Vesna Andjic/E+ via Getty Images

Far from its all-time high, with a tumultuous past now behind it and a promising pipeline for 2023, Teva Pharmaceutical Industries Limited (NYSE:TEVA) is a company to watch at only $8.97 per share.

Focus on corporate strategy

Teva’s business strategy is what makes me confident in a long-term view toward this company. After the countless difficulties faced from 2015 onward, it seems that to date something is changing, and expectations for 2023 look bright. In the latest quarterly report, Teva’s focus was mainly on four main themes, each of which will be covered in this article.

Teva Q2 2022

Optimize business

Business optimization means simplifying production processes and disinvesting in business branches that are now unproductive and irrelevant to improving synergy. Eventually, targeted new acquisitions can also bring synergy improvements.

During the last earnings call, CEO Kåre Schultz discussed this topic at length:

With regards to divestments, what we’ve done in the last five years is we’ve really analyzed the entire value chain, the entire business, and we have sold off those elements that we thought had no strategic synergy with the rest of the business and we’ve kept all the elements that indeed gives us a strong synergist effect. So, we have no plans of divesting any parts of our business. We basically had the plan to integrate and optimize the business we have elected to keep, because we believe it all fits very well together.

Teva’s divestments have been many in recent years, and the company presents a different set-up than in the past. According to the CEO, all divestments have been focused on improving the company’s core business by removing business units that are unrelated to the company’s vision. Here are some of them:

- Sale of the portfolio in the global women’s health business for $703 million cash to CVC Capital Partners

- Sale of its emergency contraception brands to Foundation Consumer Healthcare for $675 million

- Sale of Paragard for a unit of Cooper Companies Inc. for $1.1 billion

- In the past 4 years, production sites have decreased from 80 to 53.

To date, at least as far as divestments are concerned, it seems that Teva has completed its process of simplifying the various business divisions, leaving only those in which it believes most. I do not rule out the possibility that there may be new acquisitions in the future aimed at improving corporate synergy, but I think it unlikely that these will be very costly purchases since the company’s focus is also currently on debt reduction. If Teva has carried out a divestment strategy in recent years, it has also been to improve its financial condition.

Reduce debt

Debt reduction is a constant theme in Teva’s financial reports, in fact for management this is a major focus. After the acquisition of Actavis for $40.50 billion in August 2016, Teva’s net debt suffered a major setback that still has not been fully disposed of.

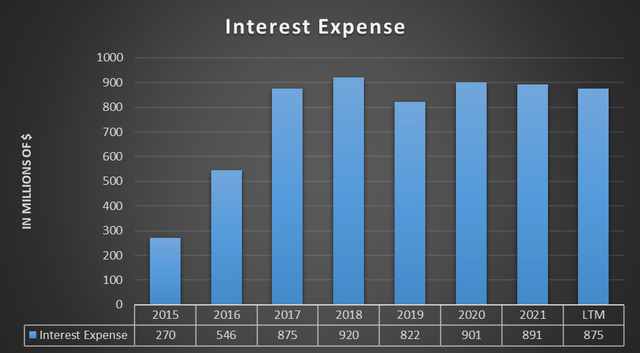

The burden of interest on debt years later is still quite high. In fact, it amounts to 5.60% of revenues for the whole of 2021. This is why Teva definitely wants to reduce it.

Nevertheless, my sentiment on Teva’s financial situation is positive. It is true that the net debt is very high, but the company is objectively working to reduce it.

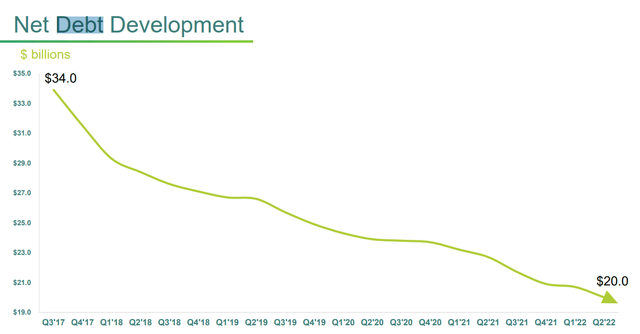

In about 5 years, Teva has reduced its net debt by $14 billion, a remarkable sum for a company with a market cap of only $10 billion.

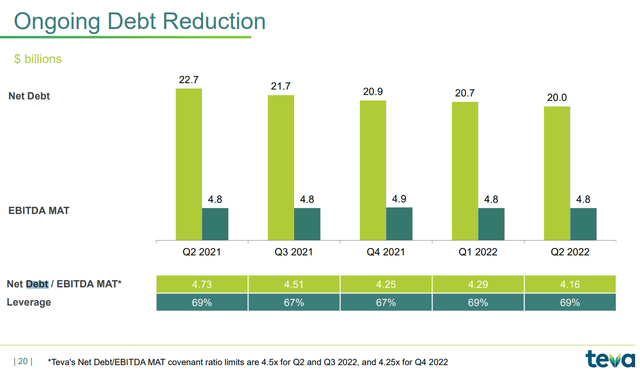

Going to analyze the structure of this debt even further, we can see that Teva is subject to covenant ratio limits that it must necessarily meet:

- For Q2 and Q3 of this year the net debt/EBITDA must be at a maximum of 4.50x

- For Q4 of this year, net debt/EBITDA must stand at a maximum of 4.25x.

Currently this value is at 4.16x, so I am confident that Teva can easily meet these thresholds. On the other hand, regarding future net debt expectations, management has set two long-term targets: one for FY 2023, and another to be achieved by 2027:

- The FY 2023 goal is to have paid down at least $18 billion of debt including interest in the last 4 years, and to reduce net debt rapidly to below $20 billion.

- The goal to be achieved by 2027 is to reach a net debt/EBITDA of 2x, or about half of what it is today. Rather than by strong EBITDA growth, I expect that this goal can be met by a strong decrease in net debt.

Finally, to conclude the debt issue, the company in the last report specified that it intends to achieve the 2027 results by relying only on its cash flows. An increase in equity with consequent dilution for shareholders is not expected.

Legal settlements

Teva Pharmaceutical in recent years has been at the center of the scandal related to the opioid epidemic, an affair that began in the late 1990s. Teva, along with other pharmaceutical companies, reassured the scientific community that opium-containing painkillers did not generate any kind of addiction in users, which led to increased prescribing of these drugs. Subsequently, this belief was disproved, and opium addiction spread rapidly within the U.S., causing a full-blown epidemic.

By the time this black swan hit Teva, the most disparate hypotheses had arisen to solve this problem, many of them with disastrous outcomes for the company. The expense of resolving this litigation involving thousands and thousands of people was incalculable, and all this only destabilized the company even more. In late July of this year, however, a settlement was finally reached and Teva will have to shell out $4.20 billion plus $100 million for the tribes. This is certainly not a success for the company, but at least a situation that had lasted for years has been clarified. The debt payment will be made over 13 years, a large deferment that favors its payment.

Focus on cash flow

Cash flow is the most important aspect, as a company that does not generate any is doomed to fail. Teva on this theme has set two main goals:

- Surpass a free cash flow of $2 billion by FY 2023.

- Achieve by 2027 a mid-single-digit revenue CAGR on a constant currency basis, as well as an operating margin of at least 30%.

What will generate this growth, according to the company, will be five main aspects:

- Stable and predictable generics business

- Strong biosimilar portfolio

- Focused specialty pipeline with high growth potential

- Reduced leverage

- Increased operating margin through input optimization

The last two aspects have already been covered within this article, so now I focus on the first three.

Stable and predictable generics business

Teva is among the world’s leading generic drug companies and sees this market segment as a reliable source of cash inflows.

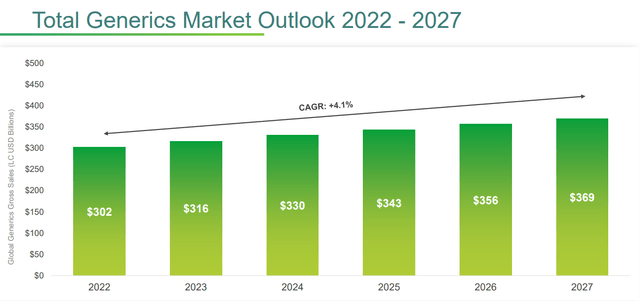

Expectations of this market segment are not so rosy, but after all it already generates $300 billion a year. Over the next 10 years, $400 billion worth of drugs will go off-patent, and Teva has already implemented 1,100 projects to cover more than 80% of off-patent products.

In this area, it is important to monitor the situation regarding the antipsychotic drug RISPERDAL® marketed by Janssen Pharmaceuticals, a subsidiary of Johnson & Johnson (JNJ). That drug is intended to treat schizophrenia and in the full year 2021 generated revenues of $592 million. In July 2022, the FDA approved the first generic versions of this drug produced by Teva that will have the same contraindications as the branded drug.

During 2022, however, there was also another important development for the generic drug portfolio. On March 7, there was the launch of lenalidomide capsules, the first generic version of Revlimid®. That drug is intended to treat multiple myeloma, smoldering myeloma, and myelodysplastic syndromes. Revenues generated in 2021 by Revlimid® were $2.30 billion. In 2023 we will be able to better understand how successful these new launches have been.

Strong biosimilar portfolio

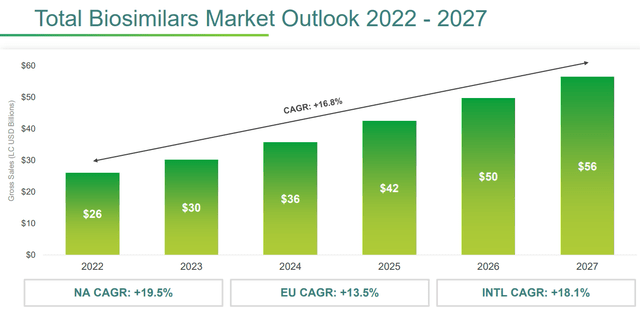

The biosimilars portfolio is probably the one with the highest prospects for improvement. The company is betting heavily on this market segment as it has very attractive potential growth: from 2022 to 2027, a CAGR of 16.80% is expected.

To date, Teva’s portfolio is well positioned in this market having 16 biosimilars, but in this article I will discuss the most interesting ones from a future perspective.

The most important is definitely the biosimilar of Humira®, a drug produced by AbbVie (ABBV) that generated $20.7 billion in 2021. Competition related to biosimilars of this drug will be fierce in 2023, and companies competing include Teva in collaboration with Alvotech. According to Sven Dethlefs there will be two main phases involving the commercialization of the biosimilar, and Teva is in a better position than its competitors. Here is his comment:

Amgen comes in January with their biosimilar and then a whole range of other companies including us in July 2023. I believe the uptake will be largely defined by the contracting strategies of PBMs and our customers, how they think they would like to build the biosimilar market versus the offer that they get from AbbVie. And that will be a two-step approach, one that will happen in 2023, primarily in the summer of 2023, and then you will see a second phase in 2024 when the whole book of contracting will be opened again. I believe we are in a good position. We have the best product profile of all companies coming to the market in 2023, and we’re already in discussions with all our customers about the access approach for next year.

Since Humira® is one of the top drugs in the world in terms of revenue generated, if the biosimilar produced by Teva were to be successful, it would result in a significant revenue improvement. We will have important news about this at the end of the year.

The second biosimilar that may shake up Teva’s revenues in 2023 is related to Lucentis®. This drug is used to treat the wet form of age-related macular degeneration and is marketed in the U.S. by Roche Group (OTCQX:RHHBY) and internationally by Novartis (NVS). The biosimilar produced by Teva will have two different trade names, although they are the same product:

- In the UK, the biosimilar of Lucentis® is called ONGAVIA and was already launched last July 22.

- In Europe it will be called RANVISIO and will be marketed in collaboration with Bioeq AG. Marketing authorization came on August 29 from the European Commission.

Richard Daniell, executive vice president, commented on the success of this launch:

With millions of people in Europe afflicted by this serious age-related eye condition this important milestone allows us, together with Bioeq, to bring ranibizumab to ophthalmologists and patients throughout Europe. The product is a welcome addition to Teva’s growing biosimilars portfolio, and delivers on our mission to improve patient access to critical therapies while delivering vital savings to healthcare systems.

Up to 77 million Europeans could be affected by AMD by 2050.

Focused specialty pipeline with high growth potential

In this segment we find drugs marketed and patented by Teva. The drugs that have found the most interesting results in the last quarter are mainly three:

COPAXONE®, a drug used to treat relapsing forms of multiple sclerosis, is the biggest issue due to its declining sales. Generic competition in the U.S. and the availability of new alternative therapies are undermining the growth of this drug with patents (both U.S. and European) expiring in 2030. North American sales are down 38% from Q2 2021 to $94 million.

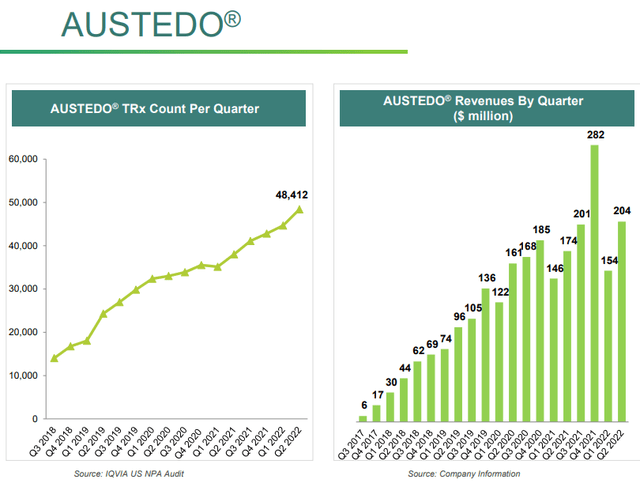

AUSTEDO® is a drug that treats the involuntary movements of Huntington’s disease and is covered by different patents until at least 2036.

Prescriptions for this drug are increasing year after year, as are revenues. In Q2 2022, revenues increased by 17% compared to Q2 2021, while prescriptions increased by 27%. According to Grandviewresearch, the global Huntington’s disease treatment market was worth $362 million in 2021 and is expected to have a CAGR of 19.6% until 2030. This is not a particularly large market, but nonetheless has a very high CAGR that will likely support the growth of AUSTEDO®.

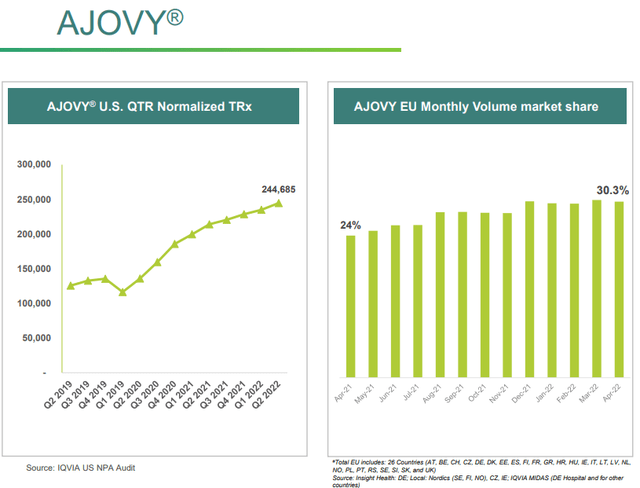

AJOVY® is a drug prescribed for the treatment of migraine in adults whose last patent expires on November 2, 2026.

Its global sales reached $88 million in the latest quarterly, registering a 27% increase on a global basis from last year. AJOVY® is the second leading brand in Europe and is marketed in 24 countries. Looking forward, I expect less growth from this drug than AUSTEDO® for two reasons:

- The last patent will expire at the end of 2026, while AUSTEDO® is covered until 2036

- The target market for AJOVY® is more competitive and has lower growth. According to Marketdataforecast this market is expected to reach $5.63 billion by 2027, with a CAGR of only 4.87%.

In conclusion, it is important to note that AUSTEDO® and AJOVY® growth is covering losses related to the reduction in COPAXONE® sales. This trend may continue and was discussed at length by the CEO:

If you look at the guidance for this year now, you could say for the first time, not only are the growth drivers bigger than the detractor, so to speak, so the combined sales of AJOVY and AUSTEDO are now bigger than the declining sales of COPAXONE. They’ve actually reached the level where they’re twice as big. You saw for instance on AUSTEDO that the IP situation looks like it’s very safe until the early 2030s. So, there’s a long growth path for AUSTEDO going forward. And so, that whole combination means that we’re confident that we can achieve single-digit growth.

How much is Teva worth?

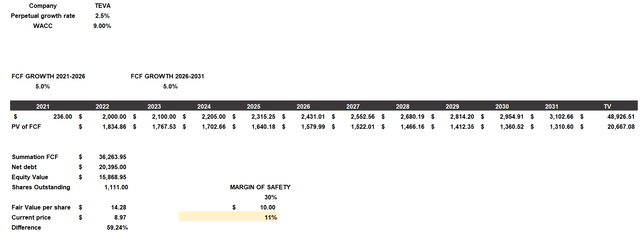

To understand what Teva is worth, I will use a discounted cash flow. This model will be constructed as follows:

- The cost of equity will be 14.75% while the cost of debt will be 6.38%. With a capital structure consisting of 70% debt and 30% equity the resulting WACC is 9%.

- The free cash flow for 2022 and 2023 will follow the expectations of this year’s and next year’s guidance. Subsequently, I have considered a 5% growth rate since the company’s goals include growing at a mid-single digit rate.

- The net debt and outstanding shares belong to TIKR Terminal.

According to my assumptions, Teva’s fair value is $14.28 per share, so the company is undervalued. While there is such a strong undervaluation, it should be specified that the degree of riskiness of this investment is quite high given the high debt and still weak profitability; therefore, it is better to be prudent in my opinion. Certainly, the outlook for 2023 is quite good, which is why I opened a small position, but I think it’s reasonable not to overexpose. The soundness of this company is not comparable to some big pharma like J&J or Roche. I think it may turn out to be a good investment at this price, but it should be considered that this is a speculative investment whose volatility may greatly affect the performance of the entire portfolio.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment