mesut zengin/iStock via Getty Images

Investment Thesis

Texas Roadhouse (NASDAQ:TXRH) is the largest steakhouse chain in the U.S. Despite the big size they already have in the US, they plan to open more restaurants, implement new brands and expand abroad where they might thrive even more. Management’s capacity to allocate capital is very impressive. They are able to reach breakeven for any restaurant they open within 2 year. However what I really like of the company and what got me interested, it is its financial. For being a company that operates in the restaurant industry, TXRH looks in great financial health and its cash flows are astonishing. Even though the current headwinds might slow down the growth and reduce the marginality, the long term outlook appears positive. If the price had to drop and reach the target price I came up with, I would be more than willing to start building a position and keep the stock for the long term.

Business Model

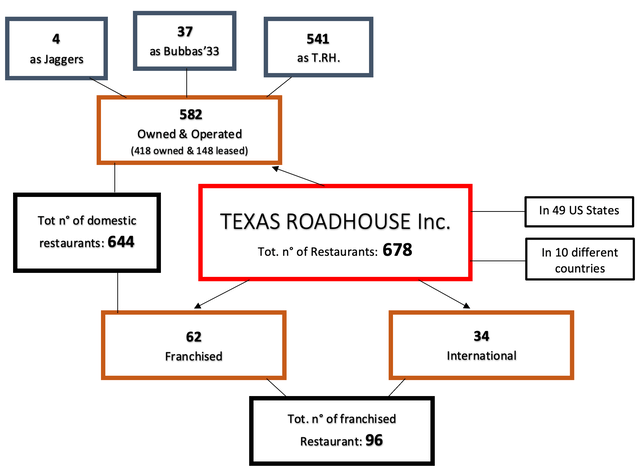

The company is a growing restaurant company operating predominately in the casual dining segment. Their mission statement is “Legendary Food, Legendary Service.” The company’s operating strategy is designed to position each of the restaurants as the local hometown favorite for a broad segment of consumers seeking high quality, affordable meals served with friendly, attentive service. As of June 30, 2022, they own and operate 582 restaurants and have franchised an additional 62 domestic restaurants and 34 international restaurants.

- Of the 582 restaurants they own and operate, they operate 541 as Texas Roadhouse restaurants, 37 as Bubba’s 33 restaurants and four as Jaggers restaurants.

Image created by author using data from TXRH’s latest Q10

2. The second part of their business model structure are the restaurant franchise arrangements. As of June 30, 2022, they have 25 franchisees that operate 96 Texas Roadhouse restaurants in 23 states and ten foreign countries.

financials/2022/q2/TXRH-Q2-2022-earnings-release.pdf

Approximately 75% of the franchise restaurants are operated by ten franchisees and no franchisee operates more than 16 restaurants.

Financials

Income Statement

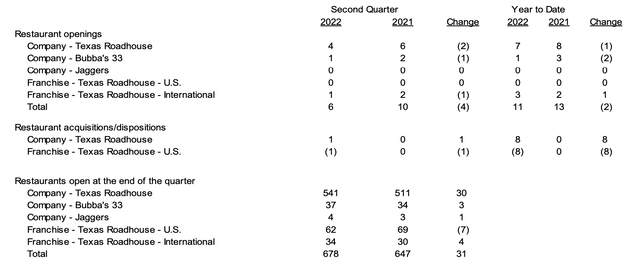

When it comes to the financial statement the first voice that shows up is the revenue. The turnover has been going nothing but up, growing at a 12% CAGR over the last 10 years moving from $1.263 to $3.464 billion. The positive trend seems to continue even though the growth is likely to slow down in the future.

financials/2022/q2/TXRH-Q2-2022-earnings-release.pdf

Gross profits in the FY2021 were $627 million, growing almost as much as the revenue. The gross margins were 18%, slightly down compared to the previous years. It looks like the bigger they become the more costs they have to cope with. In fact 5 years ago the margins were almost 20%. I don’t see this as much of a problem because they are still trying to grow, keeping competitive prices and entering in new markets. I feel that over the years this metric will eventually stabilise. Plus, they have been killing the competitors, gaining increasingly more market share, as we will see later on in the analysis.

At the bottom line we find the Net Income. Texas reported for the FY2021 a net profit of $245 million, growing almost 250% in the last 10 years, compounding at 14,5% per year. As I will explain later on the valuations, the money that TXRH is able to print is much more appealing than what shows up on the obsolete and common net income.

Balance Sheet

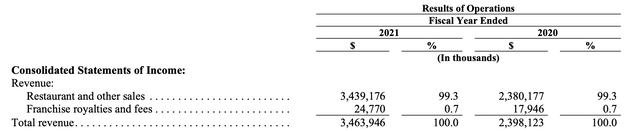

Texas Roadhouse looks to be in great financial health, better that any restaurant company I have ever looked at. Let’s start with the cash line. As of June 28, 2022, they have $180,411 million in cash and equivalents with a total current asset of $281 million. The total current liabilities amount to $529 million, which means they need to find roughly $250 million within a year. That brings their quick ratio to 0,53. Usually, a rate below 1 might show that the company doesn’t have enough quick cash to meet all its short-term obligations, but that is not the case. Let’s remember that Texas is a money printing machine, so they will be able to pay their debts without divesting from other assets or issuing new debt. Plus they found themselves in this situation only for reasons I will explain in a few moments in the cash flow statement, otherwise the rate would be around 1.

Regarding the Total liabilities, during the last year they have been paying down their long term debt, passing from $190 million to $75 million, which compared to the amount of cash that they generate in free cash flow every year, the debt is practically nothing. Furthermore, the debt is not due for the next three years, so no concerns on that.

The current total Equity is sitting around $1 billion, a number that over the last years has been steadily growing. A company that is able to increase their equity over time like that, shows good financial health.

Image created by author using data from TXRH’s latest Q10

Cash Flow Statement

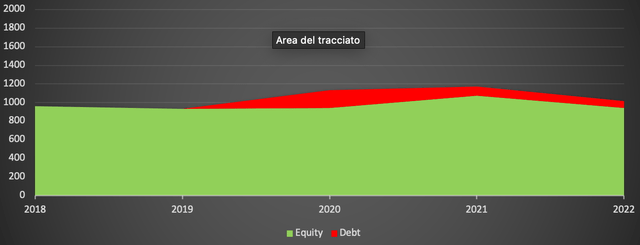

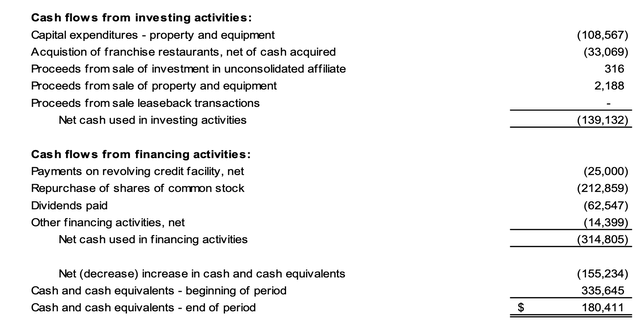

Here we can discover why Texas is really appealing. In FY21 they made $470 million in operating cash flow and spent $200 million in Capex, generating a free cash flow of roughly $270 million. When it comes to analysing how much a company generates exactly in FCF/owner earnings, we should distinguish the different expenses they cope with during the year in the capital expenditure section, but I’ll explain it better in the valuation paragraph.

Now, let’s take a look at what they did during Q2. With regards to cash flow, they ended the second quarter with $180 million in cash, which is down $145 million from the end of the first quarter. Cash flow from operations of $111 million was more than offset by $60 million in capital expenditures, $31 million in dividend payments, $25 million in debt repayment and $128 million in share repurchases. With the addition of the 1.7 million shares that the company repurchased in the second quarter, they have now repurchased over 2.7 million shares of stock for $212.9 million this year. At the end of the second quarter, they have approximately $167 million remaining under their share repurchase program. They also acquired one franchise restaurant for $6.6 million, amounting in total for the first 6 fiscal months to $33 million. They continue to expect full year 2022 capital expenditures to be approximately $230 million.

The statement below shows the cash flow activities (expenses) of the first H1.

financials/2022/q2/TXRH-Q2-2022-earnings-release.pdf

My view is that they will not buy back anymore shares for at least a year. The reason for this is because, if we assume that within a year they are able to generate the same amount of operating cash flow they did in the FY21, keeping the capital expenditures as they expect and paying dividends, they won’t have enough money to buyback shares. They would have to either issue new debt or lower their expenses, if they intended to do it. It’s more likely they will stop, at least for the moment, their repurchase program and keep paying down the debt rather than issuing a new one.

All the data listed under financials can be found in the latest Q-10.

Future outlook and growth

For 2022, the Company plans to open approximately 21 Texas Roadhouse company locations and the franchise partners plan to open as many as five restaurants. In the first six months of 2022 the company has already opened eight company restaurants and three international franchises.

Moreover, since Bubba’s 33 has had a great success so far, for 2022 they plan to open as many as four additional restaurants. At the moment only one restaurant has been opened.

In the first half of 2022, the Company completed the acquisition of eight franchise restaurants for an aggregate purchase price of $33.1 million. They are currently not accepting new domestic Texas Roadhouse franchises. My take on that is that maybe over the years they might want to get rid of the franchise structure, at least in the US, in order to better their profits or maybe just buying out the most profitable ones, since they have been doing so for the last five years.

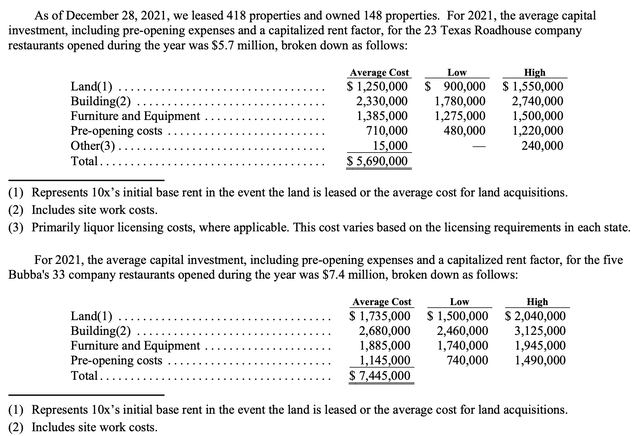

Economics of developing

They expect the developing costs to be in 2022 around $6.5 million for the Texas Roadhouse restaurants and $7.3 million for the Bubba’s 33. As they stated in the first fiscal 10-Q .

Furthermore, they have entered into area development and franchise agreements for the development and operation of Texas Roadhouse restaurants in several foreign countries and one U.S. territory. On June 28, 2022 the total number of international restaurants were 34.

Competitors

Competition in the restaurant industry is very intense. Since we cannot take into analysis every restaurant chain, I believe that a better comparison would be just on focusing on steakhouse competitors that are publicly traded, have almost the same size and are as financially healthy as TXRH. The only company that has these kind of requirements is LongHorn Steakhouse owned by Darden Restaurants (NYSE:DRI). We could take into analysis also Outback Steakhouse owned by Bloomin’ Brands Inc. (NASDAQ:BLMN), but the company is highly leveraged and a slightly overpriced, at least from my point of view. Furthermore LongHorn’s quality of food appears to be better than Outback’s.

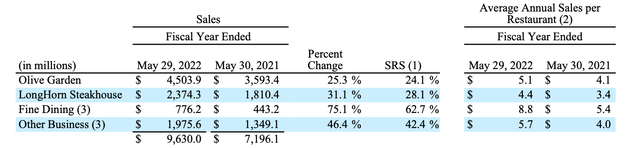

LongHorn total net sales for the FY22 were approximately $2.3 billion, 31% higher than the previous year. A stunning result, but we have to keep in mind that more than a half of their fiscal year was impacted by covid restrictions, so it makes sense they did not make much money back then.

Darden Restaurants annual report 2022

Now, if we make a comparison with Texas Roadhouse, it’s clear that the winner is only one. TXRH in same period of time grew its revenue by almost 50% compared to same previous period (LongHorn’s FY21). The result is even more astonishing if we think that the two companies own almost the same number of restaurants. Just for instance, if we divided the total revenue (excluding franchise royalties and fees) with the number of restaurants owned and leased, TXRH makes about $6.5 million per restaurant, LongHorn only $4.4 million.

Regarding instead the analysis of the financial statements, Darden Restaurants International (the company that owns LongHorn) appears to be slightly more leveraged compared to Texas Roadhouse. As of May 29,2022 their total cash on hands, equivalent and restricted cash amounted to around $430 million, instead their current liabilities were $1.85 billion, so within a year they must be able to find the $1.4 billion difference. It is true that they have also roughly $275 million in inventory, but it is always a tricky current asset. The long-term debt instead, consisted principally of:

-

$500.0 million of unsecured 3.850 percent senior notes due in May 2027.

-

$96.3 million of unsecured 6.000 percent senior notes due in August 2035.

-

$42.8 million of unsecured 6.800 percent senior notes due in October 2037.

-

$300.0 million of unsecured 4.550 percent senior notes due in February 2048.

The latest Fitch’s rating on Darden restaurants’ debt is “BBB”.

On the cash flow side, in the FY22 they were able to generate $1.25 billion on operating, and spent on capital expenditures roughly $380 million. If they generate the same amount of cash flow for the next year and also reduce the capex and suspend dividends and the repurchase of shares, they might be able to pay all their current liabilities due, without resorting to issuing new debt. Otherwise they either divest a few assets, even though they do not own anything that can be turned into liquidity rapidly, or more likely, they will issue new debt. All the data reported cab be found in the latest annual report of Darden Restaurants.

One last thought on Darden Restaurants. The company’s financials seems to be well managed. If I instead had to assess instead management’s honesty to customers, I would not give a good score. The problem is with their Olive Garden chain. They want you to think you are having a good Italian meal, but in reality the food is everything but Italian.

Conference Call

During the conference call a few matters arose, which are worth noticing.

Regarding new openings and updates, at the begging of the call, the management stated that they expect to open 2 company-owned Jaggers and their first Jaggers franchise restaurant later this year.

The management was then asked about how they are coping with the often spikes of beef’s cost in the near term. They replied by saying that 70% of the beef prices were locked in Q3 and only 30% locked in Q4. So there might be some risk there that could impact TXRH margins.

Valuation

Usually, when it comes to assessing a business like TXRH, I always use a FCF metric, but in this case I will first focus on their owner earnings, because this is what really makes this stock appealing. In order to do that, we have to take into analysis the capital expenditures of the company and try to figure out the amount of money spent just for maintenance and the money spent on growth.

The management expect Capex for the FY22 to be around $230 million. What we know for sure is that they will be opening 21 TXRH restaurants and 4 Bubba’s 33 in total. Now, if we assume that the average cost of development for those establishments is $6.5 and $7.3 million respectively, as they expect, that means we can then await “growth capex” to be around $165 million dollars. Now, if the company is able to generate $470 million in operating cash flow in the FY22, as expected, and we know that their maintenance expenses will be just $65 million, this means that in reality they are able to generate about $400 million (if they ever decided to stop growing) per year. This is much better than the $250 million in FCF shown on the cash flow statement.

Plus, since we know that provisions for taxation don’t involve any cash inflow or outflow, but it just happens to be a non cash item appearing on the debit side of profit and loss account, we could basically add back this “expense”. Their tax provision is expected to be around $40 million. Which brings the number we came up with earlier, to a total of $440 million. These are what I call hidden owner earnings!

So, if we aim to get at least a 10% long term return per year with a slight margin of safety, that means I want to buy Texas Roadhouse for around 4 billion dollars, or below $60 per share. The current market capitalisation is sitting around $5.7 billion, so it has to drop another 30% before I would make a move.

Risks

One of the risks that comes up immediately to my mind is a likely negative economic condition. Which it could cause consumers to choose less expensive alternatives. However period of recession statistically do not really last for long, so not much concern on that.

Another big issue, probably the gravest one, might be a prolonged inflation. The company expect to continue to experience commodity cost inflation and certain food and supply shortages. The management has been able to properly manage any food or supply shortages so far, but has experienced increased costs. If the vendors are unable to fulfill their obligations under their contracts, the company may encounter further shortages and/or higher costs to secure adequate supply and a possible loss of sales, any of which would harm the business.

Last but not least of the risks, it is for sure a possible change in consumers behaviour. Always more people have changed their food habits in order to have a healthy and balanced diet. The consume of beef in the US has been declining over the years. So either TXRH starts to sell veggie steaks or it might run out of business.

Conclusions

From my point of view Texas Roadhouse has all the credential to become a great compounder over time. The expansion beyond the US borders and the new brand chain really show that. It is true that the current headwinds might represent an obstacle to the further expansion, and less returns to the shareholders in the short-term, but the company shows a really good financial health and practically no debt. So they will overcome this unprecedented period without any problem, maybe even outperforming the competitors and taking advantage of them. Despite my more than good feedback on the company, the only thing that matters to me is the price and return on investment. I would not say that TXRH is overpriced, but it is certainly fairly priced at the current market levels. If I had the stock in my portfolio, I would hold it for sure, otherwise, as I’m doing, I would wait for the price to drop. However, as Warren Buffett says “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price”. It all depends on how the stock and the price you are paying fits you.

Be the first to comment