourished under Disney’s rule, with the movie universe being successful in generating more than $22.5 billion at the global box office. This combined with the company acquiring Lucasfilm and Star Wars in 2012, led to a period of box office dominance.

Disney Box office market share US & Canada (Statista)

With David Zaclav taking over as the CEO of the new joint company in April, Warner Bros. Discovery has doubled down on attempting to explore its most valuable IP. We already have several rumors of new Harry Potter universe TV shows being in pre-production, with a renewed focus on J. K. Rowling’s world of witchcraft and wizardry.

House of Dragons, the prequel series to the critically acclaimed Game of Thrones, has its first season ready to release in August and is going to end up competing with Amazon Prime’s Rings of Power. We have also been fed teaspoons of information on the newly announced Jon Snow sequel that is currently in the making, which is only one of multiple projects Warner Bros. Discovery is exploring in the World of A Song of Ice and Fire. Furthermore, there are ongoing discussions on Warner Bros. wanting to reboot or at least significantly overhaul its entire DC cinematic universe, in an attempt to effectively mimic the success story of the MCU from Disney.

This causes multiple issues for Netflix and raises questions about the efficiency of its capital deployment toward programming. They have the occasional hit with shows like the “Squid Game,” “La Casa de Papel,” or “Stranger Things,” but at large they find themselves in a position where they are throwing things at the wall and hoping they stick.

If offered the possibility to invest your personal wealth into one of the following series, which one would the average investor pick?

- A new Star Wars project costing 100mm per season.

- A different project with no fan base costing 100mm per season.

The answer here is rather obvious, with most investors and studios most likely heading towards the same decision. Star Wars could be easily substituted with any other well-established IP with an already existing fan base. This is exactly where the issue lies for Netflix.

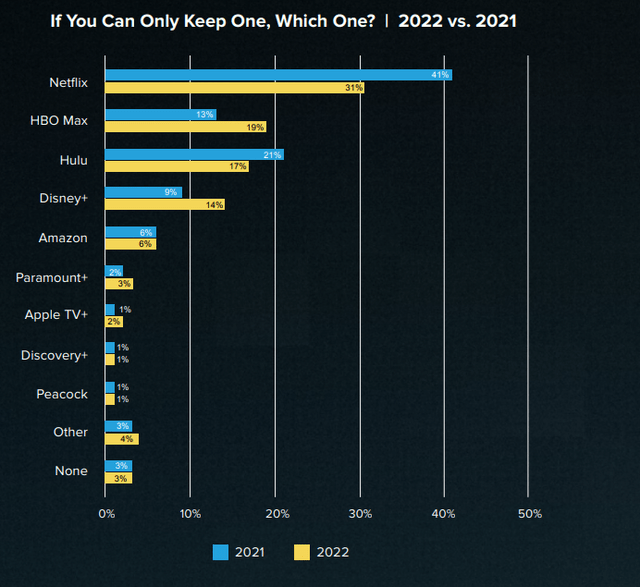

Keep One Service? (Streaming Satisfaction Report, Whip Media)

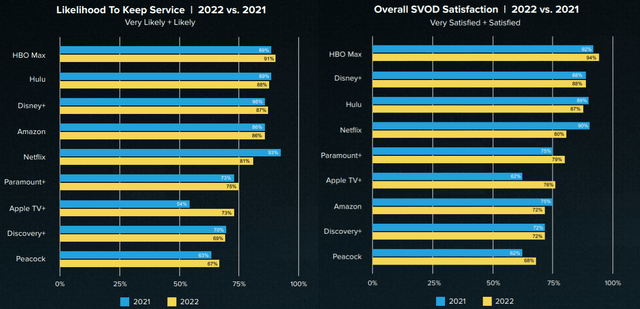

The data clearly collaborates on this, with Netflix losing its influence over consumers and dominance over the market each year. A renewed focus on streaming by competition and industry consolidation are making this only worse. There is a very clear trend of HBOMax and Disney+ being on the rise, with Netflix slowly falling behind in all customer satisfaction categories.

Overall Satisfaction and Likelihood To Keep (Streaming Satisfaction Report, Whip Media)

The company is in a position where it is forced to outspend its competition in order to achieve the same cultural impact its rivals can achieve with much less. To make matters worse, for the first time in history, it is facing a significant backlash from its investors, who are desperate to finally see some financial prudence from the streaming giant. This makes for a horrible combination, more so in the upcoming period with a bearish market and a recession-headed economy.

Final thought and closing arguments

An entertainment company was disguised as a high-growth technology company for far too long, and now investors and management alike are forced to face the reality of owning and operating a business in the entertainment industry. The consequences of not running a profitable or cash flow-positive business model for years, as well as certain disadvantages associated with being a newly formed company with no legacy cash flows to fall back upon are starting slowly to sink in.

After enjoying years of first-movers advantage benefits in the streaming space, Netflix has been finding itself increasingly under pressure from the competition, which seem to be far better positioned to circumnavigate the spending wars and come out on top. At the same time, the market is still willing to assign a premium to the streaming giant, as it is currently being valued by the market at 13.79x EV/EBITDA, 17.98x P/E, as well as a particularly high 87.42x P/FCF.

In our view, this seems to be far from reasonable given the declining macroeconomic environment and the bear-headed market. As a result, even after Netflix has declined more than 68% year-to-date, shares of the formerly undisputed market leader still fail to look attractive enough to warrant an investment.

Be the first to comment