ollaweila/iStock via Getty Images

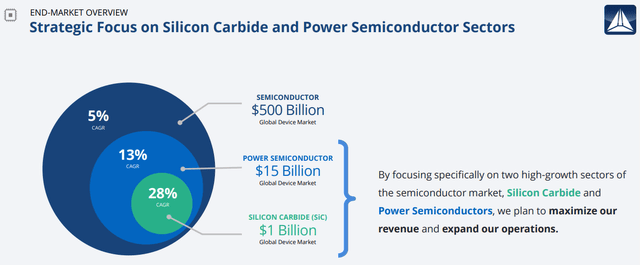

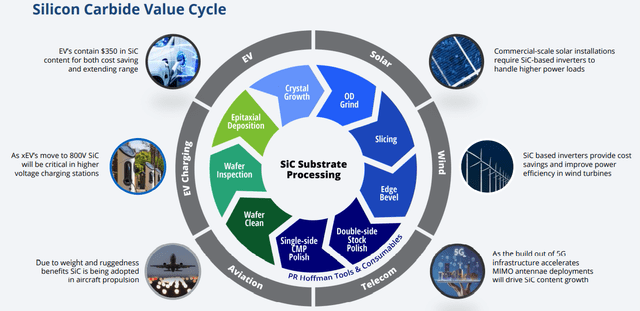

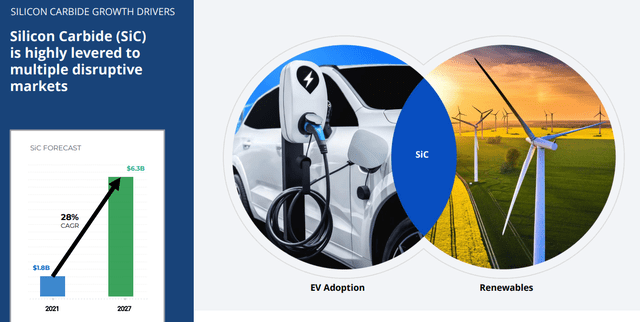

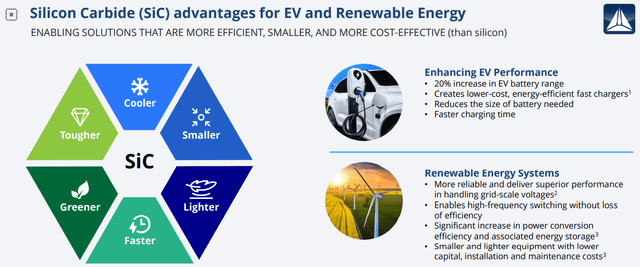

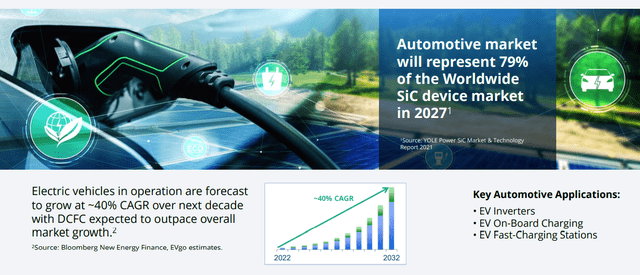

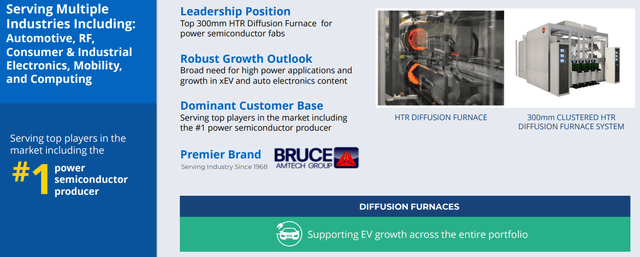

A companion pick to my CVD Equipment (CVV) play in silicon carbide production equipment is Amtech Systems (NASDAQ:ASYS). Amtech is set to grow rapidly selling the equipment necessary to charge our electric vehicle [EV] growth future. Not only are global shortages of lithium, nickel and other metals for batteries all but assured moving forward, but inventions utilizing processed silicon carbide (to speed high-voltage charging stations and upgrade semiconductor parts inside autos) will be required in far greater quantities each year.

The good news for investors is both CVD and Amtech are still relatively undiscovered players in this high-growth semiconductor field. Both have super-strong balance sheets with plenty of cash, and both are prepared to increase production of silicon carbide critical equipment rapidly.

Essentially, my buy thesis is based on and enterprise value to forward projected earnings yield approaching 18% over the next year, with the potential to double and triple over the following 2-3 years. Where else can you find a similar bottom-line return on capital, with a supercharged growth catalyst in EV adoption?

The Business

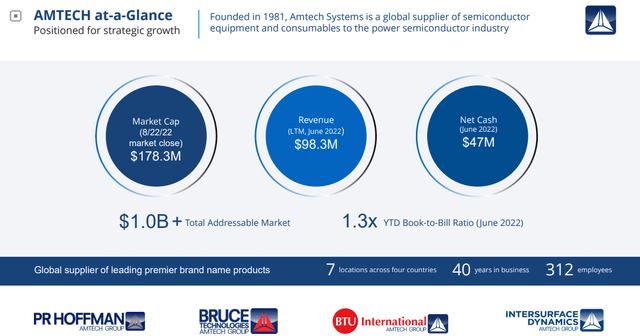

Below are slides taken from the company’s September Investor Presentation, describing the foundational business setup and ramping growth future. The company sold a building asset in 2022 to raise cash for expansion. Total cash held in June represented almost 40% of the current $125 million equity market capitalization at $9 per share. And, current assets including cash are a good $65 million better than total liabilities, meaning the share quote is roughly 50% backed by a very liquid net worth! In comparison to 2x liquidation value, most semiconductor-related business are still selling at equivalent ratios above 5x today, despite the dramatic bear market selloff this year.

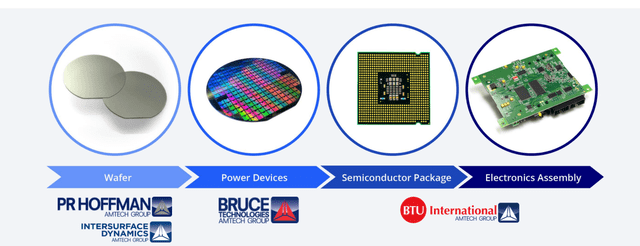

September 2022 Investor Presentation September 2022 Investor Presentation September 2022 Investor Presentation September 2022 Investor Presentation September 2022 Investor Presentation September 2022 Investor Presentation September 2022 Investor Presentation September 2022 Investor Presentation September 2022 Investor Presentation September 2022 Investor Presentation September 2022 Investor Presentation

Bargain Valuation Story

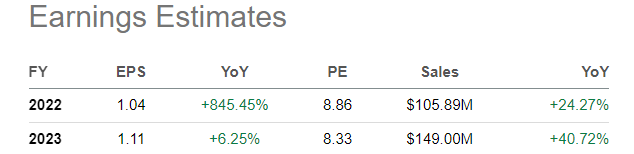

The bear market in tech stocks during 2022 has suppressed the price for Amtech, possibly opening a tremendous buy opportunity since late summer. If the silicon carbide marketplace evolves like management and Wall Street analysts assume, this investment could be one of the top PEG choices available on Wall Street right now (price to earnings divided by earnings growth rates). Moving from flat income generation in 2021, to solid profitability this year (excluding the building sale gain), EPS of $1.11 is estimated for 2023.

Seeking Alpha Table – Amtech Analyst Estimates for 2022-23, November 17th, 2022

And, if silicon carbide demand explodes as expected past 2023, EPS growth many not have an upside limit for many years. Who knows, Amtech could be about to grow revenues 40%+ annually for a solid 5-10 years straight.

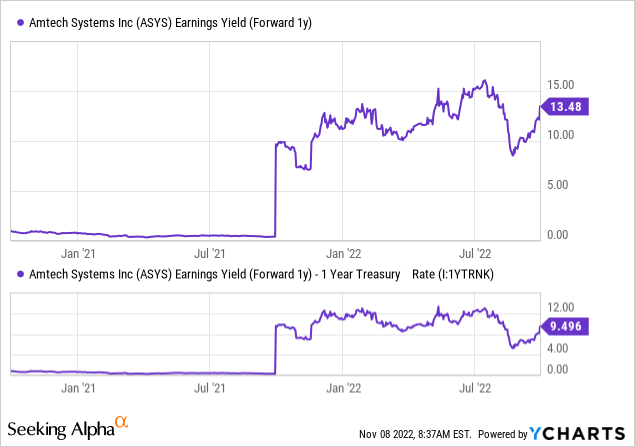

However, for now, we can quantify a likely strong showing for profits into next year. Below is a graph of the 13.5% earnings yield available for investment, which is a monster +9.5% positive spread vs. 1-year Treasury rates of 4% today. The opposite of last year’s overvaluation argument in Big Tech, where earnings yields were exceptionally low vs. rising inflation and interest rates, Amtech can be purchased with solid earnings and cash returns vs. the underlying worth of the company right now.

YCharts – Amtech, Forward Projected Earnings Yield, Since November 2020

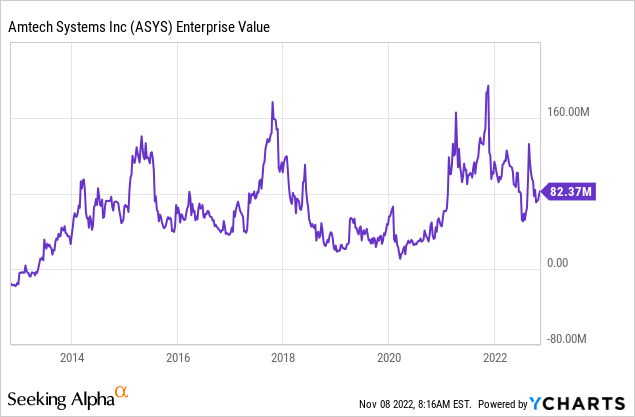

Plus, when we adjust the value of the whole company for cash already held in bank accounts, a single owner in a buyout situation could pocket an earnings yield closer to 18%, a good +14% above risk-free acceptable Treasury rates ($15 million in future 2023 after-tax profits vs. $82 million enterprise value).

YCharts – Amtech, Enterprise Value, Since 2012

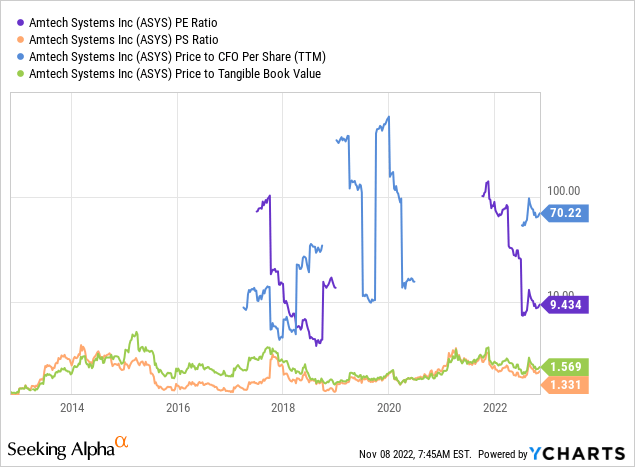

Equally cheap, almost irrationally so, is the company’s valuation on trailing fundamental results. Despite one of the best growth arguments I can find for any stock, price to trailing earnings, sales, and tangible book value are below 10-year averages. And, cash flow numbers look set to improve markedly in 2023. All told, if the immediate growth in sales and earnings meet current projections, the valuation now is honestly the lowest since 2018’s $4 quote.

YCharts – Amtech, Price to Trailing Fundamental Ratios, Since 2012

Technical Momentum Building

Beside the price to growth valuation and solid balance sheet setup, another draw for me to buy shares is the chart pattern. Momentum indicators are becoming increasingly bullish, pictured on the 18-month chart of daily price and volume changes below. For starters, how many other semi names are trading around both their 50-day and 200-day moving averages? Any type of upmove puts price above both in coming weeks, while both could be turned into uptrends with price above $10 in December.

Perhaps the most bullish technical argument is the low 14-day Average Directional Index reading, a sign of supply/demand balance in recent weeks. Past ADX lows under 15 (circled in blue) have coincided with great entry points before short-term swings higher for investors. If history repeats, Amtech could be ready for a strong advance into the spring.

In addition, the Accumulation/Distribution Line (green arrow) and Negative Volume Index (red arrow) have been in nice intermediate-term uptrends since the summer of 2021. Extensive buying on weakness could be the signal we are getting from an upsloping NVI since April 2022 (buyers outstripping sellers on slower volume trading days).

StockCharts.com – Amtech with Author Reference Points, 18 Months

Final Thoughts

Although I am not very optimistic about the overall market direction in coming months, the upside potential for Amtech vs. somewhat limited downside (looking at its superb balance sheet) is worthy of ownership in November 2022. I have a small stake and may add to it over time.

What are the risks holding Amtech? Good question. The company’s minor, almost microcap size should convince retail investors to hold only a minor position in portfolio construction. Volatile swings in price are normal for Amtech. I am modeling a worst-case scenario in a deep recession (which downshifts EV growth) to $7 per share, this year’s low trade. At that level, the company would be selling at a minor $50 million in enterprise value. How much lower can it realistically go if sales are growing and earnings are positive.

What’s the upside? For sure, new modern price highs closer to $20 could be reality in 2023. If the company is earning $1 per share, with sales expanding 40% annually (as EV-manufacturing explodes in 2023-24), a P/E of 20x and sales ratio under 2.5x seem quite conservative to me.

So, we have a best-case upside forecast of +100% over the next 12 months vs. downside of -30%. I cannot come up with any logical argument to avoid this bullish setup. So, I rate shares a Strong Buy, as a double or more in the stock quote may be the only way forward, as the path of least resistance.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment