Dimitrios Kambouris

Written by Sam Kovacs

Introduction

$1 Trillion dollars!

There is always a certain ring to that number, don’t you agree?

Nobody in the world is worth $1tn. Elon Musk is about a quarter of the way there, yet he remains nowhere close.

There are, however, plenty of trillion-dollar companies, and even more trillion-dollar industries.

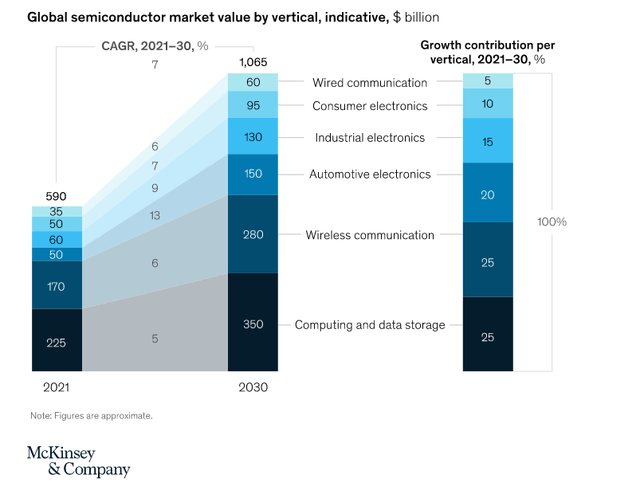

By the end of the decade, there will be a new comer: semiconductors.

According to McKinsey, by year 2030, the semiconductor industry, having grown at 6-8% per year between now and then, will be worth $1 trillion dollars.

But the industry’s historical cyclicality might make some investors take pause, especially in the current environment.

This article will seek to give a clear picture of where the semiconductor industry comes from, where it is headed, and suggest 2 stocks you should buy to make the most of this decade long opportunity.

This article is perfect for those of you who are preparing for retirement, and want to live a calm retirement, flush with dividends.

The history of semiconductors

The birth of semiconductors goes back to the invention of the rectifier in 1874.

It is only decades later, that they gained massive traction industrially, then commercially.

One turning point in 1967, was when Texas Instruments (TXN) invented the electronical desktop calculator (or if you’re not a technical snob, simply called “calculator”), using an integrated circuit.

Just 3 years later, in 1970, Intel (INTC) developed the first commercially available dynamic random access memory [DRAM] chip, which would come to dominate its business within the following decade.

Extreme cyclicality

From its advent, the semiconductor industry has been a cyclical one.

This cyclicality can be attributed to 2 things, as suggested by Regions Asset Management in a 2019 report:

- Inventory: Inventory buildup can occur either due to increased supply or slowing demand. In periods of high demand, profitability of semiconductor manufacturers is high. Profits are usually invested to increase capacity. When capacity comes on line, supply tends to overtake demand resulting in an inventory buildup and falling prices. This leads to falling revenue growth and the industry downturn. Similarly, weak product demand can also result in inventory buildup and the inevitable downturn.

- Worldwide Economic Growth: There is a significant correlation between GDP and semiconductor industry cycle. GDP growth leads to increased industrial output and related demand for semiconductors, triggering an upturn in the semiconductor cycle. On the flip side, decelerating or stagnant economies, result in lower IT spending by corporations and reduced consumer spending which leads to a downturn.

Historically, this has been very accurate.

Let’s take a close look which goes all the way back to 1981, a year which resembled the current environment in many ways. Rampant inflation is just one of them.

After enjoying a decade of phenomenal growth, Intel’s revenues dropped.

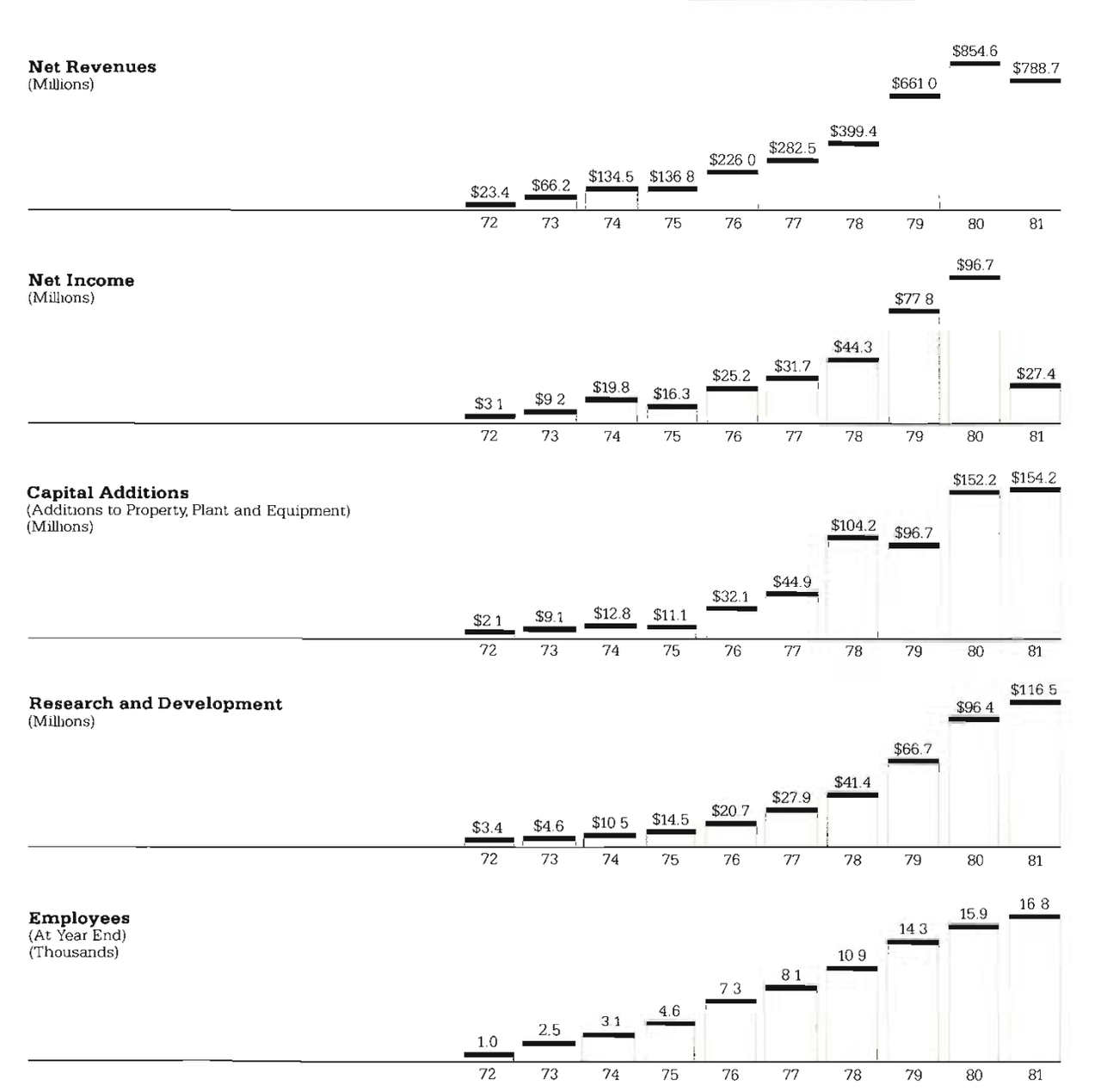

Intel Annual Report 1981

As you can see, the typical thing happened: Demand was strong in 1979, so Intel significantly ramped up capital additions in 1980. Note that competitors, from Japan, also did this. During the first half of 1980, demand remained extremely strong, but then extra capacity came onto the market.

This killed prices and caused a downturn. Despite this, to stay on top of competition, Intel had to double down on R&D and Capital additions in 1981.

By 1983, aggressive double-digit growth resumed.

Throughout the rest of the century this up-down pattern continued.

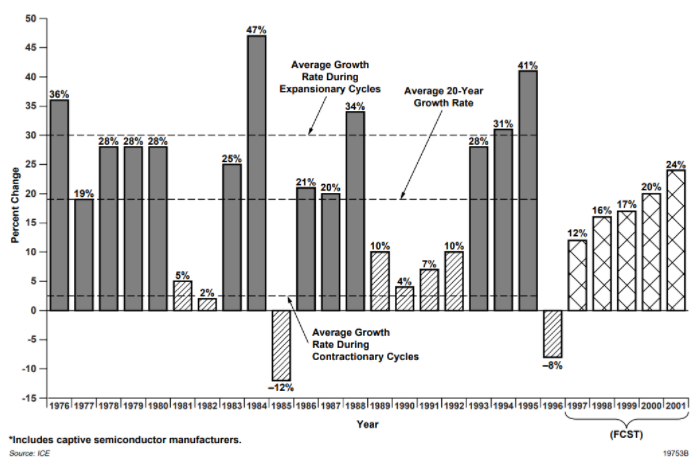

ICE (Semiconductor industry growth)

Between 1986 and 1995, explosive growth in the personal computer helped the industry get positive growth in every single year for a decade.

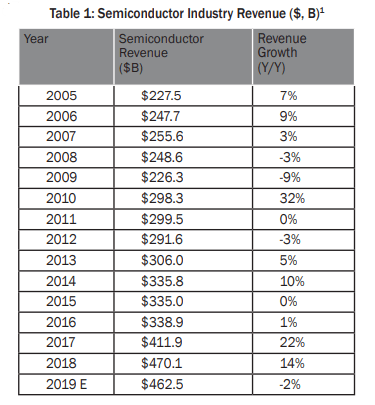

Regions Asset Management

The past few years have been extremely interesting years in the industry.

The pandemic brought on both higher demand and lower supply, as stay at home trends encouraged households to purchase more computers, all while supply chain constraints made it hard for manufacturers to add enough capacity.

The current market

2022 will likely be very much like 1980. Demand remains strong, but slowly supply becomes too much for the industry to handle. Economic slowdown on the horizon also presents a situation in which demand for consumer-oriented chips could suffer.

Capital spending is still at all-time highs, another similarity.

In a typical cycle, semiconductor stocks lead the upturn as well as the downturn in profitability by 1-2 quarters. The trough occurs 5-6 months after the peak with an average sell-off of 30% (peak to trough).

This piece of information will be useful when we look at semis today later in this article.

The Semiconductor Index (SOXX) declined by 30% between December 2021 and July 1st.

SOXX Price Chart (Dividend Freedom Tribe)

Taiwan Semiconductor (TSM) was bullish for H2, they pointed to some softness from some clients moving forward.

AMD (AMD) also guided softer than initially expected by the market participants.

Micron (MU) pointed out that production would well outpace shipments in the second half of the year. The chipmaker now expects a significant chip build in upcoming quarters.

Similar was pointed out by Intel. Their clients are drawing down their inventories beyond what is normal. While this points to reduced demand for a few quarters, it also means that inventories will then have to be refilled, setting up a nice setting for some pent-up demand in 2023.

“Texas Instruments said that Personal Electronics, which includes handsets, is an area of weakness, but outside of that, its business is strong.”

This is an interesting theme that we’ll explore more later in this article. Broadcom (AVGO) is expected to continue winning thanks to strong cloud demand.

Intel on the other hand, seemed to have peaked in Q4 2022, as the company is still struggling amid a turnaround led by Pat Gelsinger.

I called them out a few years ago, as bloated management payments, sitting on their laurels, and not rewarding shareholders seemed to be a big red flag.

I digress.

From these snippets, and the fact that SOXX peaked exactly 6 months before the YTD low, we could expect reasonably that Q2 was generally the peak for consumer driven chip demand and shipments.

But has SOXX already hit the trough? That would suggest that the industry hits its income through 2-3 quarters from now.

The rest of the article will suggest that this is possible.

The future of semiconductors

I hope that you’re enjoying this piece so far. If anything it should have gotten you up to speed on the key drivers for the industry.

There are secular changes underway which will significantly change future cycles for the semiconductor industry.

From cyclical to secular

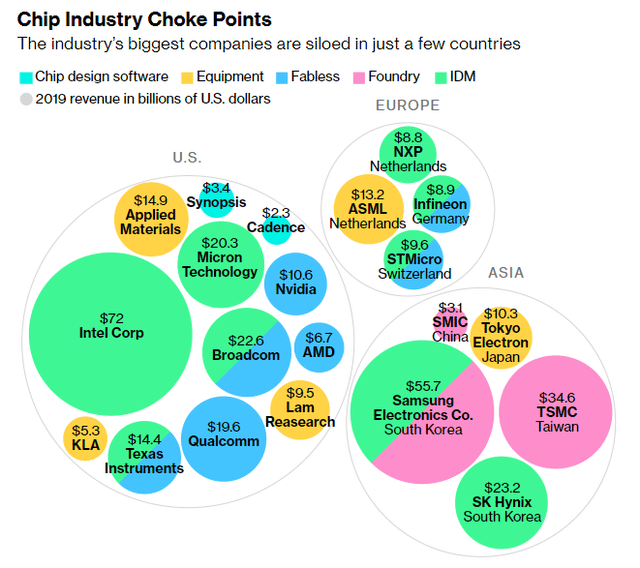

The sector is currently highly oligopolistic, with certain regions and companies dominating sections of the value chain.

for instance, Intel and British company ARM dominate the microprocessor sector, and South Korea’s Samsung dominates the production of dynamic random access memory, a type of semiconductor memory.

U.S. companies, including Qualcomm, Broadcom, and Nvidia, dominate chip design, while the majority of chip production occurs in Taiwan, with Taiwanese semiconductor giant TSMC accounting for 40% to 65% of revenues in the less advanced 28- to 65-nm chip category, and producing 90% of the global market’s most advanced chips.

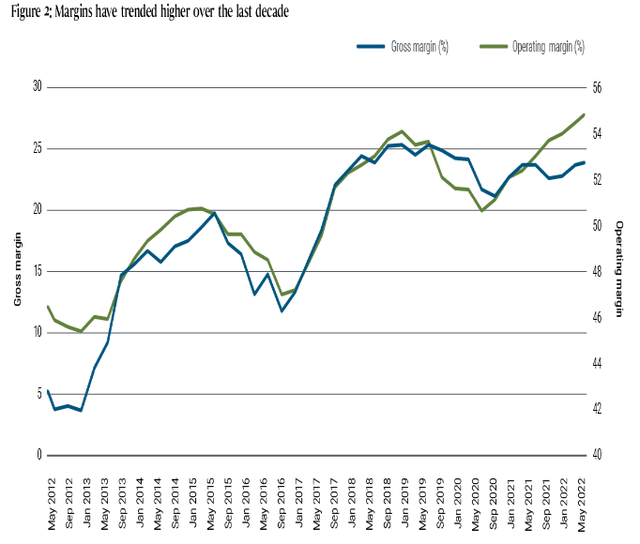

This increased specialization by markets has led to margins continuing to trend higher in upcoming years as companies have carved out their niches, thus reducing the aggressive competition.

In such an oligopoly, cyclical pressures would be expected to become more subdued.

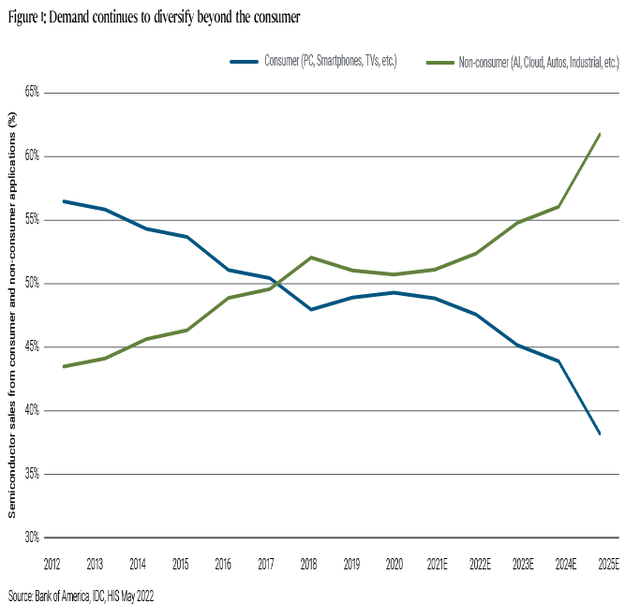

Furthermore, cyclicality in the industry was exacerbated by its consumer centric nature.

But the part the consumer plays in the industry has reduced consistently this century.

Wireless communications, automotive electronics, industrial electronics and cloud computing are going to continue to grow according to McKinsey, and will reduce the consumer’s share to less than 1/3rd of the market by the end of the decade.

Electric cars need much more chips than cars with combustion engines.

Factories will need many more chips as they automate.

Cloud computing will also require a significant number of chips.

Of course, the consumer segment is also set to grow. IoT and all those trends will lead to more chips in the household than we ever imagined.

Having multiple dominating verticals will lead to less cyclicality and secular growth for the next decade or two.

Normalizing government intervention

The second trend, is that of government intervention and geopolitics.

Historically, Asian countries heavily subsidized their own industries, while the US left good old laissez-faire capitalism do its thing.

In Japan, government intervention goes back to the 70s. From the book “The intel trinity”

Meanwhile, Japan’s Ministry of International Trade and Industry, in concert with Japan’s major banks (an arrangement illegal in the United States) helped the Japanese electronics companies embark on a massive program of tracking US patent filings in order to anticipate where they were going and beat them to the punch. The ministry provided subsidies (illegal under international law) to help Japanese companies sell their chips at artificially low prices in the United States while keeping prices high at home. In 1978, forty thousand Japanese citizens made technology-related visits, many of them subsidized, to the United States, while just five thousand American businesspeople traveled the other way.

The pandemic supply-chain shock exposed a problem that had been mounting for years. The U.S. share of global chip manufacturing has declined to 12% from 37% in 1990. South Korea and Taiwan, notably, have spent years actively investing in their own chip manufacturing, creating an uneven playing field for U.S. chip makers that harms our economy and global competitiveness.

The U.S. will invariably pass its bill to support fabrication domestically.

Intel will get new fabs. TXN also. Fabrication has to come back to the US. The EU also wants to build its own chips?

Why? Two words. China & Taiwan.

Semiconductors, like it or not, have become the backbone of our world. The world runs on silicon.

And it’s all at a crazy risk.

If China invades Taiwan, commercial relations will be the first to go.

The below is my take on the current geopolitical situation, considering key constraints.

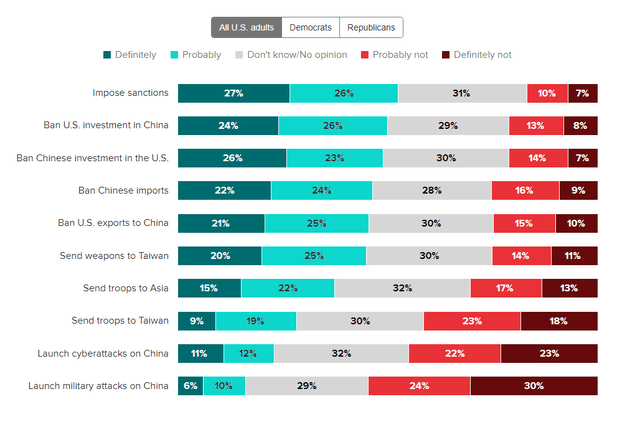

Whether or not the US will actually retaliate with military intervention of its own is yet to be seen. I’d be inclined to say no.

A majority of Americans are opposed to military attacks on China in the event of invasion.

China could also very much play Putin’s book.

Since the Great Financial crisis, we’ve shifted from a world with a singular pole, the US, in which geopolitics had little impact on markets, to one with multiple poles, and with countries pursuing their own agenda without being kept in check.

China, no doubt, wants to flex its importance and its power.

Taking Taiwan by force is one way of achieving this.

It seems increasingly that it is not a question of if, but a question of when.

And this has big ramifications for the US and the EU, which will likely not have their new plants operational before 2025, which could come too late.

China will likely not invade in 2022, as the military cost would still be too high, but they could be emboldened to invade by 2024, if they perceive the current US government as soft.

Following Pelosi’s visit to Taiwan, we can clearly see that China is not going to engage in knee jerk reactions of invading Taiwan instantly. The military exercises around the island are a big act of defiance, but still far from initiating war.

This shows patience, and the decision to wait until the right time to strike.

An invasion would make TSM’s factories non operative, which would be a blow to the jugular for the whole industry.

If the event happens before the US can build and make its new fabs operative before a strike, the impact might be subdued, to a certain extent.

Broadcom, Qualcomm (QCOM), AMD, and Nvidia (NVDA) would be the most at risk if this were to happen, given their overreliance on Taiwan built chips.

This presents an interesting curveball for supply availability.

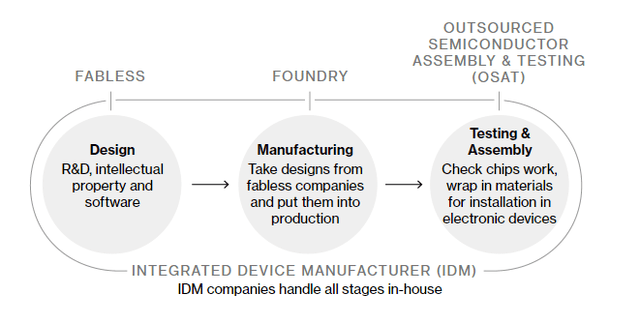

The small infographic below gives you a good idea of how the industry works.

Companies either specialize in design, like QCOM, or manufacturing, like TSM.

Integrated device managers, like Intel or Samsung (OTCPK:SSNNF) (OTCPK:SSNLF) do everything from

Which stocks to buy and which to avoid?

This is a very difficult question.

The world demands and will get more chips.

In the next 12 months, soft demand could hurt certain stocks more than other.

In the next 24 months, the Chinese wildcard could hurt certain stocks more than other.

There is no overlap among stocks that would not be impacted by the slowdown in demand and those that have geopolitical risk.

Yet when we look at valuations, there are some very attractive picks, which will likely require holding for 5-7 years to provide market beating results.

However, given that we follow a long-term, income-oriented dividend growth approach, if we can purchase a stock at the right valuation, and the dividend grows at a satisfactory rate, we can afford ourselves the luxury of patience.

The recession proof pick: Broadcom

Remember how I said that the industry is very specialized as multiple verticals are posed for high growth throughout the next decade?

Well not all verticals will react to an economic downturn in the same way.

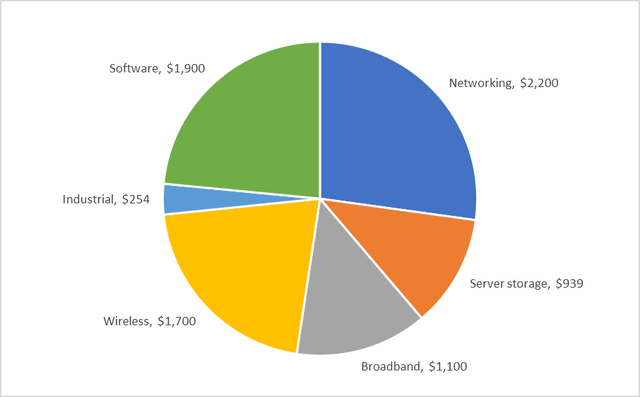

Here are Broadcom’s different verticals: networking, server/storage connectivity (cloud), broadband, mobile device connectivity, industrial, and software.

As you can tell there is very little exposure directly to the consumer.

The chart below gives a good idea of the breakdown of revenue in Q2.

Revenue in millions (Q2 Earning Call)

Looking at Broadcom’s customers, we can expect aggressive growth to continue from their networking and server storage segments.

Data-center capital expenditure is expected to grow 25% this year and mid teens in the next year, according to a team of JP Morgan analysts, which should keep shipments from Broadcom at elevated levels.

From a valuation perspective, Broadcom is very attractive.

It is the perfect dividend compounder.

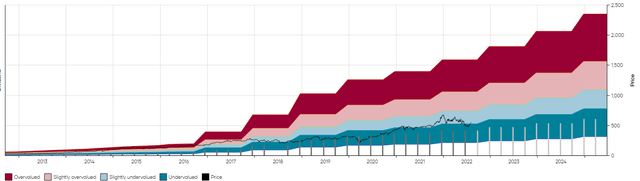

It currently yields 3%, which is below its 10 year median yield as you can see on the MAD Chart below (click here for more on MAD Charts).

AVGO 10 year MAD Chart (Dividend Freedom Tribe)

That being said, the 10 year dividend yield range is still somewhat skewed from the massive 2016 dividend increase.

It might be better to zero in on the 5 year chart.

AVGO 5 year MAD Chart (Dividend Freedom Tribe)

Here the stock has seldom traded above a price which pushed the yield below 2.8%.

If we project a 12% dividend growth rate for AVGO next year, this could easily push the stock up to $640-$650 a year from now, while retaining similar valuations.

For dividend investors AVGO remains a brilliant pick, as the market constantly values it on other metrics which make it more comparable with the entire industry, such as price earnings and price sales.

This means that they ignore that the investment opportunity from the income perspective is superior.

For perspective, a 3% dividend yielding stock requires 7-10% dividend growth (more on this here), whereas AVGO can deliver 12-15% dividend growth.

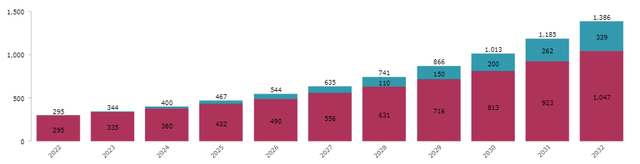

Assuming the dividend compounds in the middle of that range, at 13.5% per annum, a $10,000 investment in AVGO today would provide annual income of $1,386 in 10 years, provided that dividends are reinvested.

AVGO Income Projection (Dividend Freedom Tribe)

This shows AVGO’s potential as an income producing stock.

In the current environment, Broadcom is the perfect pick.

If China invades Taiwan, it would be in big trouble, as the company is one of TSM’s biggest customers, and has over reliance on their chips.

The geopolitical status quo of 1980 to 2010 is dead. Over the next decade we’ll see US chipmakers produce more and more of the chips Broadcom designs.

So AVGO scores high on being recession proof, but low on being Taiwan war proof.

The undervalued China proof pick: Skyworks

Ok, so who builds their own chips?

Intel does. I don’t want to cover Intel here, I’ll cover it on the Dividend Freedom Tribe, where it is possible to have a civilized discussion on the topic.

The level of fandom in the AMD vs INTC debate is beyond my understanding. Chill out boys, they’re just big corporations trying to sell you hardware.

One interesting, and often not discussed enough chipmaker is Skyworks Solutions (SWKS).

They have come under fire, because just over half of their revenue comes from Apple (AAPL).

Talking heads have been fast to say that they will share INTC’s fate, and that AAPL will build their own chip and cut them out.

Here’s the thing: AAPL needs a lot of different chips. And they’re not all made equal.

They cut out Intel when Intel was going through a period of sluggishness and was pushing back deliveries of the newer chips.

These were also relatively easy chips to produce, whereas the chips which SWKS produces are high tech, high precision, and would be extremely difficult and costly for AAPL to get into a position to replicate.

The likelihood of AAPL deciding to compete with the entire chip industry by vertically integrating everything are close to zero.

And let’s flip this around for a second.

As consumer demand starts to go down, if you could pick one consumer discretionary company in the world which likely has more staying power than others, regardless of valuation, which would you pick?

Likely Apple, right?

In July iPhone sales remained strong while the rest of the smartphone industry started to show some weakness.

For an in detail analysis of this, you can read fellow SA author, Alan Vashi’s article on Apple here.

SWKS just beat earnings and revenue estimates, and guided strong double-digit dividend growth for the rest of the year.

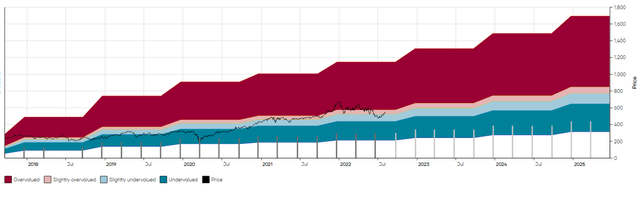

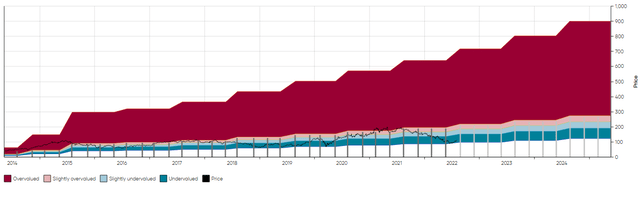

Relative to the dividend, the stock is very cheap. It usually yields between 1.15% and 1.65%, but currently yields 2%.

Since initiating its dividend in 2014, it has never yielded more than 2.6%.

SWKS MAD Chart (Dividend Freedom Tribe)

I project dividends to continue growing at a 12% to 15% CAGR in upcoming years.

Remember with this, we’re looking for a rolling average, not growth in any one year. While the dividend only grew 11% this year, it is quite frequent that management grow the dividend by less when valuations are low, as they don’t believe the market will react much to it. Anyway the stock is already down.

Increasing modestly allows them to scale it up later by keeping a buffer.

I’m sure this will happen, as SWKS only pays out 36% of its FCF.

The stock is a buy.

As the CEO said in the past, their DIY approach insulates them from Taiwan.

We don’t make everything in-house, but most of it is done in-house. So owning our own factories, delivering within our facilities, being efficient there, managing the constraints, but then also bringing that technology up.

Tomas Andrade, who writes for the Dividend Freedom Tribe, has recently done a deep dive article analyzing SWKS, going into detail into everything we love about the stock. For brevity’s sake, we’ll keep it out of the discussion here.

Sell AMD

I feel like a soccer hooligan about to head to the other teams tribune to taunt them when I say this, but it is the obvious call.

The market is so high on AMD.

Despite the stock dropping 33% from its ATH, it still trades at 40x earnings.

Everyone is so focused on it taking market share from Intel.

This ignores the coming slowdown in consumer demand. This also ignores the fact that Intel is the prime beneficiary of the US Chips act, and that if Gelsinger gets his way, eating Intel’s market share might not continue for much longer.

That is all I’ll say about the debate on market share from both companies, but here is the clear breakdown of why we’re suggesting to sell AMD:

- Sky high valuation. Growth isn’t high enough to justify 40x earnings.

- Exposure to Taiwan. AMD relies on Taiwan for chips.

- Exposure to the consumer. Two thirds of AMD’s revenues are consumer centric.

These factors create too many risks, especially given the value.

Conclusion

This was a very long article. It is hard to cover such a complex topic and provide actionable insights in a few words, so if you made it to here, thank you.

If you liked the article consider following us, by clicking on the button next to our name.

Be the first to comment