FOTOKITA/iStock via Getty Images

“Will we be ready for the ‘big one’?” Bing asked its “site-seers” on June 30, below its picture of the day.

At first glance, that abstract-looking picture didn’t look impressive. It was mostly comprised of rusty reds, dull greens, and varying shades of brown. In the center then was a mostly blue and white mass with more of those boring earth tones strewn throughout it.

Fortunately though, Bing adds an explanation to each image it posts, so viewers never have to be left in the dark for long. In June 30’s case, it was an aerial picture of the Acraman crater in southern Australia.

Which I didn’t know was a thing before.

Thanks for the education, Bing! Including with the following description:

“Today is Asteroid Day, and it’s a reminder that as our planet follows its path around the sun, it encounters a lot of stuff. Science tells us that, every day, Earth’s atmosphere is hit with roughly 100 tons of dust and particles the size of a grain of sand. And every year, at least 30 small asteroids enter the atmosphere, only to burn up before touching the ground. NASA says it’s pretty much guaranteed that at least one of them will be about the size of a car. As time progresses, the likelihood increases that even larger celestial rocks will hit the ground and cause significant damage.”

After the last few years we’ve had? Bring it on.

A Famous Investor Predicts an Economic Asteroid

Before anyone pounces on that last statement, rest assured it was a joke. I’m not hoping for an asteroid impact any time soon. Or at all.

Though they do happen sometimes, as Bing explains:

“Across the globe, there are plenty of reminders of these events in the form of craters… One that could really threaten civilization hits every few million years.”

In that case, they’re far more rare than the economic destruction caused by serious recessions. Which, incidentally, Peter Schiff went on record to predict.

You might know Schiff as CEO and chief global strategist of Euro-Pacific Capital Inc. It’s a role that lands him a lot of attention, with people seeking his opinion on everything economic – including the whens, wheres, what, hows, and whos of downturns.

Sometimes he even gives that information out for free.

That seems to have been the case late last month when he took to Twitter. What he said there inspired MoneyWise to write – and Yahoo Finance to pick up – the following very longwinded headline:

The article itself notes how “Schiff has long been a fan of” gold…

Is hardly adverse to “dividend stocks” that “offer investors a great way to earn a passive income stream” while serving “as a hedge against recessions.”

And he has been known to talk the talk and walk the walk about agriculture as well.

Schiff didn’t actually recommend any of those in his tweet though as far as I know. The article was a little “clickbait-ish,” in that case.

Fortunately, I can step in and vouch for that second category, as you know I love to do.

Average Downturn or Not, My REIT Strategy Stays the Same

Schiff’s actual tweet read:

“Anyone thinking this recession will be mild doesn’t understand recessions. The longer interest rates are held too low during a boom, the more mistakes that must be corrected during a bust. Since rates have never been so low for so long, this recession will be the most severe yet.”

If he’s right, that means the Great Recession – the downturn that wrecked me so badly I had to build myself back from the ground up – was nothing comparatively speaking. Which, I’ll admit, isn’t a comfortable thought.

However, it’s not a terrifying one either. Not when I’m investing in quality real estate investment trusts (REITs) that I’ve purchased at reasonable or better-than-reasonable prices.

Now, I’ve gone on record a few times already in saying that I do expect a recession, though just a “garden variety” one. One of the more recent pieces I published that opinion was on June 20 in my “I’m Rooting for a Recession” article.

If I’m wrong about that and Schiff is right, then I’ll be the first person to admit as much.

Fortunately though, it won’t make much of a difference in my strategy. In fact, it probably won’t make a difference at all.

You see, I learned my lessons from the Great Recession. That very difficult time taught me a thing or two about what not to do… which was essentially everything I had been doing up until that point:

- Relying on too much leverage

- Not diversifying enough

- Ignoring transparency issues (with my business partner)

- Investing everything in illiquid assets (i.e., actual real estate instead of REITs)

Let me go into detail about each one of those before revealing two portfolio picks that do the exact opposite.

Which means they should hold up just fine no matter what comes.

Too Much Debt

Consider the fact that I once had close to $50 million in recourse debt, some of which was secured by non-income-producing real estate. One such property was a dark K-Mart shopping center that my partner and I had acquired for around $4 million.

Keep in mind, most of my properties were generating income, but when the income machine dried up (I’ll tell you why below), it made paying $50,000 quarterly interest-only payments so much more painful.

I spent most of my development career (1995-2008) reaping the benefits of bankers who would give me almost anything I wanted. Many of the shopping centers that I developed were not pre-leased and very little equity was required.

My deals made money, at least most of them, but all were rooted in massive leverage, and very little hard equity.

Back in those days, banks would allow me to substitute developer fees for equity, which simply means I had very little skin in the game. The term loan to cost meant nothing, as most banks would lend up to 80% based on the value of the property.

Of course, we now know why around 450 banks failed in the US from 2007 to 2012 (according to the FDIC), many of them community banks.

One of my good friends was an appraiser during that time, and he was fortunate enough to be sitting on the sidelines. I don’t know his financial statement, but I suspect his net worth more than tripled as he took advantage of the distress by purchasing bank loans at pennies on the dollar.

All Eggs in One Basket

Another lesson learned in 2008 was the fact that I had almost all of my eggs in one basket. Most of my net worth was concentrated with one partnership that was something like 90% of my net worth at the time.

I did have other investments, like two franchises and some rental houses, but they offered no liquidity (more on that later).

Also, the partnership assets were mostly retail properties located in North Carolina and South Carolina. So, when the Great Recession hit, many of the mom-and-pop tenants struggled.

The biggest lesson for me though was to not put most of my net worth in real estate. As much as I love the sector, it’s important to build a solid foundation across multiple investment categories.

Today REITs of all types collectively own more than $3.5 trillion in gross assets across the U.S., with public REITs owning approximately $2.5 trillion in assets, representing more than 500,000 properties.

These REITs invest in a wide scope of real estate property types, including offices, apartment buildings, warehouses, retail centers, medical facilities, data centers, cell towers, infrastructure, and hotels.

Transparency is a Must

Although leverage and concentration were risks, the primary torpedo that sunk me was a failed business partnership.

At the peak, I was an investor in roughly 30 SPEs (special purpose entities) that generated K1s that flowed into one master partnership. Within this partnership, I was a 50% equity owner, however I was not the manager.

What this simply means is that I could not control the money.

In the first decade, things were good, as I was busy chasing new projects, securing new sites, leasing space, hiring contractors, and obtaining financing (with little to no equity required).

However, conflicts of interest began to surface, and funds in the partnership were not being used as intended (like paying the mortgage). In addition, tax returns were extended, and at some point, I was not getting K1s from the manager.

I tried to sort this out by separation, relocating to a new office, and attempting to divide up the assets. However, in the course of these negotiations it became clear that many of the trophy assets had been pledged to others.

One property (in which I was a 50% equity owner) had five mortgages on it, behind the senior secured loan. I watched equity in the property disintegrate from around $4 million (my share) to zero.

Yes, it was an ugly mess, and it took years to unwind from it all. I would never want anyone to go through it, and of course now you know why I insist on transparency.

Of course, the great thing about REITs is that they’re required to provide financials every quarter and you can fire the manager at any time, with the click of a button.

Liquidity

Shares of publicly-listed REITs are readily traded on the major stock exchanges, and had I owned REITs, instead of private real estate, I could have navigated the other risks and avoided substantial losses.

All of these issues – leverage, concentration, and mismanagement – can also be risks for REITs, however, the liquidity attribute is extremely valuable and one of the reasons I have become a large advocate and investor in the sector.

Shares of listed REITs are bought and sold on major U.S. stock exchanges every day, and there are more than 200 REITs with a combined equity market capitalization of more than $1 trillion traded on U.S. stock exchanges and held by institutional and individual investors as well as REIT mutual funds and ETFs.

2 Portfolio Picks

Of course, one of the most important lessons learned from the Great Recession is to always hold cash, because I want to be like my friend I referenced earlier and be able to scoop up shares in cheap REITs.

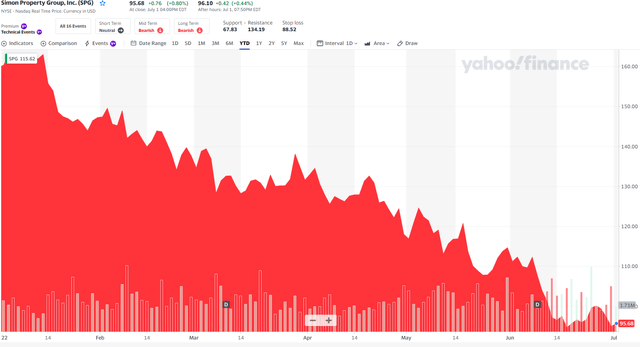

Simon Property Group (SPG) is down 40% year-to-date:

Yahoo Finance

While I recognize that inflation is eating into the consumer’s pocketbook, the blue-chip mall landlord has solid fundamentals supported by a portfolio made up of 72% US Malls and Premium Outlets, 11% The Mills, 9% International, and 8% other assets.

SPG has a fortress balance sheet which has credit ratings of A3 from Moody’s and A- from S&P, and this is a major advantage for the company and one reason why they dominate the sector with the highest rated portfolio.

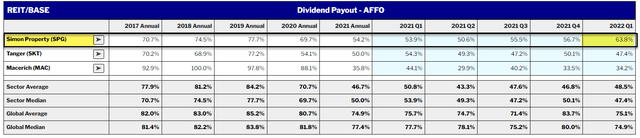

Shares of SPG currently pay a dividend of $6.80 per share annually, which equates to a dividend yield of roughly 7.1% with a payout ratio of 64% (based on AFFO):

REIT BASE

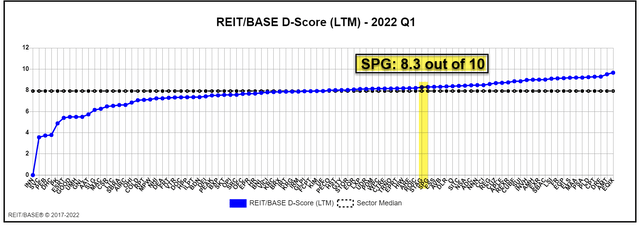

SPG has a dividend safety score of 8.3 out of 10:

REIT BASE

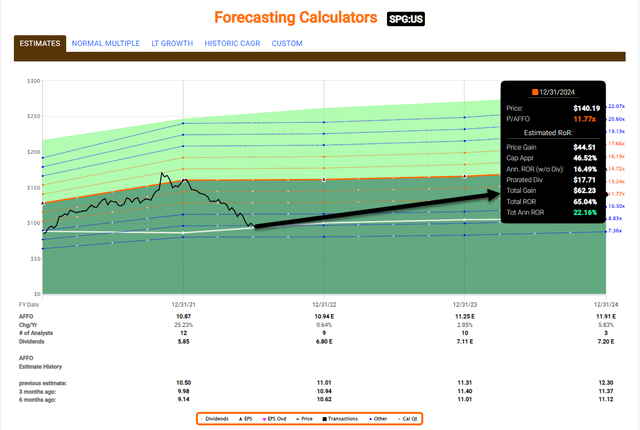

In terms of valuation, shares of SPG trade at a P/AFFO multiple of ~8.8x compared to a five-year average closer to 15x, which makes the company screen extremely cheap. Although growth is forecasted as modest in 2022 (+3%) and 2023 (+6%), we consider SPG a terrific pick that could return 20% to 25% annually.

FAST Graphs

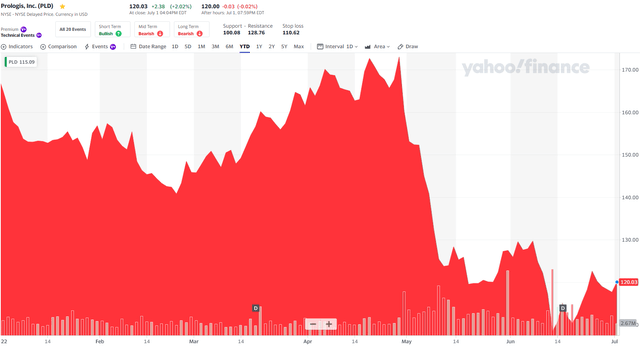

Prologis, Inc. (PLD) is down 29% year-to-date:

Yahoo Finance

Once again, I like owning dominating landlords and PLD certainly fits that bill, with a massive portfolio that consists of 4,675 buildings made up of 1.0 billion square feet of leasable space. These buildings are leased out to roughly 5,800 customers across the globe.

The majority of their portfolio is located in North America, with 81% NOI coming from this region, but they also have a strong footprint in Europe as well. As of the most recent earnings release, Europe made up 11% of NOI.

PLD also maintains a very strong A- rated balance sheet, which should further provide investors with comfort in the event we do fall into a recession, as many expect.

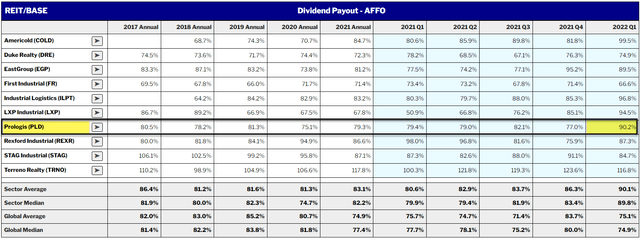

Shares of PLD currently pay a dividend of $3.16 annually, which equates to a dividend yield of roughly 2.6% with a payout ratio of 90% (based on AFFO):

REIT BASE

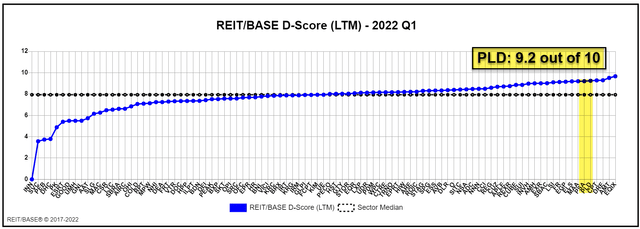

PLD has a dividend safety score of 9.2 out of 10, fifth best on the iREIT 100 list:

REIT BASE

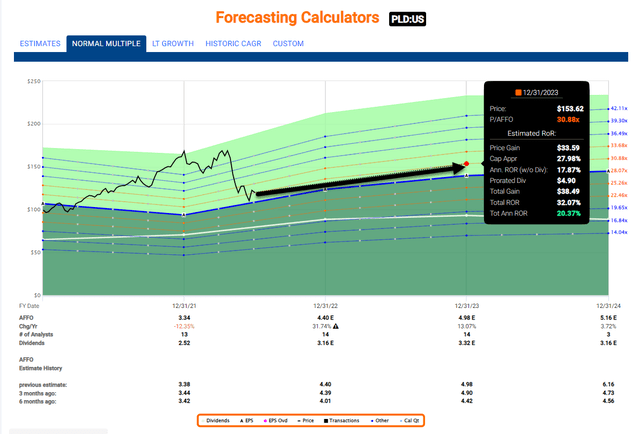

In terms of valuation, shares of PLD trade at a P/AFFO multiple of ~31.0x compared to a five-year average closer to 28x. Analysts are forecasting PLD to grow by 13% in 2023, and of course this does not include the latest merger news with Duke Realty (DRE). As we informed iREIT on Alpha members,

“PLD estimated $387M of future accretion, including $80M from incremental property cash flows and Essentials, and $300M from development value creation.”

A few weeks ago, we bought 150 shares (at $108.04) for the Durable Income portfolio.

FAST Graphs

One Final Lesson…

I know you’ve heard me saying this before here on Seeking Alpha, but I would be remiss if I did not say it again.

“The most durable education is self education.”

Over the years, almost 30 as a real estate investor, I have learned a lot from my mistakes and also from the mistakes of others.

In fact, I would say that within my 3,350 articles (since 2010) I have taught thousands of others how to invest in REITs.

In my classroom, I tend to promote the less enthusiastic names, by avoiding high-yielding stocks, simply because I have learned the hard way the difference between investing and speculating.

In other words, I have grasped the danger of risking capital and my lessons learned have created in my personality a profound concern for money, a commitment to working hard, and an intense conservatism in my spending. Ben Graham said it best,

“Adversity is bitter, but its uses may be sweet. Our loss was great, but in the end, we could count great compensations.”

Be the first to comment