Morsa Images/E+ via Getty Images

The individual who says it is not possible should move out of the way of those doing it.”― Tricia Cunningham

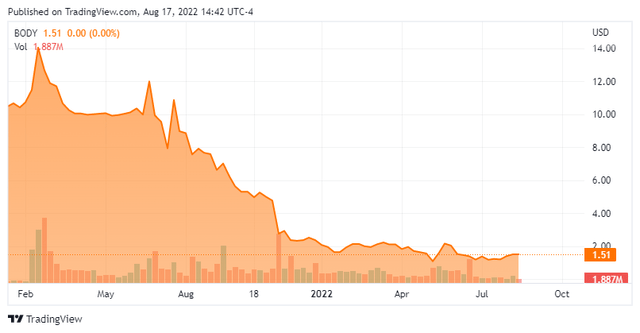

Today, we take our first look at The Beachbody Company, Inc.(NYSE:BODY), which to this point in its history has been yet another SPAC disaster for long-term shareholders. However, after its long descent, this small cap concern saw considerable insider buying in its shares in June. A sign the company can rise from the ashes? An analysis follows below.

Company Overview:

The Beachbody Company is headquartered just outside of Los Angeles. The company operates as a health and wellness platform that provides fitness, nutrition, and stress-reducing programs. The company has two primary business divisions

Beachbody:

This division operates Beachbody on Demand, a digital subscription platform that provides access to a library of live and on-demand fitness and nutrition content. It also provides Openfit, a digital streaming platform that provides digital fitness and wellness resource.

Other:

This part of the company provides offers nutritional products, such as Shakeology, a once-a-day premium nutrition shake; Beachbody Performance supplements comprising pre-workout Energize, Hydrate, post-workout Recover, and protein supplement Recharge products

The company came public via a merger with special-purpose acquisition company Forest Road Acquisition and Myx Fitness Holdings in the summer of 2021, on the tail end of the SPAC craze. Myx was a small competitor to Peloton Interactive (PTON) that made stationary bikes and offered online fitness classes/subscriptions at the time. Like almost every offering via this method during that era, the stock has destroyed most of the shareholder value it debuted on the public markets with. The stock currently trades around $1.50 a share and sports an approximate market capitalization just south of $500 million.

Second Quarter Results:

On August 8th, the company reported second quarter numbers. Beachbody had a GAAP loss for the quarter of 14 cents a share, four cents below the consensus. Sales declined by nearly 20% to a tad below $180 million, approximately two percent below analyst estimates.

Digital revenues fell 17% from 2Q2021 and digital subscriptions were off 16% to 2.28 million. Subscriptions provide in-home fitness content on-demand (over 4,500 videos and 440 live workout streams) through Beachbody’s live streaming platform.

Nutrition and Other revenue came in at $90.5 million, a 30% decrease compared to 2021 as subscriptions fell by a third to 280,000. The company pairs meal plans and supplements to fitness programs. The company is hoping that the launch of First Thing and Last Thing supplements, a nutritional combination that’s ideal for customers looking to improve overall wellness, improve mental clarity, reduce stress, and improve sleep will boost sales starting in the third quarter.

Connected Fitness revenue came in at $10.6 million as the company sold 8,800 bikes during the quarter. Connected Fitness revenue was $11 million in Q2 2021 prior to the merger, with approximately 10,200 bikes delivered.

Total operating expenses decreased approximately $53 million, a reduction of nearly 30% year-over-year to $131.7 million.

Analyst Commentary & Balance Sheet:

The analyst community is not sanguine on the prospects for Beachbody at the moment. Bank of America ($2.40 price target), Credit Suisse ($1.90 price target) and Robert W Baird ($2.00 price target) have all reissued Hold ratings on the stock over the past six months. Only DA Davidson ($2.00 price target) have stuck with their Buy rating.

Approximately one in ten shares are currently held short in BODY. In June, the CEO at the company and beneficial owner of the stock added just over $4 million to his holdings. This followed approximately $700,000 worth of buying in May by the same individual. There were also numerous but smaller purchases by the CFO, COO, Vice Chairman and another director in May.

At the end of the second quarter, the company had just over $55 million of cash and marketable securities on its balance sheet after posting a net loss of $41.9 million for the quarter. Leadership noted the company did reduce its cash burn by nearly $38 million and operational costs by 20% compared to the first quarter of this year. Beachbody recently entered into an agreement with Blue Torch Capital to provide $50 million in debt financing. The credit facility also includes the option for Beachbody to borrow up to an additional $25 million, subject to the terms of the credit agreement.

Verdict:

The current analyst firm consensus has the company losing just over 50 cents a share in FY2022 as revenues fall nearly 20% to just over $700 million. That loss is forecasted to narrow to just over 30 cents a share in FY2023 as sale decline at a slower pace to $670 million.

When the company came public in its current form, Beachbody’s CEO stated the company’s goal was to be the “Disney+ of Fitness.” Unfortunately, for shareholders the ride so far has been more like “A Nightmare On Elm Street” than “Aladdin.”

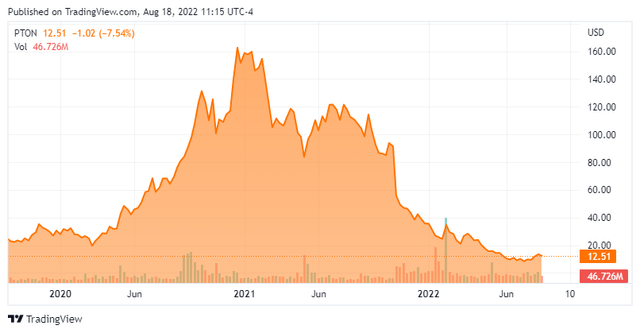

This space certainly had its day during the pandemic when names like Peloton (whose stock has a similar trading pattern to BODY) couldn’t keep up with demand thanks to the lock downs. Now there are too many names targeting a dwindling population in what turned out to be an unprofitable niche of the consumer fitness market to date. With the economy either in recession or most likely to be so soon, it is hard to see the environment getting any better in the sector.

Key Operational and Business Metrics

|

For the Three Months Ended June 30, |

For the Six Months Ended June 30, |

|||||||||||||||||

|

2022 |

2021 |

Change v 2021 |

2019 |

Change v 2019 Pre-Covid Baseline |

2022 |

2021 |

Change v 2021 |

2019 |

Change v 2019 Pre-Covid Baseline |

|||||||||

| Connected Fitness Units Delivered (in thousands) |

8.8 |

0.5 |

NM |

0.0 |

NM |

25.4 |

0.5 |

NM |

0.0 |

NM |

||||||||

| Digital Subscriptions (in millions) |

2.28 |

2.72 |

(16%) |

1.69 |

35% |

2.28 |

2.72 |

(16%) |

1.69 |

35% |

||||||||

| Nutritional Subscriptions (in millions) |

0.28 |

0.42 |

(33%) |

0.34 |

(18%) |

0.28 |

0.42 |

(33%) |

0.34 |

(18%) |

||||||||

| Total Subscriptions |

2.56 |

3.14 |

(18%) |

2.03 |

26% |

2.56 |

3.14 |

(18%) |

2.03 |

26% |

||||||||

| Average Digital Retention |

95.6% |

94.9% |

70bps |

95.2% |

40bps |

95.6% |

95.4% |

20bps |

95.1% |

50bps |

||||||||

| Total Streams (in millions) |

31.0 |

44.5 |

(30%) |

25.5 |

22% |

69.2 |

100.4 |

(31%) |

52.0 |

33% |

||||||||

| DAU/MAU |

30.0% |

31.9% |

(190bps) |

28.6% |

140bps |

31.6% |

33.5% |

(190bps) |

29.1% |

250bps |

||||||||

| Digital |

$78.0 |

$94.3 |

(17%) |

$58.8 |

33% |

$159.8 |

$189.5 |

(16%) |

$124.8 |

28% |

||||||||

| Connected Fitness |

$10.6 |

$0.0 |

NM |

$0.0 |

NM |

$30.1 |

$0.0 |

NM |

$0.0 |

NM |

||||||||

| Nutrition & other |

$90.5 |

$128.8 |

(30%) |

$124.9 |

(28%) |

$188.2 |

$259.8 |

(28%) |

$269.9 |

(30%) |

||||||||

| Revenue (in millions) |

$179.1 |

$223.1 |

(20%) |

$183.7 |

(3%) |

$378.1 |

$449.3 |

(16%) |

$394.7 |

(4%) |

||||||||

| Net Income/(Loss) (in millions) |

($41.9) |

($12.4) |

(238%) |

$19.6 |

(314%) |

($115.4) |

($42.5) |

(172%) |

$27.1 |

(526%) |

||||||||

| Adjusted EBITDA (in millions) |

($1.5) |

($4.4) |

66% |

$17.7 |

||||||||||||||

The company has made nice progress over the last quarter cutting operational costs, but seems a long way from profitability. The pace of the sales decline should also level off as “normalcy” fully returns as the pandemic is fully put in the rear view mirror in 2023. Insider buying is one of the few other positive things right now around Beachbody. Therefore, discretion seems the better part of valor. The shares are best avoided despite the big pullback in the stock, until management shows more traction turning around the company.

The reason fat men are good natured is they can neither fight nor run.”― Theodore Roosevelt

Be the first to comment