NicoElNino

Investment Thesis

Asana (NYSE:ASAN) delighted investors with not only a significant topline beat, but $350M from CEO Moskovitz. This implies two things.

Firstly, Moskovitz is super incentivized (and super wealthy).

Secondly, the business is unquestionably growing to scale at a very rapid rate.

With the stock selling at close to full on misery, there’s probably more bad news than good news being priced in.

Altogether, for the first time in a long while, I’m tepidly bullish on this name.

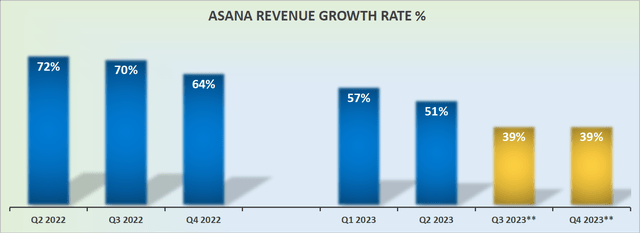

Asana’s Revenue Growth Rates Remain Strong

For Q2 2023, Asana had guided to be up 43% at the high end. As you can see above, when earnings came out, its revenues were up 51% y/y, beating the high end of its guidance by more than 700 basis points.

Once we consider the macro environment that we’ve all become accustomed to in the past several weeks, from higher inflation, geopolitical tensions, and the strong dollar all impacting many companies, this was a very welcome result.

With all this in mind, investors are now fully assured that when Asana now guides for 39% into Q3, the business is probably going to report somewhere in the mid-40s% CAGR range.

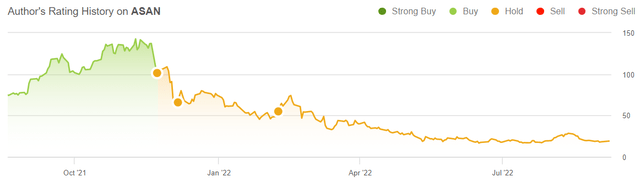

Given everything that has happened to Asana that has led this once crowd-favorite stock to drop by more than 70% in the past 12 months, shareholders cheered and welcomed some respite in these results.

Investors now believe that perhaps the worst is over now in terms of Asana’s multiple compression.

Profit Margins Continue to be SBC-Heavy, But Does It Matter?

While Asana’s topline increased by 51% y/y in the quarter, management’s stock-based compensation was up 140% y/y. Needless to say that this management team is clearly getting rewarded here.

In fact, including $48 million of stock-based compensation being added back to free cash flow, the business saw its free cash flow turn increasingly negative. More specifically, Q2 2023 had a negative free cash flow of $42 million, compared with a negative $9 million in Q3 2022.

So again I pose the question, does stock-based compensation matter? Is it a real cost? And does the market actually care?

While we ponder on these questions, we should keep in mind that Asana continues hemorrhaging free cash flow in earnest.

Consequently, CEO Moskovitz infused $350 million into the company. Then, during the call, Moskovitz said that Asana will be positive free cash flow, before the end of the calendar year 2024.

Some may argue that 2 years is a long time away in this market. But bulls clearly see things differently and the stock popped after hours.

ASAN Stock Valuation – 6x Next Year’s Revenues

The problem for Asana is that despite all the focus on its strong revenue growth reported in the quarter, billings came in lower than its revenue growth. Billings in the quarter adjusted for currency were up 43% y/y in the quarter.

As a reminder, billings are a leading indicator of where revenues will be recognized over time. If you are going to invest in a growth stock, you really want billings to match revenue growth rates, or slightly higher. But not lower, as was the case for Asana.

Obviously, the big question that truly matters here is what sort of growth rate can investors expect in fiscal 2024 (starting February 2023).

If Asana could grow its revenues by approximately 35% CAGR, that would put its revenues at close to $740 million. That’s approximately 5% higher than analysts presently expect.

Altogether this means that the stock today is priced at 6x next year’s revenues.

I don’t consider this to be particularly cheap, given that the business is still a few years away from reaching positive free cash flow.

On the other side of the equation, bulls would make the case that if one wants to get a disruptive tech company, even in this market, they’ll have to pay up for exposure.

The Bottom Line

We are navigating a difficult and choppy market. A market where things can go from doom and gloom to bright green days on a dime.

Realistically, I don’t view Asana as particularly cheaply valued. But if I allow my price anchoring bias to speak out, the stock is already down so substantially since I was last bullish on this name. With all that in mind, there’s enough in this report to make me tepidly bullish on this stock.

Be the first to comment