Lemon_tm/iStock via Getty Images

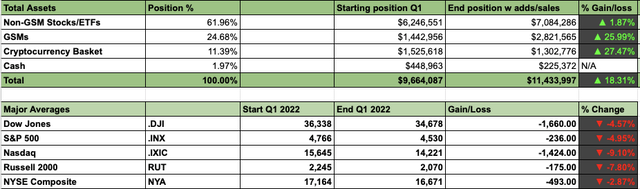

The All-Weather Portfolio (“AWP”) returned 18.31% in Q1 2022, outperforming the S&P 500/SPX and other benchmark averages. For reference, the DOW Jones and the SPX finished the quarter down by about 5%, and The Nasdaq declined by 9% in the same time frame. So, how did the AWP outperform major stock market averages by such a wide margin? A combination of diversification, timely adjustments around the peaks and troughs, and effective hedging during the declines enabled the AWP to maximize returns. Let’s dive deeper to see what worked, what didn’t, and what could have worked better throughout the first quarter.

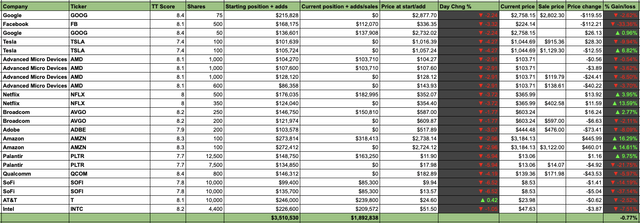

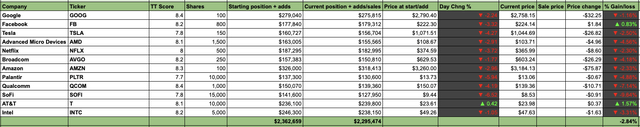

The Tech Plus Segment

At the end of Q1, the tech plus segment accounted for approximately 17% of portfolio assets. Top holdings included Amazon (AMZN), Netflix (NFLX), AMD (AMD), AT&T (T), and other names. I came into the quarter light in tech (only about 10% of holdings). Moreover, most higher risk, high-multiple names were sidelined to begin Q1. I added around the lows to increase tech exposure, and I hedged via covered call dividend and collar strategies on the way down. At the end of the quarter, the tech segment “worked” as losses were minimized, and the segment provided a positive return once hedging premiums got factored in. The best performers here were Amazon and Netflix, while the worst performers included Palantir (PLTR), SoFi (SOFI), and Facebook (FB).

Looking forward: Tech performed well in the recent rebound, and we should get a continuation of the positive price action through the earnings season and possibly through much of 2022. Therefore, I raised the AWP’s tech plus segment’s weight to 20% to start the second quarter. Top weighted positions include Amazon, Google, AT&T, and others.

China Holdings Did Not Work

The AWP’s China holdings continued performing poorly in Q1. The assets in this group included Alibaba (BABA), Baidu (BIDU), and NIO Inc. (NIO). By far, the worst-performing segment of the AWP was the China sector. I came into the quarter with a 6% allocation in China names, and this area dropped by 24% in Q1. Moreover, while I minimized losses and made profits from hedging China in past quarters, this segment did not receive the hedging attention it deserved in Q1. My mistake was believing that these stocks could not drop much further, but they did. Therefore, if there was an ugly spot in the AWP, it was the China sector in Q1.

Looking forward: I kept the AWP’s China basket essentially the same for Q2, representing about 6% of portfolio holdings. Top holdings include Alibaba, Baidu, and a couple of other Chinese stocks with substantial upside potential. The Chinese segment has been beaten down badly over the last year, and top Chinese companies offer significant upside potential as we advance.

The Healthcare Basket

The Healthcare portion of the AWP was at about 7% going into Q1. Several stocks like Bristol-Myers Squibb (BMY), AbbVie (ABBV), and AstraZeneca (AZN) performed well. However, Novavax (NVAX), Moderna (MRNA), and Gilead (GILD) did not, and the segment finished the quarter essentially flat, down by less than 1%. The bright spot was the hedging premiums received from the covered call dividend and collar strategy on Modern and Novavax stock. Despite being a quiet, boring segment, the healthcare basket worked relatively well in Q1.

Looking forward: For Q2, I reduced the healthcare segment to about 6% of portfolio holdings in Q2. All positions remain the same as Q1 minus Gilead (GILD). Gilead has performed poorly in recent months, and I don’t see much upside potential in the near term for this stock. I kept other top-performing healthcare positions in the AWP. Also, while Novavax and Moderna remain volatile, the stocks provide significant covered call dividend yields and offer speculative upside potential.

The Energy Segment

The energy segment had about a 9% allocation to start the quarter. Due to inflation, geopolitics, and oil’s supply-demand dynamic, energy names did well. We saw considerable gains in Schlumberger (SLB), Exxon (XOM), Valero (VLO), NOV Inc. (NOV), and Occidental (OXY). Lukoil (OTCPK:LUKOY) was the only miss, but I dumped that stock right after the Russian invasion. Unfortunately, it was after a 40% loss. Despite this write-off, the oil/energy segment returned approximately 14% in Q1.

Looking forward: The energy space had a significant runup in Q1, but I think there’s more room to run here. Oil will likely continue appreciating due to favorable fundamental factors and high inflation. This portion of the AWP is at about 10% to start the quarter, and it includes two clean energy ETFs that account for about 3% of portfolio assets. The remaining 7% are split up amongst top oil and oil services names.

Materials and Industrials

Another clear, bright spot that worked was the materials and industrial segment. This sector started the quarter with a 10% allocation but with some intra-quarterly adds grew to more than 12% of holdings. Some top performers here included Cleveland-Cliffs (CLF), Mosaic (MOS), Sociedad (SQM), RIO Tinto (RIO), and BHP (BHP). This segment delivered an 18% return in Q1. One mistake I made here was booking profits too early in several names. I could have squeezed more profits if I held for the entire quarter. Nevertheless, I am happy with the excellent performance in this space.

Looking forward: The materials and industrials segment got boosted this quarter. We now have two defense names in the portfolio, Raytheon (RTX) and Lockheed Martin (LMT). These two positions account for approximately 3% of the AWP’s holdings, and the entire segment accounts for about 15% of portfolio assets. Defense stocks should continue to do well with ongoing saber-rattling and the likely continuation of the Ukraine/Russia conflict. We should see higher demand and multiple expansion in this space, and I may add more defense names throughout Q2. Other top picks include Rio, BHP, Mosaic, and others.

Financials

The financial segment was another ugly spot in the AWP last quarter. We saw poor results from top banks to the start of Q1, and they never really recovered. Goldman Sachs (GS) and JPMorgan (JPM) gave up ground, but the biggest loser in the quarter was PayPal (PYPL). A bright spot was collar hedging in PayPal shares, but the financial segment lost about 12% in Q1. I managed to dollar cost average for several positions, but financials were an inferior performer in Q1.

Looking forward: Despite a poor showing in Q1, I believe that Q2 could be a much better quarter for financial names. In my view, PayPal is relatively cheap now, and big banks like JPMorgan, Goldman Sachs, and others represent substantial value. We may see increased demand and multiple expansion in this space, and I suspect that banks can get a robust boost throughout the second quarter.

Now For Some Good News: Gold & Silver

The AWP finished the quarter with a significant gold, silver, miner/GSM position of around 25%. I built up this segment in anticipation of a run-up due to high inflation and other variables, and the GSM space delivered a 26% return in Q1. Top performers included Yuaman (AUY), Gold Fields (GFI), VanEck Gold Miners ETF (GDX), and others.

Looking Forward: We may not see the same stellar performance in Q2, but we should see more positive price action from GSMs in 2022. Inflation remains high, and the fundamental backdrop looks favorable for gold and silver. I suspect we can see a substantial run-up in gold and silver prices later this year. Therefore, I kept the GSM segment overweight at approximately 24% of holdings.

Bitcoin/digital assets

The AWP came into Q1 cautious, with only about 5% allocated to Bitcoin and digital assets. Moreover, I decreased the position to zero at one point in the quarter. There was too much uncertainty in this space during the correction. Nevertheless, I built the cryptocurrency basket back up, and it became the AWP’s top performer. By the end of Q1, the segment produced a 27.5% return and finished the quarter with a weight of about 11.4%.

Looking Forward: While the BTC/digital asset space remains in an uncertain place, there is potential for more upside here. I recognize that it is much riskier than other AWP segments, but the digital asset space has brought in substantial gains in recent years. It is crucial to watch this segment closely and decrease holdings if breakdowns occur. The digital asset segment was at about 9% to start Q2.

Essential Hedging

Some of the most profitable hedges were AMD, SoFi, Palantir, Novavax, and PayPal. Collars on these names appreciated several-fold in the weeks surrounding the correction and helped boost the AWP’s quarterly performance. The covered call dividend strategy also increased returns in specific names. While we may not see another correction for several quarters, volatility may pick up at times and should provide other hedging opportunities in Q2 and beyond.

The Bottom Line

While major stock averages finished the quarter firmly in the red, the AWP delivered another solid performance. Diversification, adjustments around inflection points in the market, and effective hedging increased the AWP’s returns significantly in Q1. The AWP returned 18.31% in Q1 and is set up to deliver another robust quarter in Q2. Top sectors going into Q2 include technology, industrial and materials, energy, and GSMs. Persistent inflation coupled with resilient economic growth should power commodities and specific stock sectors higher throughout 2022 despite a tightening monetary atmosphere, in my view. Therefore, I am going into Q2 with a relatively small cash position, and I am overweight in several stock sectors like technology, materials, energy, and others. My year-end target range for the S&P 500 remains at 5,000-5,300.

Be the first to comment