Rasi Bhadramani/iStock via Getty Images

The best investors make money not because they understand abstruse mathematical models, but because they have a deep intuition about the machinations of financial markets. Markets have been complex for a long time, and their ebbs and flows always have depended, not only on intricate disclosures about assets and liabilities, but also on human psychology. That has not changed since the 1920s. The names and details change, but the cycles of mania, panic, and crash do not.

The number of conservative investors in the United States was dwindling. Instead, stock buying and selling was dominated by exuberant day traders, people who bought and sold shares of risky companies throughout the day, often holding positions for just a few minutes . . . there were more day traders per capita during the early 1920s than at any other time in history.

Most people who bought from bucket shop operators lost money, but that didn’t stop them. Human beings inevitably overestimated the probability of success. Too many young men thought they could become the next Babe Ruth; four of five people believed they were of above average skill when driving a car. A majority of people said they could outsmart the stock market, or win money gambling.

As stock trading became more popular during the early 1920s, so did this kind of cognitive error, and the widespread passion about markets led investors to focus on winners more than losers, like the gambler who vividly remembers cashing a winning ticket from a particular race at the horse track, but conveniently forgets that she lost money overall.

At the time, even the hardest skeptics were drawn to widely publicized tales of successful trading schemes. Americans have always wanted to believe rags-to-riches stories are true, and the more they heard about young men from poor backgrounds who made implausible fortunes, the more they believed those stories could be theirs.

– The Match King: Ivar Kreuger, The Financial Genius Behind a Century of Wall Street Scandals

For the six months ending June 30, 2022, the Broyhill Equity Portfolio declined 3.9% versus 20.0% and 12.0% declines for the MSCI World and MSCI World Value Indices, respectively. Individual account returns will vary depending on asset allocation, legacy positions, and capital flows. Detailed quarterly reports, including account and benchmark performance, portfolio holdings, and transaction history, have been posted to our investor portal.

We are pleased with our performance year-to-date, which has provided yet another opportunity to demonstrate our ability to protect capital in the most challenging investing environments.[1] After years of rampant speculation, which culminated in animal spirits and levels of optimism that would have made the “Match King,” Ivar Kreuger, giddy, it would appear that most investors were in fact swimming naked. According to The Wall Street Journal, “of the 1,342 actively managed domestic stock funds, only 32 managed to end the trailing-twelve-month period in positive territory.

The average performance for the fund managers was ugly. The funds recorded a total return of minus 15.2% for the twelve months.” [2] While that’s slightly better than the median college endowment, which lost 10.2% before fees,[3] we suspect that those returns might look more comparable if private assets were actually priced in line with reality. In contrast, the Broyhill Equity Portfolio, which is 100% invested in liquid equities, gained 5.9% in the trailing year through June, versus 15.4% and 7.4% declines for the MSCI World and MSCI World Value Indices, respectively.

PERFORMANCE REVIEW

Value means different things to different people. But regardless of how you define it, the fact remains: cheap stocks have significantly outperformed the market year-to-date. Although the second quarter– when all domestic sector returns were in the red—was more challenging, we remain quite satisfied with our overall results.

The largest contributors to performance during the first half counted three of our top five holdings: McKesson Corp (MCK), Dollar Tree Inc (DLTR), and Philip Morris International (PM).

McKesson surged 32% during the first six months of the year, which coincidentally is in line with the stock’s three-year average annual return. For most of that time, however, shares traded at a 50% discount to the market as improving fundamentals drove the majority of gains. In contrast, this year’s gains have been largely driven by multiple expansion as investors pushed the shares of noncyclical, inflation-resilient businesses higher.

As a result, McKesson’s price-to-earnings ratio increased ~ 40% and closed the quarter at a 15% discount to the market, relative to the ~ 50% discount to start the year. Although the company recently raised guidance and reported another strong quarter of results, we have begun reducing our position as shares have approached our estimate of fair value.

Like McKesson, Dollar Tree made the list of our top contributors for the second consecutive six-month period. Shares gained 11% during the first half, following management’s report of better-than-expected earnings and increased guidance for the full year. Earlier this year, we increased our position in the stock when weak results from Walmart (WMT) and Target (TGT) sent retail investors racing for the exits and Dollar Tree lost nearly a quarter of its market capitalization over a mere three-day period.

Despite the stock’s sharp rebound from these lows, we continue to hold a significant stake in Dollar Tree because we believe the company’s transition to multiple price-points is still in the early innings and has not yet been properly reflected in its stock price. Management is not waiting for the market to take note. Since the first quarter, Dollar Tree has announced seven c-suite changes and seven new directors. We will have more to share with investors after the October Analyst Day with Executive Chairman Richard Dreiling.

Despite geopolitical challenges in eastern Europe and a surging dollar, which acts like a headwind against foreign earnings, shares of Philip Morris International returned 7% in the first half of the year. We recently outlined our investment thesis for the company at ValueX Vail, sharing our thoughts on Boomers and Millennials, ESG & Tobacco, and Disruptive Innovation & SaaS (Smokes as a Service). And, for an added bonus, we brought along packs of Zyn for attendees. That presentation is available here.

The largest detractors to performance during the first half of 2022 were: Madison Square Garden (MSGE), Meta Platforms (META), and Fiserv (FISV).

Madison Square Garden Entertainment shed 25% during the first half after gaining 18% in the first quarter. Despite adjusted operating income exceeding estimates, several key metrics surging above pre-pandemic levels, and broadly positive comments from management, investors hastily sold MSGE shares in the second quarter as they rushed for safety in the wake of the broader market’s accelerated downturn, indiscriminately punishing shares with limited liquidity and limited analyst coverage.

The only positive we can say about our investment in Meta Platforms is that we sold most of our position at significantly higher prices during the post-COVID rally. Unfortunately, we also bought some back after shares recorded their biggest drop ever following a terrible first quarter forecast. So while we missed a chunk of the stock’s 52% first-half decline, we did get to “enjoy” about half of the fall. Thankfully, the company formerly known as Facebook remained a relatively small position in the portfolio.

It is also the only “FANG” stock (or whatever we are calling them these days) we have recently owned, as every one of these companies, which represented more than a quarter of the index at their peak, fell significantly harder than the market. In fact, META’s decline was large enough that the company was added to several value indices during the year.[4] The setup today looks very similar to sentiment when we first established our position in 2018 during the Cambridge Analytica crisis. Then, as now, investor expectations soured alongside concerns of slowing top-line growth and rapidly rising expenses.

Despite those concerns, operating profit, which stood at $20 billion at FY17, is expected to surpass $33 billion this year in spite of analysts’ reduced expectations. While Reality Labs presents another wrinkle in the current story and future growth will almost certainly be slower, for investors to lose money in META today—when it is trading at 14x its likely depressed earnings–the company would need to fall far short of analysts’ already extremely pessimistic expectations. Although that outcome is possible, we believe we are being compensated sufficiently to take that risk.

Our large investment in Fiserv (FISV) was among our top detractors during the first half of the year, despite the stock’s relative outperformance. The share’s 14% decline through June was markedly better than the broader market and a fraction of the losses posted by the “sexy, rapidly-growing disruptors” we highlighted in our investment thesis, published with our year-end letter to investors. Silicon Valley favorites like Adyen (OTCPK:ADYEY), Square, and PayPal (PYPL) plummeted 40%, 62%, and 63%, respectively, during the six months ending in June.

In contrast, Fiserv reported better-than-expected growth and raised full-year guidance subsequent to quarter end, putting shares back in the green for the year.

PORTFOLIO COMMENTARY

At quarter-end, our top five investments in alphabetical order were Activision Blizzard (ATVI), Altria Group (MO), Dollar Tree, Fiserv, and McKesson. There were no material changes to the portfolio in the first six months of the year, with one exception, discussed below.

Many investors believe a lot of stocks are cheap after falling 40%, 50%, or more, and they are enthusiastically buying up stocks that are hitting “new lows.” Spoiler alert: most of these stocks remain overpriced, trading far above historical valuations and much too high to likely generate attractive returns. As such, we find it difficult to part with our existing portfolio companies, despite the growing inventory of “cheap” stocks.

Our companies are well positioned for the current environment and continue to trade at levels that offer substantial value. What’s more, what looks cheap today often turns out to be a value mirage. Cheap stocks can get much cheaper in a protracted bear market, so we have raised our hurdles and sharpened our pencils, as we wait for prices to come our way.

In challenging market environments, our pencils often gravitate towards event-driven situations that are less susceptible to fickle investor sentiment. We established one such position in the first six months of the year, which is currently a top-five holding. In January, we began accumulating shares of Activision, following Microsoft’s (MSFT) announced $68.7 billion all-cash acquisition, which valued the company at $95 per share. While we recognize the risk to Big Tech posed by increasing regulatory headwinds, we are confident we are being well paid for taking that risk and believe the odds of the deal closing are much better than the ~ 50% probability the market is currently pricing.[5]

In the context of an increasingly volatile investment climate, well-defined catalysts, like an acquisition, can provide a more predictable range of outcomes without depending on the vagaries of the market or the unpredictable mood of investors. As a result, these investments can decrease portfolio duration and volatility, reduce downside in bear markets, and provide attractive risk-adjusted returns.

We are by no means merger arbitrage specialists. In fact, I don’t think I’d call us specialists in any one thing. But if we can buy a good business at a fair price and are comfortable owning it should the deal fall through, then a merger represents just one potential path to profitability. If the deal closes successfully, we stand to make a healthy short-term gain with minimal market risk. If the deal fails–but we’ve done our homework on the company–then that path to profitably is simply extended over a period that is more consistent with our typical time horizon.

Our broad mandate is one of Broyhill’s core competitive advantages, particularly relative to peers trapped inside a single style box. That flexibility allows us to look across market segments for the most attractive risk-versus-reward opportunities. Most of the time, merger arbitrage does not rank high on that list, which is why it is not a permanent fixture in the portfolio. Like most corners of the market, merger arbitrage isn’t always attractive. In good times, deal spreads are narrow, and returns on offer are meager. As a result, downside risk is often far greater than the potential upside rewards. But in times of stress, when investors are unwilling or unable to take risk, forced selling drives spreads wider and prospective returns higher.

In difficult times, investors abandon the “outside view” for an “inside view.” Said differently, panic shortens time horizons and shines a spotlight on immediate risks rather than longer term probabilities. Fortunately for us, the outside view, informed by a statistical basis of past mergers and acquisitions, demonstrates that the overwhelming majority of announced deals are closed on their initial terms, despite temporary bouts of doubt and drama.[6]

It is during these temporary bouts of doubt and drama that we look to get involved. That’s precisely what is happening today, which is why we are doubling down on our efforts to uncover value in special situations, and we expect our allocation to event-driven investments to increase so long as market conditions cooperate. And while we wouldn’t call ourselves merger specialists, we have the experience and know-how to get the requisite due diligence done. In fact, some of our largest and most profitable positions at Broyhill have been event-driven situations established during similar periods of stress. The most recent example is our investment in Time Warner, which we initially discussedhereand later revisited in the following year’s annual letter.

MARKET COMMENTARY

We believe we have entered a new market regime. Over the past year, the investment landscape has shifted 180 degrees, from loosening liquidity to tightening financial conditions. The post-pandemic flood of liquidity–$5 trillion of deficit spending and another $5 trillion of balance sheet expansion–lifted asset prices to levels beyond comprehension, but that tide is now receding. The Fed left its foot on the pedal far too long, causing inflation to overheat. Now they have to gingerly tap the brakes to avoid spiraling out of control and also engineer a “soft landing” without causing the economy to screech to a halt. The only problem: there’s no such thing as a soft landing.

Further complicating this dilemma is the staggering size of the Fed’s balance sheet, which poses perhaps the greatest risk to financial stability. While central bankers have begun increasing short-term interest rates, the shift from quantitative easing to quantitative tightening hasn’t even begun and represents one the most extreme pressures on money and credit in generations. If the Fed is “successful,” the economy will be its next victim. And as liquidity is vacuumed out of the market, the most speculative assets are the most vulnerable.

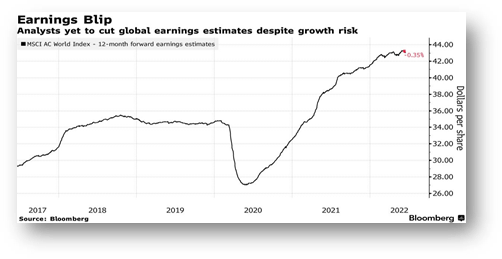

As we see it, markets are trapped in a catch-22. If stocks hold up, the Fed will continue increasing rates until something breaks. If the economy stalls, rate hikes may get put on hold, but stocks are likely to face more severe challenges. Against this backdrop, we see significant room for negative earnings revisions and disappointing margins given tightening liquidity, growing macroeconomic risks, bloated inventories, and increasing cost pressures. The market has yet to price in this likely lower path of profitability. Although valuations have corrected much of their previous excesses, earnings estimates have barely budged–in contrast to the typical 20% – 30% fall around previous recessions.

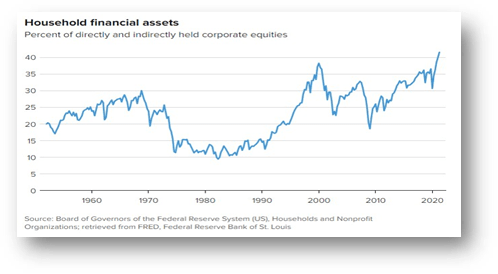

Perhaps the best upside argument for markets at the moment is that the first-half blood bath left sentiment extremely pessimistic and markets deeply oversold, setting the stage for the rally currently underway. Call us skeptics, but our View from the Blue Ridge remains suspicious at best. To start, there is still a massive disconnect between investor sentiment and actual positioning. So, while investors in aggregate may claim to be more bearish than usual, their actual behavior and collective bets on equities do not reflect those concerns. They still remain heavily invested in equities.

As is often the case, the simplest explanations are usually best. Last year, “investors” were paying $1.3 million for pictures of a rock, cab drivers were showing customers their $4 million Robinhood (HOOD) accounts, and for a couple weeks, SPACs were raising $3 billion per night, which is roughly equivalent to every dollar of US savings at the time.7 Did we really need somebody to ring a bell?

Even after this year’s severe beating, speculators are just as eager to call “the bottom” and buy the dip. In recent weeks, the number of Bloomberg stories about a “new bull market” increased roughly 10x.Retail investors are already jumping back on the wagon and doubling down on bets gone sour. In July, purchases of the most popular tech stocks by individuals hit the highest levels recorded in almost a decade. Leveraged funds tracking the tech sector remain among the most popular ETFs purchased by individual investors this year. [7] And the poster child for the most speculative corners of the market, the Ark Innovation ETF, has seen inflows every month this year, but June.[8]

We wonder how likely a market bottom is, if everyone still sees this year’s decline as a massive buying opportunity, simply because “everyone else is so bearish.” Common sense tells us that it’s more likely this cycle has a ways to go. Simply put, markets don’t hit their long-term bottoms when everyone is looking for one. Bottoms occur when the masses have truly given up, and there is no one left to sell. In contrast, investors today are still buying, household equity allocations remain near record highs, and bubble stocks still dominate traditional headlines, social media chatter, and Robinhood accounts.

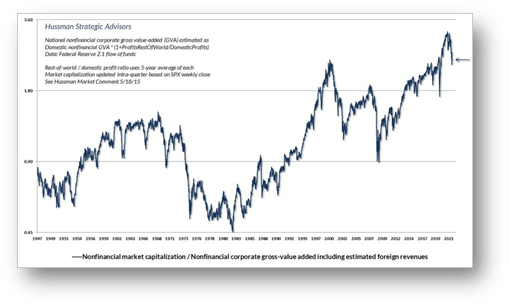

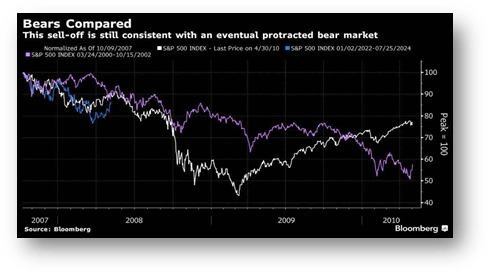

The uncomfortable truth is that a decade of stimulus on a level never before seen in history fueled speculation beyond the extremes of even 1929 or 1999, and all the recent sell-off did was take us back to those extremes. Given the magnitude of excesses on the upside, investors should not be surprised if markets were to overshoot to the downside. That being said, does this look like a bottom?

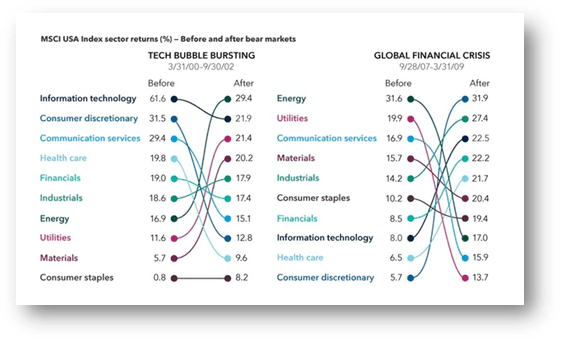

Market regimes evolve over a long enough timeframe that widespread beliefs become engrained in conventional wisdom. As a result, the consensus is still clamoring to buy the winners of the prior regime. Those beliefs were reinforced again and again over the last decade, making them even more difficult to change. They are so engrained that many investors simply cannot believe that sky-high profit margins and stratospheric valuations won’t return and be sustained indefinitely.

When regimes shift, leadership changes.[9]

Throughout financial market history, winners of the last regime have lost their luster, and made room for the new cohort. We expect this time shall be no different even if it takes several years for most investors to realize it.

We believe last decade’s cool crowd is likely to give way to a Revenge of the Nerds –an ascendance of cheap, boring companies with strong, recurring cash flow. What worked in the past won’t work in the future. Going forward, the drivers of returns will change. As one of our partners likes to remark, profits will once again be more valuable than promises.

Markets have taken their first step towards normal this year, but we still have a long road ahead. We believe we are well positioned for the difficult journey ahead and look forward to the return of fundamental investing.

Source: Capital Group

REVENGE OF THE NERDS

The pandemic may have been the spark needed to put the old regime to bed, as the preconditions for the current value cycle were put in place during the depths of COVID. Policymakers spent 3.5x more to rescue the economy from a pandemic than from a global financial crisis. US households received more than $1.5 trillion in stimulus, unleashing animal spirits at a magnitude never seen.

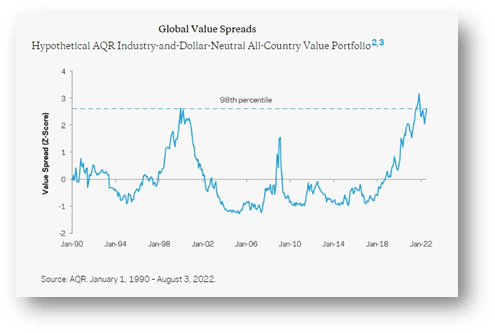

Extreme stimulus drove extreme performance of expensive stocks and created a spectacular divergence in valuation, as well as one of the most attractive opportunities for value investors in history.

Despite value’s recent outperformance, the valuation disparity between the cheapest and most expensive stocks remains near historical highs and double the long-term average. In other words, the opportunity set has rarely looked better for disciplined value investors.

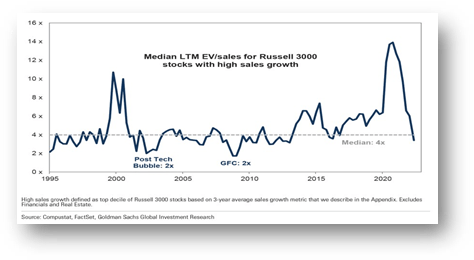

Even after this year’s brutal sell-off, the most expensive stocks remain wildly overvalued, trading at nearly 50x earnings, while the cheapest stocks currently change hands at mid-single-digit earnings multiples, the bottom of their historical range.

The recent gains enjoyed by value investors have barely managed to take global value spreads back toward levels last seen at the peak of the dot-com bubble.

There are still nearly 500 companies in the US with market capitalizations greater than $1 billion that lose money. More than a quarter of them trade north of 10x sales. While these stocks are less expensive than they were over the past few years, we would not call 10x sales cheap.

Valuations have fallen hardest amongst the fastest-growing “unprofitable growth” stocks, but these companies are likely to face additional challenges. The rising cost of capital and tightening financial conditions will make it difficult to raise additional funding. At best, this should cap valuation upside in the near term. At worst, these companies will struggle to remain solvent.

In our year-end letter to investors, we warned that reality was sinking in, but acknowledged that the more speculative corners of the market still represented tens of billions in value. “Tesla is still a trillion dollar business, Dogecoin is worth more than many companies in our book, and despite watching her flagship fund lose more than half of its value, Cathy Wood still manages more money than David Einhorn.”

It would seem that Market Karma is currently correcting some of these injustices. We are ~ 18 months into an ARK bear market that has seen the fund drop ~ 80% from peak to trough, yet as recently as June, the fund posted its longest streak of inflows in more than a year. Meanwhile, David Einhorn is still going around, cup in hand, even after posting the firm’s best relative performance on record. In a recent letter to investors, after reporting a couple of their best quarters in the history of the firm, Einhorn asks the question: does this mean value investing is back? His answer is worth republishing here:

We think the answer is still a resounding no. To be clear . . . it isn’t as if investors are now embracing value investing and pouring into value stocks. The community of disciplined value investors has shrunk considerably. Traditional long-only active managers have lost assets to index funds and have generally scaled back their research efforts.

Short sellers are significantly diminished and many have left the industry. The market is still dominated by . . . those that either will not (index funds), cannot (untrained novice investors) or choose to not (valuation indifferent professional investors) have valuation as a cornerstone of their investment processes. A lot of these investors have had a tough go of it during the current bear market.

We believe that part of the reason value stocks have fared better lately is because there is hardly anyone left to sell. Another factor may be that value stocks have become so cheap relative to the earnings of the underlying businesses, companies are able to buy back a large portion of their own market capitalizations.

There is hardly anyone left to sell. That’s when markets bottom. While that may accurately describe the environment for value investing, it couldn’t be further from the truth for the broader market. The average investor is still more worried about missing the rally than losing his or her shirt. The emerging narrative among those investors is that bad data is good news as it will prompt dovish central banks to reverse the course led by the Powell Pivot. Call us skeptics, but we aren’t buying it.

The NASDAQ saw seven rallies greater than seventeen percent from 2000-2002. Some gained as much as 40% – 50%. Yet every single one of them was followed by lower lows, and ultimately the tech-heavy index declined by nearly 80% from peak to trough. On several measures, recent extremes make 1999 look like amateur hour. Many investors, however, were eager to call the bottom after the NASDAQ’s recent 20% rally–just the first of this cycle. We think they have a long road ahead of them. The beatings are likely to continue until the retail speculators throw in the towel and completely capitulate. Or when there is hardly anyone left to sell.

BOTTOM LINE

We have built Broyhill to thrive in challenging environments. Everything we do is laser-focused on one goal – protecting your capital. Simply put, this is where we earn our keep. We are proud of this year’s results, but are not resting on our laurels. We got a lot right this year, but we’ve also had our share of mistakes. The upside of mistakes is that they encourage humility, while driving the team to remain open-minded, consider all potential outcomes (which is never possible), and above all else, maintain a beginner’s mind and child-like curiosity.

While the recent rally has prompted many to rush back into the water, we see plenty of risks lurking beneath the surface. As much as we might like to jump in with everybody, we just don’t see current conditions warranting such a leap of faith. Diving headfirst into the shallow end rarely ends well.

We are as excited about the developing opportunity set as anyone else, but we will remain patient and disciplined in putting our capital to work. In the meantime, we continue to re-underwrite the portfolio regularly, pruning our book as assumptions evolve and increasing liquidity so we are well positioned to move aggressively when the water is just right. This too shall pass, and when it does, the seeds planted during these challenging times should produce a healthy long-term harvest.

We are grateful for your continued trust and partnership. We come into the office each day striving to earn it, and we realize just how fortunate we are to have such a wonderful group of like-minded, long-term investors who place their confidence in us. You enrich our network, strengthen our competitive advantage, and just make our work all the more enjoyable.

ORGANIZATIONAL UPDATE

As if the current bout of volatility wasn’t enough, we’ve had several exciting organizational updates that we’d like to share with you. In our last letter, we noted our decision to outsource BAM’s back and middle office operations to Agile Fund Solutions, as well as our search for a new Chief of Staff. Well, it’s been three months since Pam Reid joined the team, and we could not be more thrilled. Pam is a leadership professional who brings more than two decades of experience in organizational process and business operations to Broyhill.

Most recently, she served in higher education managing operations and finances for the McColl School of Business at Queens University of Charlotte. While vetting Pam and other candidates over several months, I was told by one reference that, “she will be the best hire you’ve ever made.” Somehow, I think they may have undersold her. When talking to colleagues about the contributions she’s already making to the team, the most common response is, “I need a Pam!” My typical reaction: “Get your own!” Pam has already spoken to many of you, and I trust you will enjoy working with her in the years ahead.

In the meantime, please feel free to drop her a line to introduce yourself. She can be reached at pam@broyhillasset.com or 828.610.5535.

We are equally excited to introduce you to a new addition to our investment team. Olivia Guillebeau recently joined us from Bank of America. I have known Olivia since she was a student at Appalachian State University and competed in the Global CFA Institute Research Challenge. While the “Broyhill Fellows” have won the North Carolina competition all but one of the ~ dozen years I’ve served as their mentor, Olivia’s team was the first to move onto the Global Finals after winning the Americas’ Regional Championship for ASU. Olivia’s leadership and passion for discovering truths which others choose to ignore, drove her team to a top five finish in the world. We know she’ll have an equal impact at Broyhill.

And last but not least, as we expand our roots beyond our origins as a single-family office, we have made some changes to the ownership structure of Broyhill Asset Management, which are reflected in our updated Form ADV. And with a little luck, the next time we write to you, we will be doing so from our new Charlotte headquarters. As a proud Trent Walker (Vince Vaughn) once told the Mike Peters (Jon Favreau), “Our little baby’s all grownup!”

As always, please feel free to reach out any time with questions. We enjoy hearing from you.

Sincerely,

Christopher R. Pavese, CFA

Right now it’s kind of sunny, things are doing fine, everyone thinks the Fed can handle it. That hurricane is right out there down the road coming our way. We don’t know if it’s a minor one or Superstorm Sandy. You better brace yourself. – Jamie Dimon

APPENDIX: BROYHILL INVESTMENT STRATEGIES

Over the years, we’ve occasionally gotten questions from friends and colleagues regarding our willingness to manage outside capital. Because we were founded as a single-family office nearly half a century ago, it’s understandable why people may be uncertain.

We have preferred slow and steady growth, carefully selecting the right clients rather than gathering assets as quickly as possible. Our business has grown at an equally measured pace. We began managing external capital via SMAs mirroring our internally managed equity portfolio. In addition to last year’s launch of our opportunistic credit fund, we recently made additional strategies available to investors, so we thought it would be helpful to provide a quick summary of our offerings here.

THE BROYHILL TACTICAL EQUITY PORTFOLIO

Our Core Equity Portfolio is our flagship equity strategy that mirrors the internal portfolio managed for the Broyhill Family. The approach is concentrated, opportunistic, and benchmark agnostic. As a result, we don’t seek to track or outperform an arbitrary benchmark but rather aim to generate attractive long-term returns with lower risk than broader equity indices. To do this, we periodically employ options and hedges to manage downside risk and often hold large cash balances, which damper volatility and provide optionality on tomorrow’s opportunities.

Our flagship equity portfolio’s risk/reward profile is more similar to a classic hedge fund than a long-only index. Less the two and twenty. Relative to our hedged peers, we offer higher returns with similar downside protection, greater transparency, increased tax efficiency, and lower fees.

THE BROYHILL EQUITY PORTFOLIO

For clients with a greater risk tolerance or allocators who prefer to manage cash themselves, we recently launched a fully invested version of our core equity portfolio, allowing investors to better align their exposure with their own needs. After learning of the demand for a strategy with greater market exposure from several institutional investors via platforms like Envestnet and Adhesion, we decided to make it available to existing investors through our separately managed accounts.

Importantly, this new product will invest proportionately in the exact same securities as our flagship strategy, grossed up to 100% equity exposure. As a result, it does not require additional resources from the investment team, and trading is largely automated alongside our core equity strategy.

THE BROYHILL BALANCED PORTFOLIO

While many investors look to Broyhill for our conservative approach to equity investment, others have all or most of their net worth invested with us. For these investors, we offer the Broyhill Balanced Portfolio, which combines our equity strategy with additional asset classes to provide greater diversification and exposure to alternatives. The strategic equity exposure of our balanced portfolio is 50% and will range from 25% to 75% based on the opportunity set.

The strategy leverages our robust network and long history of allocating to external managers to provide clients with exposure to niche investments like closed-end funds, targeted allocations to emerging market equities, and various alternatives to complement a long-only portfolio.

THE BROYHILL QUALITY INCOME PORTFOLIO

Broyhill Quality Income is a low turnover, concentrated portfolio of quality businesses with strong balance sheets and sustainable, growing dividends. After incubating the portfolio internally for some time, we recently made the strategy available to external investors seeking to generate additional income in a world starved of yield. With asset prices at all-time highs, yields at all-time lows, and risk of rising inflation, Quality Income offers clear benefits relative to a passive equity allocation and is an attractive alternative to bonds.

The strategy is designed to appeal to investors who wish to limit their market risk while maintaining exposure to equities; are seeking a tax-efficient alternative to bonds and other income-producing options; are concerned about the impact of inflation on income-generating assets; and who want global diversification to complement their domestic equity exposure.

THE BROYHILL ALTERNATIVE INCOME PORTFOLIO

The Broyhill Alternative Income Portfolio is designed for investors seeking alternatives to near-zero yielding cash and equivalents. We think the strategy is extremely attractive for investors with cash on the sidelines, hesitant to dump it into stocks at all-time highs or into bonds with yields at all-time lows.

The strategy aims to minimize the risk of a continued rise in interest rates – which could quickly wipe out any income gained through bonds via principal losses – by utilizing a conservative and balanced approach, diversifying risk and sources of income across multiple asset classes (rather than simply sticking money in a plain vanilla bond fund). As a result, the portfolio offers higher yields with less interest rate risk than a conventional fixed income portfolio.

BAM CREDIT OPPORTUNITIES FUND

For decades, Broyhill has cultivated and nurtured relationships with external managers, completing rigorous due diligence and selectively investing only with partners we deem best-in-class. In 2021, we took the first step in providing investors with direct access to some of these external managers.

The BAM Credit Opportunities Fund leverages the hybrid approach to investing employed by Broyhill for a generation, whereby investments in niche external managers are complemented by direct investments in stressed and distressed credit. The fund is currently closed to new investors, but we anticipate launching similar hybrid funds in the future. Stay tuned.

If you’d like to learn more about investing with Broyhill, please contact us at info@broyhillasset.com.

Footnotes

[1] Since inception, the Broyhill Equity Portfolio has captured roughly three quarters of the market’s downside during down months, and more than 100% of the upside in up months.

[2]The Few Mutual–Fund Managers Who Avoided the Debacle

[3]College Endowments Post Biggest Losses Since Financial Crisis

[4]Facebook, Netflix and PayPal Are Value Stocks Now

[5]Microsoft–Activision Deal Doubt May Yield Big Reward

[6]The Inside View and Making Better Decisions

[7]Individual Investors Ramp Up Bets on Tech Stocks

[8]Revival of Bear Market’s Laggards Shows Perils of July Rebound

[9]Braving Bear Markets: 5 Lessons from Seasoned Investors

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment