Jonathan Knowles

Shares of eye specialist Ocular Therapeutix (NASDAQ:OCUL) have risen by 60% since my June 2019 Buy recommendation yet have fallen by over 20% since my May 2020 update. So far in 2022, shares have lost a quarter of their value.

My good friend Doug on Biotwitter suggested I revisit this platform technology play given its attractive investment profile via multiple shots on goal and high optionality via upcoming wet AMD readout.

$400 million market capitalization (sub $300 million enterprise value) looks attractive relative to the size of the wet AMD market ($10 billion in expected sales by 2024) and penetrating even a small percentage of the opportunity would be meaningful for a company of this size.

Let’s dig deeper to see if they legitimately have a shot at success or whether this enterprise is too speculative for us to invest in.

Chart

Figure 1: OCUL weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see shares peak above the $22 level back in late 2020. From there, shareholders have been long suffering as the stock declined below $4 and bottoming during the summer. Recently shares have rebounded slightly to $5 and my initial take is that given revenue growth is reaccelerating and material catalysts are approaching, readers interested in this name would do well to accumulate dips in the near term.

Overview

In my prior update piece, I highlighted the following aspects of our bullish thesis:

- I stated that the company’s principal focus was the commercial launch of its first drug (Dextenza). Its intention and value proposition are to make drop therapy obsolete, using a hydrogel-based platform to eventually cover all indications for which drops are currently prescribed. The same goes for conditions that call for an injection to the back of the eye (i.e. current VEGF therapies). Ocular essentially invented a new route of administration (intracanalicular inserts and intracameral injections) – the procedure of insertion of Dextenza shows it’s very rapid and easily accomplished.

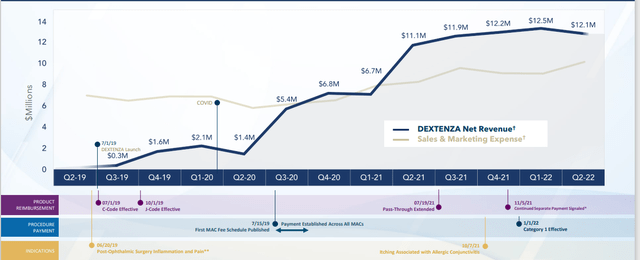

Figure 2: Dextenza sales growth in the “buy and bill” space (Source: corporate presentation)

- Sizing up just the initial market opportunity, management had stated that there are around 8 to 9 million total prescriptions of steroids and 6 million surgical prescriptions for topical steroids (for the latter, Dextenza is indicated for all of those). In total, 4 million of those scripts are for cataract surgery and half fall under Medicare part B. While Ocular Therapeutix is a small company, keep in mind that 60% of the annual 2 million Medicare Part B surgeries take place in around 900 surgical centers (top doctors do between 2,000 and 3,500 surgeries per year). Management stated that if the company gets the product of these high-performing doctors’ protocols, that could mean $2 million to $3 million income per year for one doctor. Ultimately, it appeared that peak sales potential of Dextenza in the post-cataract setting could fall anywhere between $150 million and $250 million.

- As for back of the eye programs, I noted that the OTX-TKI phase 1 study continues (dose escalation) and would give us an early read on efficacy. Animal data showed action of the drug up to 12 months with continued effect (if replicated in humans, would be a significant catalyst in my opinion). I pointed out that Kodiak Sciences (KOD) was valued at nearly $3 billion based in part on lead candidate KSI-301 (objective in DAZZLE pivotal study is to bring nearly all wet AMD patients to an every 3-month durability interval).

- OTX-TIC (intracameral injection) represented another source of potential upside, with the phase 1 study in a third therapeutic dose cohort with goal of providing six months sustained release of travoprost. A fourth cohort was planned as well with a slightly smaller implant. Interim data showed clinically meaningful lowering of IOP with duration of therapy out to 13 months (implant biodegraded by seven months).

Figure 3: Pipeline (Source: corporate presentation)

Let’s flash forward to my notes from the HC Wainwright presentation to determine how the story has progressed here.

Webcast Notes

CEO Anthony Mattessich starts by noting they are working to make eye drops obsolete and also working to make immediate-release injections into the back of the eye a thing of the past. They believe that finding better ways to deliver effective medication to the eye results in happier patients and better health outcomes.

In the case of eye drops, compliance is exceptionally poor so medication does not get where it needs to go and treatment benefit is not realized. They are developing medications to address ocular surface diseases like dry eye disease and allergic conjunctivitis and also treat conditions inside the eye like glaucoma. I really like the statement where CEO presents value proposition as bridging the gap between what effective molecules are able to achieve in clinical trial settings and what they actually achieve in the real world.

Immediate-release injections in the back of the eye lead to poor outcomes including risk of infection (also high levels of anxiety lead to missed visits and potentially permanent loss of vision).

Business model is to sell the products they develop so they can invest the cash flow in future products. “Buy and bill” products are doctor-administered and take the patient out of the equation, thus ensuring compliance and leading to better outcomes. Thus, commercialization ends up being more efficient and products developed can (theoretically) rapidly achieve positive contribution and fund the future.

Dextenza is the initial proof that this business model is workable. Dextenza is the world’s first approved drug-alerting intracanicular insert and is simply a better way of getting steroid to the ocular surface without the need of preservatives. Dextenza is a medical benefit with an associated procedure code, which involves significant benefits including improved patient outcomes and economic benefits (no co-pay so patient pays nothing out of pocket). Doctors receive separate reimbursement and a margin of up to 6% on the average selling price as well as volume-base rebates. These attributes have led to a quickly profitable launch (Figure 2 above). Lines cross within 5 quarters of launch and backdrop of picture is Covid pandemic which adversely affected customers’ ability to perform elective surgery and staffing levels. Dextenza will deliver much more rapid return in the future as markets return to normal post pandemic.

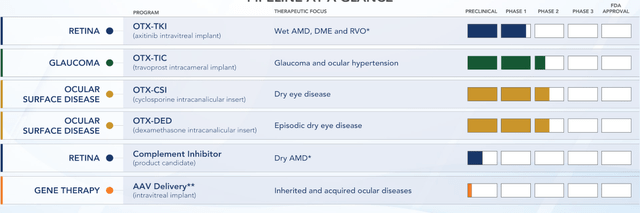

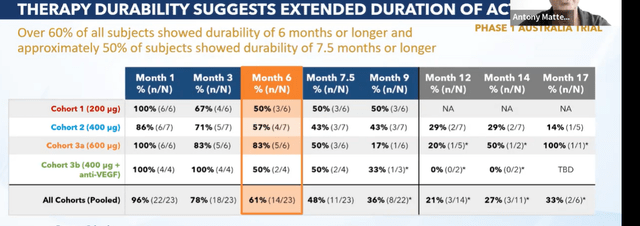

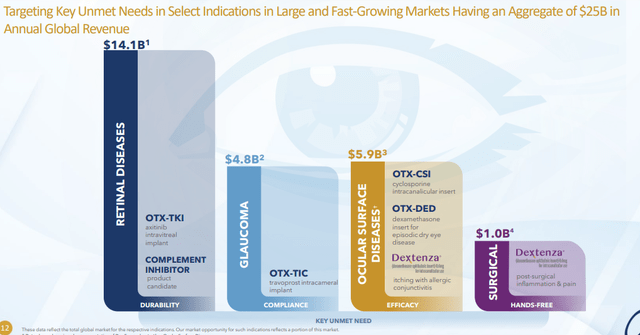

Pipeline consists of products that have the potential to become standard of care in indications currently worth over $25 billion in annual global net sales revenue. They have 4 assets in clinical development and 2 high impact programs in preclinical development. They begin with the end in mind including key unmet need of the patient (market driven and scientifically enabled). Retinal disease is the largest opportunity by far, especially wet AMD where Eylea is the key player (durability clearly drives the market and will determine who gets greatest market share). Ocular Therapeutix’ goal is to move standard of care from 3 months between injections to 6-9 months between injections. Challenge is to deliver 6 to 9 months of active ingredient and fit that amount of drug in a single depot that can be administered via 25 gauge or narrower needle (wider gauge increases trauma to the patient and multiple inserts can negatively affect vision). OTX-TKI incorporates axitinib (10 fold more potent than any other TKI) to achieve this goal. Second major ingredient is the polymer (proprietary hydrogel that has been used in over 5 million patients to date and has not demonstrated potential for inflammation). Goal of the polymer is to do its job and then quickly resorb leaving no build up or space junk behind in the eye. OTX-TKI is the perfect combination of potency and polymer with potential to compete effectively if it makes it to market. Monotherapy in patients with active fluid at time of entry was done in Australia study (putting drug in worst possible situation in most difficult kind of patients). 200 microgram cohort saw fluid stabilize in some patients, 400 microgram cohort showed complete resolution in some cases and 600 micrograms saw more consistent set of responses. Of particular interest was the way OTX-TKI worked on patients previously naive to anti-VEGF treatment. Important subgroup data is expected at an upcoming conference.

They also showed significant durability including rescue-free rates at month 6 in all cohorts above 60% and rescue rate in 3A 600 microgram cohort above 80% (sole subject rescued with just 1 injection). Rates for trials involving current anti-VEGF therapy often have expected rescue rates of that magnitude in their clinical studies (important from regulatory standpoint).

Figure 4: Extended durability observed for OTX-TKI (Source: corporate presentation)

In summary, OTX-TKI was well-tolerated and they became the only company to demonstrate signal of clinically meaningful decrease in retinal fluid as monotherapy. They also found they could extend durability of benefit and polymer behaves as intended (consistently bio-absorbed and not affecting vision). Current phase 1b study in the US is looking at OTX-TKI in a more traditional way (in subjects dried out with anti-VEGF induction phase and then dosed with OTX-TKI given once at baseline or Eylea every 8 weeks). This is a much easier to treat population than the prior study with much easier ask for the product (goal of maintaining already dry patient in a dry state, which is how the product will be used as a maintenance study). Soon they will unmask the study and complete the data set (September 30th presentation at AAO). This is the most important moment in the company’s history to date.

Figure 5: Market opportunity broken down by disease & indication (Source: corporate presentation)

Quickly on to the $5 billion glaucoma market, the primary unmet need is more reliable patient compliance. For some reasons patients simply don’t take the product which results in permanent vision loss. OTX-TIC will be injected by the treating physician on at least 6 monthly interval taking patient noncompliance out of the equation and preserving their vision. They are highly confident the product will lower intraocular pressure and have extended durability. Key factor will be maintenance of corneal health to be able to dose chronically. This product candidate gets less attention than OTX-TKI, but management believes it has higher probability of success. They are currently enrolling phase 2 study using two doses and two different formulations versus active control. They are looking for clues to determine whether possibility of redosing is something they can reasonably expect and so far it looks to be the case.

Moving on to ocular surfaces disease ($6 billion global market), they have OTX-CSI for treatment of chronic dry eye and OTX-DED for treatment of short term dry eye disease. Next step is to derisk these programs as opposed to jumping directly into risky phase 3 studies (need to understand differences on signs and symptoms of dry eye disease when they are tested against appropriate placebo comparator).

As for news flow, Dextenza revenues are expected to clear $55M for the calendar year. Updates on several readouts are expected in the coming year including glaucoma, dry eye and most importantly wet AMD readout (transformational event if they can extend durability).

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $134M as contrasted to net loss of $18.8M. Management estimates operational runway through 2023 including for service of debt. Research and development expenses fell slightly to $13.1M, while SG&A rose to $10.1M.

Total net product revenue for 2022 is expected to be in the range of $55M to $60M representing 26% to 38% growth over 2021.

Accumulated deficit now stands at $545M, which to my eyes is on the high side but not unexpected given breadth of the pipeline and the fact the company has been operating since 2006.

As for prior financings, December 2020 equity offering was priced at $21.50, representing 4x upside from present levels.

As for institutional investors of note, Opaleye Management owns a 7.8% stake.

As for insiders, a consistent history of insider purchases is a green flag to my eyes including Summer Road with nearly 6 million shares and President & CMO Michael Goldstein with over 330,000 shares. Chairman of the Board Michael Warden owns over 1.4 million shares.

As for executive lineup and relevant experience, Chief Medical Officer Rabia Ozden served prior in the same role at gene therapy ocular disease pioneer Nightstar Therapeutics before it was acquired by Biogen.

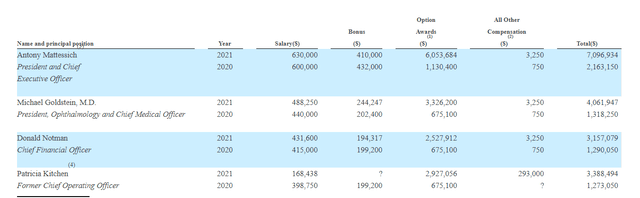

As for executive compensation, cash component is a bit on the high side for a company this size while stock and options awards seem sufficient (neither high nor low).

Figure 6: Executive Compensation Table (Source: Proxy Filing)

The important thing is to avoid companies where the management team is clearly in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

As for useful nuggets of information from Twitter, Sentiv Capital notes that Ocular Therapeutix received a coveted late-breaker slot at AAO for its TKI 6 month data which will provide the first direct comparison to Eylea (did nearly $6 billion in 2021 sales) for a TKI.

Moving onto useful nuggets from members of the ROTY community, DSJ.2018 stated the following back in April:

I like OCUL here. To be fair, I bought it way back in 2018 and my average cost basis was $3. I sold a lot in the mid teens; more on the way down around 9. I have held the rest and I have just started nibbling buying some more. In fact, I bought some yesterday. There’s nothing wrong with the story but there are two considerations: 1) other competitors have made inroads making the competitive situation a little more cloudy and 2) the bear market has mauled it like so many others. Today, Dextenza is on its way to being a $100M+ in revenue product PLUS they have a major readout coming mid year for their TKI product. We have already seen that they can take the majority of patients out to 6 months which is huge given that the norm today is monthly VEGF injections.

As for IP, I verified that the company licensed a total of 20 US patents and 8 US patent applications from Incept. 6 US patents cover their intracanalicular insert and intracameral implant product candidates. Two patents issued in the US and Japan are expected to expire in 2030 and two patents expired in 2020 that covered the hydrogel composition of the intracanalicular inserts and methods of making and use of hydrogel implants. A US patent is expected to expire in 2024 that covers the process of making the hydrogel composition of OTX-TP and OTX-MP. A U.S. patent is expected to expire in 2027 covering certain drug-release features of the hydrogel implant in combination with its hydrogel composition. A granted U.S. patent is expected to expire in 2033 covering the process of making the hydrogel implant with its drug release features. They also have pending applications in the US, EU and Japan directed to drug delivery vehicle which would extend IP out to 2040.

