francescoch/iStock via Getty Images

It is not a difficult process to protect your wealth from combatants (risks) that can attack from any side. There are only four major economic categories or regimes that can exist. There are assets that historically deliver positive real returns for each of these regimes. The all-weather portfolio for 2022 will offer assets that will (should) work no matter what the world and markets throw at us in 2022, 2023 and beyond.

Will generations of investors might get side-swiped by major shifts in economic regimes? You do not have to join them. You can protect your wealth and retirement with an all-weather portfolio.

Disinflationary, it’s all we know

Today’s investor has only experienced (and only knows) a period of modest economic growth in a disinflationary environment. At least that condition has dominated their experience. There have been some very brief periods of modest inflation or deflation thrown into the mix of the last 40 years.

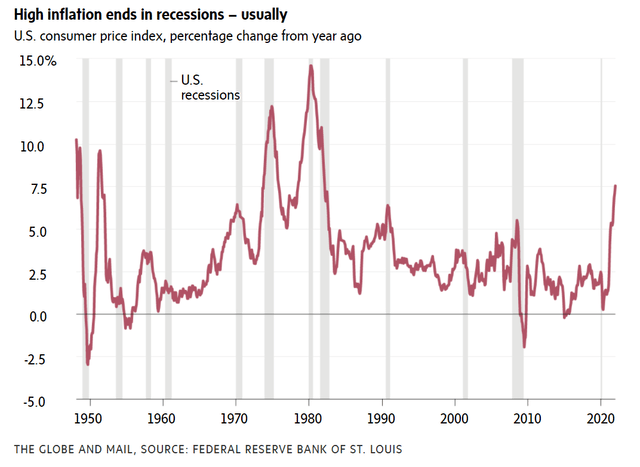

Inflation and recessions historical (Band of America )

From the above chart, we can see that the trend of lower inflation and a disinflationary environment has been in play since the end of the stagflation period of the 1970s and early 1980s.

Economic growth (even modest) in a disinflationary environment is a favorable environment for stocks and bonds. Hence, today’s investor should have very good historical returns, whether they are an equity investor or hold a traditional stock and bond balanced portfolio. Today’s investor mostly hopes (or guesses) that we will continue in a stock and bond friendly disinflationary environment. That might be a massive, and very expensive guess.

Inflation is transitory for longer

There was hope that the unexpected inflation that began in early 2021 would be transitory. It is not. At the very least, it might turn out to be transitory for longer. That said, inflation is getting long in the tooth and is still accelerating in most parts of the world. The longer inflation sticks around, the harder it becomes to kill the beast. Central banks in the U.S., Canada and Europe have not yet unleashed any serious fight against inflation.

Add in the very unfortunate events in Ukraine.

The war in Ukraine fuels inflation.

There are serious risks of energy shocks and food shortages. It’s possible that inflation and stagflation risks are at a peak. Of course, no one knows what will happen with respect to what economic regime will dominate in 2022, 2023 and beyond, but we should acknowledge the clear and present dangers.

Investors have the option to protect, or not. Of course the portfolio risks are great for a retiree or near-retiree. A young investor with decades to go in the accumulation stage might not be in need of the an all-weather portfolio. That young and brave investor might simply keep dollar cost averaging into equities and REITs.

A retiree might choose to be prepared

Are you prepared for stagflation?

Are you prepared for a deflationary spiral?

Are you prepared for a depression or a period of rolling recessions?

And on specific events, are you prepared for World War III, a nuclear war, a pandemic that is worse and more deadly than the first modern day pandemic that began in 2020 and continues today?

If investors were to answers the above questions with awareness and honesty, we’d likely get a chorus of no, no, no, no, no, no followed buy a few more no’s.

Most investors are prepared for more of the same – ongoing economic growth in a disinflationary environment. They mostly invest in stocks and bonds.

The permanent portfolio

The roots of the all-weather portfolio for 2022 can be found in the permanent portfolio. That is a simple approach that holds one asset that will work in each of the economic regimes. From that post on my blog, Cut The Crap Investing.

- Inflation in a period of economic growth.

- Inflation in a period of economic contraction.

- Deflation in a period of economic growth.

- Deflation in a period of economic contraction.

The Permanent Portfolio is designed to hold assets that will perform in each economic environment. Something is always working.

Stocks for economic growth

- 25% in stocks to provide a strong return during times of prosperity.

Bonds for deflation or deflationary

- 25% in long-term bonds, which do well during times of prosperity and during times of deflation (but which do poorly during other economic cycles).

Cash for economic contraction

- 25% in cash to hedge against periods of recessions or depressions.

Gold for inflation

- 25% in gold and precious metals to provide protection during periods of inflation. Gold can also do double duty and perform well in a deflationary environment. The asset also puts in time as a safe haven asset.

You can do better

While the permanent portfolio is simple and it can work quite well you can do better to fill those four buckets with additional assets. We might think of the all-weather portfolio as Permanent Portfolio 2.0, or the Permanent Portfolio on steroids.

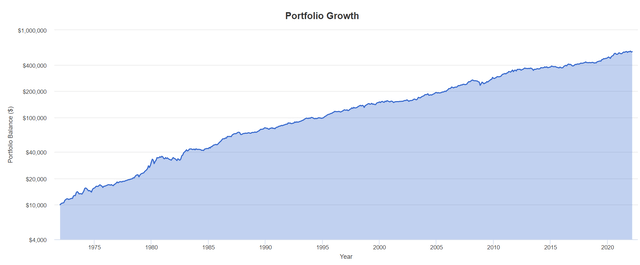

Here’s the returns for the Permanent Portfolio from 1972.

The Permanent Portfolio from 1972 (Portfolio Visualizer / Author) Permanent Portfolio Returns Table (Portfolio Visualizer / Author)

We can see that the Permanent Portfolio delivered very solid returns that included the inflationary / stagflation period. The above chart is not adjusted for inflation. That said, the Permanent Portfolio delivered real (inflation adjusted) returns in every decade for the above period covered in the chart.

The all-weather portfolio for 2022

- REITs – (RQI) (REET) 5%

- Commodities (DBC) – 10%

- Energy equities (IYE) – 5%

- Gold – 5% (*Bitcoin 2.5%)

- Short Term Bonds (SHY) -20%

- Long Term Bonds (TLT) – 15%

- Stocks – 40%

*you may decide to bolt-on a bitcoin allocation, while keeping your gold allocation. I consider bitcoin to be modern, or digital gold. I’d suggest that to make room for bitcoin, you trim evenly from all of the assets.

Stocks @ 40% – Global plus defensives

1. (VT) – Global markets – 20%

2. Defensive Stocks – 20%

Consumer Staples (XLP) 10%, Healthcare (IYH) 10%.

In place of the defensive sector ETFs, investors might (instead) choose to build a portfolio of individual stocks from the U.S. consumer staples and healthcare sector. One could also include more global diversification in this area, see European and U.K. staples and healthcare stocks.

The economic quadrants

Inflation: REITs, Gold, Commodities, Energy stocks, Consumer staples stocks

Stagflation: Gold, Commodities, Energy stocks, REITs, Short term bonds, Healthcare stocks

Deflation: Cash, Gold, Bonds, Consumer staples and Healthcare stocks

Disinflation: Stock markets, Consumer staples and Healthcare stocks, Bonds

Tackling stagflation

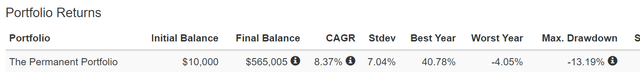

Here’s a chart that shows the challenge of finding assets that worked during stagflation. Gold and commodities delivered outrageous gains during stagflation. Stagflation is the most troubling of times, and perhaps an area where investors are least prepared.

Stock markets simply do not work during periods of unexpected inflation or stagflation.

Assets during stagflation (Bloomberg )

With many assets in the all-weather portfolio doing double duty, such as consumer staples and healthcare stocks, and gold, there is the potential to have more assets working in more economic conditions. And that is, more productive asset compared to a traditional all-weather approach.

That link shows the Ray Dalio all-weather portfolio. Keep in mind that given the low yields of bonds and the prospects for higher rates, Dalio hates bonds with a passion. He too looks for substitutes for bonds.

An all-weather example

On my site I charted the performance of an all-weather model.

Here’s – The Russcession is coming!

In that all-weather portfolio example, adding modest inflation protection increased returns by almost 7% from January of 2021.

The real threat for retirees

If you are young and in the accumulation stage you might ignore all of the above. Inflation historically was not a risk if you had 20 years or more to allow stocks to do their thing.

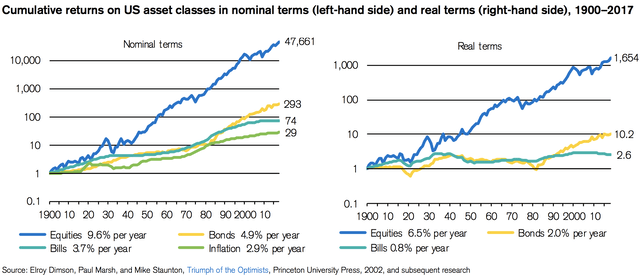

Stock and bond returns from 1900 (Princeton University Press)

When you are in retirement or within the retirement risk zone risk moves from long term to short term. A few bad investment years early in retirement can greatly impair or upend your retirement plans. Those risks are exaggerated by robust inflation or stagflation.

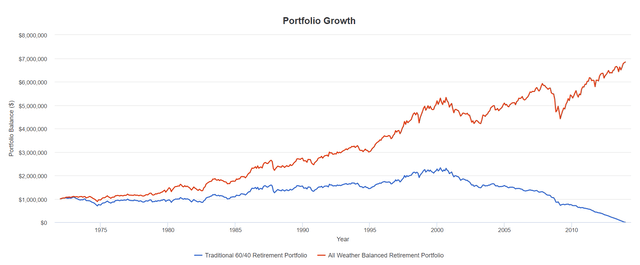

Here is a comparison of a traditional 60/40 U.S. balanced portfolio vs an all-weather portfolio that adds some inflation protection by way of 10% gold. I have also added 5% cash. To make room for the gold and cash, I reduced the equity exposure of the 60/40 portfolio that holds 60% stocks and 40% bonds.

The portfolios are spending at a 4.2% rate ($42,000 per year) inflation adjusted. The hypothetical portfolio starting value is $1,000,000.

All Weather Portfolio vs the traditional Balanced Portfolio (Portfolio Visualizer / Author)

The difference is drastic, and more than surprising. Gold and commodities can be quite explosive during periods of unexpected and robust inflation.

We see that the traditional balanced portfolio went to zero.

During periods of high inflation, and all-weather portfolio will outperform. During periods of disinflationary, the traditional balanced portfolio will outperform. It is a massive risk to guess that we will return to a disinflationary environment when your retirement and lifestyle is potentially on the line.

The all-weather portfolio for 2022

The portfolio will employ more stocks than a traditional all-weather model. The consumer staples and healthcare stocks might deliver an ongoing source of capital appreciation. There is also the opportunity for dividend growth that can help reduce the sequence of returns risk.

I have included energy stocks as they are known as the only sector that provides reliable positive real returns in inflationary periods. And fortunately (or unfortunately for the planet) oil and gas stocks appear to be benefitting from a secular and very favorable trend.

I am in the semi-retirement stage and I am putting the above all-weather portfolio for 2022 to work with great results. While my approach is not exact to the model within this post, the same asset classes and sectors are being put to work with wonderful results. Our portfolios (for me and my wife) are at or near all-time highs.

Rebalancing into 2022

Due to the surge in our energy and commodity holdings I am looking to rebalance and shore up my defensive stance, by way of stocks. I continue to add to CVS Health (CVS), Walmart (WMT), Johnson & Johnson (JNJ), Walgreens (WBA), Colgate Palmolive (CL) and Pepsi (PEP).

With that mix I am also growing the dividend income stream.

And in preparation for the next stock market correction, I will also throw a few dollars to the long term treasuries.

Thanks for reading. We’ll see you in the comment section. You can follow me on Seeking Alpha or on my blog, Cut The Crap Investing. And please hit that like button if you like the all-weather portfolio for 2022.

The above is not advice, but ideas for consideration.

Read. Decide. Invest.

Be the first to comment