Spencer Platt

Tesla (NASDAQ:TSLA) has been the victim of excessive selling, with its stock crashing by almost 50% this year. Tesla has declined more than the average company during the bear market phase, and its valuation looks increasingly attractive. Moreover, the company should announce a stock split next month and will probably beat earnings estimates when reporting in a few days. Additionally, Tesla could continue outperforming even if the downturn is protracted, and the company has an exciting new product that should arrive on the market next year. Tesla should beat earnings estimates and will probably continue surpassing consensus figures as the company advances. Therefore, Tesla’s stock is relatively cheap now, should be bought on future weakness, and will likely appreciate considerably in the coming years.

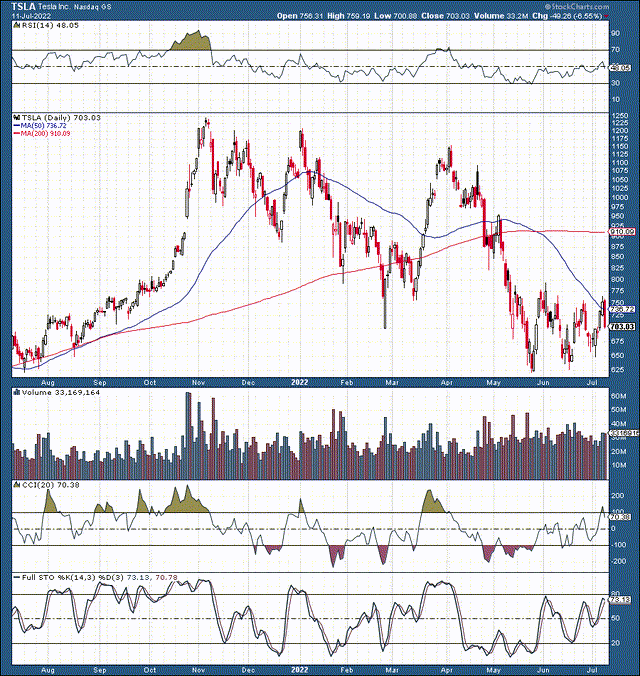

Tesla’s Volatility Problem

I wrote about the coming drop in early November, and one of my primary examples of an overheated stock market was Tesla. The stock was around $1,200 back then, and Tesla traded at about 180 times forward earnings estimates. We’ve seen quite a bit of volatility since then, and Tesla dropped by approximately 50% from peak to trough. While there is no guarantee that we won’t see more volatility in the near term, the worst is likely behind us now.

Tesla’s Valuation – Much Different Now

I mentioned Tesla’s absurd 180 forward P/E multiple around the top. However, the fundamental image looks much different now.

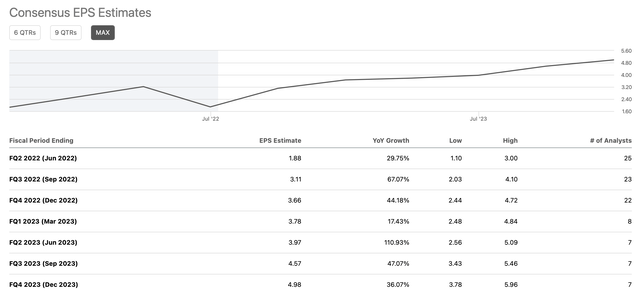

EPS Estimates

EPS estimates (SeekingAlpha.com)

Forward (2023) consensus EPS estimates are for $17.30, implying a forward P/E ratio of only 40 right now. Moreover, Tesla has shown a tenacity for surpassing analysts’ estimates in recent quarters.

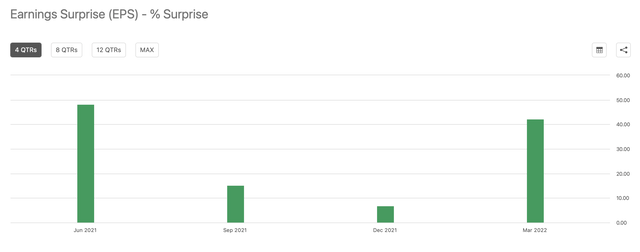

Earnings Surprises

Earnings surprises (SeekingAlpha.com)

Tesla has surpassed consensus estimates by an average of 28%, illustrating remarkable outperformance in its last four quarters. Still, the stock is down by nearly 50% from its highs. Additionally, despite the rising recession probability, Tesla’s EPS forecast has not decreased too much.

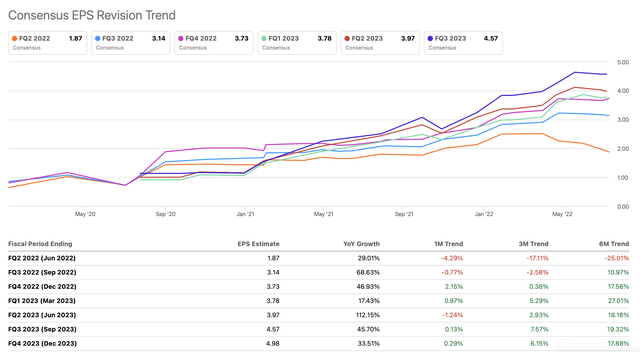

EPS Revisions

EPS revisions (SeekingAlpha.com)

While many companies (probably most) have seen sharp EPS revisions, Tesla is not one of them. 2023 EPS forecasts are higher now than six, three, or one month ago. This phenomenon suggests that analysts are confident that the company can weather a downturn better than many other companies and that prior EPS estimates may have been too low. Finally, this dynamic implies that Tesla’s longer-term profitability will probably not be impacted by a transitory slowdown.

Why A Recession May Not Be A Problem

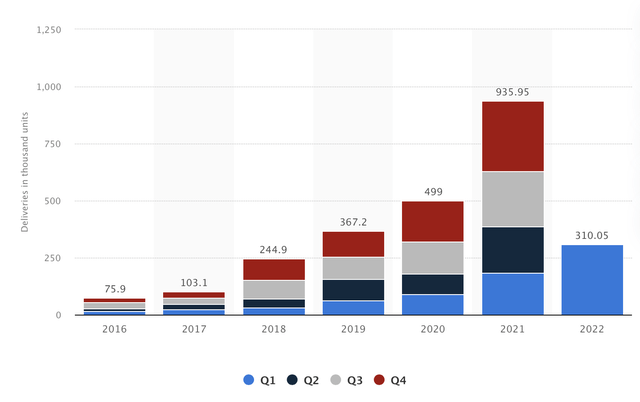

A recession may not be a problem for Tesla, as the company’s cars are not niche products. With close to a million car sales last year, Tesla’s are very much mainstream vehicles.

Tesla Sales (in millions)

Moreover, Tesla remains the undisputed leader in the rapidly expanding EV space. Therefore, while consumers may pull back on their ICE vehicle spending or think twice about purchasing a Lucid (LCID) or a Rivian (RIVN) vehicle, Tesla should benefit. Tesla is the gold standard of EVs, and while a recession could have a minor transitory impact on the company’s growth, it is unlikely to have a lasting effect.

Additionally, gas and energy prices are sky high due to inflation, high oil prices, and the war in Ukraine. Record high prices at the pump will probably push more consumers towards buying EVs, and the primary beneficiary of this phenomenon should be Tesla. Thus, a recession should have a limited effect on Tesla’s growth, profitability potential, and the company’s stock price trajectory longer term, making the stock a strong buy on any recession-related weakness as we advance.

The Upcoming Stock Split

Tesla has another stock split coming up, granted that the shareholders approve it on August 4th. Stock splits are typically a constructive phenomenon for stocks. The proposed 3-1 split would make Tesla shares more affordable, dropping the company’s share price from roughly $700 to about $233. The lower stock price would make it more attractive to retail investors and should make options strategy more affordable, leading to higher demand for Tesla shares. Tesla’s 2020 5-1 stock split created significant buying opportunities before and around the stock split, and we may see a similar dynamic play out in 2022.

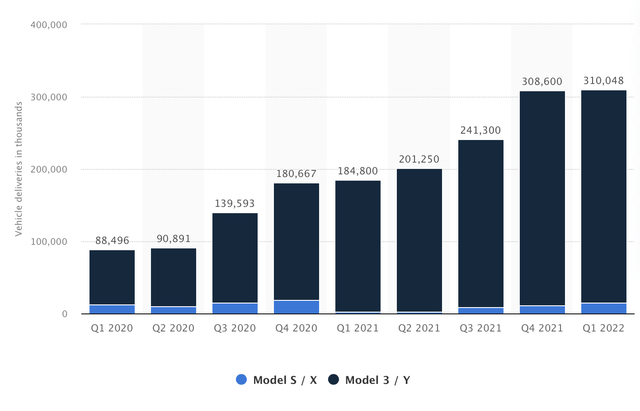

Tesla Earnings – Could Be Another Blockbuster Report

Tesla recently announced its Q2 production and delivery numbers. The company delivered 16,162 Model S/X vehicles last quarter and 238,533 Model 3/Y vehicles in the same time frame. The numbers look great, and the first thing that jumped out was the massive 750% surge in Model S/X sales. There was some concern last year that the market may be saturated with Model S/X vehicles or that demand was falling off. However, the demand for Tesla’s higher-end vehicles is quite robust. The drop-off in sales last year was likely due to Tesla’s temporary production prioritization toward Model 3/Y cars. This sales dynamic implies that Tesla should continue generating substantial revenues from the higher-end auto market in the coming years. Additionally, Tesla reported deliveries of 238,533 Model 3/Y vehicles in the quarter, roughly a 20% YoY gain.

We see strong growth in Tesla’s delivery numbers over the last few years, and the trend will likely continue as we advance. Consensus analysts expect $1.87 in EPS for Q2, but based on the delivery data, I suspect we can see a better result. In my recent Tesla analysis, I used a $49.5K ASP for the Model 3/Y segment and a $110K ASP for the Model S/X segment. However, due to inflation and other variables, I used a $50K ASP for the Model 3/Y segment and a $115K ASP for the Model S/X vehicle segment this time. Consensus analysts are looking for $1.87 in EPS, but my estimate came in at $2.24, roughly 20% above the agreed estimate.

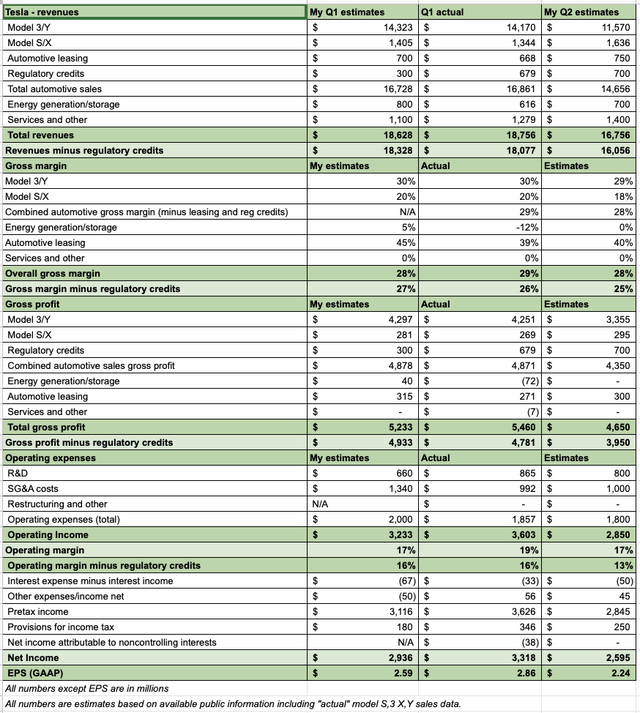

Here’s how:

Q2 Estimates/Projections

Q2 estimates (The Financial Prophet )

My Q1 estimates were very close to the actual results, but my income and EPS proved modest. This quarter, Tesla may deliver about $16.8 billion in revenues, and EPS could be around $2.24. The company reported $679 million in regulatory credits last quarter, and I am using $700 million for Q2 projections. Due to a QoQ decline (seasonal) in deliveries, we’re seeing slightly lower revenues from Q1. I also use lower gross margin projections, a slight decrease in R&D, and marginally higher SG&A expenses. Given the variables, we’re still at relatively high margins, roughly 28% overall gross margin and 17% on the operating side. The net income margin comes out to about 15.5%.

Tesla Much More Profitable Than Other Automakers

Last quarter, Tesla reported a net income margin of 17.7%. Also, Tesla’s profitability metrics are coming in much better than the most profitable (traditional) automaker Toyota (TM), which recently reported a gross income margin of 19% and net income margin of 9%. Honda (HMC) has a gross margin of about 20% and a net income margin of around 5%. Their American counterparts have even lower profitability margins most of the time, with General Motors (GM) recently reporting about a 15% gross margin and a net income margin of around 7%.

The Bottom Line

While Tesla’s forward P/E ratio is only around 40 (consensus estimates), the company could report more robust than anticipated results in the upcoming quarters and 2023. Tesla has beat consensus estimates by an average of 28% over the last four quarters, and higher-end 2023 EPS estimates go to about $21.35. However, even if Tesla earns just $20 per share in 2023 (my estimate), the company’s stock is trading at only 35 times forward earnings estimates now. Additionally, Tesla has an upcoming stock split that may boost its share price, and Tesla could surpass analysts’ estimates in its earnings announcement a few days from now. Tesla has been expanding sales of its passenger vehicles effectively in recent years, and the company’s revenues should get a robust boost from Tesla Semi sales and other initiatives as the company presses forward.

Furthermore, a recession should have a limited effect on Tesla’s growth and earnings potential. Therefore, any substantial weakness in Tesla’s share price should be regarded as a buying opportunity in the near term. The company should continue expanding revenues aggressively and growing EPS notably longer-term, leading to a significantly higher stock price in the next several years.

Here’s what Tesla’s financials could look like in future years:

| Year | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

| Revenue Bs | $85 | $122 | $170 | $224 | $288 | $360 | $440 |

| Revenue growth | 63% | 44% | 39% | 32% | 29% | 25% | 22% |

| EPS | $13 | $20 | $29 | $40 | $54 | $70 | $90 |

| Forward P/E ratio | 35 | 38 | 40 | 38 | 36 | 35 | 33 |

| Price | $700 | $1,100 | $1,600 | $2,050 | $2,520 | $3,150 | $3,630 |

Source: The Financial Prophet

Many analysts may still underestimate Tesla’s earnings potential as we continue seeing the company crush consensus estimates. Therefore, Tesla’s EPS figures could continue expanding faster than anticipated. Additionally, the Tesla Semi should start selling towards the end of next year. Tesla will likely see a substantial revenue surge as mass production and deliveries of the Semi truck begin. Given Tesla’s significant growth rate, its forward P/E ratio seems too low. Therefore, we could see Tesla’s forward P/E expand to around 40 and remain in the 30-40 range in future years. Tesla’s EPS should increase considerably in the coming years, and the company’s share price could appreciate substantially as the company advances. Tesla’s stock could reach $2,500-3,500 (250-400% upside) over the next 5-6 years. Therefore, I will initiate a Tesla position before Q2 earnings, will use any future weakness to accumulate shares, and plan to make Tesla a top holding in the All-Weather Portfolio once again.

Risks to Tesla

Risks exist for Tesla, and there are quite a few. The company may miss earnings and revenue estimates. Furthermore, a slowdown in demand, increased competition, supply issues, decreased growth, issues with regulators and foreign governments, and other variables are all risks we should consider before betting on Tesla here. Serious concerns could cause Tesla’s valuation to lose altitude, and the company’s share price could even head in reverse if any serious issues arise. Therefore, one should consider the risks before committing any capital to a Tesla investment.

Be the first to comment