Abhishek Chinnappa/Getty Images News

In a previous article about Netflix (NFLX), I warned that the biggest risk facing Netflix was FX:

The biggest risk currently not priced into NFLX is the sharp rise in the dollar that took place during Q2 of 2022. That increase means that Netflix will almost certainly miss its numbers due to FX.

And while the stock did react positively to q2 earnings on better-than-expected subscriber losses, Netflix did miss on revenue:

Netflix missed on Q2 revenue mainly due to FX (seeking alpha)

The company was unequivocal in its letter to shareholders on the reason for its q2 quarter miss and lower guidance in q3:

The US dollar continues to strengthen meaningfully against most currencies at a historic pace, with the Euro recently falling below the US dollar for the first time in two decades, a significant headwind for all multinational US companies. We have high exposure to this unprecedented appreciation in the USD because nearly 60% of our revenue comes from outside the US and swings in F/X have a large flow through to operating profit as most of our expenses are in USD and don’t benefit from a stronger USD. Our Q3 revenue growth forecast of 5% translates into 12% year over year revenue growth on a constant currency basis.

In the conference call, CFO Spencer Neumann touched on the importance of the topic:

Other than the strengthening U.S. dollar, which I’m sure we’ll talk about it affects multinationals around the world, our revenue was in line with guidance.

The interesting thing for me is they didn’t talk about it as Neumann predicted. It came up later in the call in the context of margins. Throughout Q2, executives from multinational companies have been keen to discuss the surge in the US Dollar, but analysts and reporters in general prioritized other matters.

Following Q1 earnings, Salesforce Inc. (CRM) CEO Marc Benioff couldn’t stop talking about the rise of the Dollar.

In Q1 earnings call on May 31 he said:

Turning to our revenue guidance. Well, as I mentioned, the presented foreign exchange volatility. It increased the year-over-year headwinds by an additional $300 million for a total of $600 million for the year since we first gave you guidance in our Investor Day. To give you an example, I was in Japan for the first time since the dynamic a couple of weeks ago, I mean it was 2 weeks ago. And I couldn’t believe the decline in the value of the end. It was a very good time to be a tourist in Japan. But I called our team, I said, — this is great to be a tourist in Japan, but it’s going to have implications as we roll this revenue up from the Japanese market to our U.S. dollars. And in fact, our Japan revenue in the fourth quarter faced a 12% headwind year-over-year, just the end historic fall, something I’ve just never seen.

On the same day with Jim Cramer, he mainly focused on the Dollar:

I’ve never seen the strength of the dollar like this

Roughly a week earlier in Davos with Sara Eisen, he also focused on the dollar

I saw Snap didn’t have a great quarter, but you know who had a great quarter? the Dollar…and so when you look at what’s happening with the Dollar against the Yen, the Dollar against the Euro. You look at these exchange rates wow! the dollar is having a great quarter since the second week of March. and it’s all anchored to these interest rates.

Despite his concern, the stock jumped 10% on the earnings announcement. The analyst notes covered by Seeking Alpha since the earnings (here, here, here, here, and here) didn’t even mention foreign currency exchange rates in passing.

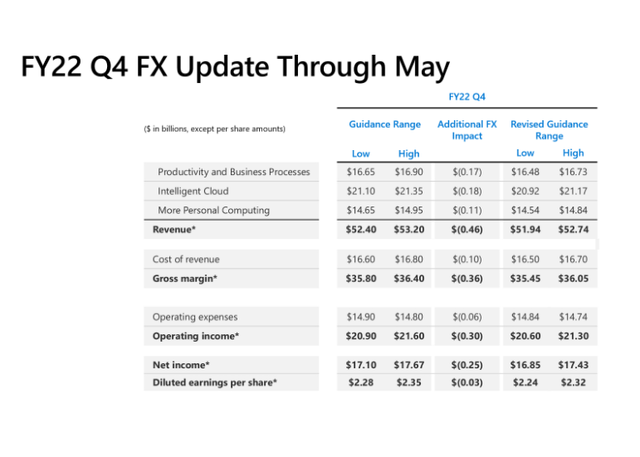

Microsoft lowered its guidance for Q4 on June 2 to reflect the impact the US Dollar has had on its financials during the quarter.

FX drags Microsoft’s sales and earnings (Microsoft)

The company then missed its updated guidance, again as a result of FX, highlighting the volatility of exchange rates so far this year. FX impacted revenue by $595 million, compared to $460 million they expected less than a month before the quarter’s close.

Alphabet Inc. (GOOGL) also missed on revenue and earnings in Q2. CNBC reported that CFO Ruth Porat said that currency fluctuations from a strengthening dollar knocked 3.7 percentage points off revenue growth, adding that the strength of the dollar will hit next quarter’s results even harder.

Porat said the outlook was full of

uncertainty in the global economic environment.

Yet the stock was up meaningfully following the earnings announcement.

I think it’s totally understandable that investors want to revel in the fact that earnings have held up well so far after months of worries over a recession. But I believe investors should also consider the risks posed by the higher dollar in order to make well-informed decision rather than rush to buy the dip on the premise that they got an all-clear signal to do so.

What’s the Big Deal with FX?

A fair counter-point is that executives talk about FX all the time and so analysts are justified in their position not to focus on them this time. What I would note is my position isn’t that FX are important this time due to the lost revenues, but because they could be a prelude to further troubles in Emerging Markets that could lead to contagion and affect US equities as well.

In fact, the crisis in Sri Lanka is strongly related to the warning made by mega-cap companies. This from a Seeking Alpha article on Sri Lanka’s situation:

In a span of just two years, Sri Lanka’s foreign currency reserves went from $9.2B to just $50M, which is not enough to even cover one day of the country’s imports. Daily rolling blackouts are also shutting down businesses and many are fearful of a return to chaos not seen since the three-decade civil war from 1983 to 2009.

While Sri Lanka’s crisis could like its look unique to the country, it is a common story that occurs whenever the US Fed enters a hiking cycle, and that’s the crucial distinction about the current warning over FX; it is more likely to spread to other countries, affecting political, financial stability, and as a result the global economy. A famous case of this is the Asian Financial Crisis. Now stocks in 1997 roared higher, but that was mainly due to booming growth in the US and the swift economic recovery of those companies. It is unclear however how stocks could react in the face of a similar scenario when growth in developed markets is already slowing down markedly.

I’m not saying that this scenario is inevitable, but merely pointing out that investors should look to incorporate the possibility of such a scenario and reflect it in their equity positioning instead of buying the dip on better-than-feared earnings results. There are reports today that Bangladesh is joining a growing list of companies seeking help from the IMF as they battle with the impact of the rising dollar. While the majority of these companies have small economies that are inconsequential to the global economy, it is an early sign that the dollar growth is starting to affect consumer health. For multinationals like the ones discussed earlier and others, this could mean that FX could turn from being a drag on growth to a driver of negative revenue growth of the Dollar keeps rising.

The (somewhat) good news for investors is that Emerging Markets can provide an early indicator to whether the Fed can pull the economy into a recession or not. My opinion is that if the US economy will go into a recession (a real one that sees not just negative growth for a couple of quarters, but higher unemployment and worse spending and consumer balance sheet health), Emerging Market countries will have probably already been in one. In fact, I would go as far to say that (at least for stocks) returns will depend on 1) whether Emerging Market countries experience a financial crisis. 2) How fast they recover from it.

Mohammed El Erian’s FT column highlighted four risks facing emerging markets. Investors would be well advised to keep an eye on them:

systemically important central banks, led by the Federal Reserve and the European Central Bank, will be able to battle inflation without tipping their economies into recession; that inflation itself will not prove sticky; that more “tourist investors” who have ventured well beyond their normal habitat (and benchmarks) will not take flight; and that the internal social and political fabric of countries will be able to absorb a significant hit from prices of food and necessities.

What to Do?

Since the issue is mainly with the rising US Dollar, companies that sell in US Dollar and buy in foreign currency might do better than multinationals. Companies that have a heavy presence in the US can do better. It might sound counter-intuitive given the negative headlines recently, but Walmart Inc. (WMT) is the type of company that fits the bill. The issue it has is in the growth of its costs in the US. It is possible however that these cost pressures are now priced-into the stock. Telcos like AT&T Inc. (T) and Verizon Communications (VZ) can also prove to be reliable options given their dividend. Emerging market companies such as Reliance Industries and Reysas Tasimacilik ve Lojistik Ticaret A.S. (OTCPK:RYSKF) are probably best positioned given they do a lot of business in US Dollar while their costs are in local currencies.

The main thing for investors to do however is to be honest with themselves about the risks they are willing to endure if they buy today, and adjust their position sizes accordingly.

Be the first to comment