Seiya Tabuchi/iStock via Getty Images

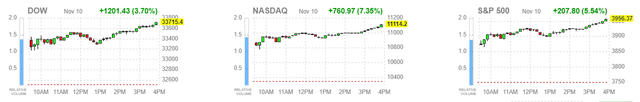

The premise behind my bullish outlook for the market and economy over the past several months has been that the rate of inflation would fall much faster than the consensus expected. That would allow the Fed to end its rate hike campaign before year end, resulting in a peak rate significantly lower than the 5-5.25% range accounted for by the markets. It would also allow consumers to realize real wage growth by this spring, helping to support spending, and it would weaken the dollar, providing S&P 500 corporate earnings with a much needed tailwind. This would pave the way for a soft landing in 2023. We took a major step in that direction with yesterday’s CPI print well below expectations, with the exception of mine, resulting in the best performing day for the major market averages in more than two years.

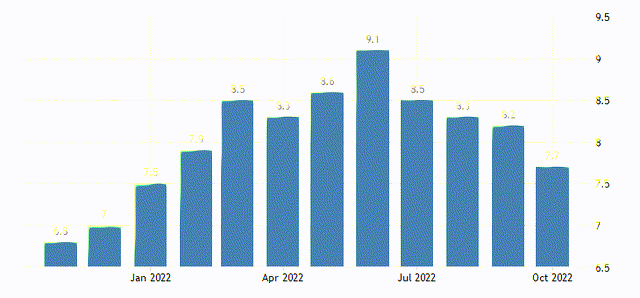

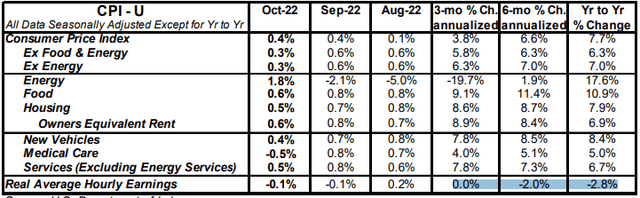

The headline number for the Consumer Price Index fell for a fourth month in a row on an annualized basis from 8.2% in September to 7.7% in October. The core rate, excluding food and energy, fell from 6.6% to 6.3%. Both were well below expectations. The monthly increase for the core of 0.3% was the smallest in over a year. Prices fell for used cars and trucks, airline fares, and apparel. The largest decline was in medical care services, but that was largely due to a once-a-year adjustment to the way the government tracks health care prices and won’t be repeated. The most encouraging aspect of the report is that the increase in shelter costs accounted for over half of the monthly increase in the headline number and more than 40% of the core.

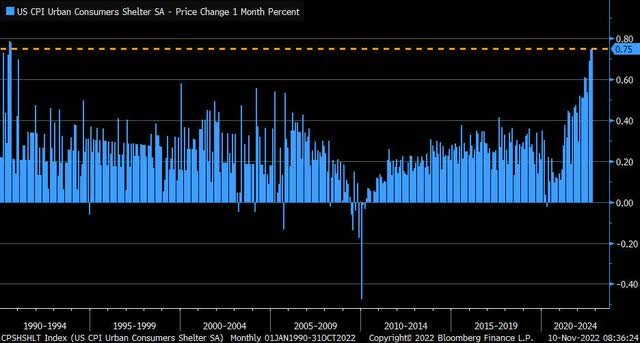

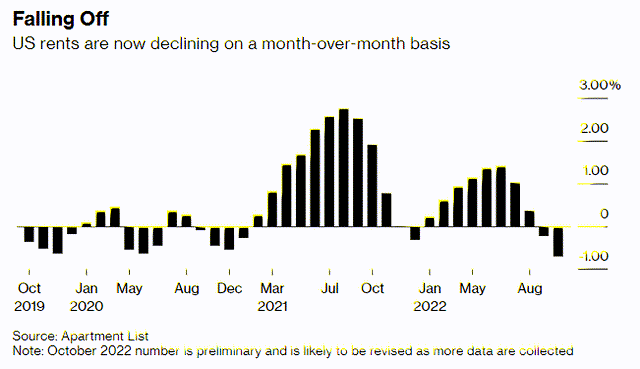

In fact, the shelter component saw the largest monthly increase since August 1990 at 0.8%. The reason I find this so encouraging is that I think shelter costs have a higher probability of declining over the coming 6-12 months than any other component of the index.

The reason is that the price increases for new rental contracts have dropped significantly, while some are realizing price declines in select locations. These new contracts take time to bring down the average rent in place today, but all indications are that this is happening.

Another extremely positive development in this report, which was ignored, has to do with real wages, Despite the tremendous nominal wage growth we have seen over the past year, especially for lower income workers, inflation has eroded all of those gains and then some, resulting in a loss of purchasing power. Yet if you look at inflation-adjusted (real) average hourly earnings growth in the chart below, you will see that the erosion is narrowing. The year-over-year decline of 2.8% has fallen to 2% over the past six months annualized and is now flat over the past three-month period annualized. As the rate of inflation continues to fall, we are on the cusp of real wage growth again. This should help support consumer spending in 2023.

A lower rate of inflation suggests that we will see lower interest rates, which is why we saw a sharp drop in the dollar index yesterday. That turbocharged the stock market rally. Multinational corporations highlighted the strong dollar as a major headwind to revenue and profit growth last quarter. Its reversal will serve as a tailwind to both in upcoming quarters.

The bears will contend that yesterday’s tremendous one-day surge in stocks was typical of bear market rallies. They will assert that the Fed will still raise the Fed funds rate to 5-6% next year, resulting in a demand-driven recession. I could not disagree more, but the Fed’s rhetoric between now and year end is bound to support this ominous outlook, because the Fed wants to keep inflation expectations soundly in check while it works to lower the actual rate down to its target. My recommendation is watch what the Fed does rather than listen to what its members say they may do. The Fed’s actions should stay data dependent, and the data to date suggests it will be done raising rates after the December meeting with another 50-basis point increase and a target rate of 4.25-4.50%. If I am correct, then the consensus is overshooting in its peak rate expectation for 2023 by 75-100 basis points, and reining in that expectation is fresh fuel for higher risk asset prices.

Be the first to comment