gorodenkoff

REIT Rankings: Data Centers

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on August 15th.

Data Center REITs have become “battleground” stocks this year, pressured by the combination of a myriad of headwinds including weakening chip demand in Europe and Asia, the broader tech sell-off, FX headwinds, and more recently, a short thesis by Chanos & Company, which launched a fund to against data center REITs. Beneath the cloud layer, however, industry fundamentals are less murky and, in fact, perhaps as strong as they’ve been in a half-decade. Contrary to the short narrative, pricing power has strengthened in 2022 as robust demand has clashed with increasingly constrained supply levels. Within the Hoya Capital Data Center Index, we track the two major data center REITs – Equinix (EQIX) and Digital Realty (DLR) – alongside a handful of former REITs, potential future REITs, and diversified REITs that are major players in the industry after a wave of M&A over the past two years shook up the sector.

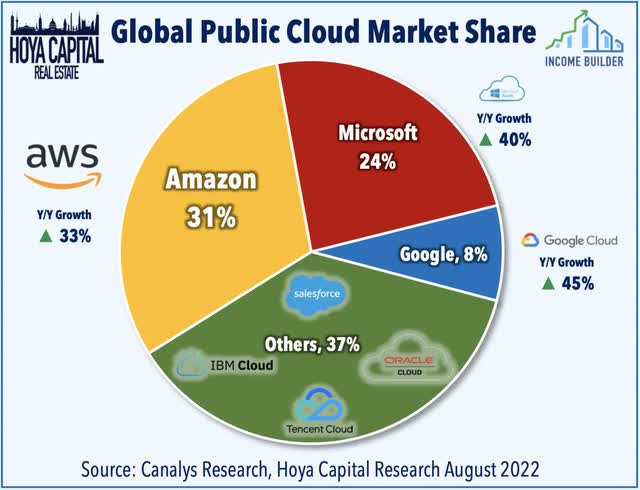

The companies synonymous with cloud computing – Amazon (AMZN), Microsoft (MSFT), Google (GOOG) (GOOGL), Alibaba (BABA), Oracle (ORCL), Salesforce (CRM), and Snowflake (SNOW) – are among the largest and most critical tenants of these data center operators, and have become even more critical tenants in recent years as a growing share of leasing activity has accrued to these “hyperscale” tenants which have increasingly dictated the terms of leasing agreements and pricing. Earlier this year, short-selling firm Chanos & Company launched a $200m fund that will bet against US-listed REITs with a particular focus on data centers. Chanos’ described the position as the firm’s “big short” based on the thesis that “value is accruing to cloud companies, not the bricks and mortar legacy data centers” and believes that these cloud providers will want to self-build instead of leasing from third-parties, commenting “when your biggest competitors are three of the most vicious competitors, then you have a problem.”

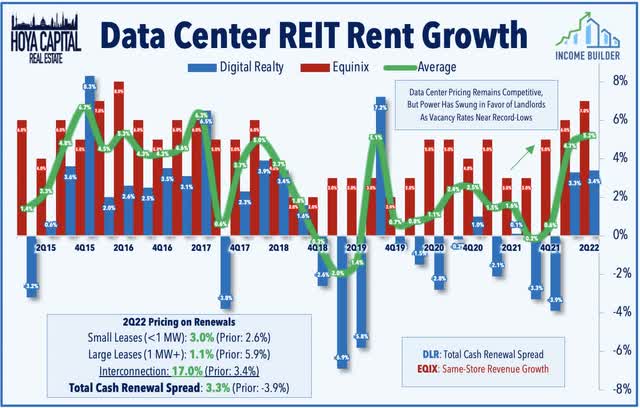

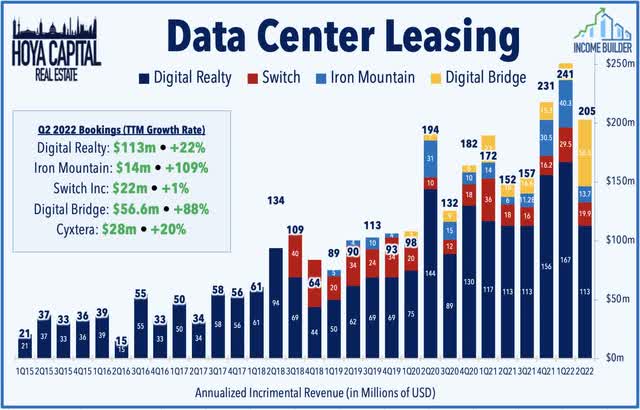

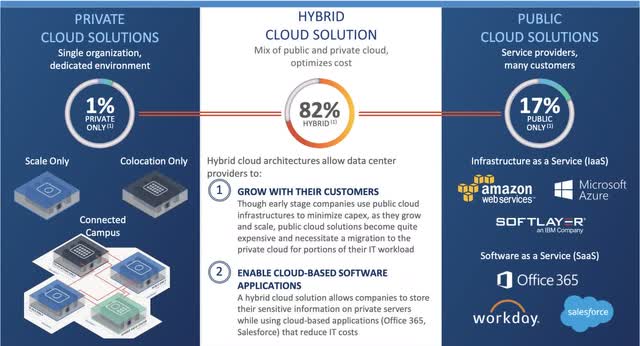

The short thesis has received significant pushback from data center REITs and the majority of the data center industry’s sell-side analysts, who point out that while Chanos accurately characterizes the overall competitive dynamics over the past five years, the degree to which the cloud is a “zero-sum” game is overstated. In fact, the pricing power of these data center REITs has strengthened considerably in recent quarters as strong absorption and moderating supply growth have sent vacancy rates towards record lows and has started tilting the negotiating leverage back towards the landlords for the first time before the pandemic. A recent CBRE report noted that “demand for capacity more than tripled year-over-year in H1 2022 as companies continued to shift toward hybrid cloud environments… but developers can barely keep up with demand. Among primary markets, almost 75% of under-construction capacity in H1 is already preleased. Vacancy rates fell from a year ago in all seven primary markets in H1 while the unprecedented demand is pushing up lease rates in the few areas where there is vacant space.”

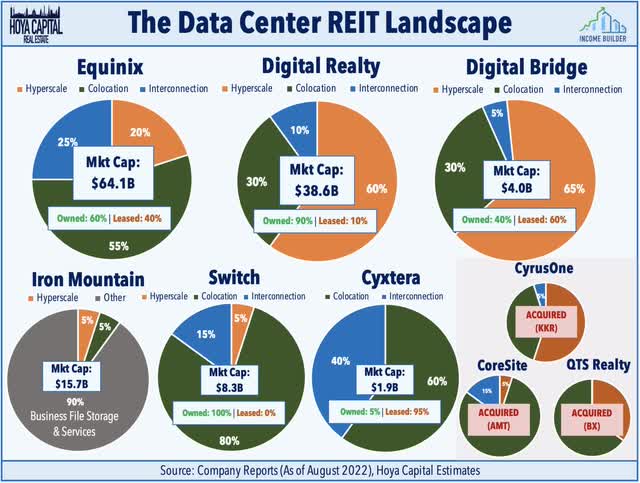

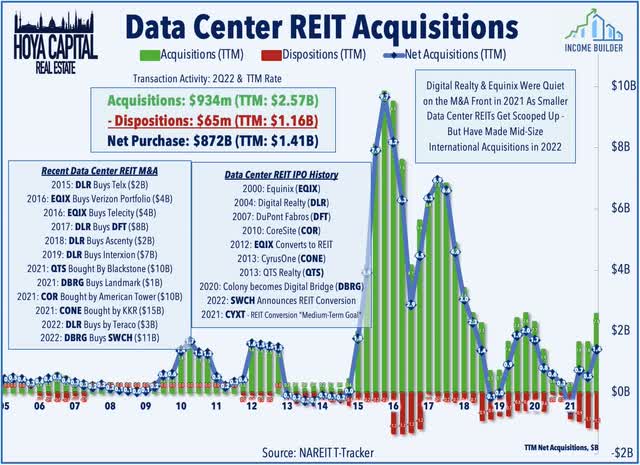

While a larger share of leasing activity is accruing to a handful of mega-sized tenants, the overall pie continues to grow and it increasingly appears that there is enough economic value to be shared by tenants and property operators alike. Consistent with the “Go Big or Go Home” theme we’ve discussed for the past half-decade, data center REITs haven’t been sitting idle amid the looming competitive threats from hyperscalers as the industry has seen a wave of consolidation and M&A over the past half-decade. Three data center REITs were acquired last year including Blackstone’s (BX) acquisition of QTS Realty, KKR’s (KKR) acquisition of CyrusOne, and cell tower REIT American Tower’s (AMT) acquisition of CoreSite. We’re now down to two major REITs after DigitalBridge (DBRG) announced last quarter that it will abandon its REIT structure and instead transition to a conventional C-Corp as it focuses its strategy on its fee-based investment management business. DBRG also reached a deal in May to acquire Switch (SWCH) – an operator that had planned to convert to a REIT by 2023.

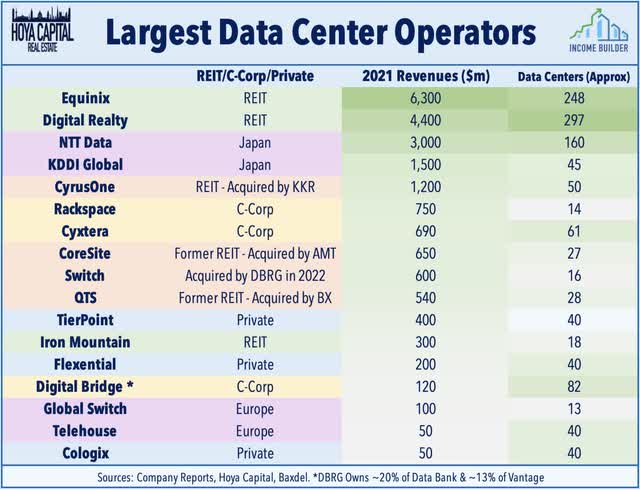

DigitalBridge – formerly known as Colony Capital – has leveraged its private equity platform to fuel a buying spree that has rapidly established the firm as one of the world’s largest technology real estate operators, having now acquired more than a dozen companies including DataBank, Vantage Data Centers, and Landmark Infrastructure. Other major publicly-traded players in the space include Iron Mountain (IRM), which operates a growing portfolio of data center alongside its business storage portfolio, and Cyxtera (CYXT), which operates 61 data centers with an interconnection-heavy portfolio and “asset-lite” operating model similar to Equinix. CYXT is reportedly up for sale after previously commenting that it sees a REIT conversion as a “medium-term” goal. Other companies operating space include a mix of international, private, and “c-corp” entities, including Rackspace (RXT), TierPoint, Flexential, Cologix, Lumen (formerly CenturyLink), and Global Switch.

Data Center REIT Fundamentals

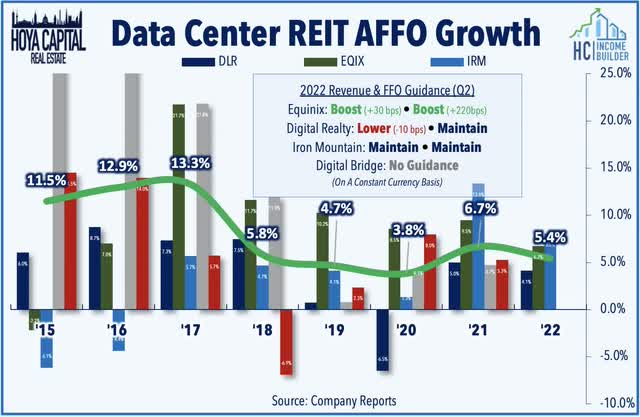

As discussed in our REIT Earnings Recap, Equinix – which we named as one of our three “Best Ideas in Real Estate” in mid-July – was among the top performers this past earnings season after reporting better-than-expected results driven by record-high levels of gross bookings in the first half of the year. EQIX raised its full-year FFO outlook to 9.5% on a constant-currency basis, up 220 basis points from its prior outlook. Respond to a question over the Chanos short thesis in its earnings call, CEO Charles Meyers commented, “On the short thesis, I think it represents an underdeveloped understanding of the data center market and the relative position of various players… the notion that this is a sort of a zero-sum game between us and the hyperscalers is just not an accurate view of the marketplace.”

Results from Digital Realty (DLR) were less impressive on the deadline numbers, however, with gross bookings falling short of estimates and with a slight downward revision in its full-year revenue outlook, but the second-straight quarter of strengthening pricing power was an upside highlight. Total cash renewal spreads increased 3.4% in Q2 – the strongest quarter for DLR since 2019 – driven by a 17% spread on interconnection leases. Last quarter, DLR increased its outlook for cash re-leasing spreads for the full year to “slightly positive’ compared to “flat” last quarter. While Equinix does not provide comparable bookings metrics, it did note that it recorded “record Q2 gross bookings that sizably surpassed the prior peak” including 38MW of leasing at its xScale hyperscale facilities. Iron Mountain, meanwhile, executed 11MW of new and expansion leases – roughly $14M in annualized revenue – and reiterated its guidance calling for total additions of 130MW this year, up from 50MW in its initial outlook earlier this year, an impressive total that establishes IRM as a series player in the space.

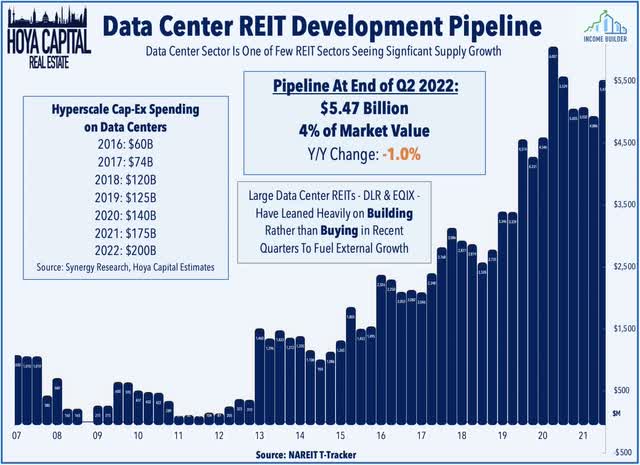

External growth continues to be the modus operandi and primary driver of growth for these companies as Data Center REITs have been relentless developers over the last half-decade. The development pipeline reached record-highs in 2021 but has cooled in recent quarters amid ongoing supply chain challenges which has helped to push the negotiating leverage back towards these landlords. Adding further color in its earnings call last quarter, DLR commented that it has seen “notable and broad-based improvement in our re-leasing spreads, reflecting a healthier pricing environment… I can’t tell you we’re fully done with never having a negative cash mark-to-market but the trend is certainly playing out which I would say is a combination of mix and also the broader pricing ratch up where the pendulum of pricing is swinging slightly more and more back to Digital Realty.”

While we correctly predicted the wave of M&A in the sector, we thought that surely Digital Realty and Equinix would be leading the charge as both major data center REITs have been “overdue” for a major M&A move based on their historical cadence and both are sitting on a mountain of dry powder. Digital Realty did close on a modestly-sized deal this month to acquire a 55% stake in Teraco, Africa’s leading data center provider for roughly $2B in a deal that is expected to be 1% dilutive to Digital Realty’s FFO in 2022, breakeven in 2023, and accretive beginning in 2024. DLR was also busy last year working on the public listing of Digital Core REIT as a standalone publicly traded vehicle listed on the Singapore Stock Exchange. Equinix, meanwhile, recently closed on a $705M deal to acquire four data centers from Entel as it expands into the Chile and Peru markets which is expected to be immediately accretive to Equinix’s AFFO this year.

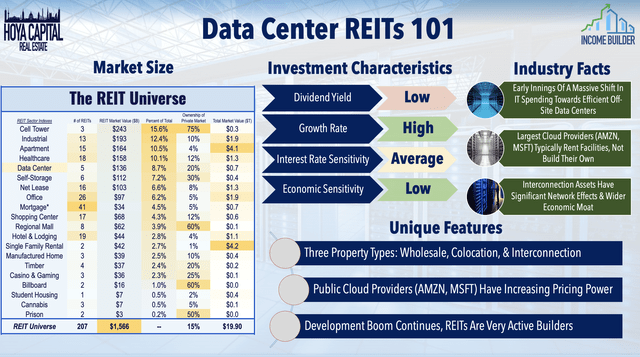

Data Center REITs 101

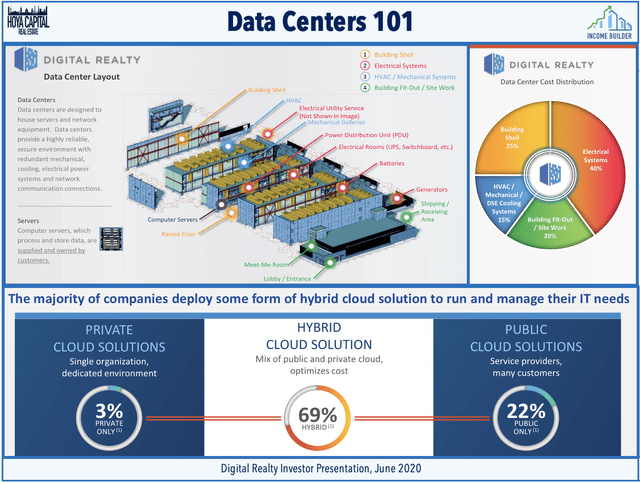

Housed in windowless buildings surrounded by massive generators and cooling equipment, data centers provide the critical infrastructure – power, cooling, and physical rack space – to a variety of enterprise customers with different networking and computing needs. Data Center REITs own roughly 600 data centers – 30% of investment-grade data center facilities in the US – and command roughly a fifth of data center capacity globally. As we’ll discuss in more detail below, responding to the mounting competitive threats, data center operators have turned to M&A to regain some degree of pricing power, with a particular focus on the higher-value interconnection-focused facilities.

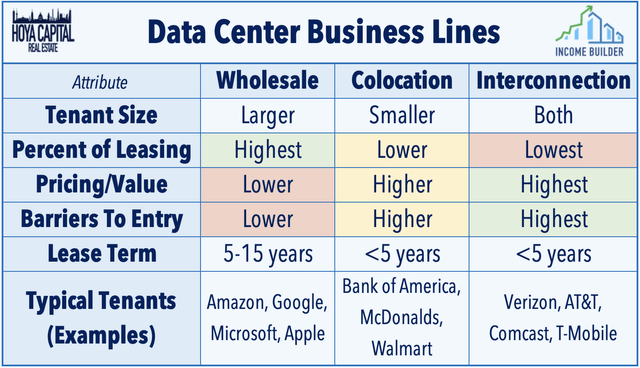

The value of each data center is largely a function of its position along the internet backbone, the physical fiber-optic network that links every connected device across the world. Properties within the backbone, or more precisely at the “intersection” of various networks, are able to provide higher-value network-based colocation and interconnection services, which command higher rent-per-MW and have higher barriers to entry due to the inherent “network effects.” Properties on the periphery or those lacking a critical mass of interconnection tenants typically provide more ubiquitous enterprise-based wholesale services, including storage and cloud-based software applications.

Interconnection, which relies on “network effects,” can translate into a competitive advantage that new entrants have difficulty replicating. Equinix has the highest “quality” portfolio of network-dense assets followed by the smaller CoreSite – which is now owned by American Tower. Digital Realty significantly expanded its interconnection and colocation business through its Interxion acquisition but remains a mostly wholesale-focused entity. CyrusOne, QTS, and the majority of non-REIT data center operators focus primarily on more competitive wholesale assets. Switch and Cyxtera operate relatively high-barrier portfolios, but while Switch – like the other REITs – own the vast majority of their data centers, Cyxtera only owns two of its facilities and leases its remaining 58 data centers.

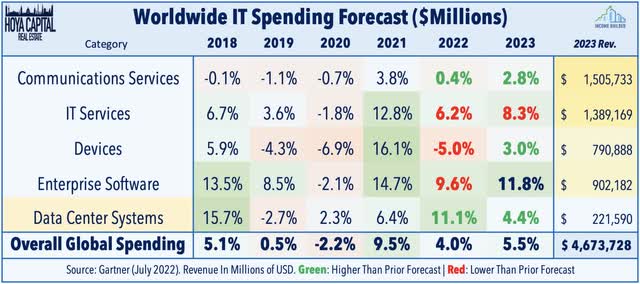

Major players on the hardware side include Intel (INTC), Advanced Micro Devices (AMD), Nvidia (NVDA), and IBM (IBM), which collectively provide the majority of networking equipment utilized by data center tenants. Interestingly, while spending on the “public cloud” by hyperscale providers continues to surge, spending on the physical hardware – servers and chips – has seen relatively lackluster growth, due in part to the lingering global chip shortage. In their most recent forecast in July, Gartner revised upward its growth outlook for IT spending on data center systems – now projecting 11.1% growth in 2022 – but revised lower its estimates for spending on consumer devices, IT services, and enterprise software.

Data Center REITs Performance

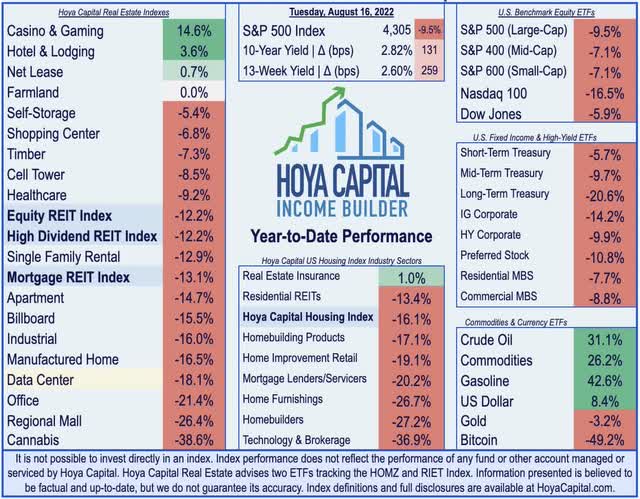

A perennial outperforming in the REIT sector throughout the prior decade, Data Center REITs have uncharacteristically lagged this year, pressured by reports of weakening chip demand, the broader tech sell-off, FX headwinds, along with the pressures related to the widely-covered short thesis. So far in 2022, the Hoya Capital Data Center Index is lower by 18.1% compared to the 12.2% decline by the Vanguard Real Estate ETF (VNQ) and the 9.5% decline from the S&P 500 ETF (SPY).

Despite the sell-off, data center REITs are still among the best-performing REIT sectors over most longer-term measurement periods with 5-year total returns of roughly 10% – nearly 250 basis points above the broader REIT average. Future growth won’t come as easy in the 2020s as it did over the prior decade and will require continued operational execution, but we believe that current valuations appear quite attractive as similar setbacks in 2014 and 2018 amid rising rate concerns and industry-specific headwinds ultimately proved to be rewarding buying opportunities.

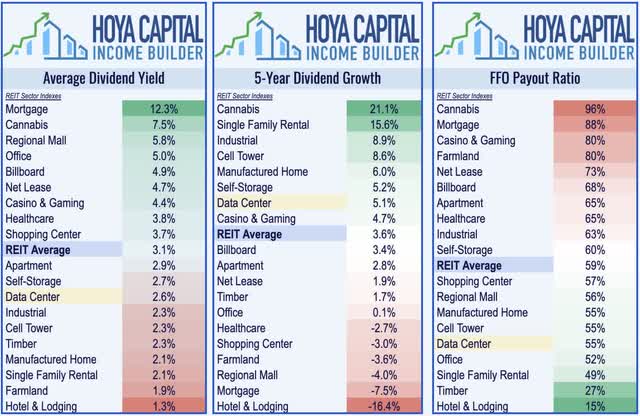

Data Center REIT Dividend Yields

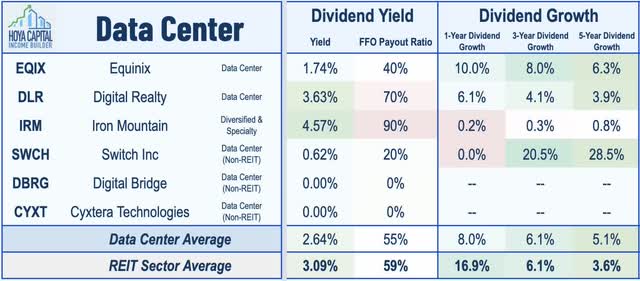

Few REIT sectors have delivered more consistent dividend growth than data centers, and both Equinix and Digital Realty raised their dividends this year. Each of the major data center REITs increased their dividend in 2021 as well following a similarly perfect record of dividend increases in the prior year as well. Still very much a “growth-oriented” property sector, data center REITs pay an average dividend yield of 2.6%, which is below the REIT sector average dividend yield of 3.1%. Data Center REITs pay out only 55% of their available free cash flow, however, leaving ample capacity to increase dividends or reinvest in external growth.

Within the sector, we note the differences in distribution strategies for these data center operators and their approximate FFO payout ratios. Specialty REIT Iron Mountain – of which data center assets comprise roughly 10% of its revenues – pays a dividend yield of 4.57%. Among the pure-play data center REITs, Digital Realty yields a sector-high 3.63% while Equinix pays a yield of 1.74%. DigitalBridge has not paid a dividend since it began its “digital conversion” as Colony Capital, but commented on its earnings call this past quarter that it will initiate a regular quarterly common dividend in the third quarter. DBRG noted that it is “steadfast to this commitment and unwavering” despite the firm’s transition to a C-Corp and shift in business strategy.

Takeaways: Enough Value To Be Shared

Data Centers are among the worst-performing property sectors this year even after a recent rebound, further pressured by weakening chip demand in Europe and Asia, the broader tech sell-off, and FX headwinds. Beneath the cloud layer, however, industry fundamentals are less murky. Contrary to the short narrative, pricing power has strengthened in 2022 as robust demand has clashed with increasingly constrained supply levels. Competition from the hyperscale giants has been a well-established risk that the two major REITs have effectively managed through consolidation – a trend that we believe will continue over the next several years. With negotiating power recently tilting back towards landlords, there appears to be enough economic value to be shared by tenants and property operators alike.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment