shaunl

A Quick Take On TFI International

TFI International (NYSE:TFII) went public in the U.S. in February 2020, raising approximately $200 million in gross proceeds.

The firm provides a range of transportation and logistics services to companies in Canada, the U.S., and Mexico.

My outlook on TFI is on Hold until we see the extent of the expected macroeconomic slowdown in the first half of 2023.

Company And Market

Saint-Laurent, Quebec, Canada-based TFI was founded to provide various integrated cargo transport services to businesses and organizations in North America.

Management is headed by Chairman, President and CEO, Mr. Alain Bedard, who has been with the firm since 1993 and has more than 45 years of experience within the industry.

Since Bedard took over running the firm in 1996, he ‘has overseen more than 180 acquisitions and generated a total cumulative return on investment for our shareholders over the past 20 years of more than 4,800%.’

Management says that no single customer accounts for more than 5% of revenue, so the firm’s customer base is distributed.

The company’s primary offerings include:

-

Truckload full load haulage

-

Logistics

-

Less-than-truckload

-

Package and courier

The firm grows its customer base both through organic efforts via a direct sales team and through its many acquisitions.

The main drivers for expected growth in the transportation industry are an increase in automotive shipping requirements and a growing need for transporting alternative fuel stocks.

Major competitive vendors include:

-

Werner Enterprises

-

Schneider National

-

Knight-Swift Transportation

-

Covenant Transportation

-

USA Truck

-

Marten Transport

-

Heartland Express

TFI’s Recent Financial Performance

-

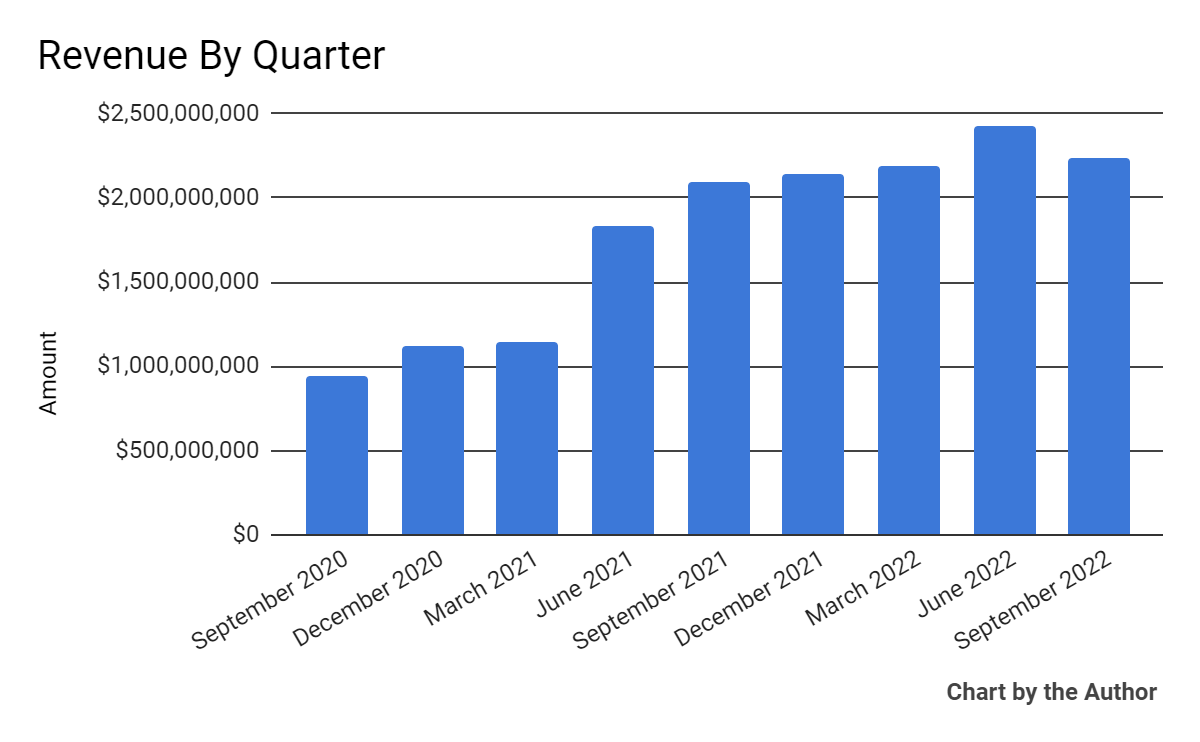

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

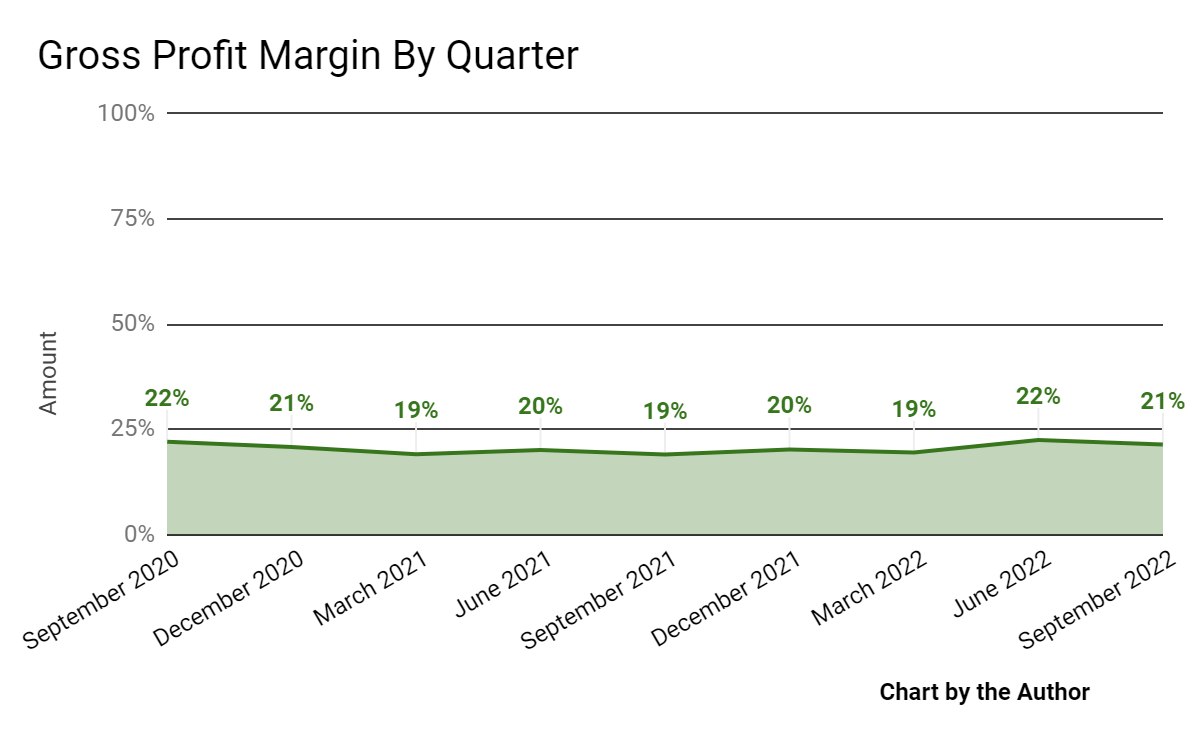

Gross profit margin by quarter has remained within a narrow range:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

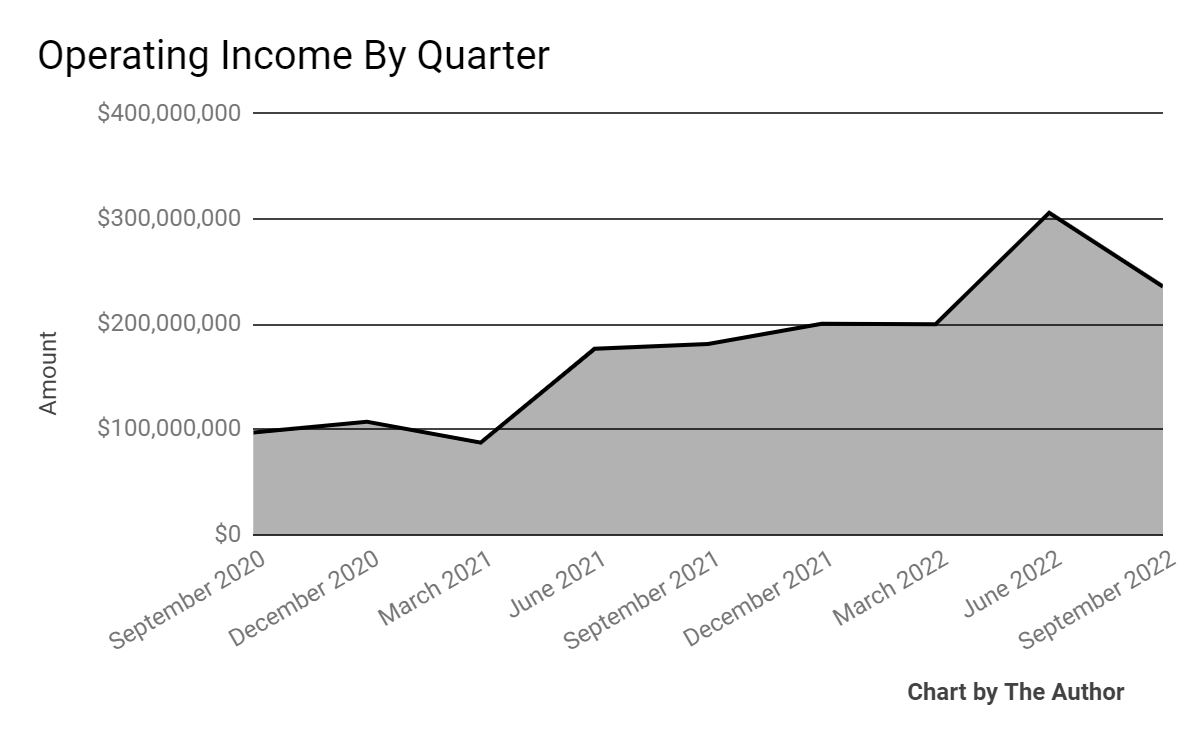

Operating income by quarter has risen significantly in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

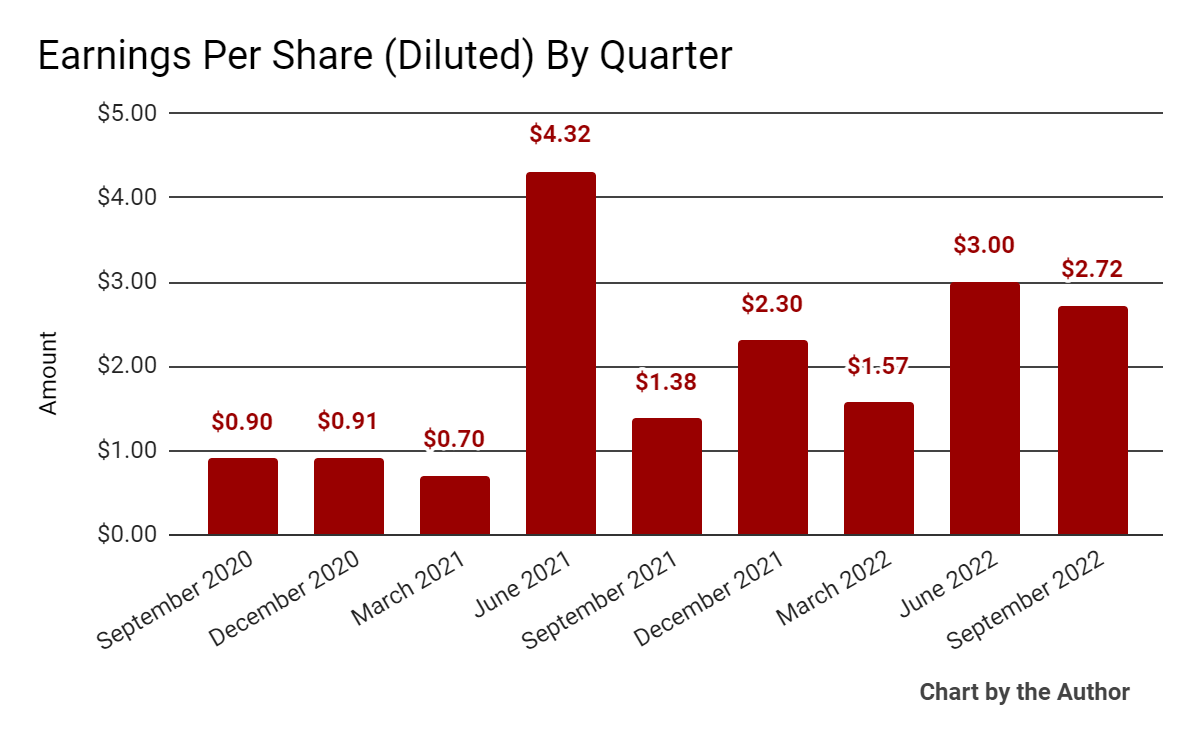

Earnings per share (Diluted) have risen in recent quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

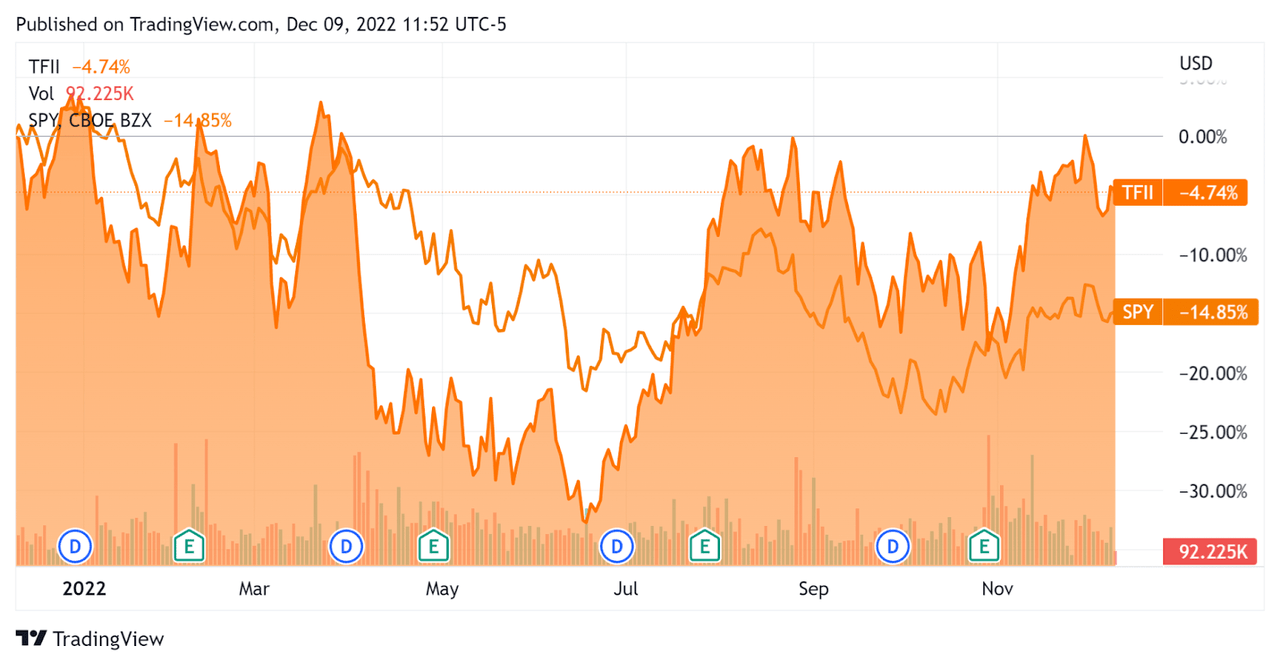

In the past 12 months, TFI’s stock price has fallen 4.7% vs. the U.S. S&P 500 Index’s drop of around 14.8%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For TFI

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

1.2 |

|

Enterprise Value/EBITDA |

8.4 |

|

Revenue Growth Rate |

45.1% |

|

Net Income Margin |

8.1% |

|

GAAP EBITDA % |

13.8% |

|

Market Capitalization |

$8,869,462,000 |

|

Enterprise Value |

$10,440,724,500 |

|

Operating Cash Flow |

$913,630,020 |

|

Earnings Per Share (Fully Diluted) |

$9.59 |

(Source – Seeking Alpha)

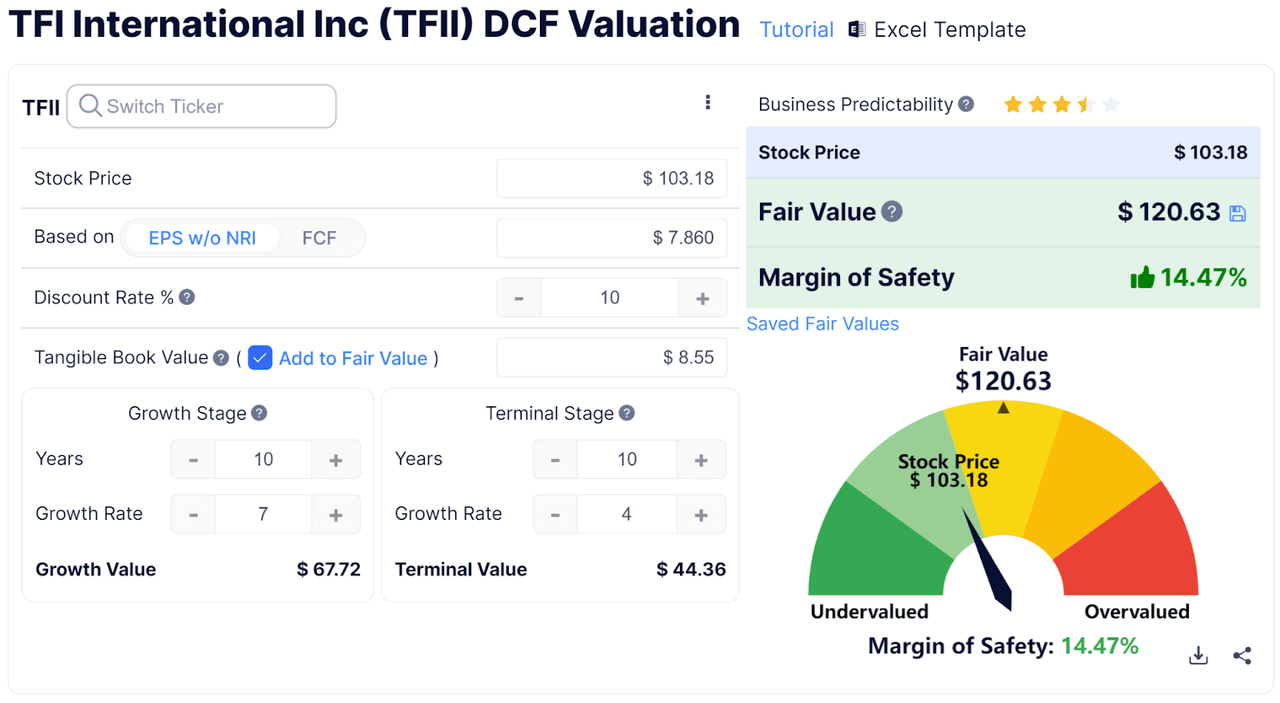

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

TFI Discounted Cash Flow (GuruFocus)

Assuming generous DCF parameters and a 7% average annual growth rate for the next ten years, the firm’s shares would be valued at approximately $120.63 versus the current price of $103.18, indicating they are potentially currently undervalued, with the given earnings, growth, and discount rate assumptions of the DCF.

Commentary On TFI

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted the firm’s ability to adjust capacity to its variable costs ‘to match changing demand.’

As to its financial results, total revenue rose 7% year-over-year, with each of its four business segments producing ‘strong returns on invested capital.’

The company has also been focusing on cost control, resulting in growing operating income, sharply boosting its operating margin to 28.2%.

For the balance sheet, the firm finished the quarter with $133.1 million in cash and equivalents.

Over the trailing twelve months, free cash flow was $572.9 million, of which capital expenditures accounted for $340.7 million in cash used.

The company repurchased 2.1 million shares for $200 million during the quarter, and the Board announced a 30% raise in its quarterly dividend.

The current forward dividend yield stands at approximately 1.35%, which is somewhat lower than the sector median of 1.62%. However, its forward dividend per share growth rate, at 18.02%, is far higher than the sector median of 6.58%.

Looking ahead, CEO Bedard reaffirmed its full-year earnings per share estimate of $8.00 and free cash flow of $900 million.

Regarding valuation, a generously discounted cash flow analysis suggests that TFI may be undervalued at its current price.

The firm is still in the process of optimizing its UPS Freight acquisition to reduce unnecessary costs, which will be especially important as the market shows slowing characteristics.

This will take time as the company needs to shift its UPS Freight IT systems to its own in order to provide its managers with the information they need to reduce costs further.

A potential upside catalyst to the stock could include a ‘short and shallow’ recession in early 2023.

Given the company’s continued challenges in integrating UPS Freight and management’s anticipation that ‘things will probably still slow down in ’23,’ I’m cautious about TFI in the short term.

My outlook on TFI is on Hold until we see the extent of the expected macroeconomic slowdown in the first half of 2023.

Be the first to comment