double_p

Stocks took a much needed and highly anticipated breather yesterday after the S&P 500 ran up against the technical ceiling of its 200-day moving average. The excuse to take some profits turned out to be what appeared like a disappointing retail sales report before the open, but the details behind the headline number were stronger than expected. That was followed by the release of the Fed meeting minutes from July, which carried a mixed tone, as the central bank discussed the downside risk to economic growth as it tightens monetary policy. I think the bottom line is that investors were looking for any excuse to take some money off the table after the near-vertical move in markets over the past four weeks.

Finviz

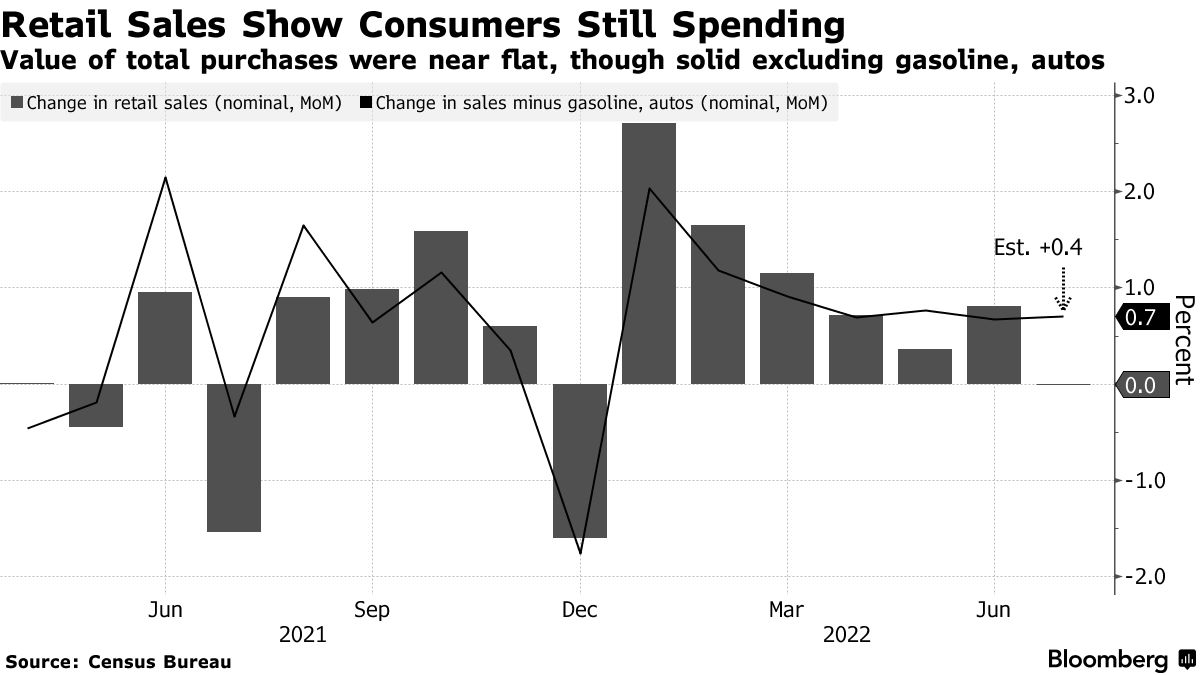

While retail sales for July were flat compared to expectations for a modest increase of 0.1%, the shortfall was a function of lower gasoline prices and lack of automobile inventory. When we exclude these two items, sales rose a better-than-expected 0.7% with nine out of 13 categories realizing an increase in spending, led by internet sales. That was likely due to Amazon Prime Day falling on July 12-13. Retail sales are now up 10.3% from a year ago, while the rate of inflation is up 8.5%, which means retail sales are rising on an inflation-adjusted basis. There is no recession in sight.

Bloomberg

The minutes from the Fed’s meeting on July 26-27 had verbiage for both bulls and bears to chew on, as usual. Fed officials discussed the need to move short-term rates to more restrictive levels in the short term to meet the committee’s objectives, which could “have a larger negative effect on economic activity than anticipated.” At the same time, members suggested that its policy rate was close to the neutral level where is it neither restrictive nor stimulative, indicating it may be taking its foot off the brakes sooner rather than later. At the end of the day, we know that the Fed will continue to be data dependent, which means that the upcoming jobs and inflation reports will be the key determinants to changes in policy and dictate the market’s direction.

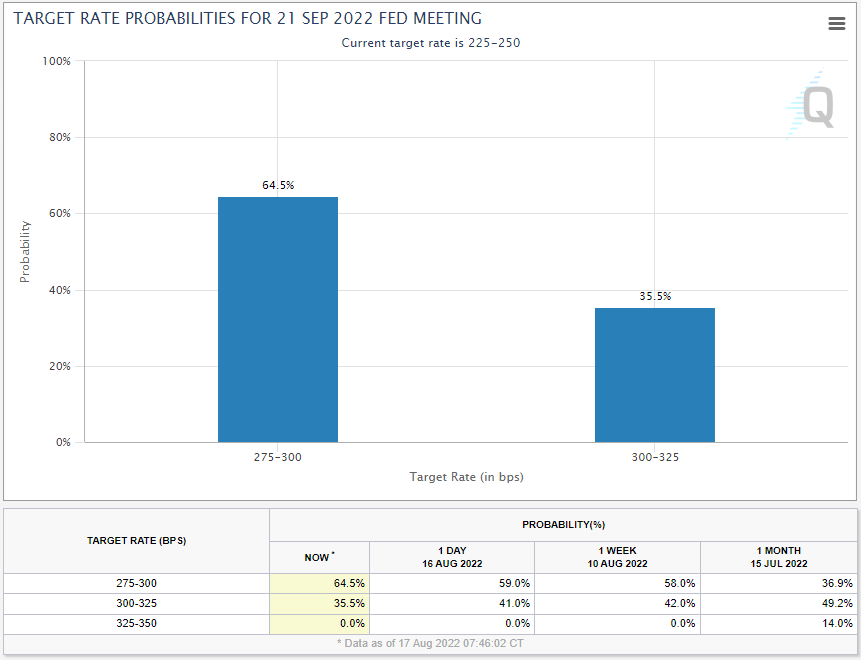

The most important aspect of the minutes release was the reaction in the Fed funds futures market. The probability of a 50-basis point rate increase rose from 59% to 64.5%, while the probability of 75 basis points fell from 41% to 35.5%. I have been consistent in expecting 50 basis points, and I think the Fed will follow the market’s expectations, as it has in the past. A less restrictive policy is more beneficial for risk assets.

CME Group

Yesterday, I discussed the unprecedented increase in wages and wealth for lower- middle-income households since the last recession. It is one of the factors making this expansion very atypical and also the reason I think we are seeing such resilience in consumer spending today, despite the surge in inflation. Moving forward, as the rate of inflation falls, the strength in balance sheets for this demographic should be key in achieving a soft landing for the economy. I think it is what the bearish consensus of strategists on Wall Street is ignoring at its own peril. My primary concern right now is that the Fed overtightens with too many rate increases between now and year end, but I don’t see that happening at this stage.

The Technical Picture

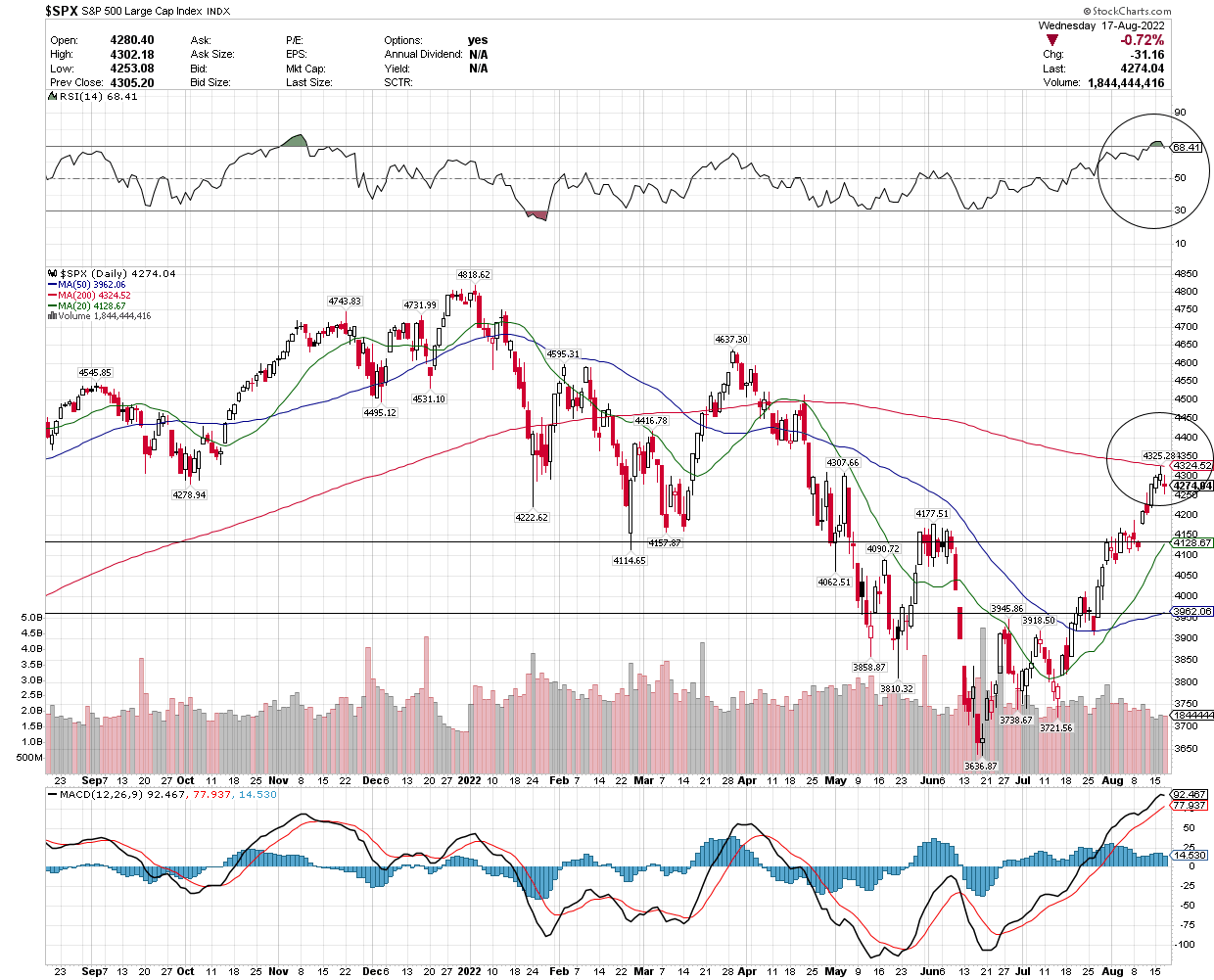

When any index runs up to major overhead resistance at its 200-day moving average at the same time its Relative Strength Index (RSI) reaches overbought territory, it’s a no-brainer that we should see a pullback. That seems to be underway with the S&P 500 and its RSI rolling over from Tuesday’s high for both. There is not much in the way of support until we fall to the 20-day moving average at 4,128, which is 3.5% below current levels, while much stronger support comes into play 7.5% below at the 50-day moving average of 3,962. I think a correction to either level, while not guaranteed, would be healthy for the long-term sustainability of the uptrend. Breaking below the 50-day would suggest that we are going to retest the June lows, which is not my base case.

Stockcharts

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment