ollaweila/iStock via Getty Images

From the Portfolio Manager’s Desk

High-beta and growth factors were the main thematic dominating the US medtech universe from FY20-January FY22. Since, the high beta trade has completely unwound and investors are no longer rewarding unprofitable companies with exorbitant valuations.

It is for these reasons we remain neutral on Beyond Air, Inc. (NASDAQ:XAIR) as we believe the macroeconomic landscape together with central bank policy has led to a decoupling of unprofitable, small-cap medtech equities to the profitable, large-cap end of town. Without clarity on when it intends to convert its LungFit PH pipeline, our research team has forecasted profitability by FY25 in the name. At present, we prefer to position against cash-compounders that will add a layer of resiliency across our equity risk budget.

Investment Thesis Summary

Here we reiterate the hold rating on XAIR given the company’s commercial stage in the growth cycle and lack of tangible/cash earnings value to buy into. Noted are the company’s differentiated offerings and lengthy pipeline, however, our U.S. investment strategy is focused on high-quality cash compounders, versus exposure to unprofitable beta in medtech. We rate XAIR a hold with $9.22 valuation.

There are several risks to the investment thesis that must be considered. There is inherent risk in investing both in small-cap and commercial-stage medtech companies. Volatility can be higher with greater price swings, and prices can become disconnected from fundamentals quickly. We face both upside and downside risk to the investment thesis in having a neutral stance.

Catalysts to Move the Needle

Given its commercial stage in the company growth cycle, clinical trial and regulator tailwinds are key to unlocking longer-term momentum in XAIR. Most recently the company treated its first patient in the Phase 1 clinical trial examining the safety and immune biomarkers of ultra-high concentration nitric oxide (“UNO”) therapy of more than 10,000 parts per million (”ppm”) in the treatment of solid metastatic tumours.

UNO is new on the scene as a novel approach to preventing relapse of metastatic tumour growth. Mintz and colleagues (2021) illustrated that current nitric oxide (”NO”) applications are limited by “pharmacodynamics, pharmacokinetics, or systemic absorption and toxicity”. Liu et al. (2018) also demonstrated that exhaled nitric oxide has been proposed as a biomarker for lunch cancer, with levels substantially higher in those with the metastatic disease.

In vitro mice, studies have indicated that local tumour ablation using UNO has a stimulatory effect to anti-tumour activity downstream to solid cancers. This has been demonstrated at doses of 20,000-50,000ppm, particularly with selective recruitment of T-cells and dendrocytes at the higher dosage. The same activity was recorded in 21-day follow-up.

According to XAIR, “UNO has the potential to prevent relapse or metastatic disease with as little as a single 5-minute treatment and with limited toxicity or off-target effects.”

Primary endpoints for the phase 1 trial are as follows:

- Incidence and characteristics of adverse events

- Incidence and characteristics of serious adverse events

- Dose-limiting toxicities

- Changes in safety parameters

Secondary endpoints are all standard efficacy outcomes, like complete response and overall disease progression. The study will also aim to identify maximum total dosage (”MTD”) for the next phases of clinical trial.

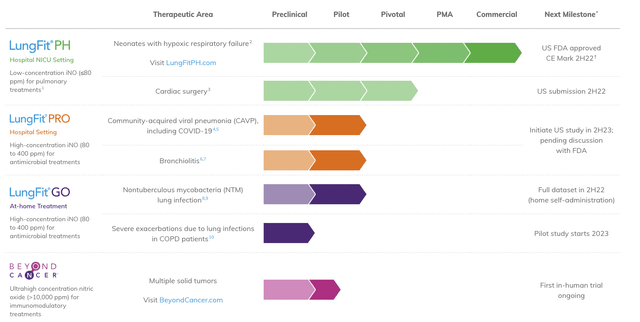

Meanwhile, in June, XAIR also advised that it had obtained FDA approval for its LungFit PH NO generator and delivery system. The system is indicated for use in neonates exhibiting hypoxic respiratory failure. XAIR is now prioritizing its multi-phase commercialization strategy for the system. It intends to start the first phase with a measured release of the system to a select cohort of hospitals, with level 3-4 neonatal intensive care units (”NICUs”). The company estimates a total addressable market of $400mm US and $700mm global for this segment. XAIR’s pipeline is seen in Exhibit 1.

Exhibit 1. XAIR pipeline progression with estimated timeline, therapeutic area and business segment

Q2 Numbers and Cash Burn

XAIR increased R&D investment 18% YoY to $3.2mm whereas it saw a c.$4.3mm headwind at the G&A line to $8.2mm, due to increased labour costs and scaling up operations in US and Israel. It used $6.8mm in net cash from operations and forecasts an average quarterly cash burn of ~$8-$10mm, which management believes gives sufficient runway for the next 12 months.

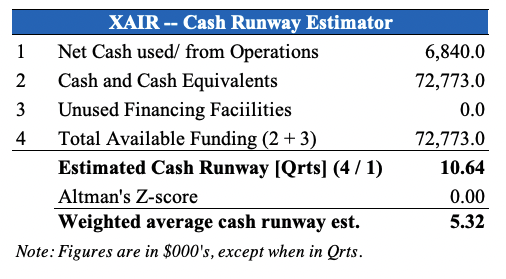

We agree with this testament and believe this is an important consideration to understand fluidity of the company’s cash runway, which we estimate at more than 5 quarters, as seen in the chart below. With that in mind, investors should look to the coming 12 months in order to examine if XAIR will be required to raise additional, dilutive equity [or head to the high-yield debt capital markets] in order to finance future operations. From the exhibit below, we estimate XAIR’s average cash burn to be ~$7mm-$13mm per month.

Exhibit 2. Sufficient cash runway for the coming 12 months by our estimation.

Has implications for if/when the company may decide or need to raise additional cash, either via dilutive equity or high-yield debt.

Data: HB Insights Estimates

Valuation and Conclusion

It’s difficult to accurately value XAIR seeing as it is pre-revenue and books a net loss due to cash spent in business operations. Ideally, we’d forecast out the company’s future estimated cash flows for each revenue segment, and discount these back to the present. If the present value of the future cash flows is greater than our cost, this justifies the investment.

However, we don’t have great confidence in the predictability of XAIR’s future cash flows. In particular, the macroeconomic landscape and central bank policy are 2 key mitigators to estimation, as we need to create multiple simulations/scenarios to achieve a range of outputs. Monte Carlo simulation achieves this, however, has its limitations on a commercial stage medtech company.

Shares are, however, priced at ~4x book value, and at this multiple, we’d theoretically be paying $8.84 per share, below the current market price of $9.03, suggesting shares are fair and reasonably priced, with a c.210bps value gap to the upside. We, therefore, value XAIR at $9.22 apiece.

With these points in mind, our research team forecasts revenues of $4.1mm in FY23 for XAIR stretching up to ~$42mm by FY24 and ~$127mm in FY25 following the conversion of its pipeline. Whilst this top-line growth is exciting, the research team also doesn’t see this pulling down to positive earnings until the latter year. As the market has shifted focus onto bottom-line fundamentals, we believe this will remain a headwind for the company looking ahead. Rate neutral on $9.22 valuation.

Be the first to comment