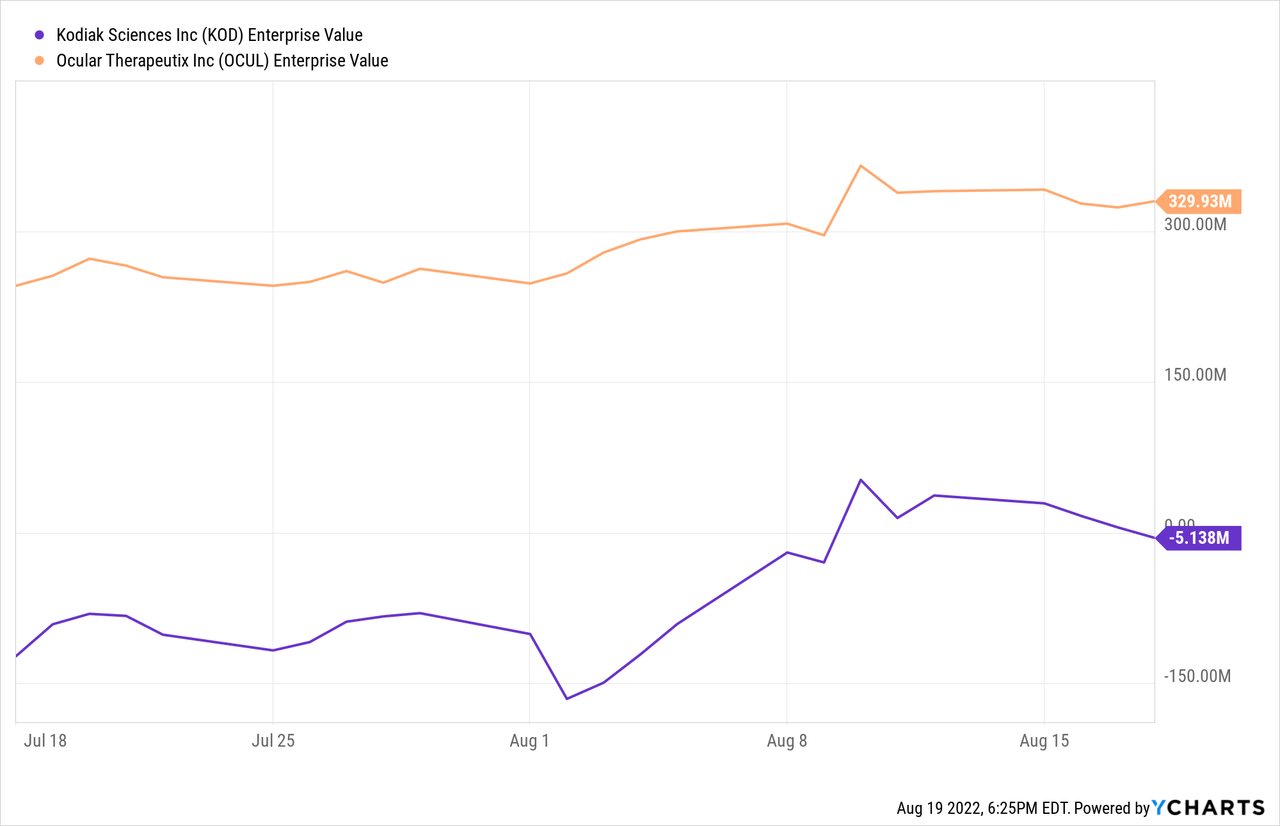

Another thought on valuation, though the 2 companies are far from similar yet each aspires to bring long acting solutions to the eye disease space, is the comparison of Baker Brothers’ favorite Kodiak Sciences and OCUL. Even this contrast of smaller players shows Ocular Therapeutix to be undervalued by a significant degree, especially should they experience success in the lucrative yet crowded wet AMD space.

Final Thoughts

To conclude, at current levels shares of Ocular Therapeutix appear attractive to both long term investors as well as catalyst traders expecting a run up into next month’s wet AMD data. After a disappointing start due to headwinds caused by the Covid pandemic, Dextenza sales appear to be reaccelerating providing much-needed cash flow to help reduce the company’s burn rate so the pipeline can move forward more efficiently. As stated prior, OTX-TKI data is clearly a “needle-moving” catalyst for a company this size but investors should be aware of binary risk involved. While the company experienced prior setbacks with dry eye programs, I appreciate how management is steadily moving each asset forward in phase 2 to incrementally derisk before attempting pivotal studies.

On a personal level, I can totally relate to the Dextenza dropless value proposition given how difficult administration of eye drops was in my grandmother’s case as well as for my mother living with Parkinson’s disease.

On the con side, management argues that generic competition is not a major cause for concern but I believe that’s simply not the case (i.e., generic eye drops are still really cheap). They state that much of their IP extends beyond 2040s and that true generic competition will be limited given that there’s no established regulatory pathway to lead to generic listing related to the company’s technology (think “long tail” revenue).

For readers who are interested in the story and have done their due diligence, OCUL is a Buy and I suggest accumulating dips in the near term ahead of expected September run up to data presentation on the 30th.

Swing traders will likely wish to take at least partial profits ahead of data, while long term investors could establish a partial position before results and add to their stakes AFTER data is presented.

From an ROTY perspective (focus on next 12 months), my skeptical take is that a pop on wet AMD data could be temporary as the number of patients in the study is low and they still have a LONG way to go to progress in mid and late stage studies. Thus, in my portfolio I prefer to stay on the sidelines and revisit at a later date.

From a Core Biotech perspective (3 to 5 year timeframe), I could see myself entering this name at some point as Dextenza sales are accelerating and clinical stage assets in the pipeline provide substantial optionality.

As for risks, given current cash burn and resources I think dilution by year end or Q1 2023 is highly likely via secondary offering or tapping the ATM. Generic competition is a substantial cause for concern in my case, as I’ve rarely had success investing in companies that compete against these lower priced alternatives. Then again, the convenience advantage for Dextenza and other pipeline assets appears highly compelling to my eyes. Competition in areas of interest, particularly wet AMD, from companies with greater amount of resources is also a major risk factor.

While as an investor I leave price targets to the analysts, I do look at a blend of technicals, enterprise value, upcoming catalysts and future prospects to provide a realistic guess of potential upside in the medium term. If wet AMD data ends up being a positive surprise and Dextenza sales keep accelerating, I think a return to the halfway point to 52 week highs ($10 level) appears reasonable and represents a double from current levels. $800 million market capitalization would still appear cheap relative to combined revenue opportunities across the entire pipeline ($20 billion or more).

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. Consider clicking “Follow” next to my name to receive future updates and look forward to your thoughts in the Comments section below. Lastly, be aware that most of my articles appear first to members of the ROTY community.

Be the first to comment