Pgiam/iStock via Getty Images

By Ashish S. and Harshit K.

Investment Thesis

In the last quarter, Tetra Tech, Inc. (NASDAQ:TTEK) reported strong results with net revenue up 12% Y/Y driven by robust demand from commercial and federal government clients. The backlog grew 8% Y/Y and reached an all-time high while the operating margin improved by 160 bps Y/Y. The margin growth was augmented by a favorable mix of projects and increased utilization of the company’s services by federal agencies.

Looking forward, I expect a healthy demand from the company’s water, environment, and renewable energy services end-market. This coupled with high-backlog value should result in an increased revenue growth rate. I believe the acquisition of RPS Group plc which has a higher margin than TTEK and a favorable mix of projects should be accretive to the company’s margin in the quarters ahead.

However, the company’s valuations appear on a bit higher side versus its historical levels as well as peers like AECOM (ACM). Hence, I prefer to be on the sidelines.

TTEK Q4 2022 Earnings

TTEK recently reported better-than-expected results in the fourth quarter of FY 2022. The revenue for the quarter stood at $903 million which was ~$190 mn higher than consensus estimates while net revenue was $736 million, up 12% Y/Y. Solid demand from international, commercial, state and local, and federal government clients helped the business. For the GSG segment, revenue grew 8% Y/Y to $336 million, while revenue for the CIG segment at $400 million represented 15% growth from the year-ago quarter.

In the quarter, the operating margin stood at 12.7%, an improvement of 160 bps Y/Y. Revenue growth and margin expansion boosted adjusted earnings per share by 20% Y/Y to $1.26 in the quarter which was above the consensus estimate of $1.15.

Revenue Analysis and Outlook

In the fourth quarter of 2022, TTEK’s net revenue stood at $736 million, up 12% Y/Y. Robust demand from commercial and federal government clients contributed to the top-line growth in the quarter. The U.S. federal clients, representing 29% of its revenue in the quarter, were up 15% Y/Y. This growth was driven by an increase in the priority of water, environmental and international development programs for TTEK’s key government clients. The U.S. commercial net revenue accounting for 25% of its overall consolidated net sales, was up 25% Y/Y driven by growth in demand for high-performance buildings and renewable energy services.

In the quarter, the revenue for the GSG segment was at $336 million, an increase of 8% Y/Y. This performance was driven by solid demand for high-end data analytics and design services for federal water and environment programs, augmented by TTEK’s digital water work across the United States. In the quarter, the company won new programs for key U.S. federal agencies, including the Department of Energy, the U.S. Environmental Protection Agency, USAID, the Army Corps of Engineers, and others, that work on the government’s water environment, resilient infrastructure, and decarbonization initiatives

The revenue of the CIG segment grew 15% Y/Y to $400 million. The results were driven by growth in international operations as well as strength in sustainable infrastructure and renewable energy markets in the United States. The international revenues were boosted by an expansion in sustainable infrastructure programs in Australia, the United Kingdom, and all across Canada.

TTEK’s ‘Leading with Science’ approach, in which the company leverages its global expertise and collective technology including advanced data analytics and digital technologies to create customized solutions for its clients, is helping it better serve customers and gain more projects.

The company’s ‘Leading with Science’ approach along with its focus on water, environment, and sustainable infrastructure, helped the company generate increased new orders of $1.3 billion in the quarter. Impressively, higher orders improved the book-to-bill ratio sequentially from 1x in Q3 to 1.4x in Q4. In the quarter, the company won new programs and task orders for water, environment, and renewable energy services while adding over $1 billion of additional contract capacity. In the CIG segment, the company generated strong commercial orders of over $400 million to provide renewable energy, environmental restoration, and sustainable infrastructure services.

In the fourth quarter, increased orders resulted in a new all-time high backlog value of $3.74 billion, up 8% Y/Y or 13% on a constant currency basis. The growth was driven by strong demand for services to address climate change problems.

Looking forward, I believe the demand should remain robust for the company’s water, environment, and renewable energy services. . This coupled with high-backlog value should result in an increased revenue growth rate.

The 3 major legislative actions passed by the US government have set the stage for higher spending in the end markets served by TTEK.

First, the $1.2 trillion Infrastructure Investment and Job Act (IIJA) should facilitate growth across the water, environment, sustainable infrastructure, and renewable energy markets. Some of the specific initiatives in IIJA which should help TTEK include a $50 billion investment in Resilience and Western Water Infrastructure to make the communities safer and infrastructure more resilient to the impacts of climate change and cyber-attacks; a $55 billion investment in Clean Drinking Water to replace all of the nation’s pipes and services lines; and $65 billion investment in Power Infrastructure to upgrade the power of infrastructure and build resilient transmission lines to facilitate the expansion of renewable energy.

The second major legislative action is a $280 billion CHIPS and Science Act. This act aims to fund the expansion and development of semiconductor facilities in the United States. TTEK has a strong competitive position for providing high-end sustainable infrastructure design services for US-based chip manufacturers. For example, the high-end design of TTEK facilitates advanced water treatment & water recycling, which are crucial to the chip industry as chip manufacturing is not feasible without ultrapure water supplies and sustainable water management. The science component of the act potentially represents another $200 billion in scientific R&D funding, which will be directed to federal agencies which are Tetra Tech’s clients.

Third and the most recent legislative action is the Inflation Reduction Act (IRA), signed in August 2022. The IRA includes a $369 billion investment in energy security and climate change over the next 10 years. All across the globe, governments are taking initiatives toward clean energy and carbon-reduction goals. I believe such a transition towards energy security and carbon reduction should facilitate strong demand for the services of TTEK in upcoming years.

In the fourth quarter, the company reported the highest backlog value of all time. This coupled with a strong demand outlook bodes well for the future revenue growth rate.

Margin Outlook

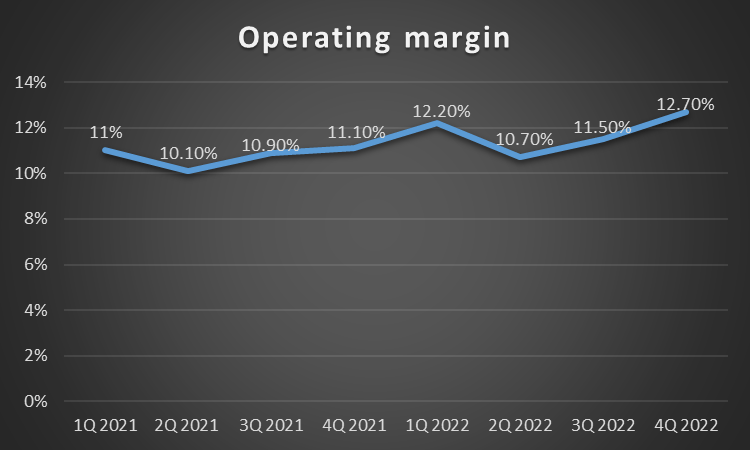

TTEK Operating Margin (Company Data, GS Analytics Research)

In the fourth quarter of 2022, the operating margin stood at 12.7%, an improvement of 160 bps Y/Y. This improvement was primarily driven by a favorable mix of projects which are based on more high-end work concerning data analytics, digital water, and other higher-margin services. In the quarter, the GSG segment generated a strong operating margin of 15.1%, up 130 bps Y/Y. This growth was driven by increased utilization of the company’s services by the federal agencies as they recently recovered from a slower Q2 and Q3. The operating margin of CIG was at 13.6%, up 80 bps Y/Y.

Looking forward, I believe the recent RPS Group buyout and a favorable mix of projects should be accretive to Tetra Tech’s margins. The RPS Group has operations in the United Kingdom, Europe, Australia, and the United States. Notably, the RPS Group historically has had higher margins than TTEK. So, I believe that the inclusion of the RPS Group in TTEK should accelerate its margin expansion in the quarters ahead. Also, management is expecting the company to get more high-end work with respect to data analytics, digital water, and other higher-margin services that are in high demand which should improve the project mix. This should be accretive to margins in the coming years.

Valuation and Conclusion

TTEK is currently trading at 31.85x FY2023 consensus EPS estimates of $4.92. The company’s current valuations are higher than its 5-year average forward P/E of 28.65x. Further, the stock is also pricey compared to TTEK’s peers like Aecom which is trading at 21.24x FY2023 consensus EPS estimate. While I like the company’s encouraging fundamentals, I believe it is already getting reflected in the stock at the current valuations. Hence, I prefer to be on the sidelines and have a neutral rating on the stock.

Be the first to comment