Drew Angerer/Getty Images News

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The Drugs Don’t Work

Since there will be more words written about inflation and the Fed and markets today than there are hours in a year to read, we’ll get to the point here.

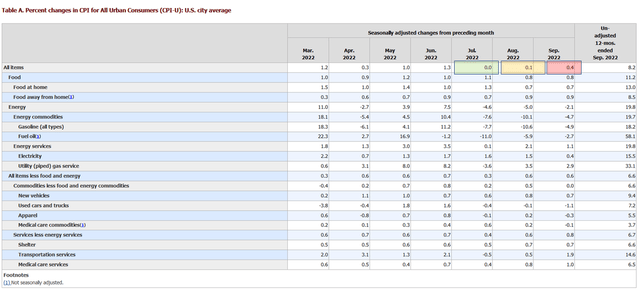

CPI inflation came in hot – above expectations and in particular showing a continued uptrend from the July flat month-on-month into August up month-on-month to September up more month-on-month. This despite a very rapid series of rate hikes from the Fed.

US CPI (US Bureau of Labor Statistics)

The answer you will find on all of FinTwit now is that (1) the Fed has to raise rates faster and (2) equities are doomed and (3) so are bonds and (4) so is the metals complex and oh by the way (5) so is crypto.

Now, at some point we are all doomed and today could be that day. But we don’t think so.

We think the error here is in assuming a causal and/or inverse relationship between Fed base rates and inflation, be that in CPI or PPI or PCE or any other measure. The Fed is ramping rates fast – from a low base it’s true, and still to a low measure by historical averages – but the rate of change has been rapid and literally nobody doesn’t know that this is happening. If you have any kind of credit or are thinking about opening any kind of credit line, you know this is happening. And you know that inflation is happening. If you buy anything at all you know it is happening.

So the Fed has set expectations – stop spending so much else rates up more which harms your credit and your 401(k) – but inflation keeps rising.

It’s almost as if it isn’t consumers’ fault that prices are rising.

Indeed it’s almost as if the Fed can’t control inflation with rates.

Here’s our own view. Lob potshots at it in comments below by all means, we claim no special genius on the topic. But specifically because of our lack of genius on the topic we come at it with a view askew, which in investing as in life is usually worth having.

We think that inflation is rising because:

- The low inflation environment of the last 15-20 years was a function of a liberalized (small ‘L’) global trade environment that meant low consumer prices for finished goods and low producer prices for raw materials, subassemblies etc

- That world has gone and it’s not coming back for a generation. Why this is, we know not, something to do with the passing of the generation that remembers WWII maybe. (It’s fine for everyone who doesn’t remember a big ol war to get aggressive when they don’t have any memory or experience of what global conflict looks like.)

- With the world leaning more protectionist comes higher consumer prices and higher producer prices. Labor costs rise because there’s less supply of substitute labor.

- All of this was happening anyway but then you roll in the shock of the Russian invasion of Ukraine hitting oil, gas, fertilizer and crop prices, and you have the present high inflation environment.

We don’t see any reason why the Fed on this course will dampen inflation down. What will dampen inflation in our view?

- Reliberalization of the world. (Not going to happen for >50 years in our opinion. Needs another huge war to remind everyone why co-operation is good and being at each other’s throats is bad. Probably means a few million deaths again to make the point, but, what can you do, history books just don’t have the same impact as losing three of your sons) and/or;

- Cessation of the Russian invasion. This isn’t going to plan. And nobody can yet come up with a negotiated settlement because at this point neither side has any motivation to back down. Pressure is rising on the West to contain Russia so we shall see how this plays out. The opening gambit of the war – not the missiles but the unwitting recruitment of the Western consumer into pressuring their governments to ease up on Russia in order to ease up on fuel and food costs – went well for Russia. That seems to be waning along with the military effort. Our own view is that this all ends badly for Russia which means inflation will start to fall.

That, we believe, will leave rates persistently higher than the 2% Fed target which in our view is at best naive and at worst ignorant of the tectonic shifts that have happened in global politics in the last decade. An outsourced, interdependent, low tariff, low inflation world is suitable for a 2% target. Right now? Try 4%, maybe even 5%. Those aren’t outlandish numbers on a long-run historical basis.

We believe the Fed will not raise rates faster than the current course they have set. We don’t expect a 1% rise resulting from September CPI. Even if dogmatism causes the FOMC to cling to this notion, reality is intervening.

There are a number of noises-off in the financial system that are indicating strain arising from rapid rate rises. The UK is at the bleeding edge of this due to its own specific issues, but cracks in the pensions system there and extreme volatility in government bonds are consequences of the rapid rises in global base rates. (No we are not saying this is Mr Powell’s fault. We’re saying that where there are cracks, a little pressure causes them to open further). In addition, labor market tightness isn’t going to go away. Between the lowered supply of substitute labor arising from the new protectionism (look to the semiconductor industry as a prime example) and the silent withdrawal from the labor market of millions of working age people following the COVID pandemic – either a result of long COVID (think that’s not a thing? Sure.) or just the desire to maintain a life away from centralized workplaces – that’s a lot less worker hours available and that means only one thing, wages up. Again not something higher base rates can quash. Not least because the Fed is supposed to target full employment as a counterbalance to their inflation targets (the logic being, quash inflation, risk of recession, watch unemployment as a counter, if unemployment rises too much, back off on rates).

These linkages are broken, even if they ever were real.

Our house view? A new normal will rise in the consciousness of market operators and Main Street alike.

- Inflation in the 4%-5% zip code deemed good

- Rates at or around the current level deemed acceptable

And we think markets will reprice off of these levels. You’ll know when Wall Street has shrugged off its false consciousness – stocks will stop falling. Next comes Main Street. And then, only then perhaps, the Fed.

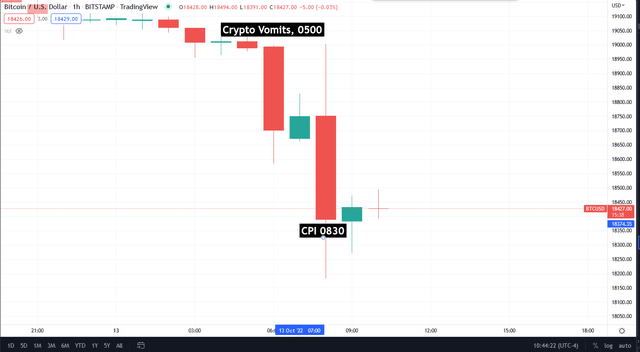

Oh by the way. The real question for today is not, whoah what do you mean inflation hot? The real question is, how did the Crypto Bros-In-Chief know at 0500 Eastern?

Embargoed Till 0830 LOL (TradingView, Cestrian “Analysis”)

We think we should be told. (Thanks for the free money Crypto Bros by the way. We use BTC and ETH as canary indicators. Which helped us put our staff personal account index hedges in place nicely right before the print, as shared in our subscription service Growth Investor Pro.)

Cestrian Capital Research, Inc – 13 October 2022.

Be the first to comment